Gap Trading: How to Play the Gap

- December 4, 2024

- 1615 Views

- by Manaswi Agarwal

Gaps represent the blank space between the candlesticks on a chart which signifies no or little trading in between. In technical analysis, gaps are analyzed by traders to pick the best profitable opportunities. But how to really play the gaps or which is the best approach for gap trading? This blog answers all your questions associated with gap trading.

Table of Contents

ToggleWhat is Gap Trading?

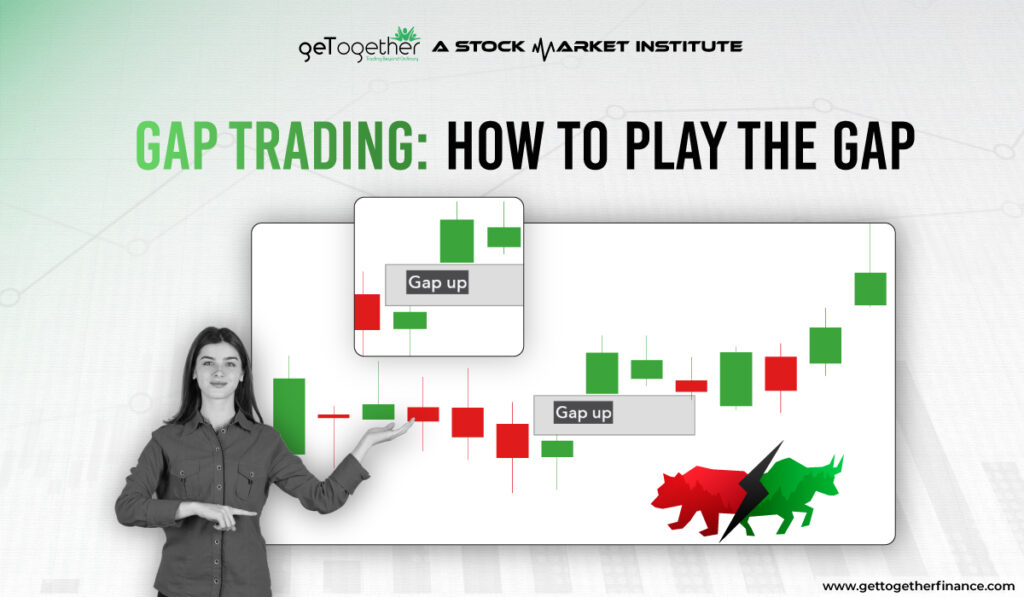

Gap Trading is a strategy followed by investors to capitalize on significant gaps formed on the price chart of financial instruments. A gap in a financial instrument occurs when the opening price differs from the closing price of previous trading sessions; traders can visibly observe a difference in the candle with a gap up or gap down opening.

A gap in the price can be observed due to any fundamental or technical reasons. For example, release of positive earnings reports or overnight happenings can lead to gap up or gap down opening of the prices. Another reason could be the technical breach of demand and supply zones. Any external news event like changes in interest rates might affect market sentiment, causing the price gaps.

In technical analysis, significant gaps are examined. Each trader has a different trading approach depending on the gap type. What are the gap types in trading and how do they work? Let us discuss them:

How does Gap Trading Work?

To trade on gaps, some steps needs to be followed cautiously for better results:

Identify the Gaps

The first and foremost step is to spot the gaps on the chart patterns, traders look for discrepancies between the closing prices of the previous day and opening prices of the current trading session as it is visibly seen on the charts.

Gap Classification

Each trader has a different trading approach; trading gaps are categorized into different types like novice gaps, pro gaps, breakaway gaps, etc. Trading on each gap pattern is associated with its significance and implications for trading. Clear your concepts by watching advanced technical analysis Trading in the Zone course by GTF. (link)

Time and Volume Analysis

As gaps are associated with opening prices of an asset, it often takes place during the first hours of the trading session when gaps tend to exhibit significant price movement. Moreover, the volume in the security must accompany trading gaps. High trading volumes help traders have a positive outlook on their trades depending on their approach.

Gap Trading Strategies

After knowing the gap classification, let’s identify how trading strategies are implemented by traders with different techniques.

Gap Filling Strategy

Many traders assume that the gaps formed in the price action will eventually be filled and the price will return to the level where the gap occurred previously. To enter a position, traders make their entry in the opposite direction of the trend with an anticipation that the prices will bounce back to the gap level. However, this is not a reliable approach.

Breakaway Strategy

Breakaway gaps mark the beginning of a new trend, and traders take a position in the same direction as the trend. They enter the position when the prices open gap up or gap down with respect to the trend and take the opportunity to ride the trend.

Exhaustion Gaps

Exhaustion gaps define the trend reversal in a security with a gap opening, traders either exit their existing positions or they make an entry in the opposite direction of the trend as they expect a potential reversal in the trend.

Gap Types in Trading

A gap in the chart can be perceived by trader in various forms and these can be classified as:

Inside Gap

An inside gap occurs when the candle opens with a gap in either direction but falls within the range of the previous candle. Let us take an example;

Open: 100, Close: 110, Low: 90, High: 120. If the opening of the current candle > 110, < 120, it is considered as an inside gap up, to give an inside gap down opening it should open below 100 and above 90.

Outside Gap

In an outside gap, the second candle opens outside the range of the first candle; the opening of the second candle does not fall between the ranges of the first candle. Unlike the inside gap, the opening falls outside the range i.e. above 120 or below 90.

Novice Gap

When the candle opens with a gap in a continued trend be it upwards or downward, it represents a novice gap.

Pro Gap

The opposite of a novice gap, when the price opens with a gap in the opposite direction of the trend, then traders identify this as a pro gap. Suppose, the security is moving in an uptrend and a candle opens with a gap down this would be the pro gap.

Breakaway Gaps

Breakaway gaps signify the start of a new trend with a strong shift in market sentiments. Breakaway gaps can be crucial for traders as it offers opportunities in the direction of new trends. Breakaway gaps are seen to occur after a consolidation period or range-bound trading indicating a strong market shift.

Trading Gaps in Demand Zones

Let us know the real play of gaps with demand zones:

Novice Gap into the Demand Zone: When the price observes a selling pressure with an opening in the demand zone forming a novice gap, there is a high probability that gaps will be filled from the demand zones.

A novice gap into a pro gap: Trading in a gap becomes more powerful when the price enters into a pro-gap demand zone forming the novice gap.

A pro gap from the zone: When the price exits the demand zone with a pro gap, the traders realize a strong buying pressure by reversing the downtrend in the security.

This is just the essence of trading in gaps through demand zones, understand the whole concept in depth by watching our advanced classes on YouTube. (link)

Disadvantages of Gap Trading

Like other technical analysis, and market trading strategies, gap trading might also result in capital losses which require traders to follow a well-defined trading approach while taking action on price gaps. Hence, it involves various risks apart from profitable opportunities.

A trader who is solely dependent on gap trading without analyzing other important technical factors might face real troubles. It is necessary to follow gap trading considering the demand and supply zones with factors like volume, trend analysis, sector support, etc.

Conclusion

Gap Trading is one concept under technical analysis you should not trade solely on gaps but should mix with a good technical analysis which you can learn in GTF- Trading in the Zone gap trading from session 18 on YouTube. (Link)

Instagram

Instagram