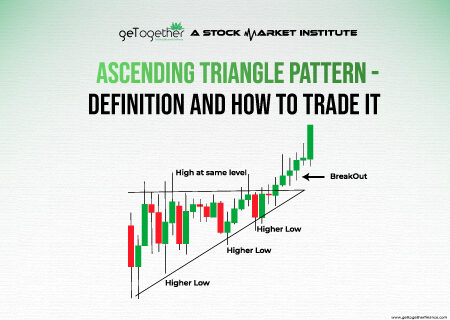

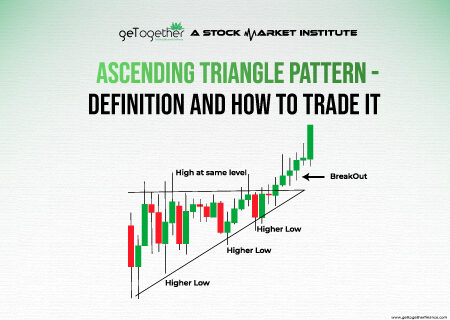

The ascending triangle pattern is a popular chart pattern used in technical analysis to identify potential bullish breakouts in the market. Traders and investors often use this pattern to make…

Meet the visionary behind it all - our brilliant founder, Arun Singh Tanwar, the man who radiates the spark of knowledge, commitment & dedication. Our founder led the stepping stone of GTF in 2019 with a vision of creating brilliant traders across the country. With a clear vision and positive outlook from the past 4 years, GTF is working to elevate the graph of traders in India, and as of now, we have successfully imparted trading education to more than 2.5lakh people. Our Founder bold strategies and techniques make him a goal-driven optimist and a Proficient trader, excelling in the stock market for more than 8 years! We are proud to say that our founder has not left a single stone unturned in converting his vision into reality and is still continuing to help people in gaining financial independence.

The ascending triangle pattern is a popular chart pattern used in technical analysis to identify potential bullish breakouts in the market. Traders and investors often use this pattern to make…

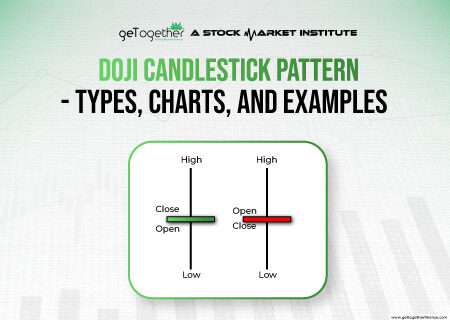

In the intricate world of stock markets, the language of candlestick patterns serves as a nuanced guide for astute investors and traders. Among these patterns, the enigmatic Doji candlestick pattern…

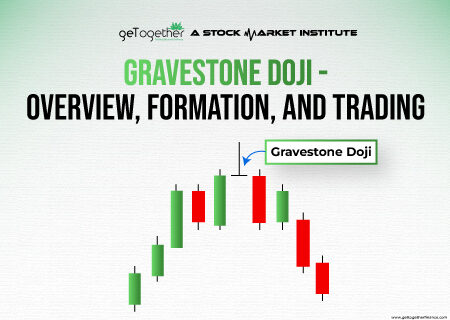

The Gravestone Doji is a candlestick pattern frequently used in technical analysis to identify potential trend reversals in financial markets. It is considered a bearish reversal pattern and is characterized…

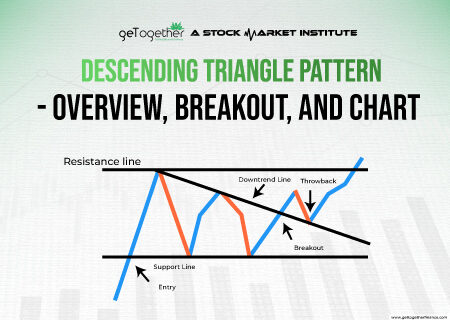

When talking about trading, technical analysis plays an instrumental role in identifying trends and patterns in the price movements of stocks. In technical analysis, chart patterns are among the most…

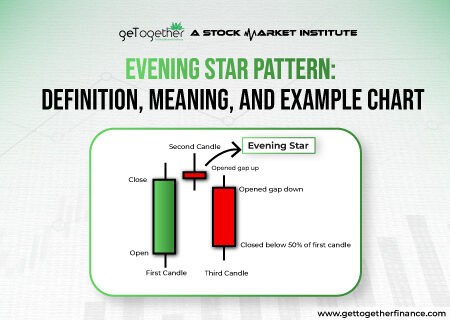

In the ever-shifting tides of stock markets, where success hinges on astute analysis and timely decision-making, candlestick patterns are an instrumental financial tool for traders and analysts alike. Among these,…

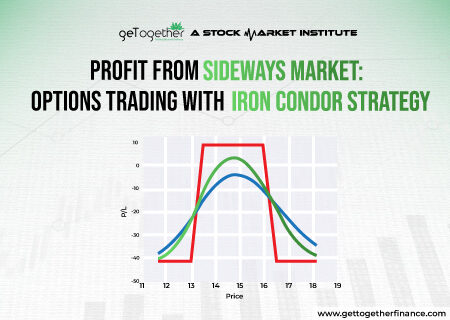

Most stock market traders buy/sell options contracts, hoping a particular stock’s price will rise or fall. Unfortunately, this happens frequently, and the price barely moves. The stock market’s unpredictability can…

The stock market roars, roars again, then falls silent. In this unpredictable dance, traders usually chase the bulls or bears, seeking profits amidst the stampede. But what if a particular…

The stock market falls and rises – not just in price but also in magnitude and volume. Some periods are highly volatile, with significant price movements. These market conditions excite…