ADX: The Trend Strength Indicator

ADX, full form, Average Direction Index is a technical indicator that is used by traders to know the strength of trends, but not its direction. It simply helps traders to know if the price is in a strong trend or not. The direction is not conveyed by the indicator.

This indicator is part of the directional movement system developed in the 1970s by J. Welles Wilder. Now, ADX is also divided into two other indicators: a positive directional indicator (+DI) and negative directional indicator (-DI).

This indicator can be helpful for traders in knowing trend strength and it further helps in taking trades based on it. It helps traders in knowing whether the market is trending currently or consolidating. In short, ADX helps traders avoid false signals and focus on high-probability setups. Let’s diver deep into this blog and know more about this indicator.

ADX Indicator

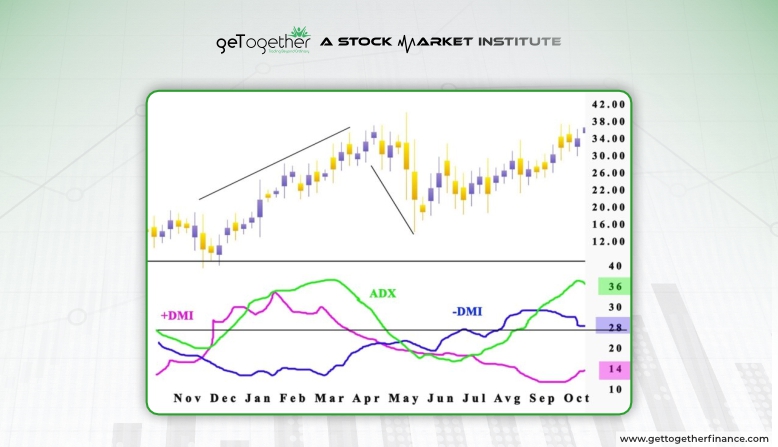

ADX indicator can be added adjacent to the candlestick charts and it is a graphical representation with 3 core lines, here’s what the ADX indicator is composed of:

- The ADX Line

The first and major line of ADX indicator is ADX line, it measures the strength of current price trend. The value of this line is from 0-100. The higher value of the line means the trend is strong and lower value shows that trend is weak. But, no direction is shown by this line.

- Positive Directional Indicator (+DI)

The +DI lines show the strength of upward price movements that are happening in the stock. When this line is higher than -DI, it means that stock is having good demand and uptrend is there.

- Negative Directional Indicator (-DI)

The -DI lines show the strength of downward price movements that are happening in the stock. When this line is trading higher than the +DI line, it suggests that the stock is in great supply, sellers are in control and the market is in a downtrend.

How These Components Work Together

All these three lines graph together to form the ADX indicator. ADX line measures trend strength while the other two help in showing trend direction. Combining these, traders can decide whether to buy the stock or sell.

For example, if +DI is above -DI and ADX is rising, it signals that the price is in a strong uptrend.

How ADX is Calculated

Here’s how ADX is calculated with these 3 steps:

- The first step is to find directional movement (DM):

- Compare today’s high made by the price to yesterday’s high for +DM

- Compare today’s low made by the price to yesterday’s low for -DM

- Then take into consideration or use only the larger value in both cases, if neither is large, then consider the value zero

- The second step is to True Range

Here’s how the TR is calculated:- Today’s high minus today’s low.

- Today’s low minus yesterday’s close.

- Today’s high minus yesterday’s close.

- Here’s how ADX calculated

- Divide +DM and -DM by the TR you calculated to get the +DI and -DI

- Find the difference between and sum of +DI and -DI, then calculate their ratio:

- Now, the next step is to calculate the Directional Index (DX), here’s its formula:

This ratio will help you understand how strongly one directional graph dominates over the other.

- At last, the DX values are averaged for a specific period, usually 14 days. The formula for this is:

Each day, the last DX value is replaced with the newest day’s value to keep the calculation dynamic to showcase the new trends.

Each day, the oldest DX value is replaced with the newest one to keep the calculation dynamic.

Note: All of this calculation is automated and you don’t have to do it yourself. Charting software like Trade Tiger and Tradingview offer ADX indicators for free. You can access it form the indicators dropbox.

Using ADX Indicator in Trading

The AD indicator is used by many traders to find a good trade setup. Here’s how conventional traders use it effectively:

1. Identifying Strong Trends

Traders take help of ADX to know whether the market is in strong trend or not with help of ADX line, when ADX line:

- Trades in the range of 0-25: Weak or not trend, more likely a sideways trade

- Trades in the range of 25-50: Moderately strong trend

- Trades in the range of 50-75: Indicates a strong trend

- Trades in the range of 75-100: Indicates a very strong trend.

All these help in just knowing the strength of the trend, with the traders can check whether the current price momentum is going to survive or not.

2. Using ADX Indicator with Other Strategies and Indicators

ADX indicators alone don’t work best, but with other indicators, their accuracy is increases

- With Moving Averages: If the trend confirmed by ADX is also highlighted by EMA and SMAs then it is a green signal.

- With RSI (Relative Strength Index): The overbought and oversold situation confirmed by RSI when used with knowledge of ADX, then trader can find more reliable trades

- With Demand and Supply Theory: All these indicators were previously used by conventional traders, but to keep up with the dynamic stock market like today’s, a powerful theory like demand and supply is needed. Using ADX in conjunction with demand and supply can be an add-on to the trade. If the strong uptrend aligns with a good demand zone then it is a green signal for long trade. Whereas the strong downtrend aligns with a good supply zone it is a good signal for a short trade.

3. Entry and Exit Signals

The ADX along with its other two lines +DI and -DI can help traders know when to enter and exit the trade.

- Buy Signal: When +DI is above -DI and ADX is trading in the range of 75-100

- Sell Signal: When +DI line is below -DI line and ADX line is in range of 75-100

- Exit Signal: If ADX lines start falling suddenly, it means that the price trend is weakening.

Limitations of ADX

While ADX is said to be a helpful trading tool, it’s still not up to the dynamic nature of the current stock market. It has certain limitations that traders should know before relying on it solely:

The lagging Nature of ADX

The nature of ADX is not based on real-time data, instead, the graph is made on past data, so the real-time changes take time to reflect upon the chat. This delay can make it a slow process for the sudden market changes and reverses, eventually ending up in missed opportunities.

ADX Values can be Misinterpreted

The ADX indicator only indicates the trend strength and not its direction. This can be confusing for traders who don’t take into consideration -DI and +DI. It is important to read all three linear graphs together, otherwise high ADX can be deceiving, it may be an indicator of a strong uptrend or strong downtrend, but nobody can find out.

Conclusion

The ADX indicator is important and widely used indicator by traders. It helps them in understanding the strength of current price trend. By using ADX line, +DI line and -DI line together, traders can make good trading decisions. It also helps in planning apt entry and exit points. It works best when used alongside a strong theory like demand and supply and reliable indicators like EMA, RSI, etc.

Nevertheless, it is extremely important to remember that the ADX is a lagging indicator, which means it reflects past price movements, and it doesn’t provide real-time updates. It is important for traders to remember this rule. ADX indicator should be used mindfully and never alone. It is only a good add on in strategy, not complete strategy.

Frequently Asked Questions

What does the ADX measure?

The ADX evaluates the strength of a trend, whether upward or downward. It does not show the trend’s direction, but it does help traders determine if the market is trending strongly or meandering sideways.

What are the key components of the ADX indicator?

The ADX contains three lines:

The ADX Line demonstrates the strength of the trend.

The +DI Line represents the strength of upward price moves.

The -DI Line represents the strength of downward price swings.

What is a strong ADX value?

0–25: Weak or no trend.

25–50: Moderately strong trend.

50–75: Strong trend.

75–100: Very strong trend.

Can the ADX be used alone?

To improve accuracy, the ADX is best used in conjunction with other indicators such as moving averages, RSI, or support and resistance levels.

What are the limitations of the ADX?

ADX is not real time indicators, its information is based on previous price data, thus lags in real time. Also, it does not show trend direction without +DI and -DI lines.

Instagram

Instagram