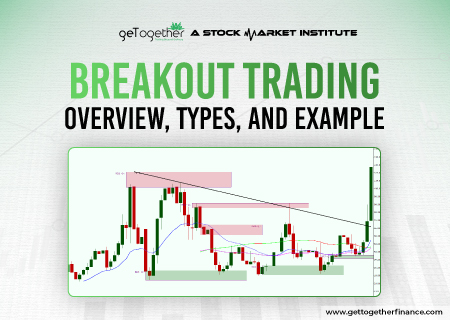

In the market of financial securities, there are vast numbers of opportunities for traders in predicting breakouts at the correct time and can offer great returns. Breakout trades are quite…

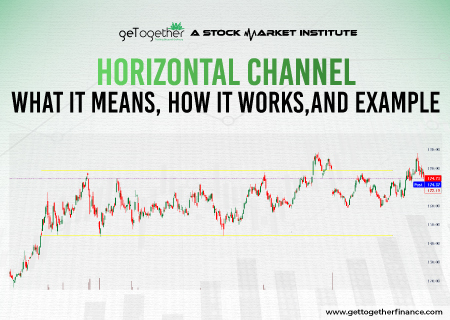

In technical analysis, prices are very much reliable on strong indicators in which uptrend ensures ongoing price movement in upwards direction. It describes the overall movement of the security in…

In the world stock market filled with intricacies, traders are constantly looking for profitable opportunities. Technical patterns and indicators are a form of identification of those profitable opportunities in the…

Jumping into the stock market without learning the basics is like jumping into a river without knowing how to swim—you’re more likely to sink than swim. The stock market is…

Did you know that 45% of young adults (under 35) in India now prefer stocks as their go-to investment choice? That’s straight from IBI, 2025, and it marks a big…

“We’ve all heard the ancient Indian adage, “गुरु बिन ज्ञान अधूरा,” which means “without a mentor, knowledge remains incomplete.” These timeless words perfectly go in the stock market, a space…