Dow Theory: Definition, Market Trends, Phases & Technical Analysis

- May 1, 2024

- 4354 Views

- by Manaswi Agarwal

Dow Theory is a technical analysis method which is based on the writings of Charles Dow who is the founder of Dow Jones & Company and developed the Dow Jones Industrial Average (DJIA) in 1896. Dow Theory is considered as a base to understand the market trends in technical analysis. There are a lot of theories that help in predicting market conditions and analyzing the overall economy, however, dow theory has been in use for centuries despite the market volatility and other factors affecting market conditions. The theory has proven to be very effective to predict future performance of the stock market.

Table of Contents

ToggleWhat is Dow Theory?

The main and foremost purpose of Dow Theory is to identify and track market trends for effective analysis. The price action of the stocks are determined with the help of technical indicators and Dow theory conducts this technical analysis very well.

Dow Theory serves as an indispensable resource to monitor the technical events in the financial markets. Investors’, using this theory, have the capability of analyzing the stocks and identify the direction of the market by giving them insights about market performance. Dow Theory not only deals with technical analysis, it also considers market conditions and philosophies that help various investors to make their decisions.

Origin of Dow Theory

The Dow Theory was originated during the end of the 19th century by Charles H. Dow which was additionally refined by William Peter Hamilton and Robert Rhea. Dow also co-founded Wall Street Journal where he published the Dow Theory in a series of editorials. Dow theory stands as the earliest technical analysis method which has been able to deal with fluctuating market conditions. Dow’s Theory is the core of modern technical analysis which believes that business conditions can be predicted by analyzing the overall stock market and hence identifies the direction of stocks through market trends.

How is Dow Theory used?

Dow theory is used by conventional traders or investors who identify the market trends to execute their transactions. The trading strategy of Dow Theory is based on identifying the market trends which can be primary, secondary or minor, trend confirmation, identifying trend reversals, and implementing risk management techniques. The trends as per the Dowf Theory impact the market conditions majorly that affects the stock market.

The Market Discounts Everything

Dow Theory is based on the notion that the market discounts everything and remains consistent with efficient market hypothesis. Efficient Market Hypothesis (EMH) is an idea which states that all the available information be it public knowledge or inside insights is aligned with the stock prices. The information includes company’s earnings, managerial efficiency, interest rates, and inflation and investors sentiments towards the security.

Market Trends

Market trends to analyze the overall price action and guide investors about the next direction in the security or an asset. If the price is moving in an upward direction for a long time then it’s considered as an uptrend otherwise sideways or downtrend. A minor opposite move in the primary trend represents the secondary trend and within the secondary trend a minor correction in opposite direction is identified as the minor trend. For example; In an ongoing primary uptrend, a correction in the stock for several months or weeks signifies the downward trend. The market trends under Dow Theory are: primary market trend, secondary market trend and minor market trend.

Primary Trend

The primary trend forms over several months or years which can be either bullish or bearish. If over the years, an asset is forming higher highs then it results in depicting a primary uptrend (bullish). It is the main focus of Dow Theory analysis where the primary trend is the most significant and influential trend. Overall, an upward direction in the primary trend represents the bull market whereas a downward direction represents a bear market. If the price of an asset moves in a particular direction for years then it is the primary bullish or bearish trend wherein secondary or minor trend takes place.

Secondary Trend

Secondary trend in the Dow Theory moves in an opposite direction to the primary trends, making a smaller movement. The trend may last from a few weeks to several months where intermediate corrections take place. The secondary trend takes place under the primary trend. The secondary trend moves in the reversal direction of the primary trend i.e. in bull market there is a correction as price moves downward represents the secondary downward trend and vice versa in bear market.

Minor Trend

The minor trends are formed because of the short term fluctuations within the secondary trends. The minor trends tend to last for a few days to a few weeks. The short term fluctuations are considered as the market noise. Minor trends occur in short term fluctuations and move in opposite directions to the secondary trend. For example; an upward move in the downward secondary trend represents a minor uptrend of the security.

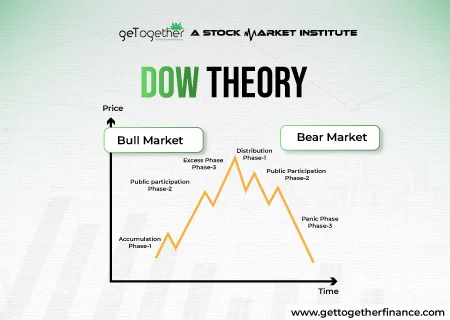

Dow Theory Phases

The main attention of Dow is to focus on the market trends which are associated to the different stages. The investors make their decisions in these stages by identifying the trends in the market. Dow Theory comprises three phases which helps to examine the trend of the market if it is bullish or bearish. The theory is segregated into three different phases which contribute to the learning of patterns. These are the accumulation phase, public participation phase and distribution phase.

Accumulation Phase

Accumulation phase represents the beginning of the bull market or after a long stretched bear market where the buyers or sellers make their positions to enter the market. In the accumulation phase traders buy the security at lower prices, hence, increasing the buying pressure gradually.

Public Participation Phase

Public participation is the secondary phase which signifies that the trend has already started and traders are joining in. The rising prices in the market attract investors which results in increased participation towards the market. The participation phase is responsible for moving the price in an upward direction quickly. It is the longest phase where the investors are rewarded because of a positive move in the asset.

Distribution Phase

Distribution is the last phase which signifies that the investors have started booking their profits. This is the transition phase where the market might look positive but it shows signs of weakness and the prices may take a downturn quickly. Investors are ought to recognize the distribution phase and realize their profits before the market turns bearish and results in potential losses.

Volume Confirmation in the trend

The trend is confirmed through volume which means that increase in volume as the primary trend increases and decrease in the volume as the primary trend loses momentum. Volume confirmation is valuable information to conduct the Dow Theory analysis. The trend must be confirmed with volume with other technical indicators to gain better insights about future price actions.

Also Read: Dupont Analysis

Reversal Confirmation

A reversal confirmation by the potential trend reversal in the primary trend to get confirmation about change in the trend and make decisions. An investor or a trader requires confirmation about the reversal in the market trend. If an uptrend market continues for a long time and consolidation takes place which is near to the breakout then it is expected that the trend might reverse and soon the downtrend can start.

Pros & Cons of Dow Theory

Some of the main pros of Dow Theory are: Long term perspective, easy to understand, and follow the market trend. While the disadvantage of Dow theory is that it is not always accurate and ignores several important other factors that doesn’t consider the market trend and is limited to some stocks only.

The Bottom Line

Dow Theory is used to conduct technical analysis to predict the future market movements and identify the price action. The theory has been used for a long time and is still used as a modern technical analysis. Apart from this, demand and supply is a technical approach which is an efficient method to identify the market movement and predict prices of the assets. As per the analysis demand and supply approach fits better in the world of modern technical analysis. However, risk management is an essential part which should never be ignored by a trader or an investor to get best results.

FAQs

Q1. What is the Dow Theory?

Dow Theory, originated by Charles H. Dow helps to recognize market trends. Investors can make their decisions about buying or selling based on this theory.

Q2. What are the trends in the Dow Theory?

The trends in the Dow Theory help to recognize market movements. There are three trends in the Dow Theory: Primary trend, Secondary trend and minor trend.

Q3. Is Dow Theory still reliable?

Yes, it can be said that Dow Theory is still reliable but looking at the vast change in the market, advanced technical analysis methods like demand and supply theory can be more reliable.

Q4. What is the purpose of the Dow Theory?

The main goal of Dow Theory is to predict future market movements and analyze price action for investment purposes.

Q5. Can Dow Theory predict market movements?

Yes, the theory helps to predict market movements and analyze the market trends through which investors gain insights about future market conditions.

Instagram

Instagram