What Is a Triple Bottom Chart in Technical Analysis?

- December 24, 2024

- 819 Views

- by Manaswi Agarwal

In technical analysis, many trade patterns are followed, among which the triple bottom pattern is an essential chart pattern that signifies a bullish move in security. This blog will help you understand the significance, importance, and limitations of the triple bottom chart pattern.

What is a Triple Bottom Chart Pattern?

Triple Bottom is the visual representation in the charts that indicates buyers taking control of the price action from the sellers. Generally, the formation of triple bottom in the chart signals a bullish move which is seen as an opportunity by traders to enter a bullish position. The pattern is characterized by three equal lows followed by a breakout above the resistance level.

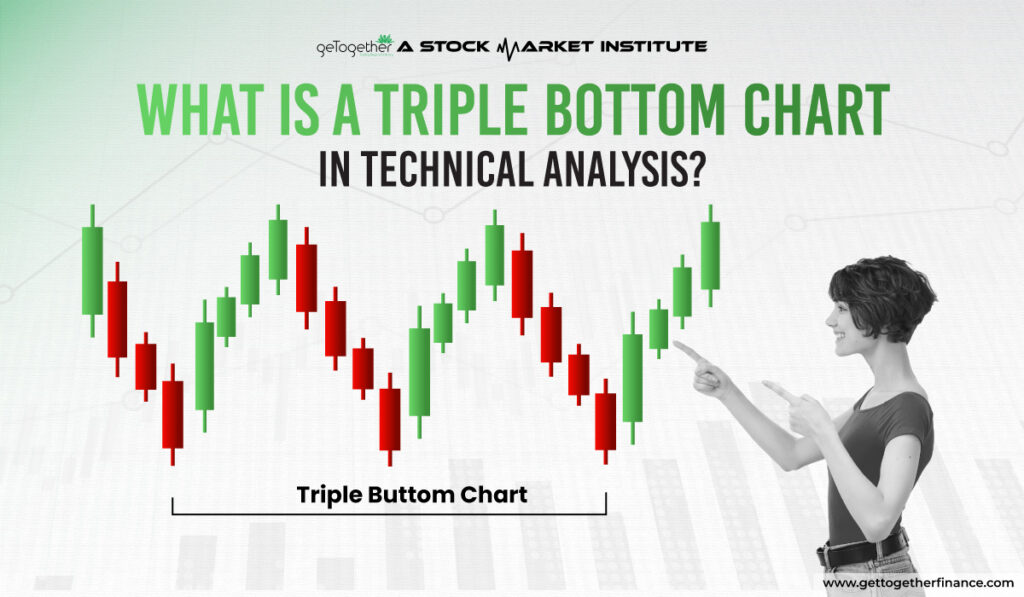

Understanding Triple Bottom Chart Pattern

To form a clear and defined pattern on the chart, the triple bottom structure needs some important components to justify and confirm its formation. Formation of these components on charts can only ensure a bullish move through the triple bottom chart.

Three Troughs / Support Level

Traders tend to observe the formation of three distinct lows on the chart pattern which represents the support level of the price action. A horizontal level is formed through which the price hikes each time as it hits the support line. The reaction of prices after hitting the horizontal line represents sustained buying in the security.

Minor Peaks

There are two pullbacks between the three consecutive lows formed in the chart pattern. The two miner peaks represent transient amounts of resistance as they rally between the three lows.

Breakout

A breakout happens when the price crosses a certain resistance level which gets created by smaller peaks. The breakthrough of this resistance level validates the triple bottom pattern. It indicates such a strong buying pressure that the asset price is able to break the resistance to move the prices upwards in future.

Volume Analysis

An increase in volume gives a confirmation of a great move in the asset’s prices. Therefore, when the price is at the breakout level with a considerable rise in trading volume ensures a strong breakout which increases the reliability of the triple bottom chart pattern.

Long Term Trading Opportunities

Swing traders and positional traders take long term opportunities in different time frames, especially in the weekly and daily time frame of the formation of the triple bottom pattern on the charts. Traders avoid short term volatility and opt for more reliable trading opportunities when trading with triple bottom chart patterns.

Versatility in Markets

The triple bottom chart is not only limited to the market Indian securities, traders can follow this pattern in versatile markets like stocks, commodities, foreign currencies and crypto currencies. These allow traders to have increased accessibility into different markets without limiting their trades to any particular market.

Moreover, this pattern is widely acceptable in different kinds of trading strategies based on trend methodologies, a swing trader, position trader which makes this pattern a valuable addition to trader’s toolkit.

