20 Rules Followed by Professional Traders

- Updated on : October 13, 2025

- 1451 Views

- by Manaswi Agarwal

Profitable trading in the financial market is much harder than it looks like and professional traders tend to possess rare characteristics that are beneficial for trading. The traits of a trader demands patience, discipline and commitment to ongoing trading education. Trading is a quite complex process which involves analyzing data, developing market psychology, controlling risks and making timely decisions. A set of guidelines gives direction to beginner traders to master the art of trading. Trading is a complete journey of hard work, continuous learning and willingness to adapt.

Table of Contents

ToggleWhat are the successful trading strategies?

Each beginner trader who has just stepped into the world of stock market wants to achieve success in the short term. After years of research into the stock market, traders have come across several trading strategies that might help beginners to turn their dreams into reality. The blog highlights some successful trading strategies used by professionals.

1. Plan your Trade, and Trade your Plan

Professional traders create a trading plan where they learn to develop self discipline and help them avoid taking risks that are not easy to handle. Planning the trade and sticking to the plan boosts self confidence of an individual. It is important for a trader to plan their trades and trade according to their plans.

2. Follow Simple Strategies

Professional traders tend to avoid complex strategies as it can create chaotic situations with a lot of confusion. Simple strategies are followed regularly that can be easily transformed as per the requirement. Professional traders make their rules and stick to them as these rules guide them towards the moves in the market. Formulating rules and sticking to them maintains discipline among traders and protects them from potential losses.

Also Read: Successful Investor

3. Control the Risks

Risk management is an essential strategy to follow for a trader where they control or manage the risks as per their formed strategies and planning. Risk control helps traders to identify the capital to risk per trade, understand potential losses and implement effective strategies to achieve the trading goals.

4. Stay Disciplined

Discipline is a key principle to achieve success in any stream and trading requires discipline and patience to ace the process. Stay disciplined with the strategies that are formed after a proper research, changing them frequently breaks the flow leading to wrong decisions. Discipline is very important in trading to get effective results. Patience helps traders to look for opportunities in the market and make best use of it. It allows traders to enjoy most of the trades and help them to deal better with volatile situations in the market.

5. Multiple Time Frame Analysis

Professional traders always execute their trading based on different time frames i.e. monthly, weekly, daily, intraday, etc. The price action of a stock is thoroughly understood by analyzing the performance of the stock over a long period. Analyzing the price action of a stock on a single time frame is not reliable and hence several time frames are analyzed.

6. Lose the Crowd

Traders who are experienced don’t blindly follow the popular trends, instead they are dependent on their own strategies by having a deep understanding about market movements. Traders should deeply understand their own charting style and not rely on the views of other people.

7. Stay Committed towards their work

Traders who work professionally always stay dedicated and committed towards their work. Distractions in trading lead towards lack of commitment which a trader cannot afford. Commitment in trading means giving sufficient time to analysis and talk to the charts for in-depth understanding.

8. Top-Down Approach

Top-Down Approach is one effective analysis used by traders to conduct the technical analysis. Professional traders understand the whole price action by analyzing the performance of the stock in its past. Top-Down Approach allows a trader to make strong buying decisions by thoroughly studying the behavior and price action.

9. Consider Warnings

Traders should never avoid warnings prompted by the charts and their trading strategies. Ignoring warnings can impact badly on the trades in future. Traders should timely implement changes in their trading strategies to prevent losses.

10. Learn to bear losses

A trader needs to accept the losses to maintain their emotional stability. Losses are a crucial internal part of trading that helps traders to learn how to grow from their losses. Traders learn from losses and implement required changes in their strategies for better results in future trades.

11. Avoid Market Gurus or Unnecessary Information

Guidance in trading can be detrimental; it requires expertise of an individual with self confidence. Getting stuck with trading gurus can put traders in unexpected situations where they can lose a huge amount of money. Individual analysis matters a lot after gaining learning from reliable trading educators. GTF is one reliable platform where traders can develop their trading skills with demand and supply theory.

12. Organize Personal Life

Professional traders have a great management of their personal life as they keep their trading activities from personal concerns. Balancing your personal life is essential to achieve harmony as well as improve your performance in trading.

