Understanding the Bearish Diamond Formation: A Simple Guide

Table of Contents

ToggleOverview

Have you ever seen a stock price chart that looks like a diamond?

It might seem pretty, but don’t be fooled—this pattern can signal an upcoming bear hit!

Among technical chart analysis patterns, bearish diamond formation is a unique chart pattern that traders watch closely because it often hints at a potential drop in stock prices. This is like a warning sign that the stock may be about to turn around and go down.

This e-paper will explore what the bearish diamond formation is, how it forms, and why it matters for your investment strategy. As we will move on, we will also unfold how to spot this pattern on stock charts to trade better.

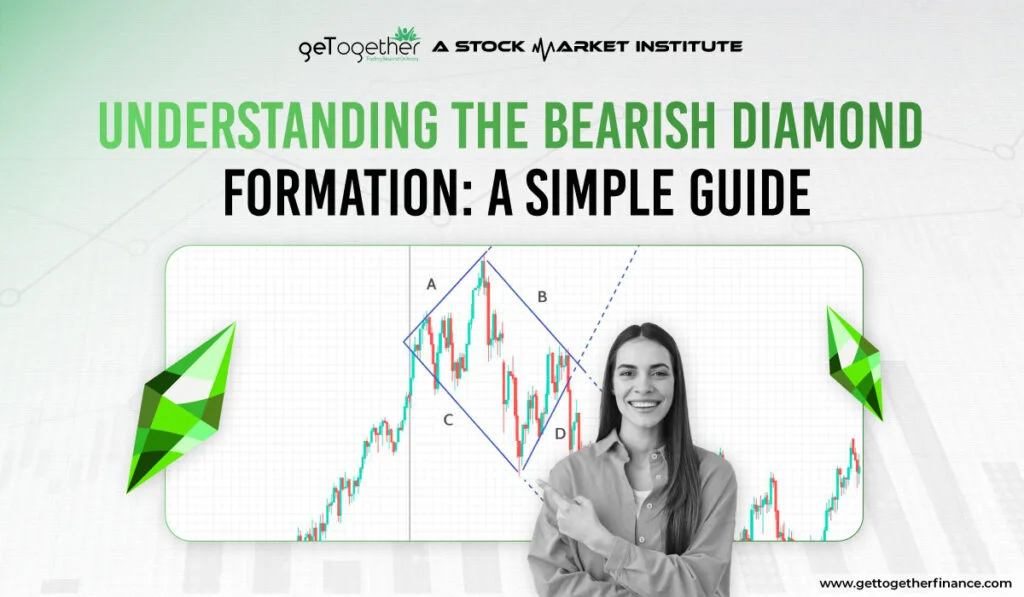

What Is Bearish Diamond Formation?

Let’s paint a picture, imagine a chart that shows how the price of something has been going up and down over a period of time, hinting traders where the prices are moving next.

This is akin to a picture that begin with a wide shot, shrinks in the middle, and then goes wide again – just like the shape of a diamond. Well, this formation shows up when prices have been going up for a while, but now people are starting to lose confidence, and the price might start going down.

In technical terms, the bearish diamond formation is a technical analysis chart pattern that appears on stock price charts. It typically forms after a strong upward movement in the stock price and can hints that the stock is about to reverse direction and head downward. This pattern is named for its “diamond-like” shape, which is created by the price movements of the stock.

Formation of Bearish Diamond Formation

Here’s what’s happening step-by-step:

- The Start: First, the price starts moving up and down in a big, wide way, making the left side of the diamond.

- The Middle: Then, it starts to narrow, meaning the highs and lows aren’t as far apart. It gets tighter.

- The End: Finally, the price starts to widen out again, but now people expect it will go down. This creates the right side of the diamond.

So, when traders spot this “diamond” on the chart after a price rise, they get ready because it usually signals that prices could drop soon – that’s the “bearish” part.

How to Trade a Bearish Diamond Pattern: A Simple Guide

The point of learning is to savor when executed. Here. So now you know how this technical analysis formation looks like on a chart, let’s learn how you can trade it step-by-step:

Spot the “Diamond”Shape

Look for a diamond shape that forms at the end of an uptrend (when prices have been going up). The shape looks like prices are widening, then narrowing, creating a diamond outline. This pattern tells the traders that the price is getting ready to change direction.

Draw the Top and Bottom Lines

In the diamond pattern, draw a bridge from the high points to create the upper trendline and the low points for the lower trendline. These lines will help you see if the price breaks out of the diamond.

Watch for the Price to Break Below the Diamond

In a bearish diamond formation, traders patiently wait to a point when price break below the set lower trendline of the diamond. This means the price might start falling, as sellers take control.

Start a “Sell” Trade

When the price closes below the lower trendline, it’s a sign to sell. This signals the start of the possible price drop, and you want to enter the trade early.

Set a Target Price

Measure the height of the diamond from the highest point to the lowest. Minus this from the breakdown point just below the diamond to figure out a target for how low the price might go.

Track Your Trade

Keep an eye on the price. If it keeps dropping smoothly, you’re on track. But if it starts moving sideways or rising, consider closing your trade.

Risk Management While Trading A Bearish Diamond Formation

The decision of risk management comes hand-in-hand with the decision of trading, if not for you, ignorance may not feel like a bliss.

One of the effective ways to manage risks is using Demand-Supply Dynamics, another simple yet profound theory of technical analysis based on science + business laws. Here is how you can protect your investment using these few risk management steps while trading:

Identify the Supply Zone

Look for where the price struggles to go higher—that’s your supply zone, marked on lower, intermediate, and higher time frame. Think of this zone as the point where many sellers are waiting to step in. It’s a key area to watch since prices often turn down from here in a bearish diamond setup.

Check Demand Zone Strength

Mark the lower, intermediate, and higher demand zone, while keeping its strength in mind. It is where buyers usually jump in due to pending orders. If the price keeps falling without strong buying support at these levels, it’s another sign of a likely drop. Weak demand means sellers have a clear path.

Set a Stop-Loss (Risk Limit)

Set a stop-loss just above the last high point of the diamond. This is a safety line that closes your trade if the price goes up again, keeping your losses small.

Exit at the Next Demand Zone

Plan to exit your trade at the next exceptional ir strong demand zone your study indicates may bounce the price. This is a safe spot to take profit before any potential bounce back.

Trading a bearish diamond pattern means looking for that price rally to reverse into a drop. By using supply and demand zones, you keep it straightforward—watching where sellers and buyers may step in gives you a clearer view on when to jump in and when to get out.

Limitations of a Bearish Diamond Pattern: What to Keep in Mind

Finding setbacks of a bearish diamond can feel like getting trapped in a maze, but it’s not always as clear-cut as it seems. Here we have listed a few things to watch out for:

1. False Breakouts

Sometimes, the price dips below the diamond pattern only to bounce back up again—this is a “false breakout or Fakeouts.” It can trick you into thinking a drop is coming, but the price may rally instead. Waiting for a full close below the trendline (not just a touch) can help avoid getting caught.

2. Slow Pattern Formation

The diamond shape doesn’t appear instantly. It takes time to form, and while you wait, the price might fluctuate quite a bit. It can be tempting to jump in early, but patience is key here.

3. Needs a Strong Uptrend

A bearish diamond usually shows up after a strong price rally (uptrend). If you see one in a market where prices are moving sideways (no strong trend up or down), it may not signal much at all. In a flat market, the pattern could simply fall flat.

4. Best with Extra Confirmation

Sometimes, seeing a bearish diamond isn’t enough. It’s helpful to check for other signals, like an increase in selling volume, to confirm that a price drop is actually likely.

5. May Lead to Small Drops

Not all bearish diamond patterns bring a big drop. Sometimes the price only dips slightly before moving back up, leading to smaller profits than you might hope for.

In short, a bearish diamond pattern can be helpful, but it’s not a “one-size-fits-all” clue. Keeping an eye out for these potential pitfalls—and using a little extra confirmation—can make it a more reliable tool in your trading toolkit.

In A Nutshell

When you’re trading, understanding patterns like the bearish diamond formation can be really helpful. It gives you clues about what might happen next with prices. But it’s also important to keep in mind that no pattern is foolproof. It is super crucial to know about the limitations of the bearish diamond, like the chance of false breakouts, how long it takes to form, and the need for a strong trend, to avoid getting stuck in the middle of wrong prediction.

The pro traders most commonly believe in combining the bearish diamond formation with other strong technical analysis tools and indicators, such as Demand-Supply Dynamics, Moving Averages, etc. Remember, trading is not a short-game, it’s about staying informed, and adapting to what’s happening in the market. With practice and careful watching, you can turn the bearish diamond pattern into a useful part of your trading setup.

FAQs

Where can I find a Bearish Diamond pattern?

You can find it on stock charts for any company, especially after a price rally when the stock is losing momentum.

How reliable is this pattern?

While it can provide good clues, it’s not 100% reliable. Always consider other factors and club it with more profound theories before making a decision.

How long does it take for a bearish diamond to form?

It can take a few days to weeks, depending on the stock’s price movements.

Can I trust online resources for pattern analysis?

Some are reliable, but remember – there is no better indicator than a human eye. Hence, always cross-check information from multiple sources before acting.

Facebook

Facebook Instagram

Instagram Youtube

Youtube