IEPF Withdrawals Made Easy: How to Access and Retrieve Your Stuck Investments

Do you ever clean out an old drawer and discover forgotten stuff (gem) with more value than it used to hold earlier?

Imagine that gem being an investment you made years ago, tucked away and gathering dust. Millions of rupees are currently sitting unclaimed in the Investors Education and Protection Fund (IEPF). Could some of that forgotten wealth be yours?

This e-guide will be your roadmap to unlocking these potential lost treasures. We’ll walk you through a step-by-step process for easily retrieving your investments held by the IEPF. Don’t let your hard-earned money sit idle any longer. Let’s help you reclaim what’s rightfully yours!

What is IEPF?

Investor Education and Protection Fund, abbreviated as IEPF, is a government authority, funded to protect the interest of investors and encourage their education. It is a statutory body administered by the Ministry of Corporate Affairs (MCA).

The key objective is to make sure that matured deposits, unclaimed dividends, and other scheme amounts are successfully returned to their righteous owners.

It functions as a depository for various unclaimed or unpaid investor dues, including:

- Unpaid dividends on shares

- Application money for allotment of securities that were not refunded

- Matured deposits and debentures with companies

- Any other investor dues that remain unclaimed for a specified period

Understanding IEPF

Established in 1999 under the Companies Act, the Investor Education and Protection Fund acts as a safety net for investors in India. This statutory body, administered by the Ministry of Corporate Affairs (MCA), safeguards unclaimed or unpaid investments. It functions as a depository for various investor dues that go missing over time, such as unpaid dividends, unrefunded application money for securities, matured deposits, and debentures.

Prior to its creation, such funds could be permanently lost to investors. The 1999 Companies (Amendment) Act played a pivotal role by mandating companies to transfer unclaimed dues to the IEPF after seven years. This ensured a second chance for investors to reclaim their forgotten wealth. Over the years, the Investors Education and Protection Fund has actively promoted awareness about its services and streamlined the claim process, leading to a rise in successful retrievals.

The benefits of a functional IEPF are multifold. It safeguards investor interests by providing a mechanism to reclaim lost dues, reduces investor anxiety by offering a safety net, and promotes market confidence by fostering trust in the system. The IEPF’s continued relevance in the present day lies in its ability to facilitate the retrieval of unclaimed investments, thereby protecting investor interests and promoting a healthy market

What Amount Goes to IEPF?

The Investor Education and Protection Fund accumulates various unclaimed or unpaid investor dues from companies. It receives funds as mandated by specific sections of the Companies Act, of 1956 (and its amendments). Here’s a list (not exhaustive) of what goes into the IEPF:

a) Unpaid dividends that have been outstanding for seven years.

b) Funds in the Investor Education and Protection Fund as per section 205C of the Companies Act, 1956.

c) Deposits that have matured with companies other than banks.

d) Debentures that have matured with companies.

e) Income earned from investments made from the Fund.

f) Redemption amounts of preference shares that have remained unpaid or unclaimed for seven or more years.

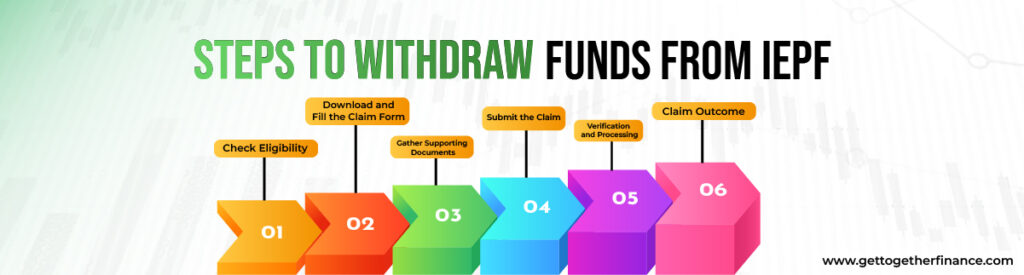

Steps to Withdraw Funds from IEPF

Here are the steps you can take to withdraw funds from the Investor Education and Protection Fund (IEPF):

- Check Eligibility: Before initiating the claim process, verify if you have unclaimed or unpaid investments with the IEPF. You can do this by searching its official website using your name, PAN number, or folio number (if available).

- Download and Fill the Claim Form: The official website provides a downloadable form called “IEPF-5.” This form needs to be filled out accurately with details like your personal information, investment details (company name, type of security, etc.), and the claimed amount.

- Gather Supporting Documents: Attach the necessary documents to support your claim. These may include:

- A copy of the IEPF-5 form with your signature.

- Proof of identity (PAN card, Aadhaar card, etc.)

- Proof of entitlement (dividend warrant, investment certificate, etc.) depending on the type of claim.

- Cancelled cheque with your name and bank account details for receiving the refund.

- Submit the Claim: Submit the completed IEPF-5 form along with the supporting documents to the Nodal Officer (IEPF) of the company that issued the investment. You can find the contact details of the Nodal Officer on the company’s website or by contacting the IEPF authorities.

- Verification and Processing: The Nodal Officer will verify the claim and forward it for processing. This process can take some time, so be patient.

- Claim Outcome: The Investors Education and Protection Fund will review your claim and notify you of the decision. If successful, they will transfer the claimed amount directly to your bank account mentioned in the form.

Documents Required for IEPF Recovery

Here are mentioned the documents and necessary processes required to proceed further:

Claiming Unclaimed Investments from IEPF:

- Required Form: Claimants must fill out Form IEPF-5, available for download on its official website.

Form IEPF-5 Details

- Applicant Information: Name, address, contact details etc.

- Company Details: Name and contact information of the company that issued the investment.

- Investment Details: Type of investment (shares, debentures, deposits etc.)

- Specific details like number of shares, amount claimed etc.

- Year-wise details of the securities or deposits (helpful for tracking claims)

- Identity Proof: Aadhaar number for Indian residents or passport/OCI/PIO Card number for Non-Resident Indians (NRIs) and foreigners.

- Bank Account Details: Account number and IFSC code linked to your Aadhaar card (mandatory for Indian residents). NRIs and foreigners might have different requirements.

Verification and Decision:

- The IEPF is required to make a decision on the claim within 60 days after receiving a verification report from the company that issued the investment.

It’s important to submit the completed form along with all necessary supporting documents as mentioned previously (proof of entitlement, cancelled cheque etc.) to the Nodal Officer of the company, not directly to the MCA website. The IEPF website likely offers a guide and FAQs to assist you with the claim process. Moreover, a 60-day timeline for the decision is an ideal target, but processing times can vary depending on individual cases.

Also Read: Securitization

Conclusion

The IEPF application process can be quite cumbersome and lengthy, including filling out multiple forms and the need for serious continuous follow-ups with authorities. However, the safety of your IEPF funds is inevitable as your capital is safe with the government of India. Remember – it is always safer to go safe than find yourself victimised by the fraudulent withdrawal of investment.

FAQs

How can I check if I have unclaimed investments with the IEPF?

You can search for unclaimed investments on its official website using your name, PAN number, or folio number (if available). Besides, you can visit their official website for the search tool.

What documents do I need to submit for an IEPF claim?

The primary documents required are the completed IEPF-5 form, proof of identity (Aadhaar card for residents, passport for NRIs), and proof of entitlement (dividend warrant, investment certificate etc.). Refer to the IEPF website for a complete list and any specific requirements based on your claim type.

Where do I submit the IEPF claim form?

The completed IEPF-5 form and documents need to be submitted to the Nodal Officer of the company that issued the investment, not directly to the MCA website. You can find the Nodal Officer’s contact details on the company’s website or by contacting the Investors Education and Protection Fund authorities.

How long does it take to receive a decision on my IEPF claim?

The IEPF aims to make a decision within 60 days of receiving a verification report from the company. However, processing times can vary depending on individual cases. You can track the status of your claim online using the Investors Education and Protection Fund website.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube