Choppy Market: Overview and Examples of Trendless Trading

- January 8, 2025

- 2528 Views

- by Manaswi Agarwal

Choppy Market: I think you must be aware of this term if you have been in trading for a long time and have been afraid of trading in this market. This is a common occurrence in the stock market as well as in other markets like crypto currencies, forex, etc.

It is quite easy to trade in a trending market but it is very difficult to make profits in a trendless market. This market is usually dangerous because the price action cannot be predicted correctly.

What is Choppy Market?

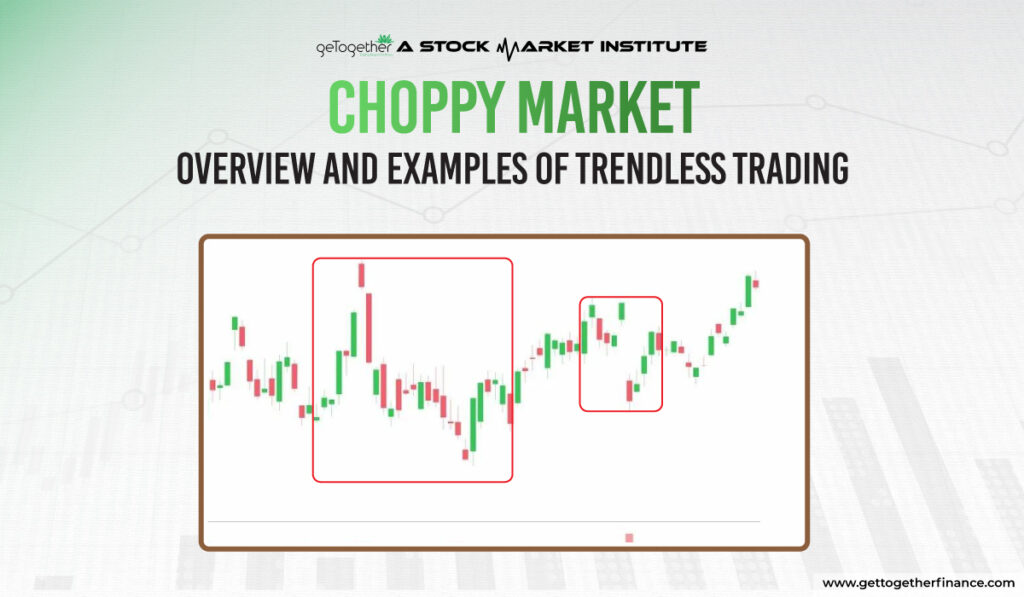

Choppy market describes the situation of considerable price swings in the stock market that can be for either short term or an extended period of time. When the market is indecisive and is not able to move in a particular direction representing a fight between the buyers and sellers or a balance among them.

How to identify Choppy Markets?

Trading in choppy markets becomes very difficult due to its indecisiveness in nature. To identify the nature of choppy market, let us understand its important elements for identification purposes:

Small Moves

Choppy market gives small moves as compared to trending markets and which requires a high winning percentage. To trade in this pattern, you need more than 50% win ratio level, which can be very tough because of indecisive situations in the market.

To capture the best small moves, you are required to keep tight stops and tight profits targets. It becomes essential to limit your losses as well as book profits quickly.

Price Action

Analyze the price action of the stock in order to come across with the choppy market. Identify the formation of bullish or bearish patterns in the security, if there is no particular move and you can observe multiple highs and lows in the same region forming a rectangle shape, this can probably be the choppy market.

Flexibility in Strategy

You can strategize or change your reading plan according to the movements of the market and adopting techniques like scalping or using oscillators can help you approach uniquely to different market conditions.

Low Risks of Trend Reversal

In a sideways market, there is no drastic sudden reversal like observed in trending markets which makes it easier for traders to manage the risks. Sudden reversals of trending markets can catch traders off guard which results in making significant losses for them.

What Causes Choppy Markets to Form?

When investors get cautious and have uncertainty about market conditions which affects the future movement of prices keeping the buyers and sellers almost equal and hence it depicts a lack of a strong trend.

The indecisiveness in the market can be due to conflicting market situations, conflicting economic indicators, geopolitical concerns or unclear corporate earnings forecasts. In choppy markets, there is overall lower market volatility which reduces risks of unexpected price swings.

Low volume in the market can also be a cause of choppy conditions as there are not enough participants in the market to push the market or movement of a security in a particular direction. Due to low volume, the prices move up and down erratically as individual traders establish their foot to decide the prices.

Fact: Let me make you aware of the fact that 80% of the time the market remains choppy as the majority strength in the market follows sideways patterns. Being a trader you are required to find that one opportunity from the market movements that can help you identify the trending market and when the market is choppy. Trading during trending markets can help you make certain profits instead of trading in choppy markets. As a trader with a mind set of consolidating markets you tend to trade various ranges while during the trending market you will take fewer positions that can take maximum profits.

Trading Mindset for Choppy Market

Human psychology or mindset affects the most in trading, therefore it is important to develop a robust trading mindset in choppy market conditions.

- It is necessary to recognize that choppy markets often result in smaller profits and more frequent losses.

- Traders must focus on capital preservation rather than aggressive profit-making.

- One of the most important things is to resist the urge to trade frequently in an attempt to do something necessarily.

Common things to Avoid in Sideways Markets

Avoiding common pitfalls is essential to protect your capital and maintain discipline. Here are key things to avoid:

- Avoid Trend Based Strategies

- Avoid Overtrading

- Avoid ignoring support and resistance levels

- Avoid chasing breakouts

- Avoid using wide stop losses

The Bottom Line

To be consistent in the market, a trader must be able to identify the trending markets as well as when the market is choppy. Trading decisions are made based on market conditions which can be efficiently observed by demand and supply theory as it is much reliable in the market.

FAQs

What is Choppy Market?

Choppy market occurs when the market direction is indecisive due to fights between buyers and sellers. Prices tend to move up and down quickly in large or small moves.

How to trade in Choppy Markets?

Trading in choppy markets is quite difficult for traders who trade in trending markets. You must have a pre planned strategy to set up a position in a choppy market with proper risk management to protect them if it goes in the opposite direction.

Should I consider Choppy market for trading?

Trading in choppy or trending markets always depends upon the style of a trader. You can consider trading in choppy markets with proper risk management activities as in this market a clear move cannot be observed.

Instagram

Instagram