The plea submitted by the ministry of petroleum and natural gas to ban the diesel passenger vehicles in India has created a chaos for the investments in the automobile sector….

Meet the weaver of words and a sorcerer of finance storyteller, Manaswi Agarwal, who can convey unfiltered data into golden nuggets. In GTF, content writing is about being a relentless researcher and conquering the digital realm through financial knowledge. With a vision of transforming mundane topics into meaningful insights and wisdom since two years, she has been constantly honing her craft while staying versed with the industry trends. She puts her knowledge in writing as a blend of creativity and craftsmanship to meet the growing landscape of content creation. Her work focuses to illuminate GTF students towards the path of stock market literacy with each word that she writes.

The plea submitted by the ministry of petroleum and natural gas to ban the diesel passenger vehicles in India has created a chaos for the investments in the automobile sector….

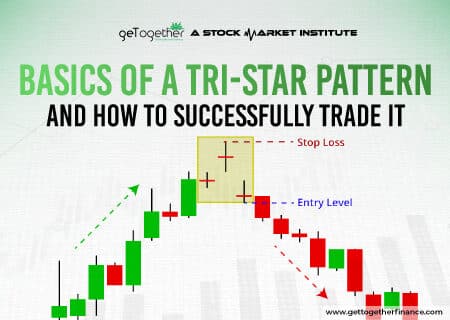

In the world of financial markets, you must have come across various trading chart patterns with a number of trading strategies. Tri-Star Pattern is one strategy that attracts you each…

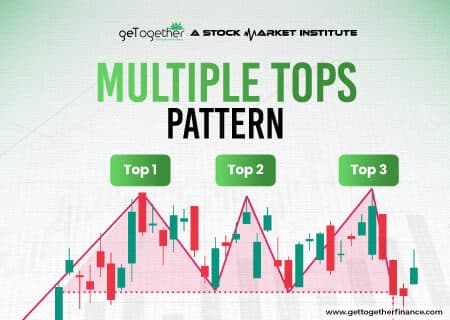

Multiple Tops Pattern in technical analysis is one significant pattern to help traders recognize potential trend reversal and analyze future price actions. In the pursuit of gaining maximum returns, traders…

As a regular market participant or a full time stock trader, it is essential for you to understand outside day patterns in security. The pattern can either be bullish or…

As we already know, there are two depositories in India which monitor security holdings of investors with stock exchanges. CDSL or Central Depository Securities Limited is the other primary depository…

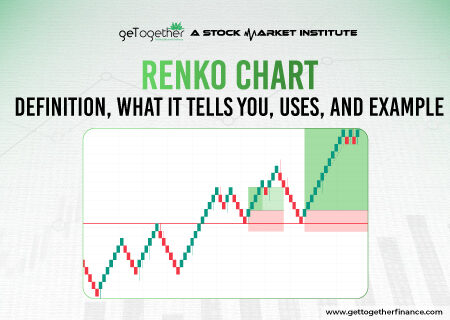

Renko charts is a type of technical analysis that is simply based on price movements and highlights significant trends to reduce the market noise so that traders can avoid making…

Before getting into the depth of the stock market, we must first understand the basic functions of how financial authorities monitor the market. NSDL is the security depository which has…

RBI is the apex body of the Indian financial system which aims to regulate the overall economy of the country by controlling, issuing and maintaining the money supply in the…