Breakaway Gap: Meaning, Overview, Examples

- February 5, 2025

- 9604 Views

- by Manaswi Agarwal

Gap Trading is well known by traders as the prices tend to fluctuate due to uncertain market conditions and result in giving gaps. It is way more important to realize how to consider gaps while trading and analyzing breakaway gaps can be a path to successful trading. Let us discover everything about breakaway gaps in the blog.

What are Breakaway Gaps?

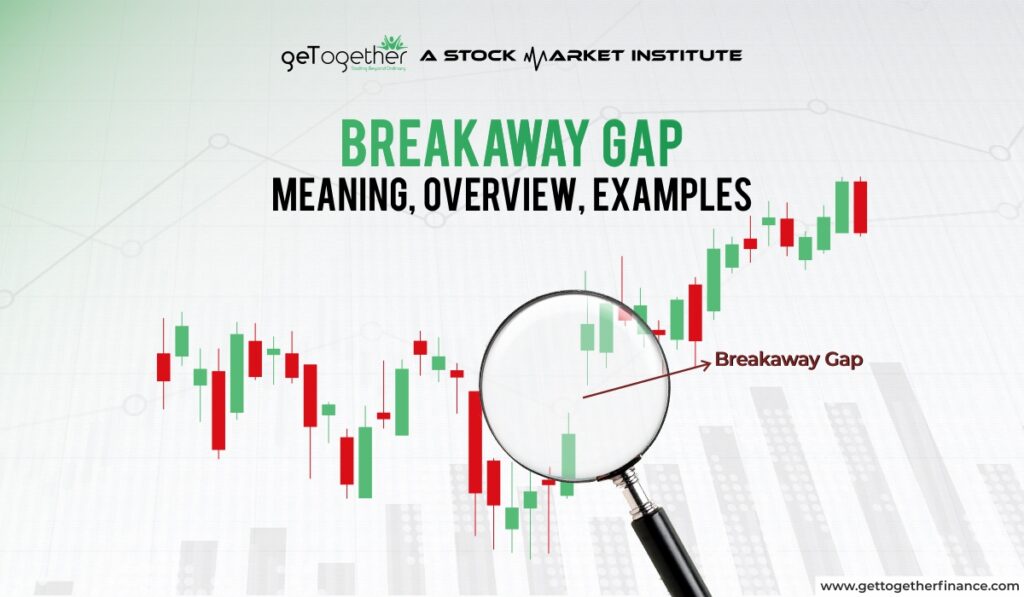

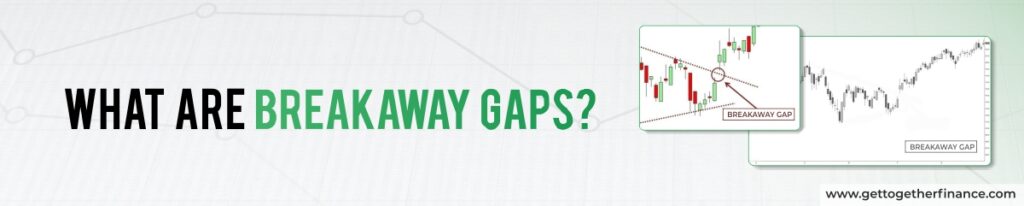

Breakaway gap in technical analysis identifies the strong price movement with the help of support and resistance levels. The gap defined the difference between the open price and prior close price where no trading activity takes place.

How to identify a Breakaway Gap?

Breakaway gaps occur when the price gaps above resistance or gaps below support. Breakaway gaps signal the start of a strong price trend due to a significant shift in market sentiment caused by major news events or fundamental changes. But how to really identify the structure of a breakaway gap, here are some of the characteristics:

Trading Volume

A break away gap is identified by observing a significant price move in the charts where gaps are created which is accompanied by high trading volume of the security.

Abrupt Movement in Prices

You should look for an abrupt movement in the prices of the security that leaves beyond established support or resistance levels instead of breaking the barriers during the usual trading activities.

Chart Patterns

The prices must have surged past resistance or plummeted beneath support levels which happens adjacent to chart patterns like Head and shoulders formation.

Breakaway gaps include four major characteristics

- Beginning of a new trend

- High volume

- Significant jump above resistance or below support

- Signals a new trend.

What does the breakaway gap signify?

Breakaway gaps are typically associated with the confirmation or the beginning of a new trend. For example the trend of security is in downwards direction and the chart forms a large cup and handle pattern giving a break away gap in an upwards direction confirms the end of the downtrend and the beginning of a new trend. The break away gap signifies its strong conviction on the part of the buyers as it is towards a breakout with an increase in volume.

Breakaway gaps are important for technical analysts to determine because they provide valuable insights about market dynamics and can present trading opportunities.

- Bullish Breakaway: A breakaway gap to the upside signals a bullish momentum in the security while indicating a strong buying pressure with a potential for further movement and upwards direction.

- Bearish Breakaway: A break away gap to the downside direction is considered bearish which signals and increases selling pressure with a potential of further downward movement in the security.

How to trade using a Breakaway Gap?

To trade with the help of technical analysis in breakaway gap, the validity is notified by price gap, high trading volume and confirmation from other technical indicators as well as chart patterns.

The second step after the verification is to identify the prevailing trend before the gap occurs. Traders get the signals of potential continuation of the trend if the gap aligns while in the other case a potential trend reversal is expected.

- Entry Position: Traders plan their entry positions at the opening price with a breakaway gap or adjust their positions if the gap fails to follow through.

- Stop Loss Orders: Stop loss levels for risk management are set below the low of a bullish breakaway gap or adjust their position if the gap fails to follow through.

A high volume is accompanied by a break away gap as the volume exceeds the average which denotes market conviction with a specified direction of the trend while increasing the expectations of its continuation.

Demand and supply

In breakaway gaps, the trade becomes more reliable when entry and stop loss are placed as per the demand and supply zones. To make the long position, you must enter the trade in a breakaway gap that coincides with the demand zones.

Stop losses are placed just below the demand zone as the price runs might run after hitting the demand zone. This is the reason, zone must be considered in breakaway gap and stop loss must place the demand zone otherwise the price would hit the stop loss and run.

Reasons for Breakaway Gaps

A break away gap is frequently triggered by major fundamental events of the company like earning reports or any other developments which might indulge investors interest. A break away is also predicted from additional technical tools including moving averages, RSI, and volume that confirms the relevance of the gaps on the chart.

Earnings

In a security the break away gap appears when the company releases its earning reports with the results that greatly exceeds or falls short of market expectations. It leads to a break away gap in the stock prices as investors react to the reports accordingly and adjust their positions.

News

A sudden break away can be caused by a major news event like merger announcement, regulatory decision or jio political development that can trigger the stock prices and the negative news might react negatively for investors.

Technical break out gap

A technical breakout might occur when a stock breaks out of a well defined trading range or pattern.

Challenges of Trading with Breakaway Gap

Apart from the importance and benefits of breakaway gaps, there are various disadvantages which are important to be known by traders as it can impact their overall trading process.

False signals

Not all breakaway gaps result in sustained trends or predicted price movements.

Rare occurrence

Breakaway gaps rarely appear on the chart patterns which make it challenging for traders to find these gaps on a regular basis. This reduces the number of potential trading opportunities for traders and they need to be patient for suitable setups and utilise breakaway gaps in their strategies.

FAQs

What is the breakaway gap?

A breakaway gap is a term used in technical analysis to describe a price gap on a stock chart that occurs when the price of a security moves sharply higher or lower, breaking out of a trading range or consolidation pattern.

What causes a breakaway gap?

Breakaway gaps occur due to significant news, earnings reports, mergers, or other events that cause a sharp increase or decrease in demand for a stock. Traders or investors react strongly, causing the price to “gap” beyond the recent range.

Are breakaway gaps more common in certain markets?

Breakaway gaps can occur in any market but are more common in stocks, futures, and commodities due to their sensitivity to news and earnings announcements.

Can breakaway gaps occur in intraday trading?

Yes, breakaway gaps can occur on intraday charts, especially in the times of high volatility periods

How reliable are breakaway gaps?

Breakaway gaps are reliable when combined with demand and supply, however, false breakouts can occur, so confirmation is essential.

Instagram

Instagram