What is EBITDA Margin?

In the world of investment, profitability is king. However traditional metrics like net profit margin can be influenced by various factors, making it challenging to get a clear picture of a company’s core operating performance.

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It’s a financial ratio that dives deeper than net profit margin, offering a more standardised view of a company’s ability to generate cash flow from its core operations.

So, why is the EBITDA Margin considered a powerful tool? This blog will explore the EBITDA Margin formula, delve into its advantages and limitations, and discover how it empowers investors to make informed decisions about a company’s true earning potential.

What is EBITDA?

EBITDA, a financial acronym you might encounter frequently in the investment world, stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation.

In simpler terms, EBITDA represents a company’s profit from its core business activities before accounting for financing decisions (interest), tax implications, and the ageing of its assets. It provides a glimpse into a company’s ability to generate cash flow through its core operations, which is essential for sustaining its business and rewarding investors.

But what does this seemingly complex term actually mean? Let’s break down the concept details a little further:

- Earnings: This refers to a company’s profit after subtracting all operating expenses from its revenue.

- Before Interest: We remove interest expense, the cost of borrowing money, from the equation. This helps standardise comparisons because companies with varying debt levels shouldn’t be penalised for their capital structure choices.

- Taxes: We exclude income taxes, which can differ significantly depending on a company’s location and profitability. This creates a more level playing field for comparing companies across different tax jurisdictions.

- Depreciation and Amortisation: These are non-cash accounting expenses that reflect the wear and tear on a company’s assets (depreciation) or the gradual use of intangible assets (amortisation). EBITDA excludes the focus on a company’s operating cash flow generation capabilities.

Also Read: Return on Assets

How to calculate EBITDA

Now that we understand the essence of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation), let’s equip ourselves with the formula to calculate it. Here’s the equation:

Formula of EBITDA = Operating Income + Depreciation & Amortisation Expense

- Operating Income: This is a company’s profit from its core business activities, essentially revenue minus all operating expenses. You can find it on the income statement, often labelled “earnings before interest and taxes” (EBIT).

- Depreciation & Amortisation Expense: These are non-cash expenses on the income statement. Depreciation reflects the gradual wear and tear on physical assets (like machinery) over time. Amortisation accounts for the gradual use of intangible assets (like patents) over their lifespan.

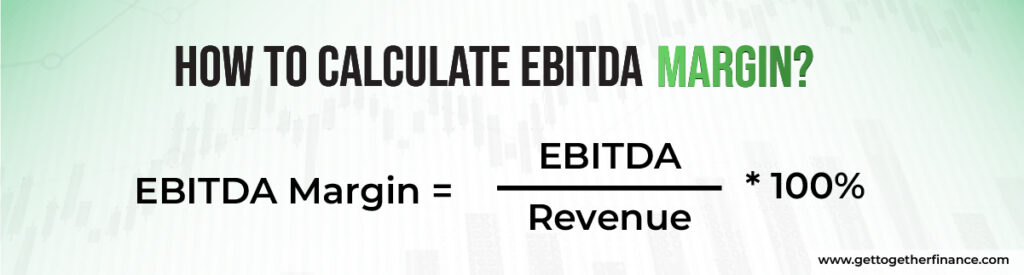

How to Calculate EBITDA Margin?

While net profit margin is a common profitability metric, it can be influenced by various factors beyond a company’s core operations. This is where EBITDA Margin steps in, offering a clearer picture of a company’s ability to generate cash flow from its core business activities.

The Calculation

Here’s the formula to calculate EBITDA-Margin:

EBITDA Margin = EBITDA / Revenue * 100%

- EBITDA: This represents a company’s profit from its core business activities before interest, taxes, depreciation, and amortisation. We’ll cover calculating EBITDA in a moment.

- Revenue: This is the total income generated by the company from its sales of goods or services.

A Step-by-Step Example

EBITDA-Margin provides valuable insights into a company’s core business profitability, but how do you actually calculate it? Let’s break it down with a practical example:

The Formula:

EBITDA Margin = EBITDA / Revenue * 100%

Here’s what we need:

- Company Financial Statements: We’ll need a company’s income statement to find the necessary figures.

- Example Company: Let’s use a hypothetical company called “Green Tech Inc.”

2. Identify Revenue:

Locate the line item for “Revenue” or “Sales” on the income statement.

Example: Green Tech Inc.’s income statement shows Revenue of ₹1,000,000 (one million rupees).

3. Calculate EBITDA (if not provided):

If the income statement doesn’t explicitly show EBITDA, you can calculate it using this formula:

EBITDA Formula = Operating Income + Depreciation & Amortisation Expense

Operating Income: This is the profit from core business activities after subtracting all operating expenses from revenue. It’s often referred to as “earnings before interest and taxes” (EBIT) on the income statement.

Depreciation & Amortisation Expense: These are non-cash expenses that reflect the wear and tear on tangible assets (depreciation) and the gradual use of intangible assets (amortisation) over time.

Example:

Let’s assume Green Tech Inc.’s income statement shows:

- Operating Income (EBIT): ₹500,000

- Depreciation & Amortisation Expense: ₹100,000

Now we can calculate Green Tech Inc.’s EBITDA:

EBITDA = ₹500,000 (Operating Income) + ₹100,000 (Depreciation & Amortisation Expense) = ₹600,000

4. Plug the Numbers into the Formula:

Now that we have both EBITDA and Revenue figures, we can calculate Green Tech Inc.’s EBITDA Margin:

EBITDA Margin = ₹600,000 (EBITDA) / ₹1,000,000 (Revenue) * 100% = 60%

Interpretation:

Green Tech Inc.’s EBITDA-Margin is 60%. This suggests that for every ₹1 of revenue they generate, ₹0.60 translates into cash flow from their core business activities, excluding financing choices, taxes, and asset ageing.

Advantages and Limitations of EBITDA Margin

Just like any other metric, the EBITDA Margin has its own strengths and weaknesses. Let’s delve into the advantages and limitations of EBITDA Margin to understand how to leverage it effectively.

Advantages of EBITDA Margin

- Standardisation: EBITDA-Margin helps compare companies across different industries and capital structures. By excluding financing choices (interest) and tax implications, it creates a more level playing field for assessing core operating efficiency.

- Cash Flow Indicator: EBITDA concentrates on a company’s ability to generate cash flow from its core business activities. This cash flow is crucial for debt repayment, investments, and shareholder dividends. A high EBITDA Margin suggests a company is adept at converting sales into cash.

- Industry Benchmarking: Many industries have established “average” EBITDA-Margin ranges. This allows investors to quickly assess how a company within a specific sector stacks up against its peers in terms of operational efficiency. A company with a consistently high EBITDA Margin within its industry might be attractive for investors seeking profitable businesses.

Limitations of EBITDA Margin

- Ignore Non-Cash Expenses: EBITDA excludes depreciation and amortisation, which are essential non-cash expenses related to a company’s assets. While not a direct cash outflow, these expenses represent the wearing down of a company’s asset base, which needs to be considered for long-term sustainability. A company with a high EBITDA Margin might have a deteriorating asset base if they aren’t adequately reinvesting in maintaining those assets.

- Financial Manoeuvring: Companies can potentially manipulate EBITDA to some extent through accounting practices or one-time events. Scrutinising financial statements is crucial to avoid being misled by inflated EBITDA figures. Investors should be cautious of companies with significant unexplained changes in EBITDA.

- Limited Picture: EBITDA-Margin is just one piece of the puzzle. Investors should consider it alongside other financial metrics like net profit margin, debt-to-equity ratio, and growth rate for a more comprehensive understanding of a company’s financial health. Relying solely on EBITDA-Margin can lead to a narrow view of a company’s true profitability.

Benefits & Limitations of EBITDA

Here is the breakdown of benefits and limitation of EBITDA:

| Advantage | Description | Limitation | Description |

| Standardisation | Compares companies across industries | Ignores Non-Cash Expenses | Excludes depreciation and amortisation |

| Cash Flow Focus | Analyses core business cash generation | Financial Manoeuvring | Can be manipulated by companies |

| Industry Benchmarking | Identifies efficient companies within a sector | Limited Picture | Needs to be considered with other metrics |

Implications of EBITDA Margin

EBITDA is a useful financial metric used to assess operating profitability of a company. But it is important to understand its implication carefully to decode its values accurately. Here is a breakdown of its implications:

High EBITDA

High EBITDA margin suggests strong cash flow, efficiency, and attracts investors, but might be industry-specific or inflated. This means the company holds more financial flexibility to invest in growth initiatives, reward shareholders, or pay down debt. However, it depends on the industry-specific and investors need to ensure whether it’s inflated by accounting tricks. It is crucial to look beyond number and fundamentals analyse for a clearer financial picture.

Low EBITDA

Low EBITDA shows profitability struggles, limited cash flow, and scares off investors. It raise questions on a company’s ability to generate sustainable profit which could be due to various reasons such as weak pricing power, competitive disadvantage, or high operating expenses. While it could hint at a turnaround, it is crucial to dig deeper to understand the reasons behind the low margin before getting hopeful.

Industry variations

EBITDA-margin benchmarks vary significantly across industries due to various factors such as competition, asset intensity, regulations, business model, etc. Companies with expensive assets (like utilities) or facing fierce competition (or heavy regulations) typically have lower margins.It is highly recommended by experts to compare EBITDA-margin to industry competitors, track trends, and understand the reasons behind specific margin to precisely interpret and imply its value.

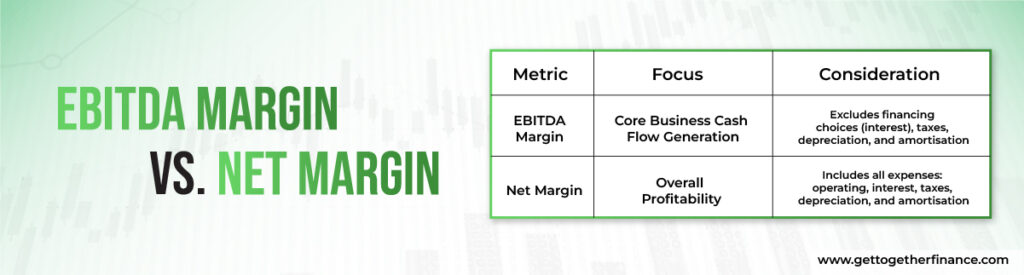

EBITDA Margin vs. Net Margin

When evaluating a company’s profitability, two key metrics come into play: EBITDA Margin and Net Margin. While they both provide insights into profit generation, they differ significantly in their scope and focus.

EBITDA Margin focuses on a company’s ability to generate cash flow from its core business activities, excluding financing choices (interest) and tax implications. Net margin represents the portion of every rupee earned by the company that remains as profit after accounting for all expenses, including operating expenses, interest, taxes, depreciation, and amortisation.

Here is the major breakdown between EBITDA-Margin and Net Margin:

| Metric | Focus | Consideration |

| EBITDA-Margin | Core Business Cash Flow Generation | Excludes financing choices (interest), taxes, depreciation, and amortisation |

| Net Margin | Overall Profitability | Includes all expenses: operating, interest, taxes, depreciation, and amortisation |

Conclusion

EBITD- Margin has emerged as a valuable tool in the financial analyst’s toolkit. It provides a standardised lens to assess a company’s ability to generate cash flow from its core operations, independent of financing structures and tax considerations. However, remember that EBITDA Margin is just one piece of the puzzle. Don’t be fooled by a high EBITD- Margin alone. Scrutinise financial statements for potential manipulation and consider other metrics like net profit margin, debt-to-equity ratio, and growth rate for a holistic view of a company’s financial health.

FAQs

Is EBITDA Margin the same as net profit margin?

No, EBITDA Margin excludes many expenses considered in net profit margin, providing a more focused view of core business profitability.

How can I use EBITDA-Margin to compare companies?

Focus on companies within the same industry and compare their EBITDA-Margins to industry averages.

Is EBITDA-Margin relevant for all industries?

While valuable across sectors, some industries have inherently lower EBITDA-Margins due to their business models.

Is EBITDA-Margin relevant in ESG investing?

While ESG focuses on environmental, social, and governance factors, some ESG funds might consider EBITDA-Margin alongside ESG metrics for a broader sustainability assessment.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube