Commodity Market

The stock market has been a popular financial market for making money and building capital but it is not the only financial market that traders use, there are a couple of other financial markets as popular as the stock market. Hence, the commodity market is one of them. The stock market is like a rollercoaster, but the commodity market is like a bungee jump, both will give you an adrenaline rush, but in different ways.

Similar to how the company shares are traded in the stock market, commodities are bought and sold in the commodity market. If you’re new to the world of commodities, don’t worry! This blog will discuss all the specifics about the commodity market that will help you to trade effectively and efficiently in this market.

Understanding the Indian Commodity Market

The commodity market has played an essential role in the global economy by encouraging the trade of tangible goods. From agricultural products to precious metals this market offers a platform for producers and consumers to manage price risks and ensure the smooth flow of goods. Just like the stock market, there are dedicated commodity exchanges like the Multi Commodity Exchange (MCX), National Commodity and Derivatives Exchange (NCDEX), and Indian Commodity Exchange (ICEX), that facilitate easy buying and selling of commodities online.

Well now that we have understood what the commodity market is now let’s understand its types:-

Types of commodity market

1. SPOT MARKET :-

In the spot market, as the name suggests it works ”ON THE SPOT” i.e. immediate exchanges take place. Commodities are bought and sold for immediate delivery payment. In this market, the prices are based on real-time supply and demand dynamics which makes this platform vital for producers and consumers. Spot markets are also referred to as “ liquid markets” and “cash markets” because transactions are instantly exchanged.

2. FUTURES MARKET :-

As the name suggests, exchanges are based on pre-fixed future dates i.e. the Futures market deals with contracts that allow parties to buy and sell the commodities at a predetermined price and future date. These contracts help to hedge against price fluctuations by providing stability to producers and consumers as well.

3. OPTIONS MARKET :-

The options market is based on a contract or agreement. The option market involves buying and selling of contracts but within the refrained time period of the contract or agreement, it stands void, if the contract expires. Furthermore, the traders can identify the value of options from the underlying commodities price.

