In the initial stage of the financial market, terms like NSDL and CDSL might sound new which hold a great significance in the working of financial securities. But what exactly…

Meet the visionary behind it all - our brilliant founder, Arun Singh Tanwar, the man who radiates the spark of knowledge, commitment & dedication. Our founder led the stepping stone of GTF in 2019 with a vision of creating brilliant traders across the country. With a clear vision and positive outlook from the past 4 years, GTF is working to elevate the graph of traders in India, and as of now, we have successfully imparted trading education to more than 2.5lakh people. Our Founder bold strategies and techniques make him a goal-driven optimist and a Proficient trader, excelling in the stock market for more than 8 years! We are proud to say that our founder has not left a single stone unturned in converting his vision into reality and is still continuing to help people in gaining financial independence.

In the initial stage of the financial market, terms like NSDL and CDSL might sound new which hold a great significance in the working of financial securities. But what exactly…

Have you ever thought about what happens when the company has excess funds or assets more than it needs for its operations? Here, capital reduction comes into the picture to…

Price to earnings ratio identifies the relationship between the stock price of a company and its earnings per share. The price earnings ratio is considered by the investors to have…

BTST stands for “Buy Today, Sell Tomorrow” which is a trading strategy that can be highly profitable to the traders when executed with proper strategies and risk management. The strategy…

A report from SEBI shows that individual traders made net losses of Rs 1.81 lakh crore in F&O in the past three years with only 7.2% making a profit. To…

When a company goes public through an Initial Public Offering (IPO), it offers shares to the public for the first time. Investors can participate in this by applying for shares….

Overview When a company goes public through an Initial Public Offering (IPO), the allocation of shares to different investor categories is a crucial process. While the majority of investors participate…

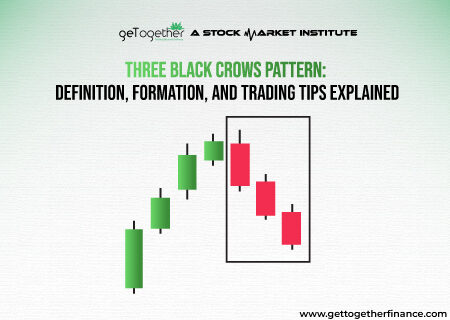

Have you ever looked at a stock chart and noticed a pattern that seemed to scream, “Time to sell!”? This interesting setup is like a warning sign for traders, suggesting…