Anchor Units and Offset Units

Table of Contents

Toggleanchor units and offset units:

Versatility is the unique qualities of an options. And a great benefit of this is we can combine multiple options into a position to create a strategy based on our purpose.

Still getting confused, let’s have a look on below example.

We know that,

Sodium + Chlorine:- Pass the Salt, Please

Like in chemistry combining of a two elements to get the third one,

Similar thing we can do with options also, we can add one leg of an options with another which is different from the first one to create a strategy.

For that let’s understand Anchor Unit first:-

An anchor unit is that which drive our profit in the trade.

A large number of novice traders use only anchor unit,

Example for the anchor units are

Long call or short puts in case if we are bullish

Or long put or short call if are bearish

Or short call and short put if we are sideways

Anchor units have some undesirable characteristics, based on the market situation (volatility, direction, time decay etc)

In such cases we have to add another units which can prevent our trade from such undesirable characteristics and this will be called as an Offset Unit.

Let’s take an example to understand offset in a much better way.

Suppose if we are bullish and we are writing a put options (OTM), now selling only put is the anchor unit which have some undesirable characteristics like volatility can be shoot up or may be gap down risk in next day, so to prevent it from all of these we will add another strike long put as well, which will be more out of the money strike than our anchor unit.

Suppose stock is trading at 1000 and we are bullish and writing a put of 980 (-PE) then this is anchor and adding another unit into this like 940 (+PE) is called as offset unit

So the formula will be like this

Short Put (OTM) + Long Put (Deep OTM) -> Bull Put Spread

Note:-

We have added offset unit just for our protection and this is not going to pay us. Only Anchor Unit will count money for us but our offset will prevent us from unexpected gap down or a hike in Implied Volatility.

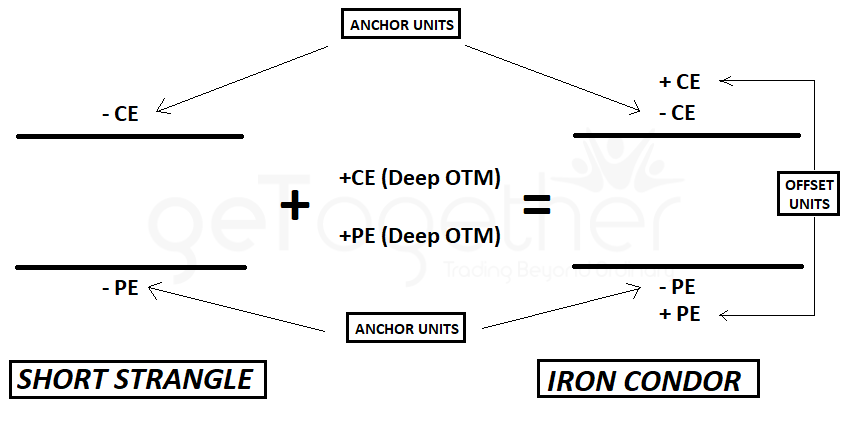

Adding another leg in strategy doesn’t always means its offset unit, like Short Strangle Strategy in which we sell both call and put and both are the anchor unit because both of them are going to pay us. But to prevent from unexpected gap and gap down we will add another unit long call and long put (Both deep OTM), these two units are not going to pay but going to prevent us hence these are Offset Units.

Also Read: FII and DII Data

Or we can say Offset units act as an insurance.

If you like this post, then I’d really love it if you can share it on

CATEGORIES

Facebook

Facebook Instagram

Instagram Youtube

Youtube