Exhaustion Gap: Overview and Examples in Technical Analysis

- December 21, 2024

- 896 Views

- by Manaswi Agarwal

In regard with gap theory, we have understood, an exhaustion gap signals a significant shift in trend of the security. This blog is a comprehensive guide about exhaustion gaps which helps you understand how to trade exhaustion gaps and what are the benefits of trading exhaustion gaps with a demand and supply approach.

Table of Contents

ToggleWhat is an Exhaustion Gap?

A gap theory simply states the difference between the opening prices of the current trading session with that of the closing price of the previous trading session. The occurrence of exhaustion gap signified the reversal in the trend as the price opens with a gap in a contrast direction of the trend. It is one significant technical pattern that is used by traders which is characterized by a gap in price accompanied by higher trading volume and the culmination of sustained price movement. As a technical indicator, exhaustion gap determines an imminent reversal in the prevailing market direction which recommends traders about a pivotal shift within the market security.

The principle on which the exhaustion gap relies is a potential decrease in the number of buyers where sellers have aggressively stepped into the market warns traders about a stop in the upward trend.

How to Identify Exhaustion Gap?

To recognize the formation of an exhaustion gap or identify a bullish or bearish exhaustion gap, there are key characteristics that help traders understand the gaps in technical analysis.

Prevailing Trend

There is a prevailing trend in security which might be an uptrend or downtrend that can last for a period of several days, weeks or months depending on the prices.

High volume

The formation of exhaustion gap is determined by the higher volume as the stock trades above its average daily volume during the formation of the gap.

Aggressive Moving Trend

Before the occurrence of exhaustion gap in the security, the price traded aggressively in a single trend with a low volume. When the price action changes, there is an immediate change in the trend with a sudden surge in the volume indicating a reversal with exhaustion gap.

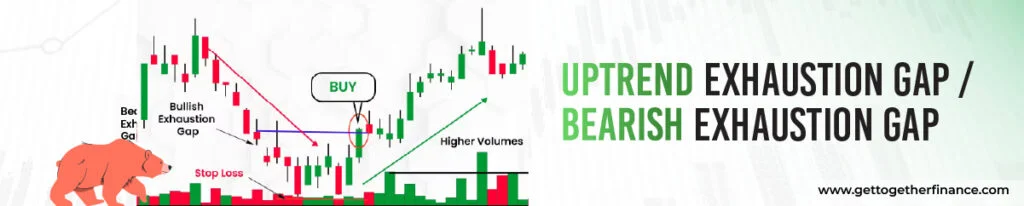

Uptrend Exhaustion Gap / Bearish Exhaustion Gap

Let say Security ‘A’ is rising constantly forming an uptrend.

The volume during the formation of uptrend is low.

After the uptrend, suddenly a candle gives a gap up opening and starts moving downwards with a surge in volume.

This signals a bearish move in the security signaling the end of uptrend.

Downtrend Exhaustion Gap / Bullish Exhaustion Gap

When the prices of an asset ‘B’ fall continuously, the security forms a downtrend with low volume.

The gap down opening of the price with an upward move signifies the downtrend exhaustion gap. The trend reversal is confirmed with an increase in volume with the formation of exhaustion gap.

It signifies the end of downtrend in the asset prices with a bullish movement.

Entry: Enter the short position if the price breaks below the low of the exhaustion gap candle. Enter the long position if the price breaks above the high of the exhaustion gap candle.

Stop Loss / Exit: Place the stop loss above the exhaustion gap’s high (for a short trade) or below its low (for a long trade). You can also exit the position as the price nears your target or shows signs of reversal.

Consider demand and supply zones while making entry positions. Coincide the exhaustion gap with the supply zone to enter the short position and vice versa to enter the long position. Combining the theory will give efficient results as the prices would react instantly.

Advantages of Exhaustion Gaps

In technical analysis, each method of analyzing the charts has several advantages that are vital for a trader to be aware of:

Trend Reversal Signals

Exhaustion gaps are an indication of a trend reversal in the security which offers profitable opportunities when traded correctly with the support of other technical indicators. Traders receive a signal of a reversal in the trend which helps them to timely enter or exit the trade or manage their positions with great precision and confidence.

Easy Identification

Exhaustion gaps can be clearly identified by traders as they are the easiest pattern to track on candlestick charts. Even traders who lack experience have the accessibility to capitalize on exhaustion gaps because of the ease that they provide.

Timeframes

Exhaustion gaps offer ease in identification on different time frames as well. Like traders can observe the gap formation at daily, weekly, or monthly time frames. This allows swing traders, positional traders and investors to pick profitable opportunities.

Exhaustion Gaps with Demand and Supply Approach

Demand zones are quite powerful areas to determine the pending orders of institutions. Traders are recommended to trade these zones to pick profitable opportunities. If exhaustion gaps are formed within the company of demand or supply zones then the reliability of your trade doubles ensuring large profits.

Cons of Exhaustion Gaps

In technical analysis, a trader must be very cautious and be aware of the consequences if the prediction goes wrong. To trade exhaustion gaps, there are some important considerations which are as follows:

Lacks Reliability

Trading on exhaustion gaps does not ensure reliability as there are potential chances of market traps and other mishaps that can affect a trader’s portfolio. It can only be reliable when the trade is executed with help of other strong technical indicators like demand and supply zones.

False Signals

Trading in index and stock with the help of exhaustion gaps is subject to false signals. False signals in exhaustion gaps are quite prominent and hence should be avoided with careful and appropriate trading strategies that are capable of managing your risks as well.

Risk Management

There are no defined entry or exit points in the exhaustion gaps, it is the best indicator to analyze the trend reversal. However, you can never maintain your risks simply based on this single technical indicator.

Wrap It Up…

In technical analysis, you might find exhaustion gaps to be useful to identify the trend reversal in the security. However, demand and supply is an advanced approach that allows you to predict not only the trend in the security but the whole price action with appropriate risk management measures.

FAQs

What is an Exhaustion Gap?

After a continued trend in a security, when the prices open gap up or gap down and move towards a different direction, it represents the reversal of trend in the security.

What does an exhaustion gap signify?

The formation of exhaustion gap signifies the end of prevailing trend in the security and emergence of new trend with a surge in volume.

How to trade an exhaustion gap?

Trade an exhaustion gap with the demand and supply theory to get the accuracy. With a change in the trend of the security, a reversal is confirmed where traders can execute their positions.

What to consider while trading an exhaustion gap?

While trading an exhaustion gap, a trader must consider following a demand and supply approach as well as other strong technical indicators to better understand the price action. This increases the reliability and accuracy of trading with exhaustion gaps.

Instagram

Instagram