The Balance Sheet Explained: Assets, Liabilities, and Equity

Did you ever find yourself looking at the nutritional label to understand what you are consuming? Just like the nutritional label helps us make informed dietary choices, a balance sheet helps us understand a company’s financial health. It is a financial statement that includes the financial aspects of a business, including its net worth, revenues, assets, expenditures, and so on.

A balance sheet is a crucial document in the business world, essential for many reasons, such as securing a loan, attracting an investor’s attention, or selling your business. But what is it, how it works, and what key components it contains? This e-guide will take you through its definitions, significance, and limitations to give you a better view of the balance sheet analogy.

Table of Contents

ToggleWhat is a Balance Sheet?

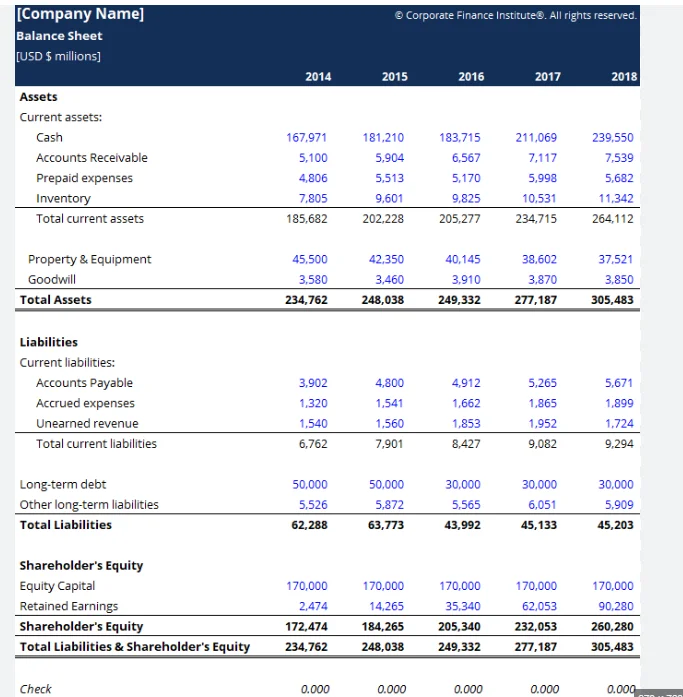

A balance sheet is a financial statement that includes a company’s assets, liabilities and shareholders’ equity at a specific point in time. It gives a snapshot of a company’s financial health and is one of the three key financial statements, along with the income statement and cash flow statement.

The document gives a sneak peek into the basis of a company for computing rates of returns and assessing its capital structure to investors. By comparing two or more balance sheets, one can evaluate how a business has grown over a period of time.

The Purpose of a Balance Sheet

A balance sheet is more than just a financial guidebook, it entails an overall record of every transaction since the business began. This makes it a powerful tool for understanding a company’s overall financial health.

By looking at this financial document, you can see exactly how much money has been invested in the business and how much debt has been accumulated over time. This gives you a clear picture of the company’s capital structure.

But the use of a balance sheet goes beyond just looking at the transaction. You can use the information it contains to calculate important financial ratios, like the debt-to-equity ratio or the current ratio. These metrics offer insights into the company’s ability to pay its debts and meet upcoming financial obligations. Whether you’re an investor, business owner, or accountant, the it is an invaluable resource.

How Balance Sheets Work?

A balance sheet serves as a fundamental financial statement for any business. The data tells the story of two sides of financial health, one side stands all the assets and other sides the liabilities plus shareholder’s equity.

Assets = Liabilities + Shareholders’ Equity

Assets are resources the company owns that have monetary value, such as cash, accounts receivable, inventory, property, plant and equipment. Liabilities are the company’s financial obligations, like accounts payable, loans, and bonds. Shareholders’ equity represents the amount of money that would be left if the company sold all its assets and paid off all its liabilities.

Also Read: Assets and Liabilities

Components of a Balance Sheet

A balance sheet consists of two main sections: Assets and Liabilities & Shareholders’ Equity. Each section is further split into specific components in detail:

Assets

An asset is a resource that a company owns and has economic value. On the basis of convertibility, usage, and physical existence, it can be divided into below categories broadly:

Current Assets: These are highly liquid assets that can be easily converted into cash within one year. Examples include:

- Cash & Cash Equivalents: readily available cash in bank accounts and short-term investments.

- Accounts Receivable: money owed by customers for goods or services sold on credit.

- Inventory: raw materials, work-in-progress, and finished goods ready for sale.

- Prepaid Expenses: expenses paid for in advance but not yet consumed (e.g., prepaid rent).

Non-Current Assets: These are assets that are less liquid and take longer to convert to cash. Examples include:

- Property, Plant, and Equipment (PP&E): land, buildings, machinery, and equipment used in operations.

- Intangible Assets: non-physical assets with value, such as patents, trademarks, and copyrights.

- Long-Term Investments: investments in other companies held for more than one year.

Liabilities

This considers the economic debts and financial obligations that a company owes to other parties. This section is generally listed on the right side of a balance sheet. They are typically listed in order of their due date (current vs. long-term). On the basis of context, they are divided into two parts:

- Current Liabilities: short-term debts due within one year, such as accounts payable (money owed to suppliers), accrued expenses (expenses incurred but not yet paid), and short-term loans.

- Non-Current Liabilities: long-term debts due beyond one year, such as long-term loans, bonds payable, and mortgages.

Shareholders’ Equity

This means the ownership interest in the company. It’s calculated as the difference between assets and liabilities. Shareholder’s equity includes:

- Paid-in Capital: the total amount of money invested by shareholders in the company.

- Retained Earnings: the accumulated profits of the company that have not been paid out as dividends.

It is super important to know these elements as it gives a comprehensive view of a company’s financial value. It provides insights into the company’s ability to meet its short-term and long-term obligations (liquidity and solvency), as well as its overall resource base and funding sources.

A Sample of Balance Sheet

Limitations of a Balance Sheet

A balance sheet definitely comprises all the financial data, but it isn’t enough to understand the complete picture. Here are some limitations or drawbacks:

- Snapshot in Time: This only shows a company’s financial position at a single point in time, not its performance over a period. To view the growth over time, investors need to compare it with other sheets which could be lengthy work and quite overwhelming, especially for beginners.

- Historical Cost Accounting: The records only use historical costs for assets, which may not reflect their current market values.

- Omission of Intangible Assets: Many valuable intangible assets like brand value, customer relationships, and intellectual property are not properly captured on the sheet. Hence, investors need to equip their studies with other fundamentals to know the value of intangible investments.

- Subjective Estimates: Certain items in this sheet, like allowances for doubtful accounts or inventory valuations, involve management estimates and judgments.

- Off-Balance Sheet Items: Some liabilities and assets, such as operating leases or contingent liabilities, may not be included on the sheet.

- Lack of Forward-Looking Information: This only gives a retrospective view and does not directly indicate a company’s future prospects or growth potential.

In A Nutshell

A balance sheet is a crucial financial statement for assessing a company’s financial growth but it has limitations. It should be reviewed in conjunction with other financial reports and metrics to get a comprehensive understanding of a company’s overall financial health and performance. Ultimately, it is a powerful financial reporting tool that allows businesses, investors, and lenders to gain crucial insights into a company’s overall financial health and trajectory. Its importance cannot be overstated in the world of corporate finance and investment analysis.

FAQs

u003cstrongu003eWhat are the differences between a balance sheet and a profit and loss account (Pu0026amp;L)?u003c/strongu003e

A balance sheet is a financial statement of a company that tells you u0022what you haveu0022 (assets u0026amp; equity) and u0022what you oweu0022 (liabilities), while the Pu0026amp;L account tells you u0022what you earnedu0022 and u0022what you spent.u0022

u003cstrongu003eDo Indian companies have to follow specific accounting standards for balance sheets?u003c/strongu003e

Yes, Indian companies generally follow the Indian Accounting Standards (Ind AS), which are based on International Financial Reporting Standards (IFRS). These standards ensure consistency and comparability of financial statements across different companies.

u003cstrongu003eWhat are some red flags to look for when analysing a balance sheet?u003c/strongu003e

While reviewing a balance sheet, you should look out for red flags, such as declining current ratio as it suggests financial risks. A high debt-to-equity ratio may signal complexity in meeting short-term obligations. Also, if you spot a large increase in inventory, it may suggest overstocking or slowing sales.

u003cstrongu003eWhat role do auditors play in relation to balance sheets?u003c/strongu003e

Independent auditors review a company’s financial statements, including the balance sheet, to ensure they are presented fairly and in accordance with accounting standards.

Facebook

Facebook Instagram

Instagram Youtube

Youtube