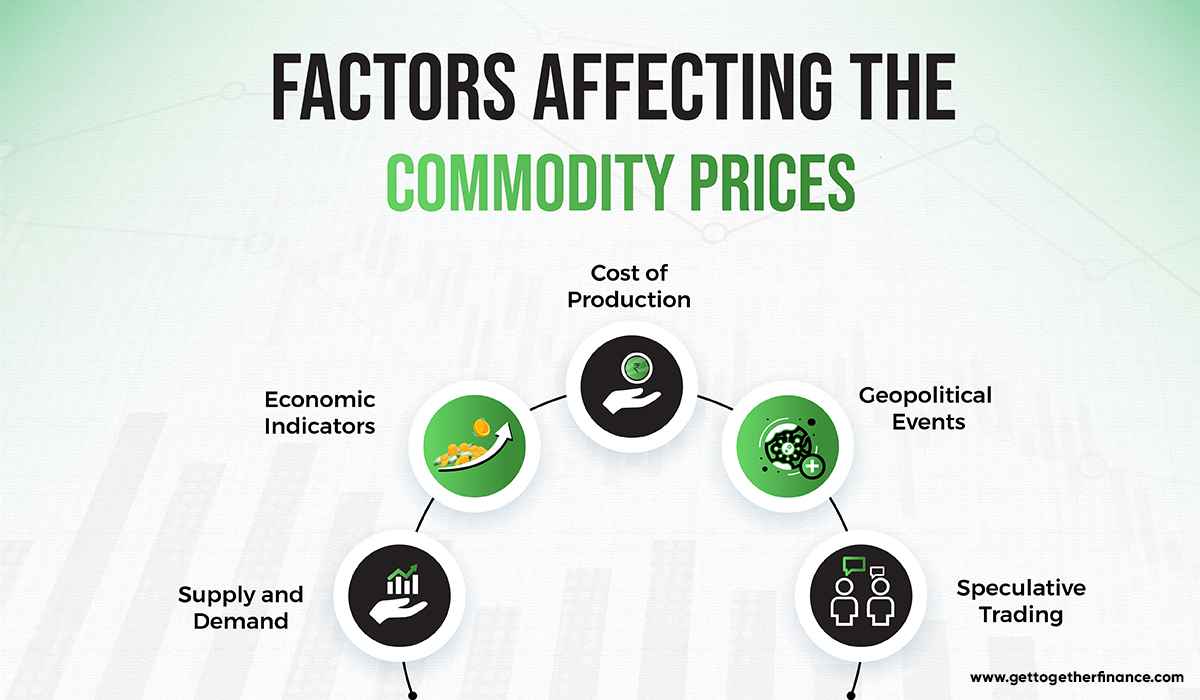

Factors affecting the commodity prices

The commodities market plays a very significant role in the Indian economy as it determines the prices of raw materials. Below mentioned are the factors by which the cost of the commodity is affected:-

1. Supply and Demand

Just Like the stock market where traders trade on the basis of supply and demand dynamics, the commodity market is also controlled with similar dynamics i.e. supply and demand as they are the primary controllers of the commodity prices. When the demand for commodities is high and it exceeds the supply, the prices of the commodity will naturally increase but when the supply of the commodities is high and it exceeds demand, prices will decline.

2. Economic Indicators

As commodity prices are closely tied to economic indicators such as GDP growth, inflation rates, and interest rates, strong economic growth often leads to increased demand for commodities. There are times when the government implements certain policies that encourage investing in some commodities, and as a result demand for those commodities increases, leading to the increase in the price of commodities.

3. Cost of Production

Another significant factor affecting the cost of the commodity is cost of the production which includes the cost of inputs such as raw materials, labor, and energy as well as the cost of transportation and storage. When the cost of production increases, the supply of a commodity decreases which ultimately increases the prices of commodities. On the other hand, if the cost of production decreases, the supply of a commodity will increase, leading to a decrease in the price.

4. Geopolitical Events

Geopolitical events such as political instability or conflicts in regions can also have a major impact on commodity prices. These events certainly hike the prices of commodities. One such major example of this is the COVID pandemic, the prices of all raw materials were increased as there was less or no supply to some regions. Moreover, if a major importer of a commodity experiences economic problems, it can lead to lower demand and lower prices.

5. Speculative Trading

In addition to demand and supply, speculative trading also plays a vital role in determining commodity prices. But before understanding speculative trading let’s understand what does ”speculation” means, believing in something without strong evidence. Here in the commodity market traders often do speculation when they buy or sell any commodity just because they have heard about the change in prices from somewhere. They buy and sell commodities in the hope that the price of a commodity will rise in the future resulting in an increase in the commodities price.

Also Read: Commodity Trading

Conclusion

Now that we have understood all the major terminologies and information about the commodity market by the above information, we can conclude that the commodity market is a dynamic and essential component of the Indian economy. Furthermore, traders can trade in the commodities market through futures and options but having an understanding of the mechanisms and factors that influence the price of the commodity is crucial for traders to make informed decisions in this market.

FAQs

1. Is the commodity market less risker than the other financial market?

Whether it is a commodity market or the stock market, every financial market consists of risks it is totally up to the traders how to mitigate those risks by risk management strategies or constantly monitoring their portfolio.

2. What are some factors that increase the stock price immediately?

Stock prices may vary because of different reasons but there are some geopolitical events and unexpected changes in demand that can cause an increase in commodity prices.

3. How can I stay updated on the commodity markets?

Traders can do market research and follow reliable platforms to stay updated on the commodities market. These platforms can provide you the insights about the market for better investment decisions.

4. Is commodity trading suitable for all investors?

The commodity market involves risks, hence it is not suitable for all investors. Thorough knowledge and risk management are required for trading in the commodity market.

5. Which financial market has more success rates?

Every financial market requires knowledge and a thorough understanding of the basics, if you pertain those basics and valuable skills you can excel in any financial market.

CATEGORIES

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube