Falling Three Methods: What It Is and How It Works

- January 1, 2025

- 1015 Views

- by Manaswi Agarwal

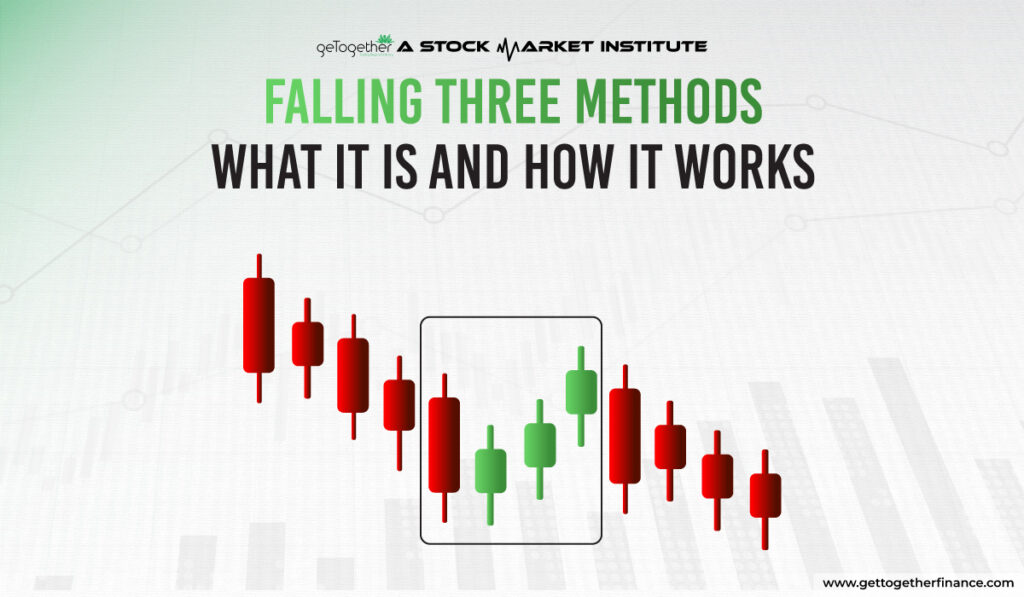

In technical analysis, you will come across several candlestick patterns, falling three-method candlestick pattern is one among those that form a bearish continuation pattern in the security. It is one of the rare candlestick patterns that helps traders to gain actionable insights.

What are Falling Three Methods?

In technical analysis, falling three-method candlestick patterns predict the potential continuation of downtrends in the price of a financial instrument. Falling Three methods represents the bearish phase in a security with a five-candle continuation pattern signaling an interruption but not a reversal of the current downtrend.

Understanding Falling Three Method

For advanced analysis, there are some characteristics that help in recognizing the falling three-method candlestick patterns on the charts. Let us determine them:

- A constant decrease in prices.

- A tall, bearish candle or a drop in the prices.

- After the large bearish candle, a set of three or more small bullish candles.

- These small bullish candles shall not exceed the range of the first candle.

- Another large, bearish red candle extends below the previous candle.

The falling three-method candlestick pattern is a well-defined and easily recognizable pattern as traders can spot these easily on the charts.

Traders can identify potential entry points with efficient risk management strategies by placing stop losses at the correct levels. Also, the pattern provides a specific price level which is used as a trigger to enter the trade.

How to Identify Falling Three Methods Candlestick Pattern?

A significant downtrend in security marks the continuation of bearish momentum with the formation of falling three-method candlestick patterns. Let us know how to look for the pattern in the charts:

Look for an Existing Downtrend

The bearish continuation in the security through falling three methods candlestick is only confirmed if it occurs during an existing downtrend.

Red Bearish Candle

The first candle is the long bearish candle having a significant impact on the price of the security.

Small Green/Bullish Candles

After the first candle, when three or more small bullish candles form in a narrow band around the first candle, it shows the indecision in market sentiments.

Final Bearish Candle

In this candle continuation of the bearish trend is confirmed after a tall bearish candle pierces the bottom of the pattern. It signals a clear downside reversal momentum in the prices.

The Psychology Behind Falling Three Methods Candlestick Pattern

In an ongoing downtrend in the security, a long bearish candle indicates significant selling pressure.

After a strong selling in an asset, the formation of small three bullish candles signifies a short-term reversal. This represents the consolidation period or the fight among buyers and sellers in the market with a minor price correction.

This consolidation marks the ending with the formation of the last long bearish candle. This candle confirms an increased selling pressure and hence signals to execution of short positions.

How to Trade the Falling Three Methods Candlestick Pattern?

After recognizing the falling three-method candlestick patterns in the charts, initiate a short position during a strong downturn.

- Analyze the downtrend with the help of a trendline or moving average indicator and look for the pattern formation.

- Enter the short position at the closing of the last bearish candle with volume confirmation.

- To manage the prevalent risks, stop loss is placed above the opening of the first red bearish candle.

- Look for additional signals like RSI, volume, and trendline breaks to get confirmation.

Trading based on the Falling Three Method candlestick pattern can be risky without additional context. This pattern alone might not provide reliable signals. To enhance accuracy, it’s crucial to incorporate demand and supply zones into your analysis. These zones help identify potential reversal or continuation areas, improving trade precision and reducing false signals in volatile markets.

Limitations of Falling Three Method Candlestick Pattern

A bearish continuation pattern which is dependent on confirmation and several other indicators to give the required move has various limitations, let us identify those cons:

Subjectivity

The pattern is subjective in nature, as traders have different ways of perception. Subjectivity leads to inconsistent application due to no universal agreement on the placement of the chart pattern.

Lacks Reliability

The pattern is not reliable due to several external factors that affect market conditions which might result in huge losses for the traders.

Undefined Movement

In this pattern, traders cannot predict exact movement to set the target price which might lead to trouble while holding their positions.

Rising Three Methods V/s Falling Three Methods Candlestick Pattern

| Components | Rising Three Method | Falling Three Method |

| Representation | Bullish Continuation Pattern | Bearish Continuation Pattern |

| First Phase | Strong Bullish Candle | Strong Bearish Candle |

| Second Phase | Three small bearish candles | Three small bullish candles |

| Third Phase | Long Bullish Candle | Long Bear candle |

FAQs

What is the Falling Three Method Candlestick Pattern?

Falling three method candlestick pattern represents a continued downtrend in the security as the prices tend to move downward after a temporary shift in market sentiment.

What is rising three methods and falling three method candlestick patterns?

In technical analysis, rising three method candlestick patterns suggests a bullish continuation in the security, on the other hand, falling three method signals a bearish momentum.

What are the key components of the Falling Three Methods pattern?

It includes components of: a long bearish candle, three small bullish candles, and a long bearish candle again which gives the confirmation.

What does the Falling Three Methods pattern indicate?

This pattern indicates a temporary pause in a downtrend, followed by a continuation of the bearish movement.

Can the falling three method pattern be used alone for trading decisions?

No, it is recommended to use the pattern with the help of other tools like demand and supply approach, trendlines, support/resistance levels, and technical indicators.

In what market conditions is the pattern most reliable?

The pattern is comparatively reliable in range-bound or choppy markets, where trends are unclear.

Instagram

Instagram