Decoding Penny Stocks: Risk or Reward?

Overview

“Quality over quantity” you must have heard this many times in different situations. Well, this is a great life mantra. It helps you to lead a life where you care about having the quality of things instead of an unnecessary quantity of things. This lesson fits perfectly into the stock market too. There are plenty of people who think they can get good returns by investing in penny stocks. The reason behind this mentality is they think they can buy the low-priced stock in bulk with minimal capital. In turn, they will have good returns as the price of the stock will rise. But in reality, stocks of penny companies majorly trap their investors and traders.

People neglect the fact that buying a good quantity of penny stocks does not increase the quality of their portfolio. These stocks have minimal equity distribution and are often manipulated by institutions. Apart from all this, the majority of penny companies get dissolved due to internal economic distortion.

What are Penny Stocks?

Penny stocks are the stocks of the companies with a relatively low market capitalization, With such low market capitalization, penny companies struggle to operate swiftly and achieve their annual target. This in turn leads to a fall in their share price. Often, the price of these stocks is manipulated by institutions. They buy or sell the stock in bulk quantity to bring sudden volatility in the stock.

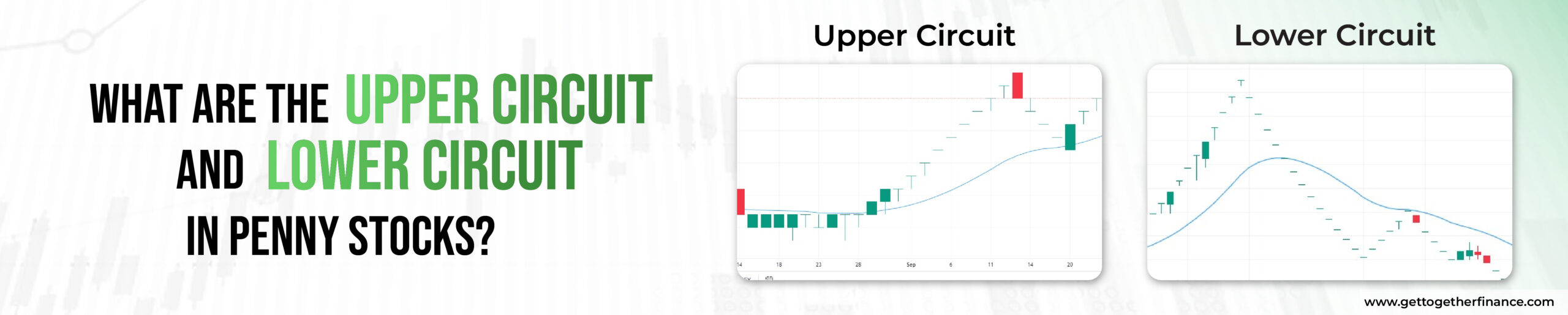

Leading to a distorted candlestick chart formation, where it is hard to track the buying and selling behaviors of investors. This distorted chart pattern is seen when the stock is continuously reaching its upper circuit and lower circuit price levels. It leads to the formation of dashes on the candlestick chart instead of proper candles.

What are the Upper Circuit and Lower Circuit in Penny Stocks?

As explained earlier, the majority of penny stocks are subjected to price manipulation by institutions. They tend to buy or sell huge quantities of the stock to bring the price boom on either side.

The upper circuit is the maximum increase in the price the stock can have in one day. The upper circuit for every stock is different and is based on a certain price percentage of its current trading price. The same happens in the case of the Lower Circuit. It is the maximum decrease in the price the stock can have in one day.

Similar to the upper circuit, the lower circuit for every stock is different and is based on a certain price percentage of its current trading price. The lower circuit and upper circuit can be seen a majority of the time in the charts of these stocks. This is because of the heavy influence of institutional buying or selling on them.

They often open at their price level of the circuit and do not fluctuate the whole day. Leading to the formation of red and green dashes. This in turn makes their candlestick chart distorted.

Also Read: Cyclical Stocks

Difference Between Regular Stocks and Penny Stocks

There is a major difference between regular and penny stocks from the view of market capitalization. Regular stocks have a higher market capitalization compared to penny companies. Regular stocks such as blue chip companies, and small/midcap companies generally trade at higher prices than penny stocks. On the other hand, penny stocks are stuck in the loop of price manipulation and small distribution of equity. Apart from the wider view of market capitalization, there are other differences:

- Stocks of penny companies are undeniably risky compared to regular stocks. Low operational funds and distorted economic management increase the risk of investment in penny stocks.

- The chances of regular stocks getting dissolved are negligible compared to penny companies. This is because regular stocks are associated with well performing companies. These companies have shown good growth over the years and contribute decently in their respective sector.

- Stocks of penny companies are traded in low volume compared to regular stocks. Hence, their liquidity is low.

- Penny stocks cannot be sold anytime you want, because of price manipulation and frequent lower circuits. On the contrary, regular stocks have higher trading volume. It allows investors to sell it anytime at market price.

- Penny stocks add very minimal value to your portfolio compared to regular stocks. Stocks of penny companies make your portfolio prone to risks with their extremely volatile nature. Comparably, regular stocks have a stable nature and even have the ability to recover from the any sudden loss they face.

- Regular stocks often reward their shareholders with exciting dividends. Where’s the penny companies do not offer any dividend. The reason for not paying out any dividend is because penny companies do not earn enough profits. They get lost in the loopholes of price manipulation.

Are Penny Stocks Good Investments?

Penny stocks are not the safest investment option in the stock market. Many people are attracted to them because of their low prices. However, these people forget to check about the company associated with the stock and often overlook its price action. The majority of penny companies get dissolved within a few years, resulting in heavy losses for their investors.

Apart from all this, these stocks do not have proper price action based on candlestick charts and are lacking in maintaining good financial ratios too. So, if we look from either side, fundamental analysis and technical analysis do not show any promising growth.

There are many noises in the market that can influence you to buy a certain stock. They might create hype for penny companies by saying it is going to see a boom in the next few months. Never fall for such noises and do your own research before putting your money in any stock.

Frauds in Penny Stocks

Some famous movies and web series like Wolf of Wall Street, Boiler Room, and Scam 1992 clearly show how price manipulation helps in increasing or decreasing the stock price. The term “pump and dump” associated with penny stocks can be very well understood in these movies. Many fraudsters in the market provoke normal people into buying these stocks. With increased buying the price of the stock gets a good boost. This part refers to the pump.

Whereas, when the stock rises above a certain price point, the fraudsters sell a huge amount of stock and bring the downfall in the stock. This is the dump part. This sudden fall in the price led to heavy losses for the ones who were holding the stock in the hope of good growth.

Well, not all penny stocks are regulated based on pump and dump strategy. Some stocks rise above their level and show good growth, but the chances of this happening are minimal.

Even if the company does not dissolve, there is a high chance that the stock will consolidate in the same range for years.

This sudden fall in the price led to heavy losses for the ones who were holding the stock in the hope of good growth.

Conclusion

Penny stocks may appear appealing owing to their low price and large potential profits, but they are far from a secure investment. Because of the market’s inherent volatility and lack of regulation, penny stocks are extremely dangerous. Their pricing is easily adjusted, resulting in erroneous notions of profitability. Investors are frequently duped by pump-and-dump operations, in which stock values are artificially boosted before plummeting precipitously, resulting in severe financial losses.

Furthermore, the companies behind penny stocks are sometimes opaque, making it impossible to judge their genuine worth and financial health. Inadequate reporting standards and a scarcity of information enhance the hazards. Those seeking long-term, stable growth should avoid penny stocks in favor of more secure and regulated investing opportunities.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube