Blow-Off Top: Identifying the Indicators in Technical Analysis

Introduction

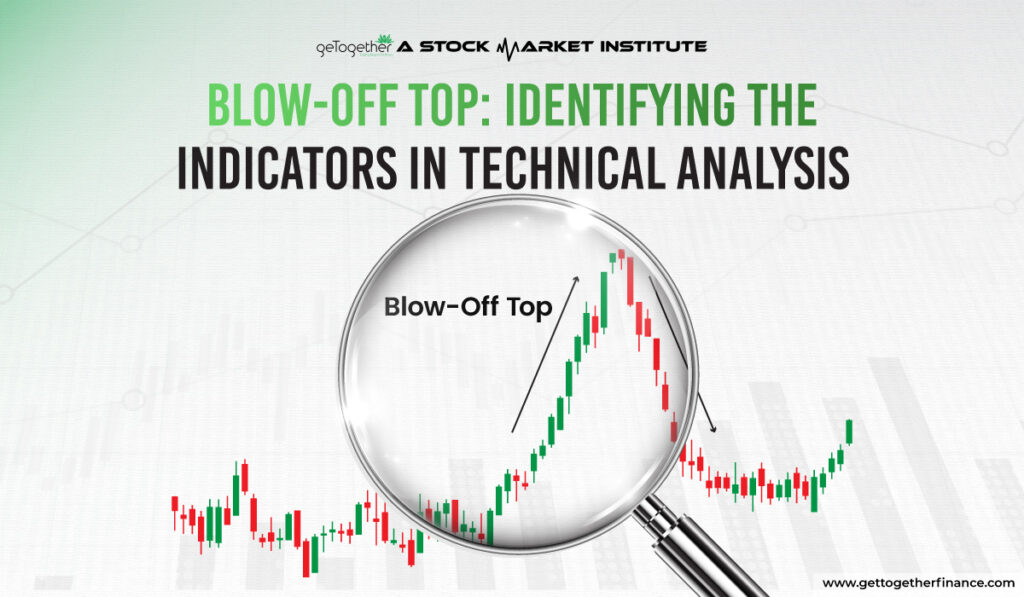

A blow-off top is a well-known bearish technical pattern that signifies the end of a powerful uptrend. It is stimulated by selling pressure and speculative mania. It is characterized by a rapid, parabolic rise in the stock or security price and an equal shift in the dynamics of the stock in no time. This pattern is usually observed in the final stage of a bull rally, when buyers start booking profits out of fear of missing out, causing distortion in buying and giving rise to a trend reversal.

Blow-off tops have been seen in various types of markets, every market that can be studied on the candlestick chart has seen blow-off tops. Cryptocurrency rallies and hype in 2017 were one of the great instances of understanding this pattern. At that time, prices of the majority of cryptos soared to unsustainable levels before crashing, wiping out significant market value. Knowing and recognizing the signs of blow-off top patterns is crucial for investors and traders, it will help them in anticipating the potential market reversals with extreme profit booking and selling pressure. Let’s dive deep into this blog and learn more about the pattern.

Understanding the Blow-Off Top Pattern

A blow-off top pattern is formed when as quickly the price has surged upwards, it falls down at the same pace. It’s like watching a rocket shoot up to the sky and return to Earth in no time.

Formation and Characteristics

Blow-off tops form when a strong uptrend is surged with an unimaginable increase in buying, making explosive green candles, creating a high rise in price. This often happens in a short period due to extreme buying pressure, pushing the price of asset or stock to all-time highs. The day this uptrend ends with sharp selling with equal force, the price falls as rapidly as it rose. Catching many traders off guard. This makes the blow-off top pattern.

Phases of a Blow-Off Top

- Rapid Ascent: The price of a stock or an asset shoots up quickly with increased trading volume as everyone is eager to buy.

- Peak: The peak of the price is often reached after sudden buying and increased volatility.

- Sharp Decline: Prices fall rapidly, triggering panic selling.

Market Psychology Behind Blow-Off Tops

This type of pattern is usually carried out by FOMO and greed. As prices rise, fear of missing out (FOMO) makes traders buy even at spiked rates. However, once the top is reached, fear of losing the profits takes over, leading to aggressive profit booking and selling.

Key Indicators of a Blow-Off Top

Identifying a blow-off top can help traders and investors in avoiding major losses. Here are some key indicators of identifying the patterns that can help:

1. Volume Spikes

A sudden surge in trading volume is a major indicator of the pattern. As the price of the security or the stock soars, more traders rush in to take entry, creating an unusually high buying activity. This surge in volume often peaks near the high made by the price.

2. Parabolic Price Movement

In a Blow-Off Top pattern, prices rise with a very high force, creating a steep and parabolic curve on the chart. This surge is often unsustainable for the price, as this part of the bull run is often the final stage of an uptrend before the market reverses.

3. Increasing Volatility

As the top approaches, price swings in the asset or stock become more extreme, it shows extreme volatility and uncertainty in the market. Large price jumps and drops within short periods signal that the trend may soon reverse.

4. Divergences in Momentum Indicators (RSI, MACD)

The divergence in some momentum indicators like RSI and MACD signals. The weakness in buying pressure shows low demand for stock. To understand this, let’s take an example, there might be cases when the stock is making new highs, but RSI isn’t. This can be assigned that buying is eventually declining.

5. Candlestick Patterns (Doji, Shooting Star, etc.)

There are some specific candlestick patterns that indicate to herself when formed at the top of a bull rally. These are Doji and shooting stars. These patterns usually show the battle between Buyers and sellers and sometimes single price reversal.

Common Traps and Misinterpretations

Identifying the blow-off top pattern can be tricky, it can often be confused with power marker movements. Here are two top misinterpretations of the pattern:

1. False Signals and Whipsaws

Blow-off tops can give false signals, leading traders to make impulsive and wrong decisions. For example, rapid price spikes with increased volume followed by a quick pulldown can appear like a blow-off top, but it might just be another volatile market scene. This phenomenon is known as whipsaw. It occurs when the market moves sharply in one direction and then quickly reverses. It causes traders to take trades at the wrong time, making them trapped in panic selling.

To save yourself from this, make sure you follow a particular technical analysis study before getting into a trade. Indicators and volume should only be used as an add-on not the sole indicator for trade setup.

2. Distinguishing Between Blow-Off Tops and Regular Corrections

A blow-off top and a regular market correction can look kind of similar but have different implications. Regular market corrections come and go and they are needed too. Short-term pullbacks often help with long-term uptrends. Whereas, the blow-off tops involve extreme price movements and emotional reactions. Leading to a much faster and uncertain fall. To distinguish both, look for signs of panic selling, and identify selling without any proper pattern or in unimaginably high amounts after a strong bull run.

By understanding these traps, traders can avoid misinterpreting market signals and better navigate volatile conditions.

Strategies for Trading Blow-Off Tops

Trading a blow-off top can turn out to be profitable if done cautiously. Here are key strategies to help navigate this volatile market condition:

1. Entry and Exit Points

Timing is crucial when trading blow-off tops. Traders should highly avoid getting into long positions when the prices are already at an all-time high. Because then, nobody can predict the move can reverse. Instead, wait for the reversal signs and take entry for a short position when the trend becomes downward.

2. Risk Management Techniques

It is important to manage risks while trading blow-off top patterns. Since it is formed during the peak volatile market only trades a small portion of your capital in this. Avoid averaging strictly. Also, Diversify your positions to reduce the impact of any single market move.

3. Using Stop-Losses and Take-Profits

Stop-loss orders are highly crucial to protect the capital against sudden reversals. To be on the safer side, set stop loss orders at certain resistance levels and also check whether the strong supply zones are broken or not. Profit and stop-loss levels should be realistically set considering the high volatility in the market. Also, once the trade gets stops loss, try avoiding entering again. Also, do not increase the target unnecessarily here. You can stop loss trailing once the price reaches the target, allowing you to lock in gains as prices move in your favor while protecting against sudden pullbacks.

4. Avoid Emotional Strategies

It is important for traders to have good emotional control over their trading behavior. In a blow-off top pattern, do not trade trudging the time the price starts reversing.

5. Confirmation Entry

It is important to take the help of other reliable indicators and technical analysis strategies to trade this pattern. Blow-off patterns should not be traded alone, use things as confirmation.

6. Be patient and wait for re-entry

There might be times when you may miss selling at the top of the rally, now avoid getting into panic selling in between the downtrend. Wait for the price to get stable before entering.

Conclusion

Blow-off tops are potent signs of market instability, frequently signaling the conclusion of a ferocious bull run fuelled by speculative exuberance and emotional trading. There are many warning indicators such as volume search parabolic price movement at certain artistic patterns that can help traders in predicting probable market reversal and help them make money out of it while trading blow-off patterns can be risky using good strategy to Exit point and putting stop loss at appropriate points can help in improving the trading strategy It is important for the trade to understand, psychological and technical points that help in treating these patterns. It is important to track the market regularly and be disciplined to make money out of these conventional patterns. Though it is never advisable from GTF to use these patterns alone, these can only be used as an add-on. One has to completely rely on their technical analysis strategy like supply for making profits in the stock market.

Frequently Asked Question

What is a Blow-Off Top, and how does it differ from a regular market correction?

A blow of Top is a bearish pattern. This pattern is formed with a quick and sustainable price increase that is followed by a quick collapse of the price too. It is run by speculative buying and emotional trading done by mostly retail traders.

What are the key indicators of a Blow-Off Top?

Volume surges, parabolic price swings, increased volatility, momentum indicator divergences (such as RSI and MACD), and reversal candlestick patterns like Doji and Shooting Star are all important indications.

How can I protect my investments during a Blow-Off Top?

To protect your investments, use risk management tactics such as setting stop-losses, avoiding new long holdings near all-time highs, diversifying your portfolio, and considering hedging measures.

Can Blow-Off Tops be predicted accurately?

While no pattern can be forecast with 100% precision, recognizing early warning signs—such as volume spikes and divergences in momentum indicators—may help traders anticipate a potential Blow-Off Top and alter their strategies as needed.

Is trading Blow-Off Tops profitable, and what strategies should I use?

Trading Blow-Off Tops can be profitable if tackled with caution. Key methods include precisely timing your entry and exit points, limiting risk with stop-loss orders and realistic profit targets, and using hedging measures to mitigate potential losses during turbulent market conditions.

Instagram

Instagram