Bullish Engulfing Pattern

Overview

Making money has never been tough, it’s just trickier. This is what we can realize when we step into the vast pool of the stock market. It indeed has endless opportunities to make money, but all of these require an advanced understanding of technical analysis. You need to master in the art of trading, and for that you need to have a strong grip on analyzing technical charts, understanding their terminologies, and applying the theories of trading. Though there are various types of patterns in the chart, but in this blog we will majorly discuss a pattern that helps traders to easily predict the movement of stocks, popularly known as the Bullish Engulfing Pattern.

What is Bullish Engulfing Pattern?

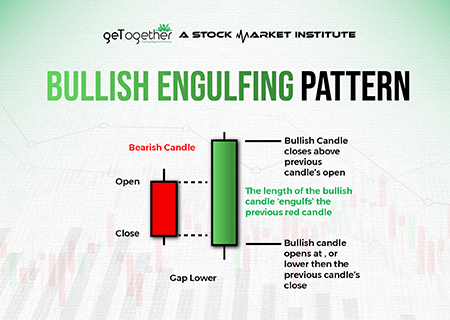

Let us now understand the bullish Engulfing Pattern in depth. A trader always searches for a perfect pattern to enter into a trade. One such pattern is a bullish engulfing pattern. More often, the bullish engulfing pattern showcases the end of downtrends and the start of upward trends. When a new candle starts at a price lower than the previous day’s closing price, a bullish engulfing candle can be seen. This can point to a probable downward trend.

However, when buying pressure picks up, the market’s mood changes, and a fresh green candle forms. The red candle from the previous day is entirely engulfed by the green candle, notifying a rise in the stock price and buying. This indicates the start of an upward trend.

Understanding Bullish Engulfing Pattern

The pattern consists of two candles that signal a potential up move in the stock’s price. Majorly, this pattern is in a downtrend, but it can be seen in an uptrend too. The patterns forms with a small red candle that is completely engulfed by the next green candle. The significance of the pattern is that it signals that buyers have taken over the market after the continuous selling in the downtrend. Many conventional traders see this pattern as a potential buying opportunity and take long positions.

What does a bullish engulfing pattern tell you?

A bullish engulfing pattern is formed when a big green candle is formed after a red candle. The green candle here completely covers the red candle. But, this formation can be here frequently in the candlestick chart. The significance of the bullish candlestick pattern is understood when it is formed after a downtrend.

A downtrend refers to a continuous downmove in the price leading to the formation of consequent red candles. When the bullish engulfing pattern is formed after a downtrend, it signals the reversal of the trend. There are high possibility that an uptrend can be seen after the formation of this pattern.

Also Read: Bearish Candlestick Patterns

Example of a Bullish Engulfing Pattern

Example 1:- In the above example of HDFCAMC, a continuous downtrend can be seen from the price level of Rs2000 to almost Rs1300. After the last red candle, a green candle is formed that completely covers the red candle. Here, the bullish engulfing pattern can be seen. After the formation of the pattern, a decent upmove in the price was observed.

Example 2:- In the above example of Poonawalla Fincorp a downtrend can be seen from the price of Rs170 to the price of Rs200. Whereas, here the downtrend is broken by a bullish engulfing pattern formed at the price of 150. After the pattern, a continuous uptrend can be seen. This uptrend has given a good move of almost 25% to the stock price.

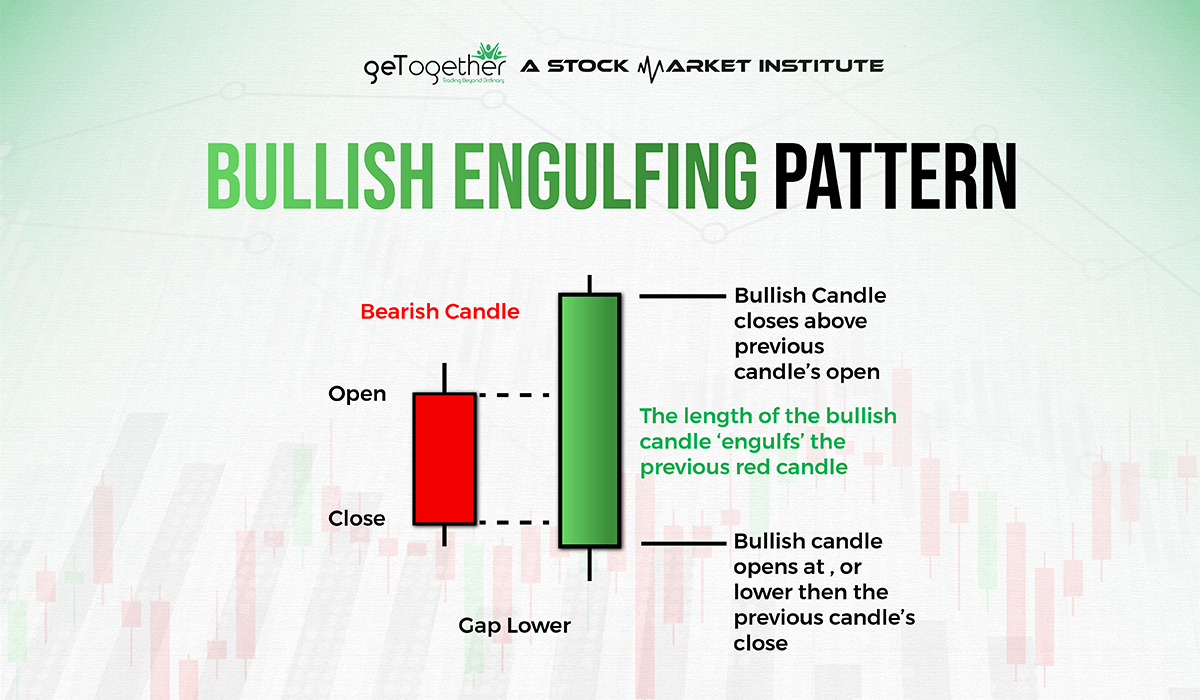

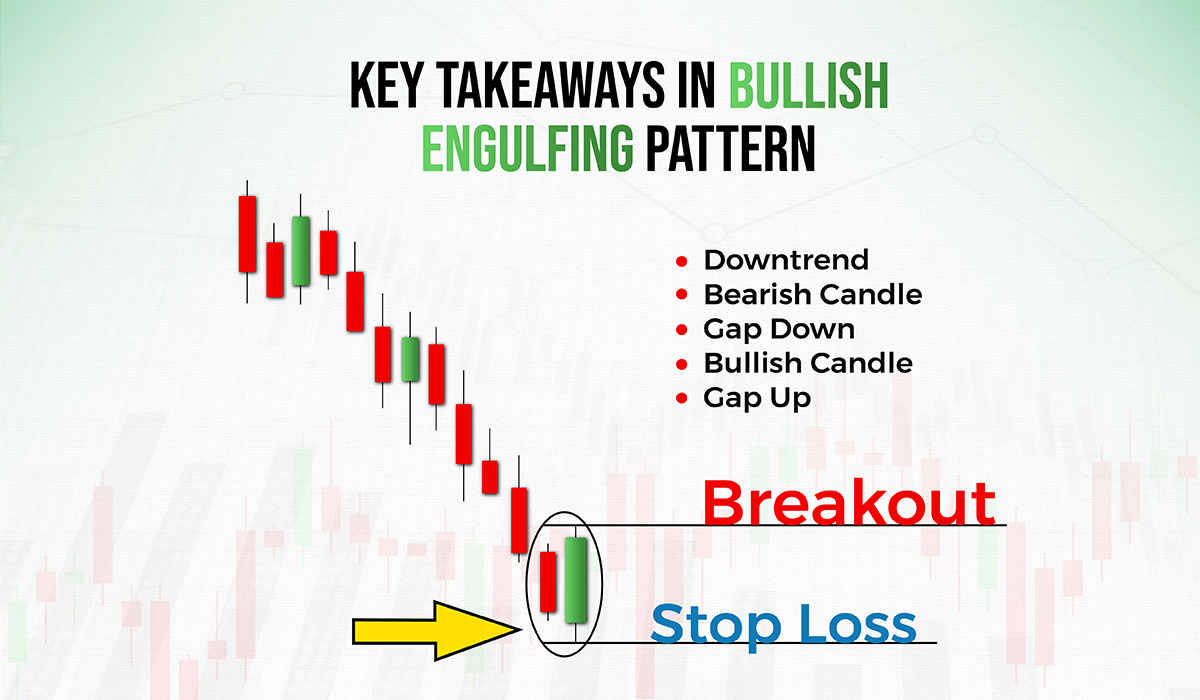

Key takeaways in Bullish Engulfing Pattern

A bullish engulfing pattern indicates a new upward trend where the stock price tends to go up. After a series of red candles, the new green candles start to form. To identify this trend at the right time, traders need to have advanced knowledge of the charts and the pattern. Here are the key takeaways from the bullish engulfing pattern for better understanding:

- There are two candles; the first is red and is considered bearish; the second is green which is considered bullish.

- Stock usually opens at a lower price than the previous day’s low, often indicating a new low. However, the positive buying behavior makes the price go higher than the previous day’s close price. Resulting in the engulfing pattern.

- Change in market sentiments can be seen. When the body of the previous red candle is entirely engulfed by the green candle, it indicates a significant shift in the market mood.

- The pattern of candlesticks indicates the buying pressure on the stock.

- Traders typically wait for confirmation before executing a pattern, such as a high price or buying on following candles. whereas, if you have advanced knowledge about candlestick patterns, you would take entry at the right time and make profits ahead of others.

- The pattern suggests that a new trend has begun ending the downward trend and now there will be a positive movement in the price.

Considering the above-mentioned points, the bullish engulfing pattern offers traders a solid chance to make an entry in the trade and book catch short-term movement. It should be utilized along with other unique tools and indicators in court transactions to increase its dependability.

What is a Bullish Engulfing Candle?

A Bullish Engulfing Candle is a green candle formed after a red candle. This green candle totally covers the red candle and is bigger than the red candle. In a simpler way, in a bullish engulfing pattern, the red candle appears to be the small shadow of the green candle.

Bullish Engulfing Candle Reversal

Bullish engulfing candle reversal is the bullish engulfing pattern that is seen after a downtrend. This pattern is competent enough to reverse the existing trend and give the price a good move. This pattern indicates a shift in market mood, with buyers gaining control and maybe signaling the end of the downward trend. Traders frequently interpret this as a strong buy signal, indicating an impending bullish trend. However, for more accurate forecasting, it should be checked using additional technical analysis tools.

Difference Between Bullish and Bearish Engulfing Pattern

The bullish Engulfing pattern and Bearish Engulfing Pattern are just opposites of each other. Unlike the bullish engulfing, the bearish engulfing signals the start of a downtrend.

In the bearish engulfing pattern a smaller green candle is totally covered of engulfed by a bigger red candle. Here, a strong red candle after the consecutive green candle indicates that sellers are now in huge numbers compared to the buyers. Apart from this, some key differences in bearish engulfing and bullish engulfing patterns are:

| Bullish Engulfing | Bearish Engulfing |

| Indicates strong buying momentum | Indicates strong selling momentum |

| Often breaks and reverses the downtrend in the price | Often breaks and reverses the uptrend in the price |

| The green candle engulfs the red candle | The red candle engulfs the green candle |

Acting on a bullish engulfing pattern

A bullish engulfing pattern signals an uptrend. However, there are several traps in the candlestick charts that can make conventional traders lose all their money. It is important to use the pattern in accordance with the demand and supply theory. Trading solely based on pattern study is never advised, as with the widespread use of patterns, they have started trapping traders. Market sentiments should be checked well before entering the trade.

How to Trade in Bullish Engulfing Pattern ?

In context of trading in a bullish engulfing pattern, if you want profit from the bullish trend in the stock market. Here is the step-by-step guide for trading in bullish engulfing pattern:

- Verification is a must after the detection of a rising bullish engulfing pattern on a chart. Do Check, if the bullish engulfing pattern is forming at a crucial support level or in conjunction with other technical indicators or chart patterns that confirm the bullish viewpoint. Other indicators that can add to the evidence include the moving average (Crossover), RSI, or MACD (Moving Average Convergence Divergence).

- To prevent losses, place a stop loss below the breakout candle’s minimum. Irrespective of your strong grip over the market or stock, it is an important step. This is a crucial risk management tactic to safeguard your money when the market shifts your position.

- Plan your price goals by using breaking highs, or levels that are close to resistance. Take a share of gains as the approach develops gradually, and think about using stop losses to minimize your losses.

- Depending on your tolerance for interference and the distance between your entrance point and the default location, select the appropriate position size. Limit the amount of money you risk on a trade. it should be decided after having the roadmap of trading in your head. One should never put all money in the same place, even if they are sure shot over the stock.

- After verifying the trend pattern, open a long (buy) position at the start after the bullish candle that engulfs the red candle. Try to start the trade near the moving candle’s closing price as you can reduce risk and maximize gains.

- Keep an eye on the status of your trades and be prepared to modify your stop loss or take profit levels if market conditions shift. Book profits in partial upward movements to safeguard your capital.

Limitations of Bullish Engulfing Pattern

Although a bullish engulfing pattern is an excellent bullish signal, there are certain drawbacks to it. With its widespread usage, it has started trapping conventional traders. Here are some potential drawbacks that should be considered before trading solely based on the pattern:

- False signals: Like all other conventional patterns, this pattern also gives various false signals. Proper technical analysis tools and techniques should be used before trusting the bullish engulfing signal.

- Highly Dependable on Market Trend: The pattern should be trusted along with the market. There are high chance that when the market trend is sideways, a bullish engulfing pattern will not be reliable.

- Unnecessary News and Noise: Stock market enthusiasts are easily influenced by the outside. They are unaware of the fact that news comes to them as an end user after the market has its effects already. This news affects the candlestick charts majorly, and there is a high chance that conventional patterns like bullish engulfing will not work.

- No appropriate risk management: Unlike any practical theory, this pattern does not provide any adequate risk management strategy to the trader. Various other factors, previous price data, trends, and market sentiments should be considered in this scenario.

Bottom Line

The bullish engulfing pattern is a strong candlestick pattern that gives traders a practical tool for identifying future gains. If properly examined and verified, this pattern can offer excellent opportunities to participate in market dynamics. Like any other trading strategy, the bullish engulfing pattern carries some risk. Traders should exercise caution, employ effective risk management strategies, and incorporate the design with other technological tools in order to increase the design’s reliability. Traders can enhance their ability to recognise and make a profit from trading patterns with the help of practical training and expert guidance. But, despite all the trade theories and patterns, one should spend a handful of time understanding risk mitigation strategies for losses in any type of trade.

FAQs

What is a Bullish Engulfing pattern?

A bullish engulfing pattern is an excellent bullish indicator. It generally forms at the bottom of the downtrend. After consecutive red candles, when a green candle forms which totally engulfs or covers the last green candle, a bullish engulfing pattern is formed. It indicates a high probability setup that might be a start-up uptrend.

How does a Bullish Engulfing pattern form?

It forms when a green candle totally engulfs the small red candle before it. The red candle is engulfed from body to wick by the successive green candle.

What does a Bullish Engulfing pattern indicate about the market?

This pattern indicates the start of an uptrend. It suggests that buyers have taken charge of the market.

Are there specific criteria for identifying a Bullish Engulfing pattern?

A bullish engulfing pattern only formed when a green candle engulfs or covers the smaller red candle completely. The pattern should be strictly made with small red and bigger green candles.

What is the significance of the engulfing candle in this pattern?

Engulfing candles shows that buyers are overpowering the sellers and now the momentum of selling is reducing. A good uptrend can start with the formation of the engulfing candle.

How can traders use Bullish Engulfing patterns in their trading strategies?

Traders can use bullish engulfing in accordance with technical analysis theories like price action or demand and supply. Using this pattern with the help of proper technical analysis theories and strategies helps in increasing the accuracy of the trade.

Are there any common variations or similar patterns to Bullish Engulfing?

Traders often get confused between bearish engulfing and bullish engulfing patterns, in the bearish engulfing pattern, the red candle engulfs the smaller green candle, which suggests the start of a downtrend. Whereas, the bullish engulfing is formed when the bigger green candle engulfs the smaller green candle. A trader needs to observe the color and pattern of the candle closely to be accurate in the trade.

What timeframes are Bullish Engulfing patterns typically used on?

The bullish engulfing pattern can be used as a good sign for an uptrend in higher time frames like weekly and monthly.

Can Bullish Engulfing Patterns be used in conjunction with other technical indicators?

Yes, the bullish engulfing pattern can be used with other technical indicators or strategies. Having the support of various other factors makes bullish engulfing a high-probability trade setup.

What are some potential drawbacks or limitations of relying on Bullish Engulfing patterns for trading decisions?

Bullish engulfing pattern has been widely used by conventional traders for years. But with its widespread usage, it has started trapping traders at various points. That’s why one of the biggest drawbacks of bullish engulfing is it gives many false signals at times. One needs to use it in conjunction with other trade theories to find accurate trades.

CATEGORIES

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube