Understanding Debenture Shares: Benefits, Risks, and Market Insights

Introduction

Debenture shares are certain types of debt instruments that are used by companies to raise capital. Unlike equity shares, they do not offer ownership to the buyer but instead act as a loan on the company. Investors who buy any kind of debenture shares receive regular interest payments and the full amount at the time of maturity. Debenture shares hold importance in financial markets because it provide security to investor’s money and also offers companies a way to secure funds without giving up their equity in the market. This way, debenture shares come up as an attractive investment option for both conservative investors and growing businesses.

What are Debenture Shares?

As explained earlier, debenture shares are types of shares that do not offer ownership to the buyer, they act as a security for regular interest payment till they mature. Now let’s understand them in depth.

Definition and Characteristics

Debenture shares are certain types of financial instruments used by companies to borrow funds from investors. When an investor buys debenture shares, they lend the money to a company in exchange for fixed interest payments till the time they get their principal amount back. Unlike equity or preference shares, ownership is not granted in debenture shares.

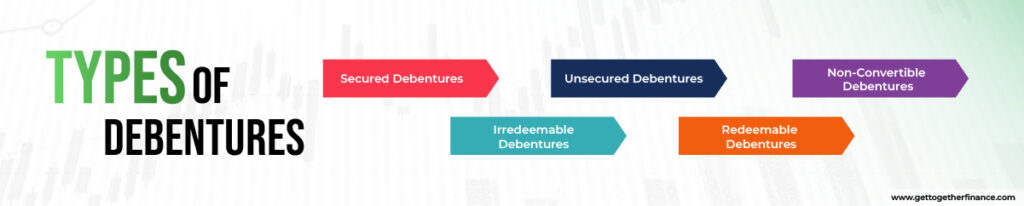

Types of Debentures

There are several types of debenture shares:

- Secured Debentures: These shares are backed up by the company’s assets, and act as a security for investors.

- Unsecured Debentures: These shares are not backed by any collateral, they are issued based on the creditworthiness and reputation of the company in the market.

- Convertible Debentures: These shares can be converted later on into equity shares.

- Non-Convertible Debentures: These shares cannot be converted into equity shares.

- Redeemable Debentures: These shares have a fixed maturity date when the principal amount is repaid to the buyer.

- Irredeemable Debentures: These shares do not have a set maturity date, they potentially last indefinitely.

Process of Issuing Debenture Shares

Here’s how the process of issuance of debenture shares takes place:

- Firstly, the company finalizes the amount of capital it requires and finalizes the terms and conditions of debentures, its interest rates, its maturity dates, and any special features like convertibility if it wants to offer it to investors.

- Following, a prospectus is prepared to entail the terms and conditions, it also has details about the financial health of the company and shows how much the company has and required in the future.

- This prospectus is made and filed under the supervision of regulatory authorities.

- Once the prospectus is approved, the debenture shares are offered to investors via any public issuance or in private board meetings.

- Later on, investors apply for debentures, and with successful allocation, the funds are received by the company, and debentures are listed on the stock exchange if they are applicable.

Investment in Debenture Shares

Here’s how investment in debenture shares works:

Benefits of Investing in Debenture Shares

There are several reasons that investors have for choosing debenture shares here’s how debentures are an ally to investors:

- Fix and Stable Income: Debenture shares are bound to pay regular interest to the investors, this gives a regular and fixed income to investors who are seeking stable and safe investment options and an excellent passive income.

- Less Risky Compared to Equity Shares: Debenture shares are associated with lower risk compared to equity shares as they are not subjected to the profit and revenue generated by the company. Irrespective of the company’s performance, the interest is paid to the investors. Also, debentures have a higher claim on company assets compared to equity shares, making it an important factor in economic crises.

- Diversification: Investors can buy debentures to diversify their holdings against the volatility of equity with the stability of debentures.

- Debentures are Convertible: Investors always have the upper hand with convertible debentures, after getting a stable return for years they can anytime convert debentures into equity shares and enjoy the growth and expansion of the company at the right time.

Also Read: Bearer Shares

Risks Associated with Debenture Shares

- Company Credibility: There is always the risk that the issuing company may fail to pay regular interest to the investors, eventually failing to pay the principal amount.

- Interest Rate Risk: The market value of debentures can be impacted heavily if the interest rates in the market rise, this deteriorates the value of debentures, making it less valuable. This is because interest rates and bond prices are inversely proportional. Increased interest rates decrease bond prices. This is because the new bonds with higher interest rates attract more investors compared to old bonds with lower interest rates.

- Liquidity Risk: Debentures are not easily tradeable on stock exchanges like equity shares. It may become difficult to sell them at the moment you want due to liquidity issues and other legal requirements.

- Inflation Risk: The fixed interest rate may not attract more investors as it does not comply with increasing inflation.

How to Invest in Debentures

- Directly from the Company: Debentures can be easily bought directly from the issuing company with the help of public offerings or can be bought online with the help of brokerage accounts.

- Mutual Funds with Debenture Holdings: There are plenty of mutual funds with holdings of debentures that offer a diversified asset allocation to its investors. Investing in these mutual funds can give you ownership of debentures too.

- Exchange-traded funds (ETFs): Exchange-traded funds are a basket of stocks and bonds, you can choose to invest in ETFs that have debenture holdings. It will diversify your portfolio and give you stable returns.

- Debentures and Company Bonds: Many companies issue bonds and debentures shares to raise capital from public investors. Keep an eye on these new offerings and research the company well to choose what can be the right investment for you.

Factors to Consider Before Investing In Debenture Shares

- Credit Valuation: Check and assess the credit valuation of the issuing company, the company should have a good history of interest and principal amount repayment. Otherwise, you may stick your money in an infinite loop.

- Compare Interest Rates: Compare the interest rates of different companies’ debenture offerings and buy the one with good credibility and attractive interest rates to build wealth.

- Maturity Period: Consider the debenture shares’ maturity rate well before investing in them. Choose and compare the maturity period with offered interest rates. Long-term debentures with low interest rates should be avoided.

- Market Conditions: Carefully study the current market trends along with interest rates. Your investment in debenture shares should align with the current and future economic ecosystem.

Market Trends and Analysis

The market of debenture shares is influenced by a lot of things like interest rates, geo-political events, government policies, etc. When the interest rates are low in the financial market, debenture shares become more attractive for investors because of the higher returns offered by them compared to traditional savings accounts and fixed-income bonds. A nation’s economic stability and growth also impact the confidence of investors. On the contrary, during economic crises, the chance of corporate default rises, causing investors to panic. Market trends also indicate a growing interest in green and sustainable debentures, which represent a broader shift towards socially responsible investment. Overall, understanding market circumstances and trends allows investors to make more educated judgments about debenture investments.

Conclusion

Debenture shares are an important financial tool that connects companies in need of funding with investors looking for consistent returns. Debentures allow issuers to raise capital without diluting ownership, with the added benefit of potentially reduced interest rates and tax savings. Investors benefit from a stable income stream and a larger claim on assets than shares, but they also face dangers such as credit and interest rate changes. Understanding the subtleties of debenture shares, such as their forms, issuance procedure, and market influences, is critical for both issuers and shareholders. As financial markets evolve, debentures remain an important tool for balancing security and opportunity in an ever-changing economic landscape.

FAQs

What are debenture shares and how do they differ from regular shares?

Debenture shares are debt securities used by businesses to raise cash. Unlike conventional shares, they do not grant ownership of the corporation. Instead, investors receive fixed interest payments and their investment back at maturity, resulting in a consistent income stream.

What types of debenture shares are available to investors?

There are several types of debenture shares, including secured debentures (backed by company assets), unsecured debentures (based on creditworthiness), convertible debentures (can be converted into shares), non-convertible debentures (cannot be converted), redeemable debentures (with a fixed maturity date), and irredeemable debentures (no fixed maturity date).

What is the process for issuing debenture shares?

The issuing procedure includes determining the required capital, negotiating terms, drafting a prospectus, receiving regulatory approval, and offering the debentures to investors. Investment banks frequently aid in the structuring, pricing, and marketing of debentures, ensuring that they meet legal criteria.

Why should I invest in debenture shares?

Investors may choose debenture shares because of their fixed interest payments, lesser volatility compared to stocks, and greater claim on corporate assets in the event of financial problems. They provide a consistent income stream, making them ideal for cautious investors looking for predictable returns.

What are the risks associated with investing in debenture shares?

Credit risk (the issuing firm may fail to make payments), interest rate risk (increasing interest rates might reduce the value of existing debentures), and potentially lower returns than shares. Despite these risks, debentures can provide attractive returns, particularly from financially sound issuers.

Instagram

Instagram