Why Financial Planning For Small Businesses?

Abstract

Financial planning for small businesses is very essential these days. Everyone out there is planning and earning profits. It generally includes setting realistic goals, and managing all the expenses, and it also includes saving, investing effectively, managing all the debts then optimizing all the taxes. One can create a strong financial plan that can help you gather goals and this blog will help you as a guide so that you can also plan wisely.

What is Financial Planning?

Financial planning is the proper road map which will include analyzing your current financial situation and creating a plan that can help you achieve your goals. Financial planning can also cover various aspects that are saving, investing and managing all of your debts. By financial planning, one can achieve financial stability and freedom which is needed by all.

Why is Financial Planning important to small business owners?

This is the major question that might be in your head when it comes to financial planning for small businesses.

Small business owners always want to have a solid financial plan in place. Financial planning can give you an outlook for setting your financial goals and managing your budget. In this blog, we will explore why financial planning is very important, especially to small business owners. Financial planning can also be called business finances which can include revenue and expense forecasting, it is very important for small business owners.

Here are the reasons why financial planning is essential for small businesses:

Financial planning Helps in Making Informed Decisions:

Financial planning is vital for small businesses because it helps owners to make informed decisions. You can forecast your revenue and expenses and also can identify potential financial issues. After forecasting you can take major steps to fix them. For example, you know that if you forecast the cash flow problems you can take respective steps i.e reducing expenses and increasing the revenue so that future financial crises can be avoided.

Financial Planning Provides a Clear Picture of Business Finances:

Financial planning is a very clear idea of your current financial position. You can analyze things and can fix them too according to the situation. Sometimes you overspend but you need to fix it. Moreover, by keeping track of your income and expenses, you can identify trends and make futuristic decisions for investments.

Financial Planning Helps in Securing Funding:

An appropriate financial plan is important when you are funding your small business. It is important because lenders and investors will want to have a look at your financial plan. After all, it will depict your compatibility to manage finances effectively and efficiently. By having a specific financial plan you can enhance the chances of growing your business.

Financial planning Helps in Setting Financial Goals:

Financial planning is very important so that you can have financial goals for your business. When you start planning out your finances you get a roadmap on how you can achieve it and you set realistic goals. Financial planning can include an increase in revenue, reduction in expenses, and improved profitability in terms of assets. Once you have financial goals you can target them and achieve them accordingly.

Helps in Managing Cash Flow:

When you are running a small business managing your cash flow is very important and critical. Financial planning is the major thing that can forecast your income and expenses. Also financial planning can help you to identify all the potential issues that are coming in cash flow. Also then you can take steps to address them.

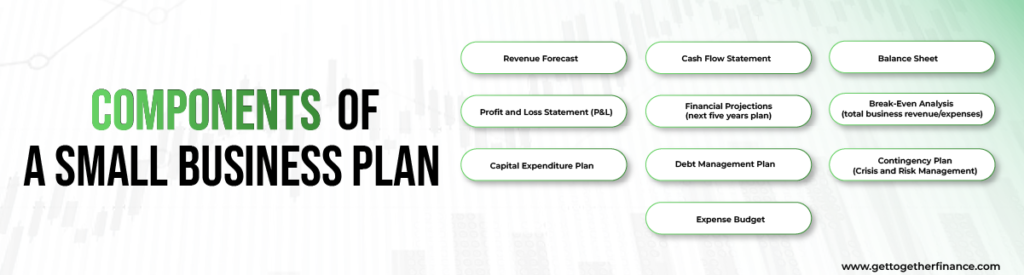

Components of A Small Business Plan

Starting and successfully running a small business can be a long journey, full of thorns and few rewards. To keep the risks minimal, what businessmen do is prepare a perfect blend of business zeal with strategic financial plans and critical decision-making.

To craft a strategic plan, you need a blueprint of all the parts (components) of the engine so you can prepare for the final model and launch the product with no ado. Here we have listed crucial elements of a small business, staple for creating a strategic financial plan.

- Expense Budget

- Revenue Forecast

- Cash Flow Statement

- Profit and Loss Statement (P&L)

- Balance Sheet

- Break-Even Analysis (total business revenue/expenses)

- Financial Projections (next five years plan)

- Capital Expenditure Plan

- Debt Management Plan

- Contingency Plan (Crisis and Risk Management)

These are the significant aspects of a small business that require proper supervision, at least at the beginning till the initial five years.

What are the Benefits of Financial Planning?

A good financial plan for your business will keep you up-to-date and focused as the company grows. You can effectively control new emerging challenges and unexpected crisis by using financial plans.

We have a lot of benefits of financial planning, some of it include:

1. Financial security:

When you plan properly, you can build a strong foundation for financial security. Financial planning helps in creating emergency funds, debt burdens can be reduced and the stable income is ensured for the better lifestyle.

2. Goal Achievement:

goal achievement is important, financial planning helps you achieve them and you can develop strategies to achieve them. Be it buying a home, funding your education and owning a business a financial plan can help you in everything as per your goals.

3. Risk Management:

we have risk in everything we do but when risk can make your future better why not take one. Financial planning involves risks and taking measures for it is what we need to do. For example, when we need to protect ourselves from unexpected events i.e. accidents, illness, or any natural disaster we need insurance coverage to protect us.

4. Accumulation of wealth:

when one starts saving but cuts a certain amount of wealth which is stored for future benefits. This is saved keeping the futuristic approach so that one can use it in the circumstances that are unpredictable.

4 Steps to Create a Financial Plan for Your Small Business

For a small business, creating a financial plan is like outlining a map for a long trip with a destination. You need to know where you’re going, what you’ll need along the way, and how to check all unexpected detours without any hassle. Here are four steps to help you create a solid financial plan:

Create a strategic plan

Similar to creating a draft route checking before the road trip, you can begin your small business journey with setting business objectives and goals. The whole process is helpful in defining capital and resource allocation efficiently.

Create financial projections

In this phase, estimates of income, expenses, and cash flow are drafted for the future. Just like estimating your food, gas, and accommodation costs for your trip. For this, investors use former financial data and market research to make these projects precise and accurate.

Plan for contingencies

Contingencies are the part of any journey, whether it’s life or business. Hence, prepare yourself for unexpected weather or road closure on a strip. Spot potential risks to your business and design crisis and contingency plans. What it requires – segregating emergency funds, securing lines of credit, etc.

Monitor and compare goals

Keep a close look at your financial performance and compare it to your set goals. If you’re off track, adjust and alter your plan as needed. It’s like going through the outline of a map before you deroute or make a wrong turn.

By following these steps, you can create a financial plan that will help guide your small business toward success, even when the road ahead is bumpy.

Also Read: https://www.gettogetherfinance.com/blog/stock-market-education/

How can one do financial planning so that it can give you returns?

There are major steps one needs to follow for planning finance, some of it which are listed below:-

1. Assessing your current financial situation

Financialplanning is a process and it is very important to know your current financial situation. It may include your earnings, expenditures, and debts. Having an idea of the current situation you can set realistic goals and develop appropriate strategies.

2. Setting SMART Financial Goals

Goals have to be SMART i.e. well defined, significant, relevant, time-bound and achievable. Whenever you are setting up financial goals for yourself it is very essential to make it specific because we need to ensure that they are aligned with overall financial objectives. For example, we must save a particular amount of money if we need to pay a down payment on a house.

3. Creating a Budget

When you create a budget for yourself, you can track your expenses as well as income because it will provide you with visibility about the money. This is the futuristic approach that will save and allocate funds for your financial goals.

4. Developing an Emergency Fund

The most important part of financial planning is organizing emergency funds. It is a very crucial component when we maintain financial stability. These funds can act in unexpected situations including job loss, and medical emergencies. One needs to develop it in such a way that it can generally cover your 3-6 month expenses.

5. Managing Debts Effectively

Another very important factor for financial planning is managing debts. Manage your existing debts on the basis of interest rates and terms also create a plan so that you can pay them off in a very systematic manner.

6. Investing for the Future

Whenever you invest you allow your money to grow over a period of time. One needs to determine what is the risk tolerance and investment objectives. Time horizon is also very important to choose the suitability of investment like mutual funds or real estate. Always check and update your investment so that it can meet your goals.

7. Regularly Reviewing and Adjusting Your Financial Plan

One must always check and update their financial plan because according to time, priorities change and life circumstances change so one needs to follow all the things accordingly. Planning is very important in that scenario because if one will not plan regularly how one will adjust the plan accordingly.

Financial planning tips for small businesses

Financial planning is crucial aspects of a small business to sustain and be successful, especially during the time of high competitive edge in the market. Here are four key tips to help you manage your finances effectively.

1. Review your operating expenses

A new or small business requires regular oversight of expenses to diagnose the areas that can afford cost-cutting smoothly. You can also find ways to minimize overhead expenses without hampering the service or product quality of the company.

2. Outline your business goals

It’s important to be precise to avoid the chaos. Clearly define your short and long-term goals. It will help set the financial resources you need to meet your set visions and create a roadmap for your business growth.

3. Consider your funding options

Explore different funding options available to you, such as grants, loans, or investors. Select what suits your business needs and financial situation the best.

4. Build your credit score

If you’re on a stage to start or sustain a small business, you definitely know the value of keeping a good credit score. If not, it’s vital like turmeric in your mom’s curry – you might have built strength by consuming it consistently but its continuous consumption will keep building you antibodies for emergencies (loan requirements and other).

What to do?

Start with paying your bills on time, keep your credit card balances low, and monitor your credit report often.

By following these tips, you can create a solid financial plan that will help you manage your finances effectively and achieve your business goals.

Conclusion

Financial planning plays a vital role in small businesses. As it helps owners to make futuristic decisions that can give a clear picture of the finance, by getting a clear picture you can secure funds and set your financial goals which can manage cash flow. By creating a solid financial plan small business owners can increase their success and achieve their financial objectives which they need to achieve.

FAQ

How can small businesses create a solid financial plan?

Any business, whether it’s small, medium or large sized, can create a solid financial plan. But first and foremost, they need to set clear goals and objectives. After setting the visions, business owners/respected divisions study the current financial situation, including cash flow, expenses, and revenues. The budget outlining along with estimated expenses and incomes is set next. It’s also crucial to consider potential risks and contingency plans.

Key components of financial planning for small businesses?

The key elements include expense budget, revenue forecast, profit and loss statement, cash flow statement, break-even analysis, balance sheet, expense plan, financial projection, debt management plan, etc.

Role of budgeting in small business financial planning?

Budgeting plays the role of father in any business plan – managing finances and allocating resources. It lets them spot the financial issues early and make anticipated decisions, considering expenses and investments.

Addressing common financial challenges in small business plans?

Common challenges that often every businessmen overlook, comes back biting them back. These problems include controlling costs, managing cash flow, securing finances, regulatory compliance and dealing taxes.

Importance of cash flow management in small business planning?

Like the balanced flow of a river which makes the natural hurdles more thrilling and fun, cash flow management plays a vital role in seamless functioning of business. It helps administer future investments and expenses, considering the overall financial health of the business.

Strategies for taxes and regulatory compliance in small business plans?

If they’re is a planned way out – why not? Hence, despite keeping the tax fund aside, the strategies vary from keeping accurate financial records, consulting tax advisors or accountants, and complying with all tax laws and regulations to prevent future issues.

Managing debt in small business financial plans?

Debt management is way too crucial in small business. It includes decoding different debt types so you can go through it once and for all. Besides, preparing a debt repayment plan and avoiding unnecessary loans should also be one of the staples of a small business.

Differences between small business and personal financial planning?

As the name suggests, personal finance focuses on managing an individual’s financial needs such as retirement goals, home loans, etc. Whereas small business financial planning includes setting a company’s goals, visions, objectives, to secure good financing, avoiding debts and crisis.

Tools/resources for small businesses in financial planning?

The tools/resources include financial planning templates, accounting software, online calculators, financial planners/accountants, and professional advisors. These may not sound like tools – but works exactly like a GPS system, navigating you with professional suggestions, every step of the way.

How often should small businesses update their financial plans?

Small businesses should go for a financial plan update, ideally on a quarterly basis. This allows them to study their financial performance, alter their ongoing plan, and stay on the track to meet their financial goals.

Influence of goals and time horizon: Mutual Funds vs Stocks?

Ah, goals and time horizon- the key two elements of finalizing whether stocks or mutual funds are suitable for an investor or not. Mutual funds are often considered suitable for long-term investment for low risk tolerance investors. Whereas stocks can play more volatile, suitable for both long and short-term investments. However, stocks can also offer potential higher return over the longer -term tenure, investors/traders may benefit in the stock market with short-term trading set-ups.

CATEGORIES

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube