How to Recognize and Trade Rising Wedge Patterns?

- December 25, 2024

- 803 Views

- by Manaswi Agarwal

Rising wedge is a technical chart pattern that typically occurs after a rising trend in the security which signals a bearish move. The formation of this pattern signifies the end of buying momentum in the security and hence it is the beginning of the bearish move.

What is a Rising Wedge Pattern?

You might have come across various chart patterns, rising wedges are also one valuable pattern formed on the charts which allow traders to predict future price movements in the security. But how does it occur? Or how does a rising wedge pattern form on the charts?

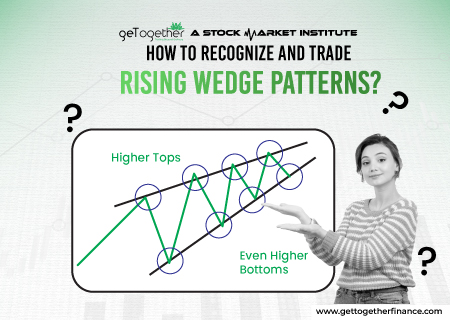

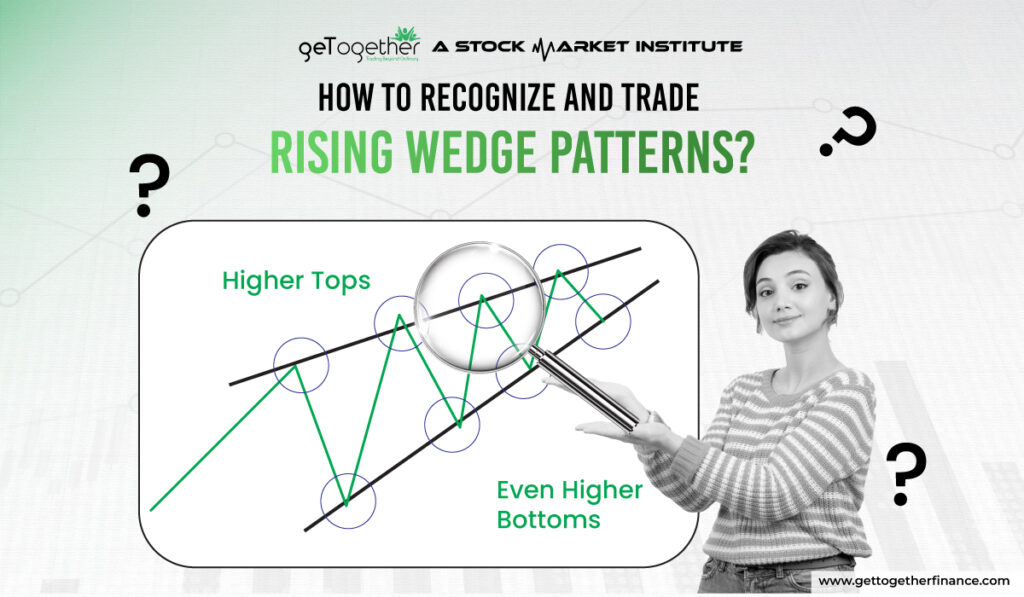

The rising wedge pattern is one of the popular wedge patterns, which is formed on the chart when the prices make multiple swings to new highs but still the waves are getting smaller. The price forms an upward trend by continuously moving in an upward direction but when the price starts to contract then it signifies a slowdown in the upward movement of prices.

With the formation of an upward trend in the prices and a slowing momentum help traders to forecast a future drop in prices and once the prices break the rising wedge. The breakout tends to be strong when the rising wedge pattern breaks the lower trend line.

Also Read: Chart Patterns

Characteristics of Rising Wedge Pattern

Rising wedge is a captivating chart pattern in technical analysis, let us deep dive into the anatomy of this pattern and how this pattern is usually observed by traders:

Prevailing Uptrend

When the price continuously moves upwards, it forms an upward trend. The wedge is always formed on a prevailing trend of security. The trend could be either downwards or upwards.

Converging Trend Lines

With the formation of an upwards trend, the two upward trend lines converge towards each other which shows a tighter movement in prices. In this case, the lower trend line is steeper than the upper one which further leads to their convergence.

Higher Highs and Higher Lows

To form a rising wedge, the prices continuously form higher peaks and higher troughs, as the lines continue to merge and the pattern matures, the difference between the peaks and troughs diminishes.

Narrowing Range

As the formation of rising wedge patterns takes place; the price range between the trend lines gradually narrows. Therefore the price moves from a wide range to narrower one forming an appearance of wedge pattern.

Declining Volume

On the charts, when a rising wedge pattern takes place, it is usually accompanied by a gradual decrease in trading volume. The constant decline in volume reflects a dwindling momentum.

What does the Rising Wedge Pattern indicate?

The rising wedge pattern can form both a continuation and reversal pattern but the traders must have the knowledge to understand the indication that this pattern tries to tell. Traders are required to constantly observe the momentum of price with their volumes and other technical factors

Decreased Momentum

Instead of moving upwards continuously, the rising wedge pattern suggests the losing momentum of buyers because of the occurrence of narrowing space between the trend lines.

Reversal Confirmation

Over the past years, traders have been able to observe that the completion of rising wedges often precedes a bearish reversal. The pattern confirms the selling pressure when the price breaks below the lower trend line.

Volume Fluctuation

To trade a rising wedge, you must determine the volume change as it decreases to provide confirmation about bearish move in the pattern.

How to trade Rising Wedge?

After identifying the characteristics of rising wedge pattern, to trade this pattern it is important to plan correct entry or exit strategies:

Entry Strategies

Traders must enter a short position once the price breaks below the lower support trendline with an increase in volume. Traders can also make their position near the upper resistance line before the breakout which is very risky.

Set Stop-Loss Levels

The stop loss is placed just above the most recent swing high or the resistance line of the wedge. Adjust the stop loss as per the entry.

Place Targets

Use key support and resistance levels to mark the targets or use fibonacci retracement levels to add certain profits.

Demand and Supply

Trade the rising wedge pattern by identifying the demand and supply zones as these zones offer efficiency by giving a sudden surge in the prices.

Limitations of Trading Rising Wedge Pattern

Maybe you are a professional trader who has watched the market for years, but you can never be sure about the next price movement. Even after the formation of a rising wedge pattern in a chart, it is not guaranteed that the move would be in favor of the traders. Let us understand why does this happen:

Market Manipulation

The rising wedge pattern is a traditional method of trading through chart patterns which is commonly used by traders all over the world. Many times, large institutions and players tend to manipulate the prices to trap retail traders. Market manipulation results in losses for traders by trapping them.

Poor Technical Approach

Ignoring the demand and supply approach to execute the trader can majorly affect the portfolio of an individual. Trading based only on chart patterns might not be profitable each time, however trading on demand and supply zones, EMA trend support, higher time frame analysis, top down analysis offer higher efficiency.

The Bottom Line

The rising wedge pattern on the charts indicates a strong bearish move as it has been historically analyzed by traders. However, the demand and supply approach is one reliable method of trading to ensure maximum profits. Relying solely based on rising wedge chart patterns can never guarantee success to a trader. The strategies are required to be transformed as per market requirements and evolvements.

FAQs

What is a Rising Wedge Pattern?

Rising wedge pattern indicates a bearish move in the prices of assets which is formed between the two trend lines. The chart pattern occurs when highs and lows of an asset’s price are rising. With these highs and lows, converging trend lines form wedge-like shapes indicating a bearish move.

How can I trade in a rising wedge pattern?

To trade a rising wedge pattern, you should place the entry when the price tries to break out of the lower trend line after completing the narrowing shape formed. The breakout of this trendline suggests a great downfall in prices of the asset.

Do rising wedge patterns hold accuracy?

It is not assured that each time, the rising wedge pattern would fall and make a bearish move. Profits are always uncertain in trading, however, the demand and supply approach is the most reliable one for traders.

What are the benefits of a rising wedge pattern?

The benefits of a rising wedge pattern is that it allows traders to identify the direction of the security while most of the time it ensures a bearish move in the prices as sellers gain control after the formation of this pattern.

Instagram

Instagram