Understanding Government Sovereign Bonds in India: A Comprehensive Guide

The world of finance is quite highly dynamic, where investment options abound. Some individuals choose to stay safe while investing and some prioritise security over higher returns. When it comes to safety and growth with the pace of inflation, government Sovereign Bonds are becoming investor’s first choice in India. For these risk-averse investors, Government Sovereign Bonds (G-Secs) issued by the Indian government, offer a compelling proposition. This e-paper aims to delve into the essence of G-Secs, exploring their characteristics, benefits, and considerations for potential investors.

What are Government Sovereign Bonds?

Government Sovereign Bonds (G-Secs) are debt instruments issued by the Government of India to raise funds for various purposes like infrastructure development and fiscal deficit financing. They are considered one of the safest investment options in India, as they are backed by the sovereign guarantee of the government.

Rather than purchasing gold in physical form, the sovereign gold bond allows you to own gold in paper form. Issued by the Reserve Bank of India (RBI), the scheme allows investors to engage in the supply and demand of gold and invest their money.

Understanding Government Sovereign Bonds

G-Secs are essentially debt instruments issued by the Government of India to raise capital for various purposes, including infrastructure development and fiscal deficit financing. As the borrower is the sovereign government itself, G-Secs is considered one of the safest investment options in India. They come with a sovereign guarantee, implying a high degree of security for investors.

Sovereign Gold Bonds (SGBs) are a unique investment option for those looking to own gold without the physical hassles. Rather than holding gold bars or coins, SGBs are essentially government securities denominated in grams of gold. You invest in cash at the issue price, and upon maturity, you receive the equivalent value in rupees based on the prevailing gold price at that time. Issued by the Reserve Bank of India on behalf of the Indian government, SGBs come with a sovereign guarantee, offering peace of mind to investors. This eliminates the risks and costs associated with storing physical gold, making SGBs a secure and convenient way to participate in the gold market.

The concept of sovereign bonds dates back centuries. One of the earliest examples comes from the Roman Republic, where wealthy citizens financed military campaigns by lending money to the government. Today, G-Secs are a cornerstone of many countries’ financial systems.

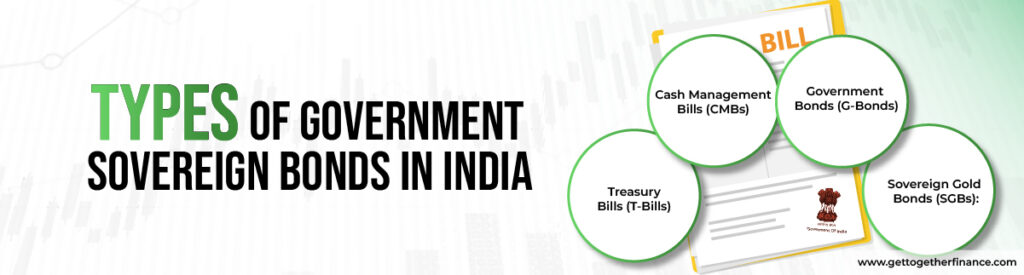

Types of Government Sovereign Bonds in India

Here are mentioned major four types of government sovereign bonds in India:

Treasury Bills (T-Bills): These are short-term debt instruments with maturities ranging from 91 days to 364 days. They are issued at a discount and redeemed at par value on maturity, offering a fixed return.

Cash Management Bills (CMBs): These are even shorter-term instruments with maturities of less than 91 days, used for managing the government’s cash flow.

Government Bonds (G-Bonds): These are medium to long-term debt instruments with maturities ranging from 1 year to 40 years. They carry a fixed coupon rate (interest rate) paid semi-annually and are redeemed at par value on maturity.

Sovereign Gold Bonds (SGBs): These are a unique type of G-Sec denominated in grams of gold. Investors receive the prevailing gold price at maturity, along with a fixed interest rate paid semi-annually.

you can check other type of bonds on our blog TYPES OF BONDS

Benefits of Government Sovereign Bonds (GSB)

Government Sovereign Bonds (GSBs) offer a set of attractive advantages for investors seeking security and stability in their portfolios. Let’s take a look at a few of those benefits:

- Safety and Security: GSBs are one of the safest investment options available. They are issued by the government, which has a very low risk of default. This makes them ideal for risk-averse investors or those nearing retirement.

- Guaranteed Returns: Unlike stocks or company bonds, GSBs offer a fixed interest rate throughout the investment period. This predictability allows you to plan your finances more effectively.

- Regular Income: GSBs typically pay interest semi-annually, providing a steady stream of income that can supplement your other sources of income.

- Tax Benefits: In many countries, including India, GSBs offer tax benefits on the interest earned. This can significantly increase your overall return on investment.

- Hedge Against Inflation: Some GSBs come with an inflation-protection feature, where the interest rate adjusts based on inflation. This helps to preserve the purchasing power of your investment over time.

- Liquidity: While GSBs have a maturity date, some offer options for early redemption or selling them on a secondary market before maturity. This provides some flexibility if you need access to your funds before the maturity date.

- Supporting the Government: By investing in GSBs, you’re essentially lending money to the government. This helps to finance government projects and infrastructure development, contributing to the nation’s economic growth.

Overall, Government Sovereign Bonds offer a compelling combination of safety, guaranteed returns, regular income, and potential tax benefits. They are a valuable addition to a diversified investment portfolio, especially for those seeking stability and long-term financial goals.

Why To Invest On Government Sovereign Bonds (GSB)?

Government Sovereign Bonds (GSBs) are a compelling investment option for several reasons. Firstly, they are backed by the government, offering a high level of security and reducing default risk. Unlike other forms of investment, such as stocks or mutual funds, GSBs offer a guaranteed return on investment. These features make them an attractive choice for conservative investors seeking stable returns.

Moreover, GSBs offer competitive interest rates, often higher than traditional savings accounts or fixed deposits. This makes them an appealing option for investors looking to earn a steady income stream. Furthermore, GSBs are relatively easy to buy and sell, providing investors with liquidity when needed.

Another key advantage of GSBs is their tax benefits. Interest earned on GSBs is generally tax-free, making them a tax-efficient investment option. This can help investors maximise their returns over the long term.

In simpler terms, Government Sovereign Bonds (GSBs) are a secure, stable, and tax-efficient investment option. This is an ideal choice for investors looking to diversify their portfolio and generate consistent returns.

Conclusion

Sovereign Gold Bonds are one of the safest investments that grow with the pace of inflation and are a good commitment for long-term investment. It offers your portfolio stability, diversification, and a good source of income. Government bonds are a good choice if you want to be part of well-rounded investing strategies, whether they are obtained directly, or by trading through investment funds and through secondary markets.

FAQs

Is sovereign gold bond a good investment?

Absolutely! SGB are one of the best and safest investment options for long-term capital growth. Any investor can opt for sovereign gold bonds.

What happens when you finish 8 years of sovereign gold bond?

Well, once investors complete the maturity period of a sovereign gold bond, they are credited with the maturity and interest amount in their bank account. SGB is a secure and easy investment option.

Are gold bonds tax-free?

According to the data, a sovereign gold bond is taxable under the provisions of the Income Tax Act of 1961 (43 of 1961).

Is Sovereign Gold Bond better than PPF?

Yes! SGB aka sovereign gold bond offers investors a hedge against inflation, whereas in PPF, the amount increases as per the pre-set interest rate, against the inflation.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube