WHY TRADE IN STOCK MARKET

Answer is simple to make money

We invest in a business to make money, similarly we can invest in a good company through stock market. Most wonderful thing is we do not need a lot of money to start making money like other businesses or unlike buying property. We can start with very small amount.

Types of Stock Trading

Stock market trading is not based on any rulebook, there are many strategies and innumerable ways to analyze candlestick charts. Different types of strategies come with different types of risks and rewards, people usually do not rely on one strategy for making profits. For professional traders, the strategy depends on the market circumstances. Here are some widely used types of stock trading:

- Intraday Trading: As the name suggests, it is done in one trading session or in one day. The positions taken by the trader are squared off by the end of the trading session.

- Scalping: It is done for a shorter time like a few minutes or hours. Here, the trader seeks to catch short-term movements of the price and make money out of it.

- Momentum Trading: In this, the trader goes with the current trend of the market and exits the position as soon as the trend starts reversing. It is one of the riskiest types of trading.

- Swing Trading: It is done for a bit of an extended time period like a few days to weeks. Here, the traders aim to catch a good move in this stock over the given time frame.

Though these are not all types of trading, they are major types of trading practiced all over the globe. Also remember, if the time period of buying extends above 6 months or years it is termed as an investment.

Largest Stock Exchanges

From the data till December 2023, New York Stock Exchange (NYSE) is said to be the world’s largest stock exchange with a market capitalization of over $25 trillion. Interestingly, the second largest stock exchange NASDAQ, is also in New York with a market capitalization of $ 23.414 trillion.

Here are the other largest stock exchanges of the world:

- Euronext, Amsterdam- USD 21.4 trillion

- Shanghai Stock Exchange, China- USD 18.8 Trillion

- Tokyo Stock Exchange, Japan- USD 15.2Trillion

Apart from this, the National Stock Exchange has a market cap of USD 3.18 trillion and stands at 11th position among the top stock exchanges of the world. Followingly BSE ranks at 13th position with a market cap of USD 2.81 trillion.

Also Read: Role of SEBI

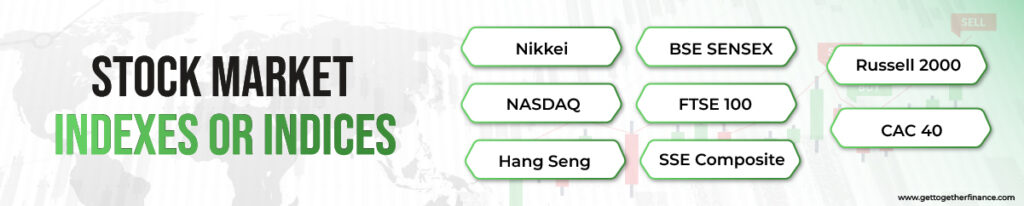

Stock Market Indexes or Indices

Stock market indices or indexes are averages of price movements of the stocks that compose the index. Heavy buying in the stocks of the index will shoot up index price whereas vice-versa happens in times of heavy selling. Here are the top stock market indexes of the world:

- NASDAQ– US Market

- FTSE 100- It is composed of the top 100 traded blue chip companies on the London Stock Exchange

- Russell 2000– It tracks the performance of the top 2000 small cap stocks of the US market. It is used by many investors to track the performance of small-cap affiliated mutual funds.

- BSE SENSEX– It is composed of the top 30 largest traded companies on the Bombay Stock Exchange, India.

- Hang Seng– Tracks the performance of the top 50 traded companies of the Hong Kong Stock Exchange.

- Nikkei– It is composed of 225 largest companies on the Tokyo stock exchange by price.

- CAC 40– It lists the top 40 stocks listed on Paris Stock Exchange, the companies are selected based on their market capitalization.

- SSE Composite- This index, often known as the Shanghai Composite, follows the performance of all A- and B-shares listed on the Shanghai Stock Exchange. It mainly favors financial and industrial firms.

How Share Prices Are Set

Share prices are not set by the companies themselves, instead in a fair market play it all depends on the buyers’ and sellers’ interest level in the stock. If the buyers are rigorously buying the stock, its demand increases which eventually leads to a shoot-up in its price. Whereas, if the sellers are selling the stock with full force that means the stock is getting out of focus on the radar of investors or traders, and this leads to a shoot down in the price of the stocks.

No one controls the share prices of the company other than its buyers and sellers.

Advantages of Stock Exchange Listing

Listing a company on the stock exchange brings a lot of rewards combined with responsibility to the company. The company is officially in the market for investors with complete transparency. The inflow of capital from retail as well as institutional investors improves the market capitalization of the company as well as the liquidity. The influx of capital can significantly help in R&D as well as the expansion and growth of the company.

Following, being listed on stock exchanges attracts attention from investors, researchers, and retailers. The enhanced visibility creates a place of better opportunities regarding partnerships, expansion, and mergers.

At last, being listed on the stock exchange offers a valuation benchmark to the company. It becomes easy for investors to assess the current valuation of the company based on its shares.

Disadvantages of Stock Exchange Listing

Though, stock exchange listing comes with a lot of rewards, but it has its own share of drawbacks. The foremost step of listing, that is getting legal permission comes with a lot of financial burden. A lot of money is gone in making agreements, seeking grants, and other legal expenses. Also, all this has to be done in the regulatory framework curated by SEBI. It creates quite a burden on the board of directors before the actual listing happens.