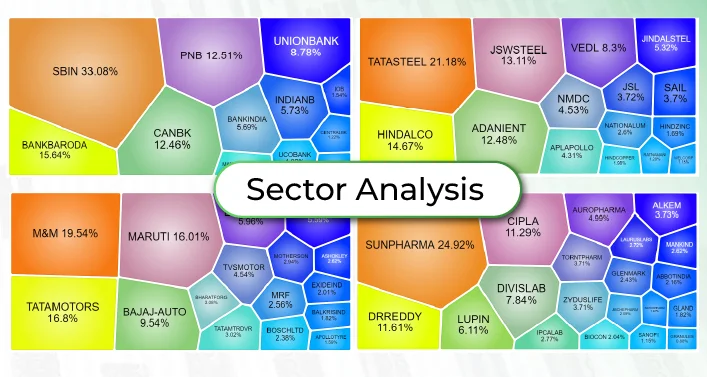

13. Sector Analysis

A professional trader keeps regular updates about each sector in the stock market. The performance of an individual stock sometimes depends on how the sector performs in the market. A good or a bad performance of a sector highly influences the price action of a stock based on which a trader has to transform the decisions.

14. Avoid the Obvious / Market Traps

Some obvious trading situations are kind of a trap where the chances are that everyone else has also spotted a wonderful trade situation which eventually sets you up for a disaster. Many people get trapped in some obvious good looking trades. Some obvious trades can sometimes be the market traps as they are hyped, professional traders stay away from these traps and focus completely towards the demand and supply zone.

15. Use your Mind and Strategy

Traders should learn effective implementation of strategies but then depend on their own formulated strategies as per their capital and risks. They should create their own brand based on their technical skills and risk tolerance for better results.

16. Don’t Cut Corners

Never underestimate the competition because your competitors have spent hundreds of hours developing effective strategies. If you expect to walk away with some profits from a few trades, that could be an unpleasant revelation. Traders are required to give proper time with hard work and discipline to attain long term success.

17. Trend Analysis

Trend analysis guides the direction of the stock where it moves. Professional traders prefer to go with the trend as an uptrend indicates an upward movement in the stock while a downtrend shows downward movement. It is one important tool to predict the direction of the stock with several other factors like demand zone, sector support, etc.

18. Tools don’t think

Several tools or software are available in the market offering a range of customized buy and sell signals. Software cannot think like a human mind, the tools are never smarter than you and can result in obstructing your crucial experience. The tools can prove to be effective when associated with your trading strategy but ultimately the charge is in your hands.

19. Get Rid of Paycheck Mentality

Trading is associated with profits and losses both; it is not like a wage which is earned for working on a long hour basis. Traders do not have fixed income like wages on hours; many people have the habit of receiving paychecks at the end of each month. Traders get to enjoy the profits as well as have to bear the losses.

20. Beware of Reinforcement

Impulsive decisions based on past successes increase overconfidence which might lead to wrong conclusions and traders must stay vigilant against impulsive behavior and stick to a well defined plan.

Why do most traders fail?

There could be several reasons for the failure of traders in the stock market. Many traders are not able to follow the rules and guidelines related to trading and hence are not disciplined and patient. Trading requires consistency with a strong hold on the technicals and chart patterns apart from the above given strategies.

The Bottom Line

A professional trader should always stay committed to the trading strategies by sticking to the formulated rules. Many traders are not able to reach their full potential as they lack commitment and discipline. The traders are required to follow the classic rules by keeping a sharp focus towards profitability.

FAQs

Q1. What is the most important rule of trading?

Trading always works well with discipline and commitment. Traders must safeguard their capital through risk management activities and ensure sustainability in the market.

Q2. What is the foremost rule of trading?

The foremost rule of trading is to have a plan for trading and trade according to your plans considering the risks.

Q3. What do professional traders do?

Professional traders make a sound strategy that they follow by managing the risks timely and respond to the warnings immediately as required.

Q4. How to be a professional trader?

An individual can become a professional trader by getting enrolled in GTF courses that ensure proper learning with lifetime mentor support.

Instagram

Instagram