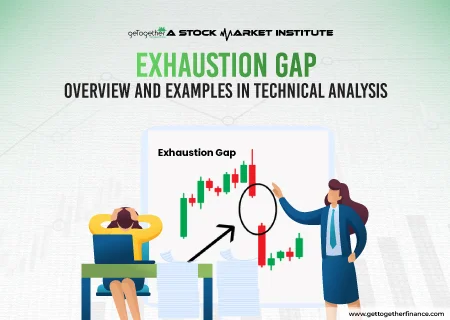

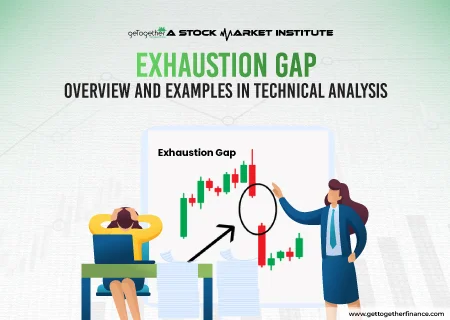

In regard with gap theory, we have understood, an exhaustion gap signals a significant shift in trend of the security. This blog is a comprehensive guide about exhaustion gaps which…

Meet the weaver of words and a sorcerer of finance storyteller, Manaswi Agarwal, who can convey unfiltered data into golden nuggets. In GTF, content writing is about being a relentless researcher and conquering the digital realm through financial knowledge. With a vision of transforming mundane topics into meaningful insights and wisdom since two years, she has been constantly honing her craft while staying versed with the industry trends. She puts her knowledge in writing as a blend of creativity and craftsmanship to meet the growing landscape of content creation. Her work focuses to illuminate GTF students towards the path of stock market literacy with each word that she writes.

In regard with gap theory, we have understood, an exhaustion gap signals a significant shift in trend of the security. This blog is a comprehensive guide about exhaustion gaps which…

As an enthusiast of the stock market, chart patterns help traders to predict future price movements in an asset. How to spot a stock’s chart pattern, how to trade the…

India is a fast-growing economy due to which it offers numerous growth opportunities. Pursuing a career in the stock market leads you towards success but it is associated with several…

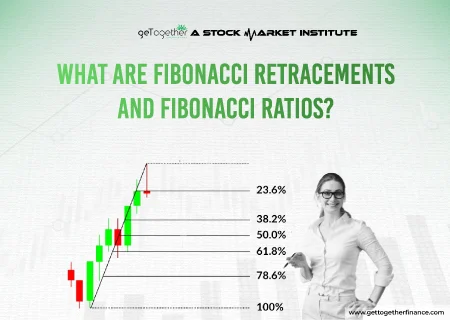

Fibonacci Retracement is a tool of technical analysis used by traders to determine the potential support and resistance levels which drives the price movement in a security. The retracement levels…

The term Falling Knife in the stock market is an indication of danger, caution and the instinct to withdraw one’s hand. On the other side, investors also look for the…

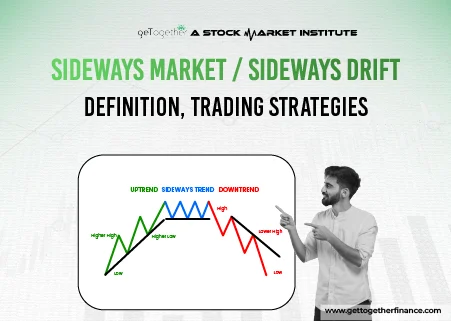

In the world of financial markets or trading, you must have heard someone saying “today’s market was trending”, “there was not much movement in the market today”. Both the situations…

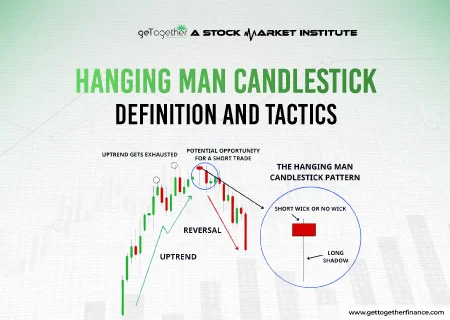

In technical analysis, as we all know candlestick patterns play a vital role in deciphering price movements in security. Traders can analyze a bundle of candlestick patterns and still the…

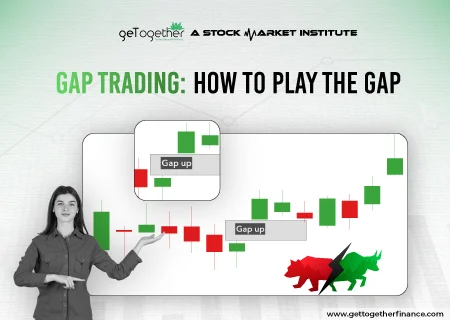

Gaps represent the blank space between the candlesticks on a chart which signifies no or little trading in between. In technical analysis, gaps are analyzed by traders to pick the…