Risk Reward Ratio

Trading on the triple bottom chart allows traders to calculate a favorable risk reward ratio. The pattern clearly defines stop loss orders as risk management to traders which also defines the resistance level to estimate their potential profits by understanding risk reward ratio.

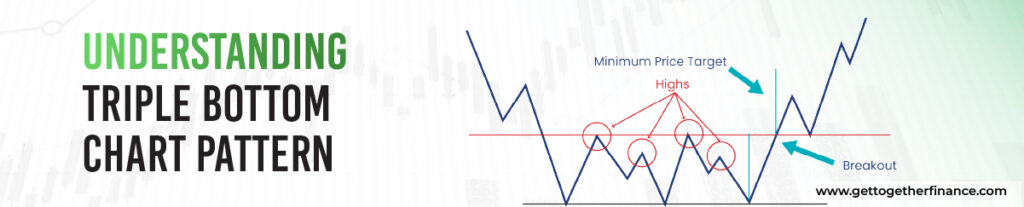

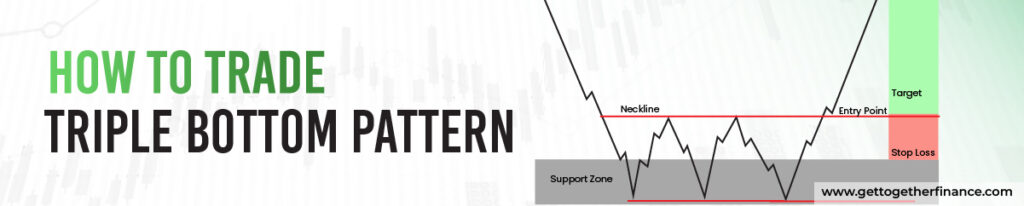

How to Trade Triple Bottom Pattern?

The formation of the triple bottom pattern on the chart indicates a potential trend reversal after prolonged declines.

- Recognize Support Levels: To trade the triple bottom chart pattern, recognize the support level with three swing lows, having swing highs in between and a declining volume with each test of support.

- Entry Point: To place a profitable trade in this pattern, place the entry at the breakout level with stop loss under the lows. Look for momentum, and expand volumes on rallies before getting into the trade.

- Target & Stop Loss: Always set a target and stop loss as per your trade plan and manage it further with partial profit bookings and trailing stop losses.

If the price is not able to follow a particular direction and it tends to reverse back into the direction; exit the long position as it might indicate failure of buyers to control the position.

Also Read: Stop Loss Orders

Why is trading with the Triple Bottom Chart Pattern risky?

Triple Bottom Chart is a valuable tool in technical analysis which ensures profitable opportunities for traders. However, traders need to observe this pattern carefully to avoid the pitfalls of trade.

False Breakouts

In each trading pattern, there is an issue of occurrence of false breakouts as it traps the traders leading them towards potential losses. The prices act to give a breakout but then reverse soon, trapping the traders who entered to gain profits from breakouts.

Market Sentiments

In a strong trending market, the triple bottom pattern proves to be less effective as overall market sentiments affect the move in a security. The pattern might fail due to market behavior or sudden selling or buying pressure and the prices can move in opposite directions resulting in losses for the traders.

Market Manipulation

Large players or institutions in the market tend to manipulate the prices and create a pattern similar to the trading chart pattern of triple bottom. This traps the traders only for them to see the prices drop when manipulation ends.

Ignoring Demand and Supply Approach

It is essential for traders to respect and execute trades as per demand and supply zones on the chart. If the prices are not supported by a strong demand zone then it has great chances of experiencing a fall. So it is always recommended to follow trades primarily based on a demand and supply approach.

The Bottom Line

Trading on the Triple Bottom chart can be very profitable and at the same time quite risky for a trader. This is the reason demand and supply zones are more reliable for a trader to pick long term as well as short term trading opportunities.

FAQs

What is a Triple Bottom Chart Pattern?

A triple bottom chart pattern forms when the price forms a support level through three consecutive support levels and two minor peaks between them.

How to trade a Triple Bottom Chart Pattern?

To trade a triple bottom chart, recognize the support level with three swing lows, having swing highs in between and a declining volume with each test of support.

What are the benefits of the Triple Bottom Chart Pattern?

The benefit of trading triple bottom chart patterns is that it allows the traders to manage risks appropriately as well as take profitable opportunities.

Instagram

Instagram