Multiple Tops Pattern

- April 19, 2025

- 504 Views

- by Manaswi Agarwal

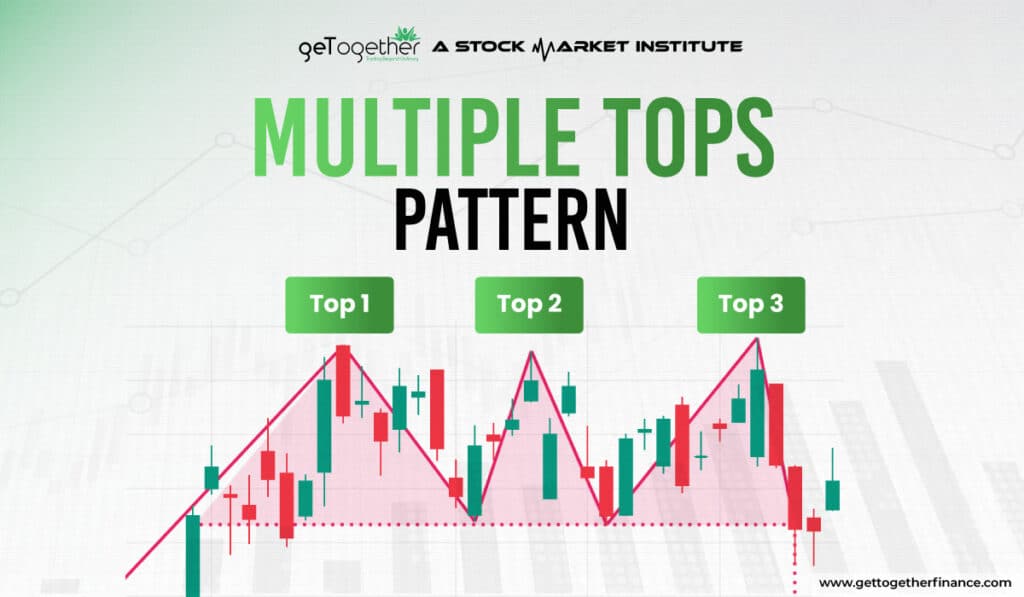

Multiple Tops Pattern in technical analysis is one significant pattern to help traders recognize potential trend reversal and analyze future price actions. In the pursuit of gaining maximum returns, traders seek for robust technical strategies that can help them gain a competitive edge. Here, multiple tops pattern is one recognizable pattern suggesting a trend reversal and gaining sufficient profits.

What is a Multiple Top Pattern?

In technical charts, multiple top patterns are a notable pattern that signifies a potential bearish reversal in the security prices. The double top pattern commands attention from traders in technical analysis as it strongly indicates a bearish reversal pattern.

Multiple Tops are formed at the resistance level signifying a fight between the buyers and sellers where sellers gain control each and every time. This states that the inability of the buyers to sustain in the market and breach the resistance level.

Identification of Multiple Tops Pattern

There are important determinants that help a trader for proper identification of multiple tops patterns. Let us go through some key points that make identification of multiple tops much easier:

Trend Lines

Connect the trend line on the charts that visually represents the formation of multiple tops at the resistance level. If the price is unable to break a certain level while showing a steep slope line indicates a strong resistance level.

Resistance Level

When the price of an asset does not give a breakthrough from a certain level after reaching a point multiple times, investors outlook this as a bearish reversal in the security as seller’s gain control over the prices again and again. This level is recognized by investors as the resistance level that pushes the prices downwards.

Support Level

Each time the price forms a top in the security, it is pushed downwards by the sellers at the support level where buyers become active. When the price breaks the support level after the formation of multiple tops, the bearish reversal is confirmed when combined with other factors.

Double Top Pattern: Trend Reversal Pattern

From a psychological point of view, a trader looking for multiple tops patterns might look for repeated tests of the resistance level to sell their holding, leading to an increased selling pressure. You can think of it as: the price tries to break a level multiple times but it is unable to do so because of increased selling pressure.

Interpreting double tops patterns requires traders to receive market signals at the right time which allow investors to gauge the pulse of the market to make informed decisions. The two peaks at the resistance of the double top suggest waning bullish momentum in the security. However, when the price breaks the support level by giving a downward movement, bearish confirmation of the security is received by the traders.

Triple Tops Pattern

Similarly, when triple tops are formed in the price pattern, it also indicates a bearish move in the prices as sellers become dominant each time the price reaches the resistance level. With the same psychology that buyers are not able to sustain the resistance level, sellers gaining control again and again determines a downward trend in the asset prices.

Advantages of Trading Multiple Top Pattern

In technical analysis, identifying the chart patterns can provide certain benefits if used appropriately with the help of other technical indicators.

Identify Trend Reversals

One main advantage of multiple tops patterns provides an early advantage to predict the bearish move in the asset prices. Traders can place their entry when price breaks the support level which can give them assured profits.

Multiple Time Frames

The trend reversal can be observed on different time frames from daily to monthly and intraday charts. The applicability of the pattern on different time frames allows swing traders as well as long term investors to trade based on multiple top pattern.

Entry Exit Points

The multiple top pattern guides defined entry and exit points for traders. It provides clarity about entry points with volume confirmation.

Entry: Enter the short positional trade when the price decisively breaks below the neckline with a high trading volume for confirmation.

Stop Loss: Place a stop-loss above the highest peak in the pattern to limit losses in case of a failed breakout.

Limitations of Multiple Top Patterns

With the recognition of multiple top patterns, many other things are required to be considered which can affect an investor’s decisions significantly. Traders must observe other technical indicators to receive confirmation for the predicted price movement. For example if volume, RSI, demand zones, top down approach, sector support are not in favor then the trader might have to deal with uncertainty and hence negatively affect their portfolio.

Trading based on technical analysis is subjective in nature which is why multiple top patterns can also fail due to any reason. However, using demand and supply theory is more accurate as compared to other technical analysis methods. Multiple Tops can be an additional advantage when it complements the demand and supply theory with other technical indicators.

Multiple Top pattern is widely recognized and used by traders which constantly decreases its efficiency as the market is all about surprises and such wide usage of pattern obsolete their nature. This acts as a limitation for traders to trade solely based on this pattern.

The End Thought

A trader or an investor must be very cautious before executing their trades. Multiple top pattern in technical analysis is one effective pattern which ensures certain profits only when used appropriately by traders.

FAQs

What is the Multiple Top Pattern?

Multiple Top Patterns is a bearish reversal chart pattern which indicates sellers gaining control each time the price hits the resistance level. The price forms multiple peaks but comes down at the support level as buyers are unable to sustain.

How to Identify Multiple Top Patterns?

Traders who seek to trade through multiple top patterns must look for some necessary determinants like: trend line, resistance level (multiple tops or peaks), support, volume, and many other technical indicators for the confirmation of pattern.

What is a Double Top Pattern?

A double top pattern is formed in the technical charts when the price forms two peaks with a significant drop in between at the support level. It is a technical way to identify a potential downward movement in the security.

Is Double Top Bearish or Bullish?

Double top chart pattern signifies a bearish reversal pattern as the price reverses back to the support level after it touches the resistance. When the support level breaches, the security forms a bearish pattern.

Instagram

Instagram