A Guide on Modern Portfolio Theory (MPT)

- May 27, 2024

- 585 Views

- by Manaswi Agarwal

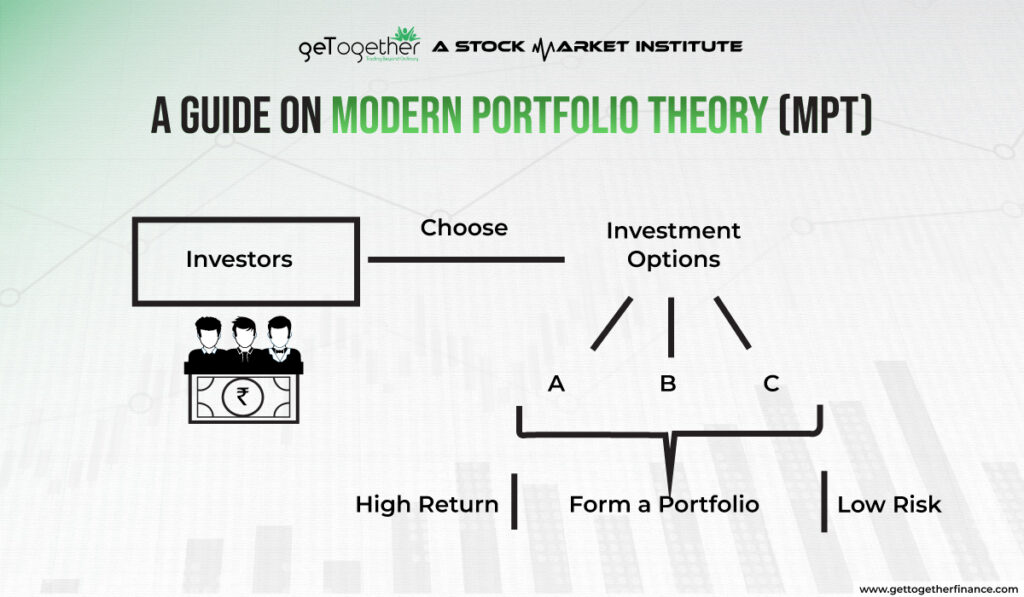

Investing can be a daunting task for the investors looking at the volatility of the market. Investing requires a professional approach and which is why modern portfolio theory has been able to gain prominence in recent times as it provides an efficient investment approach. The modern theory has allowed investors to maximize their returns on a certain level of risk. The theory allows investors to maximize their returns by creating a diversified portfolio and minimizing the market risks.

What is Modern Portfolio Theory (MPT)?

Modern Portfolio Theory is an investment approach with the help of which investors assemble an asset portfolio to maximize the expected returns for a given level of risk. The theory is aimed at optimizing the portfolios by factoring in risk and return trade-offs. The theory was introduced by Harry Markowitz, an American economist, in a paper called “Portfolio Selection” in 1952 which transformed the ways of managing portfolios for the investors. The main focus of this theory is on the diversification of portfolio and managing the relationship between risk and returns while building investment portfolios. The model is used by investors as it guides them to choose different types of investments with diversification strategies.

Also Read: Research Analyst

Concepts of MPT

The theory assumes that an investor is always rational and will choose the less volatile asset to get maximum returns on the asset. The risk is calculated through variances of each asset along with the correlation of each asset. The working of modern portfolio theory is based on diversification, the efficient frontier and capital allocation line.

Diversification

It is a strategy that suggests investors to diversify their investments into variety of assets. The motive of diversifying the investments is to spread the risk into various assets and hence reduce the overall risk in the portfolio.

The Efficient Frontier

The efficient frontier is the graphical representation of all the possible combinations of the securities to measure the risks associated with optimal returns on a given level of risk. The portfolios that lie on the frontier line tend to be optimal as they have minimized risks and maximized returns. On the other hand, if a portfolio lies below the efficient frontier curve as they offer higher return for the same risk or lower risk for the same return.

