Binary Options: A Comprehensive Trading Guide

Introduction

Have you ever entered into an all-or-nothing bet? If yes, you already understand the basic premise of Binary Options. Based purely on betting, these are high-risk, high-reward derivatives. As a result, they are not promoted and are mostly unregulated by the authorities.

However, traders find these options easier to understand than vanilla options. Hence, the popularity. More and more people are trying their hands on trading binary options. But, you should be careful and gain knowledge about the mechanisms and risks involved before trading in binary options.

This blog aims to equip you with a solid understanding of binary options to make the right decisions.

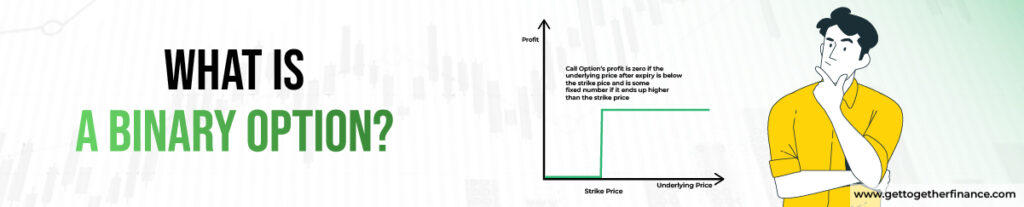

What Is a Binary Options?

Binary Options are financial contracts that allow you to make a “yes” or “no” prediction. If your prediction is correct, you receive a predetermined payout. On the contrary, if your prediction misses, you end up getting nothing.

Unlike options where the payoff is variable, binary option have a fixed payout, which you will know at the time of entering the contract. So, you know what’s at stake while placing the bet.

The bets consist of predictions like whether the price of a stock will be above or below a certain level at a specific time. Here are the key features and characteristics:

- Speculation: With the facility of placing yes or no bets, these are purely speculative instruments.

- Call & Put in the Same Option: Unlike vanilla options, where you can buy and sell call and put options, binary option allow you to call and put in the same option. If you bet on “yes,” you buy a call option, and if you bet on “no,” you buy a put option.

- Fixed Return: As a trader, you already know the maximum returns you can get by trading binary options; the returns are fixed.

- Expiration Time: Unlike vanilla options, the expiration time of binary option ranges from minutes to months.

- Underlying Asset: It can be based on various underlying assets such as stocks, commodities, currencies, or indices.

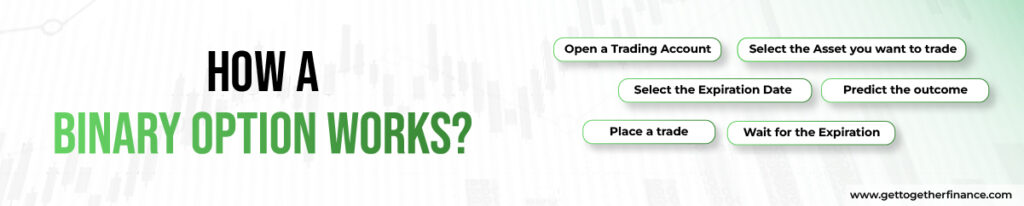

How a Binary Option Works?

Here are the steps to trade a binary option:

Step 1: Open a Trading Account: You need to choose a broker and open a trading account that permits binary options trading. Deposit the money you want to use as your trading corpus.

*Note: Binary options are illegal to trade in India. Hence, you need to open a binary account with brokers outside India to trade these options in other markets like the US.

Step 2: Select the Asset you want to trade: The first step is to choose the asset you want to trade. It can be stocks, currencies, or commodities.

Step 3: Select the Expiration Date: Decide the time frame for which you want to trade the binary options.

Step 4: Predict the outcome: You can assess the future value of the asset you want to trade and make a prediction.

Step 5: Place a trade: Once you have the prediction ready, determine the size of the trade you want to enter into and place the order.

Step 6: Wait for the Expiration: At expiry, if the option is in the money, you get the entire amount. Else, you get nothing.

Following the above steps can help you in trading binary options. However, it is advisable to start with a demo account rather than jumping right into the thick of things. Once you get a hang of it, you can start real trading.

Let’s understand it with an example.

The stock of Company X is trading at $ 95. You assess that the price can go above $ 100 before the end of the day. There is a binary option of $ 50 for the price of Company X going above $ 100, expiring on the day. You can place a bet by paying $ 30 as a premium.

Also Read: Put Call Option

Buying a Call Option

| Particulars | Amount |

| You buy a call option and pay the premium | $ 30 |

| Case 1: The option finishes In the Money (ITM), i.e., the share price is above $ 100 at expiryYou getYour Profit | $ 50$ 20 (i.e., $ 50 – $ 30) |

| Case 2: The option finishes Out of the Money (OTM), i.e., the share price is below $ 100 at expiryYou getYour Loss | $ 0$ 30 (i.e., $ 30 – $ 0) |

Buying a Put Option

| Particulars | Amount |

| You buy a put option and pay the premium | $ 30 |

| Case 1: The option finishes In the Money (ITM), i.e., the share price is below $ 100 at expiryYou getYour Profit | $ 50$ 20 (i.e., $ 50 – $ 30) |

| Case 2: The option finishes Out of the Money (OTM), i.e., the share price is above $ 100 at expiryYou getYour Loss | $ 0$ 30 (i.e., $ 30 – $ 0) |

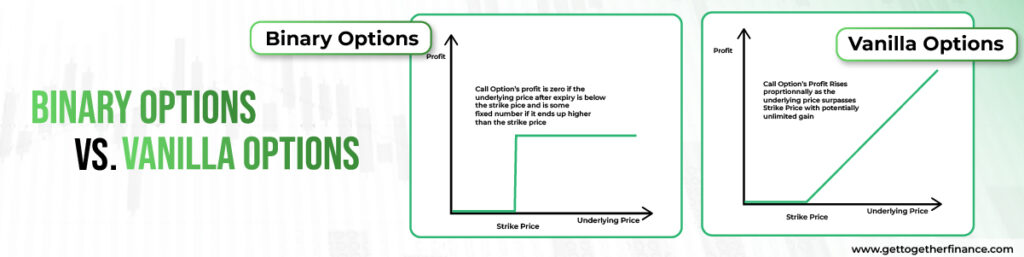

Binary Options vs. Vanilla Options

| Particulars | Binary Options | Vanilla Options |

| Purpose | Speculation / Betting | Hedging / Trading |

| Returns | Fixed (all-or-nothing) | Variable |

| Simplicity | Binary Options are straightforward to understand | Vanilla Options are complex instruments that require a deeper understanding |

| Options | You can buy either call or put options | You can buy and sell both call and put options |

| Expiry | Extremely short term | Longer term compared to binary options |

Fraud Risk with Binary Options

Unfortunately, there is no regulation on binary options platforms. Hence, trading them is illegal in India. So, these options are not untouched by fraudulent activities. Here are the common risks of fraud you can encounter while trading binary options:

- Unregulated Brokers: Brokers can operate without proper licenses or overlook important compliances.

- False Promises: You can get lured into following the wrong trading advice by promising unrealistic returns.

- Manipulated Platforms: Brokers might use rigged trading platforms to take undue advantage of traders’ money.

Opening a Binary Options Trading Account

Having learned about the risks of trading binary options, here are the factors you should check before opening a trading account:

- Choose only a regulated broker to open your trading account. You can research to check the credibility and reputation of the broker.

- Beware of fake promises.

- Check whether the platform is user-friendly and provides good customer support

<H4> Steps to Open a Binary Options Account

Step 1: Choose a reputable broker who follows the regulations

Step 2: Complete the registration process by providing all the necessary personal information & doing KYC

Step 3: Verify your identity and address proofs

Step 4: Choose the amount you want to invest and deposit the margin money required

Step 5: Research properly, select the asset, and start trading binary options

Is Trading Binary Options Considered High Risk?

Yes! It carries high risks, and traders should be careful when dealing with these options. Here are the reasons for calling them high-risk:

- All or Nothing: You either win the bet and get the fixed amount or lose the entire amount.

- Market Volatility: It is extremely difficult to predict correctly in a volatile market.

- Short-term Nature: Short-term expiration of the options also makes them highly volatile and risky.

You can mitigate these risks by learning about binary options and diversifying your investments. To learn options in-depth, join the GTF options trading course. You can also check out this options simulator to practice and refine your trading skills in the live market without investing a penny.

Best Time To Trade Binary Options

As binary options are illegal to trade in India, you can only trade in them in international markets. Depending on their opening and closing times, you can identify the best time to trade. Usually, you would find the international times written in GMT. You can convert it into IST by adding 5 hours and 30 minutes.

The ideal time is between 12 pm and 5 pm and 7 pm and 3 am. However, you should calculate the ideal time for trading binary options depending on the market you aim for and the type of asset you want to trade.

Conclusion

Binary options provide an opportunity to make quick money. But, this comes with high risk. To become a successful trader, you should learn and educate yourself about options and how binary options signals work. Choosing reputable brokers and conducting thorough research can help you avoid the risk of fraud and losses. Try the GTF options trading course and options simulator to learn options trading in its entirety.

FAQs

Is it safe to trade binary options?

Trading binary options is highly risky due to volatility and the potential for fraud. However, you can ensure the safety of your funds by choosing regulated brokers and conducting thorough research.

Is binary options a good investment?

They are speculative instruments and contain high risk. As a result, they also have the potential to provide high returns. However, you should invest in these options only if you can accept huge losses.

Can I make money trading binary options?

Yes, you can make money by trading binary options, provided you understand how these instruments work, do thorough research, create sound strategies, and manage risks well.

Is binary trading banned in India?

Yes. Trading binary options is illegal in India. The SEBI (Securities and Exchange Board of India) does not allow trading in binary options. You can access international markets for opportunities if you want to trade them.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube