Ascending Tops: What They Are, How They Work

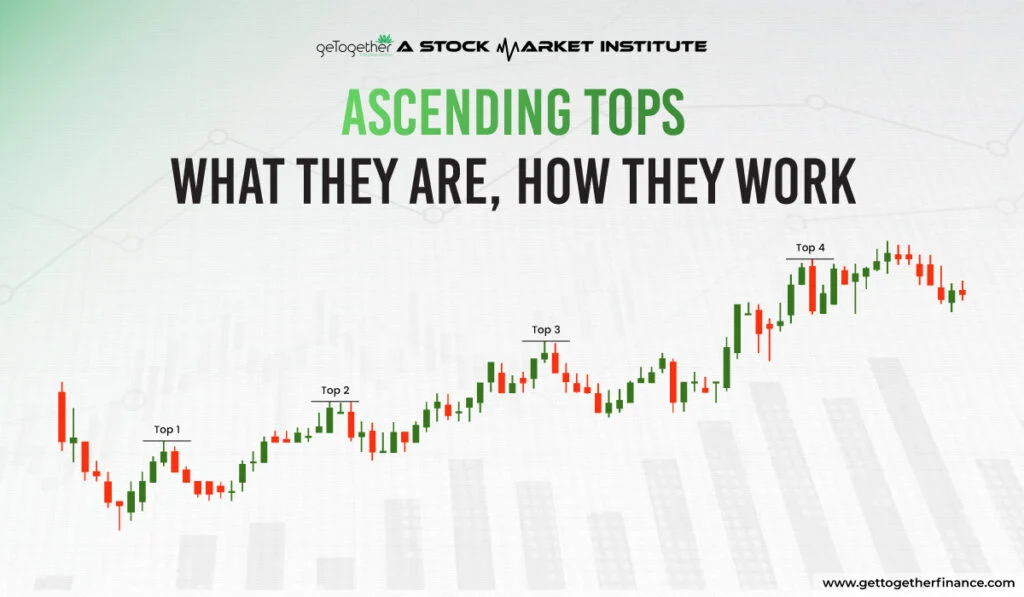

In the world of innumerable candlestick chart patterns, spotting the right pattern to capitalize on can make all the difference. One such powerful technical chart pattern is the ascending top pattern. This pattern is formed when the stock price makes new highs consistently, with each peak higher than the previous one. It looks like climbing a staircase, every new top is made by strong buying pressure. It signals that demand for the stock is consistently increasing among the institutions.

Traders take long positions in it anticipating that trend is going to continue for a long time. Identifying and understanding ascending tops can give traders a strategic advantage in their trade setup, allowing them to capitalize on trends and avoid premature exits.

Table of Contents

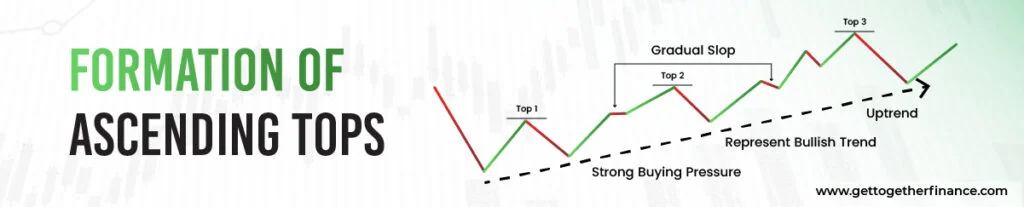

ToggleFormation of Ascending Tops

Let us understand what an ascending top pattern looks like.

Key Characteristics

- An ascending top pattern is made price continuously goes by making new highs.

- The key feature of the ascending top pattern is that every new peak or top made by the price is higher than the previous one.

- This highlights strong buying pressure in the stock, which is aggressively pushing the upwards.

- Whereas you may see little pushback before a new peak, that shows buyers are overpowering sellers completely by making a new high every time.

- The upward trend reflects the increasing confidence of institutions in the stock, suggesting that the market is likely to continue moving higher.

- Another important characteristic of this pattern is the gradual slope. The price of the stock doesn’t spike instantly, instead, it gradually goes up, building investor confidence with healthy demand.

- The volume of the stock can also increase as the price reaches new highs, supporting the idea that more traders are jumping in, further validating the bullish trend.

How to Identify Ascending Tops on a Chart

Identifying ascending top patterns is quite easy and straightforward once you know what to look for.

- To start, pick a specific time frame to study (daily, weekly, or monthly).

- Now look for a pattern where the stock price is going up by making new highs, creating a stair-step effect with peaks moving upward.

- You should be able to spot at least two to three tops that are clearly higher than the previous ones. You can also draw trendlines to connect the tops, which will ease the study.

- The trendline should slope upward, confirming that highs are consistently rising.

- If you notice this formation, you can take this as a sign that the stock is in an uptrend, and the bullish momentum is there.

- Additionally, make sure you check the volume during these higher highs—increased buying volume in the uptrend adds further confirmation that the pattern is strong and reliable for long trades

By identifying these minute points of ascending top patterns, traders can better time their trades and make informed decisions.

How Ascending Tops Work in Market Trends

Bullish Continuation Pattern

Ascending tops are said to be bullish continuous patterns, signifying that the existing uptrend is most likely to continue. As the stock price continues to make new highs, it clearly shows buyers are in clean power against sellers, which is driving the price up creating good demand. Traders who know and understand this pattern take it as a sign that the stock’s bullish momentum will likely keep pushing it higher. This pattern is often spotted in the areas with strong uptrends, where the market confidence is high and buyers are willing to purchase the share at expensive prices too.

Market Psychology Behind Ascending Tops

The psychology of the ascending top pattern reflects positive sentiments among traders and investors. Each higher and increased peak represented enhanced demanding the stock. The willingness to buy this stock at an expensive price keeps driving the price upwards. It indicates that even slight pullbacks or dips in the price between the highs where buyers step in, following new high shows confirm that bears are stronger in the fight.

This pattern also signals that sellers are losing the fight against buyers, as they struggle to push the price down. The gradual increase in price price after every small pullback, confirms the potential that stock is holding. Recognizing this psychology helps traders make decisions based on the strength of the market’s positive sentiment.

How to Trade Ascending Top Patterns?

Conventional traders used to take entry at every new top made by the price and then enjoy the upmove till it lasts.

But we as demand and supply traders wouldn’t go by buying peak, instead, we’ll figure from where the up move can tart.

Entry: Take an entry when your trade setup aligns with a good buying origin. The price should approach a good demand zone and that demand zone should’ve given a good move. Also, when the price has a little correction after making a peak, and approaches a good demand zone, take entry there and then enjoy the upmove. With this approach, you’ll be making profits before reaching the new peak.

Stop loss: Keep stop loss before the nearest low made by the ascending top pattern. If it breaks then it can be understood that the trend is going to be reversed and it’s better to take the exit.

Target: While trading an ascending top pattern, you can exit as soon as the price starts correcting, till then you can enjoy the upmove.

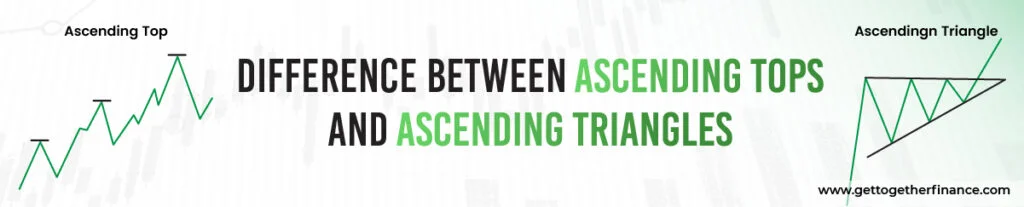

Difference Between Ascending Tops and Ascending Triangles

| Aspect | Ascending Tops | Ascending Triangles |

| Pattern Type | Series of higher highs forming an uptrend. | Flat resistance at the top with rising support (triangle shape). |

| Tops | Each top is higher than the previous one, creating an upward slope. | Horizontal line at the top where the price repeatedly hits resistance. |

| Lows | Lows may rise but are not the main focus. | The lows consistently rise, creating an upward-sloping support line. |

| Breakout Point | Breakout usually happens when the price crosses above the most recent high. | Breakout occurs when the price moves above the flat resistance line. |

| Trading Implication | Bullish continuation with more flexibility in tops and lows. | Bullish breakout expected after consolidation under flat resistance. |

| Volume Pattern | Volume may rise with each higher top. | Volume usually decreases as the pattern forms, then spikes on the breakout. |

Conclusion

The rising tops pattern is a reliable predictor of a strong uptrend, indicating increased demand and bullish momentum in a stock. Recognizing the gradual building of higher highs allows traders to expect ongoing upward momentum and strategically timing their trades. Unlike traditional methods, demand and supply traders buy near demand zones rather than at peaks, allowing for more precise entry locations and risk control. This pattern is easily identifiable on a chart and, when supplemented with volume analysis, gives useful information on market mood. Understanding ascending tops and the psychology behind them provides traders a distinct advantage in making informed trading decisions that maximize earnings while minimizing risks.

Frequently Asked Questions

What is an ascending top pattern in stock trading?

An ascending tops pattern occurs when a stock repeatedly achieves new highs, with each peak exceeding the previous one, signaling a strong bullish trend fuelled by rising demand.

How do I identify an ascending top pattern on a chart?

To find an ascending top pattern, look for a series of rising highs over a specified time period, with each peak higher than the previous one. Drawing a trendline between the tops can help validate the pattern.

What is the best entry point when trading an ascending top pattern?

The optimum entry point occurs when the price retraces to a demand zone following a minor correction. Entering before the next peak allows traders to capitalize on the rise.

How can I manage risk when trading an ascending top pattern?

Set a stop loss immediately below the most recent low to minimize losses if the price reverses. A trailing stop loss might also lock up profits as the price moves upwards.

What’s the difference between ascending tops and ascending triangles?

Ascending tops consist of a sequence of increasing highs, whereas ascending triangles feature a flat resistance line at the top and rising support at the bottom, signaling a possible breakout.

Instagram

Instagram