Risk and Return

Risks and returns are managed efficiently with the help of this theory where the risks are measured through the standard deviation of portfolio returns whereas the return is the expected profit on investment in a portfolio. Risk and return are the major components of this theory wherein returns are maximized by minimizing the risks in the portfolio.

Capital Allocation Line

The capital market line or allocation line determines the risk reward tradeoff of the securities with a portfolio that consists of risky assets. The line represents expected return of the portfolio as a function of its total risk.

Components of Risks

As per the modern portfolio theory, there are two components of risk identified which are systematic and unsystematic risk. Investors can reduce the risks by combining a diversified portfolio of assets.

Systematic Risk

These risks are considered as market risks that cannot be predicted and have the capacity to make an impact on the entire market and economy. These risks can negatively affect the investments and the theory does not claim to overcome these market risks.

Unsystematic Risk

Unsystematic risks are the specific risks related to individual assets which can be managed through the process of diversification. The risks related to individual assets are reduced by spreading it into various sectors.

Benefits of Modern Portfolio Theory

MPT is a beneficial approach to construct a portfolio that can offer maximized returns and several benefits to the investors. The theory is useful for investors to build a diversified portfolio. Let’s have an in-depth understanding about the benefits of MPT because of which it has been widely adopted in the world of finance.

· Investors can reduce the risks as the theory encourages diversification which is a strategy of spreading investments into various sectors. This allows the investors to reduce the impact of risk on individual assets.

· The theory helps to evaluate and manage risks based on the assets. Investments are reviewed regularly and underperforming assets or the assets that involve excessive risks are scrutinized and then replaced with new assets.

· Investors do not only rely on single investment for their financial stability, instead with the help of this theory, they diversify the portfolios to get maximized returns.

· The MPT approach is systematic and quantitative while constructing a portfolio. It is more suitable and reliable as compared to trades based on expectation and relying on intuitions.

· Quantitative method is a reliable one where data driven decisions are taken using statistical measures such as mean, variance, covariance which enhances investment decisions.

Criticisms of Modern Portfolio Theory

The modern portfolio theory has been widely used by the investors because of the efficiency that it offers. However, the theory faces several criticisms as it is based on various assumptions and might get impacted by market conditions.

· The limitation of MPT is that the portfolios are evaluated based completely on statistical measures like variance and avoid downside risks.

· The theory assumes that the asset returns follow a normal distribution, but that is not the case as in the market there can be extreme positive or negative events that might lead to underestimation of risk resulting in potential losses.

The Bottom Line

The Modern Portfolio Theory is constructed in a way that protects investors from losses by diversifying their investments into various assets. The theory implements statistical tools to calculate the risks associated with each investment. It is widely used by traders to maximize their profits and limit losses. However, the courses offered by GTF ensure better risk management strategies. As MPT is based on several assumptions which are followed by criticisms, the demands and supply theory have proven to be efficient to analyze market volatility and price fluctuations.

FAQs

Q1. What is Modern Portfolio Theory?

Modern Portfolio Theory is an investment model that allows investors to diversify their investment options to gain maximum profits and reduce potential market risks.

Q2. Who introduced modern portfolio theory?

The theory was introduced by Harry Markowitz who is an American economist in 1952. The theory was introduced by him in a paper called “Portfolio Selection”.

Q3. How does modern portfolio theory work?

The modern portfolio theory guides investors to optimize their portfolio by understanding risk and reward trade-offs. The portfolio is diversified into various investments to maximize the returns and analyze the performances of portfolios.

Q4. What are the key principles of MPT?

The key principles on which modern portfolio theory works is diversification, the efficient frontier, risk and return and capital allocation line.

Q5. How to manage risks while doing investment?

An investor must invest in various assets to spread the risk in several sectors and do not depend on a single asset for returns.

Instagram

Instagram