Further, heightened scrutiny is faced by listed companies from their shareholders, board of directors, analysts, and other stakeholders. Stakeholders expect the company to perform exceptionally every financial year to reward their investment. This can create a lot of pressure on the company, and if the circumstances aren’t in favor, many withdrawals can take place in the company.

Furthermore, public disclosure rules may expose critical information to competitors, jeopardizing the company’s competitive advantage. Finally, there is the possibility of hostile takeovers, as publicly listed shares make it easier for potential acquirers to assume control of the company.

What are benefits to invest in stock market?

It can take a long time to setup a business, but its take very minimal time to trade in stock market.

It’s ‘fast’ cash and allows for quick liquidation.

When we buy share of a particular company we become shareholder in that company. Shares are also known as equities. Research studies have proved that investing in a good company have outperformed most other forms of investments in the long term, or we can say that investments in some shares with a longer tenure of investment have yielded far superior returns than any other investment.

Equities are considered the most challenging and the rewarding, when compared to other investment options

Few more reason to invest in stock market

Suppose if we want to invest in gold, we can buy gold bees in electronic form if we are planning to invest in property, we can buy property shares and many more

Indian economy is growing day by day and we should part of our economic growth by investing in stock market.

Is this always safe?

No it does not mean investment in equity would guarantee similar high returns all time. Equities are high risk investments and must need to study them carefully before investing.

There are some risk associated with equity like any other business, because we are also investing in a business of a company, which is looking very good for now but may be anything can happen in future.

How to invest safely?

Whenever we plan to invest in a business, the first thing come in mind “is this worth to invest?”

Then we analyse everything like how much growth we are expecting and how much loss we can afford if business not work well and all that.

Similar to that we need to learn how to make profit from the stock market. For that we need to have our basics clear. We need to be crystal clear of each and every aspect of Investments, stock options, Stock Trading, Company, Types of Shares, Various Corporate Actions, Debentures, Securities, Mutual Funds, IPO, Derivatives. What does the Share Market consist of? Exchanges, Indices, SEBI, Trading Terms (Limit Order, Stop Loss, Put, Call, Booking Profit & Loss, Short & Long), Trading Options – Brokerage Houses etc.

Mutual Fund is also a safe way to invest in stock market.

Analysis of Stocks – How to check on what to buy?

Before we plan to buy any stock we must have knowledge either Fundamental Analysis or Technical Analysis

Fundamental Analysis will give us an idea of how to pick a good company’s share for a long term while Technical Analysis will give us an idea of short term to long term opportunity.

How much does a stock market grow every year?

According to data from the past few decades, a good growth rate for the established stock markets is said to be 10% per year. Indian stock market growth has not been steady after the hit of covid. The market has seen a good boom with increased participation. From the year 2021 to 2022, the Indian stock market grew 21%. This has been said to be the great benchmark for the market.

FAQ

1. Why should I trade in the stock market?

Trading in the stock market provides prospects for profit by purchasing and selling equities. Individuals can participate in the financial markets and potentially increase their wealth through active investment management.

2. What are the potential benefits of trading stocks?

The potential benefits include capital appreciation, dividend income, portfolio diversity, and the ability to hedge against inflation. Trading stocks can also provide greater flexibility and liquidity than other assets.

3. How can trading in the stock market generate income?

Trading in the stock market can create income from capital gains, which occur when a stock’s price rises when it is sold, or dividend income from owning dividend-paying equities.

4. What risks are associated with trading in stocks?

Market volatility, company-specific risks, economic downturns, and unforeseen catastrophes are all potential dangers. Furthermore, trading risks include timing errors, emotional biases, and leverage can result in losses if not controlled properly.

5. Is trading stocks a suitable investment strategy?

Individuals with a high risk tolerance, time to devote to study and analysis, and a deep understanding of market dynamics may find stock trading appealing. It is critical to match trading techniques to personal financial objectives and risk tolerance.

6. What resources are available for stock market trading?

Resources include financial news websites, trading platforms, research reports, online courses, books, and seminars. In addition, traders can use technical analysis tools, fundamental data, and educational materials to improve their trading knowledge and skills.

7. How do I get started with trading in the stock market?

Begin by opening a brokerage account, performing research, and devising a trading strategy. Understand various trading strategies, risk management tactics, and market analysis methods. Begin with tiny investments and progressively raise your exposure as you gain more experience.

8. Can trading in the stock market be profitable?

Yes, stock market trading may be rewarding for knowledgeable and disciplined investors who control risks and seize opportunities. However, success necessitates ongoing learning, adaptation to market conditions, and disciplined execution of trading methods.

9. What are the differences between trading and investing in stocks?

Trading involves routinely buying and selling stocks in order to profit from short-term price swings, whereas investing often entails purchasing companies with a long-term perspective, focusing on fundamentals and possible growth over time.

10. What factors influence stock market trading decisions?

Factors include firm fundamentals, technical analysis, market trends, economic indicators, geopolitical events, investor attitudes, and news catalysts. Traders use these factors to make informed judgments on whether to purchase, sell, or retain shares.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube