Descending Tops Explained: What They Are and How to Spot Them

Overview

There’s a good chance you’ve come across the words “descending” or “ascending,” but what do these patterns mean when they appear on a candlestick chart? A descending tops pattern is like a red flag waving in the market because it indicates the price is rotating down. This pattern occurs when every high or peak reached within a price is lower than the previous ones, indicating that the sellers are in charge and driving prices lower.

In this article, we will cover the descending tops pattern thoroughly together with its drawbacks and how to recognize and interpret it in relation to the direction of price change in the future. So without any delays, let us start.

What is Descending Tops

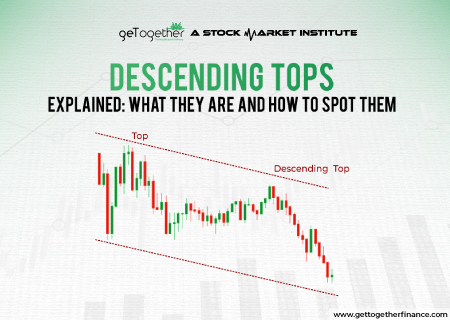

The Descending Tops pattern is a major price action pattern that traders learn and utilize and it forms during the analysis of price movements in the market. It’s a way to spot when a market is losing its upward strength and may start heading down. The pattern appears when the price of an asset makes a series of lower highs on a chart. This creates a series of peaks, but each peak is lower than the one before it. This creates a downward-sloping line if you connect the tops. Let us take a look at how to spot it when appears on the chart.

Formation of Descending Tops

The Descending Tops pattern is an important indicator of a weakening market, often showing that the price may continue to decline. It forms when the price attempts to rise but consistently fails to reach the previous peak. Here’s how this pattern typically develops:

- Initial Uptrend or Sideways Movement: The pattern often begins after an uptrend or a period of sideways movement where the market is trying to push higher but starts facing resistance.

- First Top: The price reaches a high point, known as the first peak, but then starts to decline. This hints that the buying momentum is dropping, and sellers has started to take control.

- Retracement or Pullback: After reaching the first peak, the price fls back as sellers are now in control. Although buyers try to again to push the price up again, but their efforts are weaker than before.

- Second Peak: The price rises again, but this time it doesn’t reach the same height as the first high. This lower peak signals that the market is losing momentum.

- Subsequent Lower Peaks: The price keeps trying to rise but falls short each time, creating a series of lower highs. This pattern shows that the market is struggling, with buyers unable to push prices higher.

- Confirmation or The Big Drop: The pattern is confirmed when the price drops below a key support level, suggesting that the market is likely to continue downward

How to Trade Descending Tops

In order to trade with Descending Tops, this is mostly about spotting when the market is losing strength and getting ready for a potential downtrend. Here’s how you can trade with this pattern:

- Spot the Pattern: To begin with, look for a series of price peaks or highs that are getting lower each time. These are the “descending tops.” This pattern tells you that buyers are struggling to push prices higher.

- Wait for Confirmation: Don’t jump in a trade just because you see a pattern forming. It is important for the price to break below a key support level (where it bounced back last time). This confirms that the sellers are taking over.

- Enter the Trade: Once a price go below the support level, you can enter a short trade. This is your sign that hey, a downtrend is likely to continue.

- Take Profit: Plan where you’ll take your profit if the trade goes your way. Look for the next support level below, where the price might find some stability and possibly bounce back.

This is the basic strategy to use Descending Tops bottom for a trade and make profits. However, it’s crucial to understand the limitations of Descending Tops formations to keep up with market volatility and avoid any fakeouts.

Limitations of Descending Tops

Although technical analysis chart patterns are the formations observed over time, they come with many setbacks that traders should keep in mind:

- False Signals: Sometimes, the pattern can trick you with false breakouts, leading to trades that don’t pan out.

- No Volume Check: The formation doesn’t count the factor of trading volume, so there are high chances that you might miss out on knowing how strong the trend really is.

- Different Interpretations: Not everyone sees the pattern the same way, which can lead to mixed trading decisions, end up confusing the traders.

- Late Confirmation: Waiting for the pattern to confirm can mean entering the trade a bit late, which might reduce your potential gains, losing the purpose of using this method.

- Weak in Strong Trends: In strong bullish markets, the pattern might not work well since the overall trend can override the signal.

- Short-Term Moves: The Descending tops pattern usually points to short-term price drops, which might not lead to big, long-term moves.

- Needs Extra Help: To make the pattern more reliable, you often need to use other indicators, which can make things a bit more complicated.

These points show why it’s important to be cautious when using the Descending Tops pattern and to combine it with other tools for better results while using a strong risk management.

Risk Management for Descending Tops

Among such patterns is demand-supply dynamics that uses laws of physics and business to keep traders one step ahead of conventional methods. Here is how you can equip it to make your research profound as your risk management strategy:

- Mark Supply Zones: Spot and mark exceptional supply zones, which are key areas where selling pressure has previously, leading the potential price drops.

- Spot the Demand Zone: Now locate and mark demand zones below the current price level, where buyers have previously supported the price. This area can act as support, leading to price bounce over and over before price take a big drop.

- Set a Stop-Loss: Place your stop-loss order just above the distal line of the most recent supply zone. The distal line is the point or farthest boundary of the supply zone where placing your stop-loss here protects you from unexpected price reversals.

- Target the Next Demand Zone: Set your take-profit level near the next significant demand zone below the current price, where the market may find support.

- Position Size: You should only invest what you can afford to risk. Try to limit your investing 1% of your available fund to keep your risk limited.

- Monitor the Trade: It’s important to keep an eye on the market to track your trade. If the price keeps falling and you’re in profit, you should keep adjusting your stop-loss to lock in some gains as the trade progresses.

You can use this tips to create a strong risk management for your trading setup. Besides, you can easily learn demand-supply theory from GTF’s YouTube channel from their 10 Free sessions.

In A Nutshell

The descending tops pattern is one of the most useful tool for traders who want to spot potential price drops. By learning to spot this pattern, you can anticipate when prices may go down and make smarter trading choices. However, it’s super important to remember that there is no one formation or theory you shouldn’t rely on solely.

Also, to improve your trading strategy, you can use this formation with other technical methods, such as demand and supply dynamics, etc. If you basically understand how demand and supply influence the prices, it can give you a clearer picture of what’s happening in the market. This can also help confirm what the descending tops pattern is telling you while keeping you one step ahead of conventional traders.

FAQs

What’s the most common mistake traders make with Descending Tops?

Jumping into a trade too early before the pattern confirms is one of the major setbacks a traders often fall for.

Do Descending Tops work better with certain time frames?

They can work on any time frame, but they’re often more reliable on longer time frames like daily or weekly charts. Remember – the longer time frame, the longer the trend refrain.

Can I use Descending Tops to short a stock?

Definitely. If the pattern confirms, it’s a good signal that the price may drop, which is ideal for shorting.

How does volume affect the Descending Tops pattern?

Higher volume during the formation of descending tops strengthens the signal that sellers are gaining control.

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube