3 Outside Up/Down Patterns Explained: What They Are and How They Work

Among the many candlestick patterns used in technical analysis, those that involve three or more candles are often seen as very important by traders. The Three Outside Up and Three Outside Down Patterns are two such patterns that can help you spot potential market reversals. These formations give you clues about changes in market sentiment, allowing you to predict price movements before they happen.

In this article, we’ll dig deeper into some basic questions, such as what are Three Outside Up/Down Patterns, what are their benefits and limitations, and how you can spot one when appears on a candlestick chart.

What is 3 Outside Up/Down Patterns?

The 3 Outside Up/Down patterns are one of the technical analysis candlestick patterns used in trading to help predict when the market might change direction. Both are three-candle reversal signals that show up on candlestick charts. These patterns form in a specific order, indicating that the current trend is losing strength and may be about to reverse.

The formation creates when a bearish candlestick (closing lower than it opened) is followed by two bullish candlesticks (closing higher than they opened), or the reverse.

The three outside up and three outside down patterns are often compared to the three inside up/down patterns. But we would take a look at their difference in jiffy, first study how these technical analysis patterns are created.

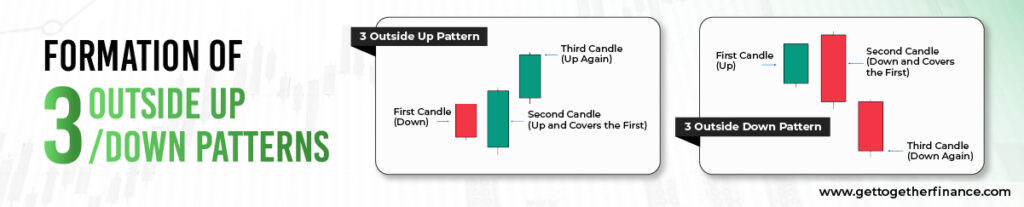

Formation of 3 Outside Up/Down Patterns

Understanding these technical analysis chart patterns is easy once you decode how it looks on the chart. Here we have break down the process of how to spot these formations.

Formation of the 3 Outside Up Pattern

Let’s take a look how it appears when you spot 3 Outside Up pattern on a candlestick chart:

- First Candle (Down): The first step in the pattern is a downward candle, showing that the price is dropping because sellers are in control.

- Second Candle (Up and Covers the First): The next candle goes up and completely covers the first one, like a bullish engulfing. This means that buyers are stepping in strongly and pushing the price higher.

- Third Candle (Up Again): The third candle also moves up and closes even higher than the second one. This confirms that buyers are now in control, and the price might keep rising, initiating a bullish time.

Formation of the 3 Outside Down Pattern:

Here let’s see how you can spot 3 Outside Down patterns when it appears on the chart:

- First Candle (Up): The pattern starts with an upward candle, showing that the price is rising because buyers are in control.

- Second Candle (Down and Covers the First): The next candle goes down and completely covers the first one, like the bearish engulfing. This hints that sellers have taken over and are pushing the price lower.

- Third Candle (Down Again): The third candle continues to move down and closes lower than the second one. Now, it confirms that sellers are now in control, and the price might keep falling, initiating a bearish phase.

These patterns are simple signals that the market may be changing direction, either up or down. They’re useful, especially when combined with other tools that help you understand the market better.

Also Read: Piercing Pattern

Advantages & Disadvantages of 3 Outside Up/Down Patterns

Like every season or theory, these patterns comes with its own set of benefits and setbacks. Here we have listed few pros and cons of 3 Outside Up/Down Patterns:

Benefits of 3 Outside Up/Down Patterns

- Clear Reversal Signs: This is for sure, if patterns are good at showing when a trend might change direction. They help you spot potential new trends early.

- Generally Reliable: When confirmed with other indicators, these patterns are often accurate in predicting market reversals. However, their accuracy is still questioned by experts.

- Flexible Use: You can use these patterns in various timeframes, making them versatile. In simpler terms, you can apply it on any chart patterns or time frame you want.

- Easy to Spot: As they say, these technical analysis patterns are pretty straightforward. Reading just three candles makes them simple to identify and understand.

Limitations of 3 Outside Up/Down Patterns

- Needs Confirmation:The patterns aren’t really foolproof on their own. You should wait for additional signals to confirm the pattern before acting. Or you should equip with more profound theories such as demand-supply dynamics to confirm the reliability of this pattern.

- Market Context Matters: The effectiveness of these patterns can be influenced by the overall market conditions. For instance, if the market is sideways or choppy, they might not be as reliable.

- Can Give False Signals: Like all patterns, they can sometimes lead to wrong conclusions, especially during market volatility.

- No Exact Targets: These formations show potential trend changes but don’t tell you specific price targets or the exact timing of the change. Combining them with other tools is usually better.

Difference Between 3 Outside Up/Down and 3 Inside Up/Down Patterns

The 3 Outside Up/Down and 3 Inside Up/Down patterns both help traders spot potential trend changes, but they work differently. The main difference is in how the second candle interacts with the first: the 3 Outside pattern shows a stronger change in direction, while the 3 Inside pattern signals a more gradual shift.

Here let’s breakdown the difference in simpler way:

| Feature | Three Outside Up/Down Patterns | Three Inside Up/Down Patterns |

| Formation | Made up of three candles: a big candle, a smaller candle, and another big candle. | Made up of three candles: a big candle, a smaller candle inside the first, and another candle that closes above or below the second. |

| Market Context | Three Outside Up shows up after prices go down; Three Outside Down shows up after prices go up. | Three Inside Up appears after prices go down;Three Inside Down appears after prices go up. |

| Signal Type | Suggests a possible change in the direction of the trend. | Suggests a possible change, but may not be as strong as the Outside patterns. |

| Candle Characteristics | The last candle must close above the first candle’s high (for Up) or below the first candle’s low (for Down). | The last candle must close above the second candle’s close (for Up) or below the second candle’s close (for Down). |

| Strength of Signal | Generally considered stronger because of the size of the candles. | Often seen as a weaker signal since the second candle is inside the first. |

| Trading Strategy | Used to enter trades when a reversal is confirmed. | Can be a warning for possible trend changes, but usually needs more confirmation. |

Conclusion

The 3 Outside Up/Down patterns are powerful tools in technical analysis chart pattern that can help traders spot potential trend reversals. Whether its about pointing to an upcoming rise or fall in price, these formations give clear signals that the market might be changing direction.

While the 3 Outside Up/Down patterns are useful, they work best when they’re part of a bigger strategy. To improve your chances of success, it’s a good idea to club them with other proven strategies, such as demand-supply dynamics. It’s highly crucial to think about the broader picture and use multiple tools to back up your trades for the best results.

FAQs

What’s the psychology behind the 3 Outside Down pattern?

The 3 Outside Down pattern shows a change from bullish to bearish sentiment, where buyers lose momentum and sellers gain strength. Basically, it’s tells traders that it’s time to sell.

What’s the psychology behind the 3 Outside Up pattern?

The 3 Outside Up pattern shows a shift in trader’s sentiment from bearish to bullish, as sellers lose control and buyers take over. In brief, announce traders of a positive buying time.

Can 3 Outside Up/Down patterns fail?

Yes! Like any pattern, they can fail, especially if the broader market trend or other indicators do not support the reversal.

What’s the difference between 3 Outside Up/Down patterns and 3 Inside Up/Down patterns?

The 3 Outside patterns includes an engulfing candle (second candle fully covers the first). On the flip side, the 3 Inside patterns includes the second candle staying within the range of the first.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube