FPO – Follow-On Public Offer

- May 17, 2024

- 1922 Views

- by Manaswi Agarwal

Follow-On Public Offering or FPO is the next offering made by the company after raising funds from its initial offering to expand its operations.

What is FPO?

What happens when a company has already raised funds from the public through IPO and is in need of more capital? To understand the answer of this question, we must learn about FPO which stands for Follow-On-Public Offer. This is the second offering made by the company after its initial public offering.

IPO and FPO are the offerings made by a company to raise funds and dilute ownership to the public wherein IPO is the initial offering and FPO is the follow-on public offering. Let’s dig into the topic.

Why is FPO required by a company?

Each business requires funds to expand its operations and accomplish financial goals. The funds are needed for research and development activities, manufacturing and marketing. When a company needs ‘additional capital’ and is already listed in stock exchange then the company can fulfill its goals by conducting Follow-On Public Offering.

Reasons to raise FPO could be:

· Reducing the debt of the company

· Raising additional capital for the company

· It helps in enhancing the liquidity of shares by making it easier for the companies to buy and sell their shares.

What types of FPO can a company raise?

Now that you are aware about the basics of FPO and the reasons to raise FPO, let’s learn about the different types of FPOs in detail. Below are the given FPOs that a company can announce based on their categories:

Dilutive FPO

Dilutive FPO is called when new shares are greater in number as compared to outstanding shares of the company. A diluted FPO results in reducing the share prices of the company to add value to the investors. ITI Ltd. can be considered as an example which is a public sector company.

Non-Dilutive FPO

These shares already exist in the market and do not dilute the existing shareholding of the company. It does not result in increasing the number of outstanding shares whereas it increases the shares which are already available to the public.

At-the-market FPO

It is called as the controlled equity distributions where companies can raise funds at real-time price of the shares. If the company experiences a fall in the prices of shares it can pull out and offer the shares at current market price.

Factors affecting FPO

Follow-On Public Offering is affected by several factors which include:

· Market Conditions: The success of an FPO may depend on market conditions as it is affected by overall economic conditions.

· Growth of company: The performance of the company determines the behavior of investors. Investors briefly evaluate the financial health, profitability and other growing factors of the company.

· Industry Trends: Industrial trends and factors impact the success of an FPO. The performance of the overall industry such as its growth, earnings, industry-specific factors and how the industrial trends have taken place during the last few months impact the working of FPO.

· Regulatory environment: FPO is affected by the changes in the rules and regulations of the industry and the company. The launch of an FPO is affected by the changes in regulations, compliance requirements, and legal developments.

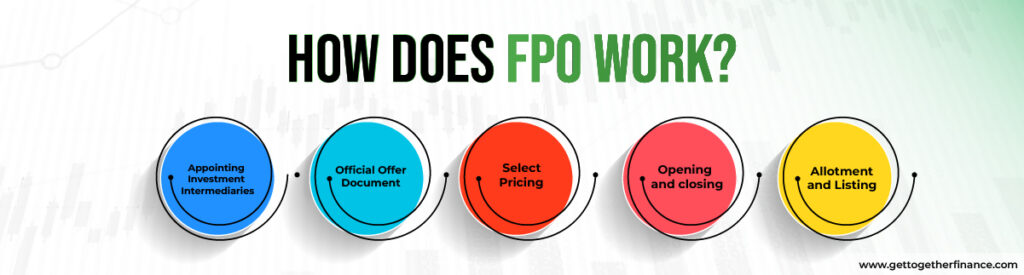

How does FPO work?

The process of FPO is quite similar to that of IPO which can be understood as:

· Appointing investment intermediaries: Intermediaries like investment bankers and brokers are appointed to provide assistance and guidance.

· Official offer document: Offer document is filed with SEBI that has all the important information about FPO size, lot size, etc.

· Select pricing: After the approval of SEBI, the price is confirmed per share for the FPO at which the investors can apply.

· Opening and closing: FPO is opened for a certain period and is closed after the bidding process is over.

· Allotment and Listing: After closing of FPO application, final offer price is allotted to the investors and the shares are listed on the stock exchange.

For investors: FPO is believed to be a better investment option because of reduced risk level. The risks are very high while investing in an IPO but when a Follow-On Public Offering is made, the investors have valuable insights of the company. Investors can easily evaluate the performance of the company by conducting fundamental and technical analysis.

Also Read: Biggest IPOs

Know the difference between IPO and FPO to understand briefly:

| Parameters | IPO | FPO |

| Objective | Initial offerings made by the company to expand the business. | Follow-on public offerings made by the company to expand its equity base. |

| Performance | Investors do not have information about the company except the document called Red Herring Prospectus (RHP). | Investors already know the essential information of the company and know its performance after an IPO. |

| Profitability | IPO can be more profitable. | FPO is less profitable than IPO. |

| Risk | Investors do not have much information about the company therefore it is risky to invest in an IPO. | FPO is not much more risky than IPO as the investors have all the information about the company. |

Some well known companies that have made Follow-On Public Offering are:

For example; Indian Railway Finance Corporation or IRFC is a public sector company which made its initial public offering in January 2020 to raise $636 million. Later, in December 2020, the company announced FPO shares to raise an additional capital of $189 million. Here, the prices of shares were discounted at 4.63% stock closing price. Let’s get to know about the companies which have made Follow-On Public Offering to raise additional capital after raising funds initially from IPOs:

· Power Finance Corporation Ltd.

· Power Grid Corporation of India

· Engineers India Ltd.

Wrapping it up…

Now you know the difference between IPO and FPO. FPO has several advantages over IPO as they are the offerings made by the company after an IPO. FPO can prove to be beneficial for both the investors and the company.

FAQs

Q1. What is FPO?

FPO stands for Follow-On Public Offering which is made by the company to raise more funds.

Q2. Can I invest in FPO?

Yes, anyone who has a Demat account can make an investment in FPO.

Q3. Which is better to invest: IPO or FPO?

IPO is more risky than FPO, because investors are aware about the position of the company before investing in FPOs.

Instagram

Instagram