Mastering Options: The Iron Butterfly Strategy Unveiled

Table of Contents

ToggleIntroduction

Who doesn’t want to be assured of the maximum profits or losses while trading in the markets? However, the stock markets are risky and entirely based on probability. It is almost impossible to know the extent of profits or losses that will happen from a trade.

But what if you can design a strategy to limit your profits and losses? Yes, you heard it right! The Iron Butterfly Strategy is an options trading model that consists of 4 contracts in such a way that the risk and returns are limited.

Traders use this strategy to capitalize in a low-volatility market. The model is designed to profit from the premium collection. This blog delves deep into the concept of Iron Butterfly trading strategy and how you can set it up to ensure higher profits.

What is an Iron Butterfly Strategy?

In a neutral market, which is relatively stable, a trader is confused about whether the prices will rise or fall. As a result, it is almost impossible to predict the future. If you encounter such a market, should you wait until the tides turn? No! Instead, use the iron butterfly options strategy.

The strategy consists of buying 4 options contracts simultaneously, forming part of a bull put spread and a bear call spread. The options must be centered around the same strike price of the underlying asset, i.e., the current market price.

Bull Put Spread

It involves the simultaneous buying and selling put options at different strike prices.

- Short Put: The put option with the strike price closest to the stock price is sold. As the strike and stock prices are the same, the option is At the Money (ATM). Hence, the maximum premium is received.

- Long Put: The put option with a lower strike price is bought. As the strike price is lower than the stock price, the option is Out of the Money (OTM). Hence, a lower premium is paid.

Bear Call Spread

It involves the simultaneous buying and selling call options at different strike prices.

- Long Call: The call option with a higher strike price is bought. As the strike price exceeds the stock price, the option is Out of the Money (OTM). Hence, a lower premium is paid.

- Short Call: The call option with the strike price closest to the stock price is sold. As the strike and stock prices are the same, the option is At the Money (ATM). Hence, the maximum premium is received.

How to Use the Iron Butterfly Strategy

The iron butterfly trading strategy is helpful in a low-volatility market. If you expect that the underlying asset’s price will remain near the strike price, you can use the iron butterfly strategy as follows:

- Identify whether the market is showing low volatility

- Choose the ideal Strike Prices for all the four options

- Select the ideal expiration date for the options

How to Set Up an Iron Butterfly Strategy

Let’s take an example to understand the iron butterfly strategy’s setup.

Assume the price of Stock A is Rs. 100. To set up the strategy, you have to carry out the following transactions:

ATM (At the Money) = More Premium Received

- Short Put: Sell a 1-month Put with a Strike Price of Rs. 100 – Earn the option premium Rs. 10

- Short Call: Sell a 1-month Call with a Strike Price of Rs. 100 – Earn the option premium Rs. 10

OTM (Out of the Money) = Less Premium Paid

- Long Put: Buy a 1-month Put with a Strike Price of Rs. 90 – Pay the option premium of Rs. 1

- Long Call: Buy a 1-month Call with a Strike Price of Rs. 110 – Pay the option premium of Rs. 1

Net Premium Received: you receive a net premium of Rs. 18 (Rs. 10+10-1-1). This is the maximum profit you can make.

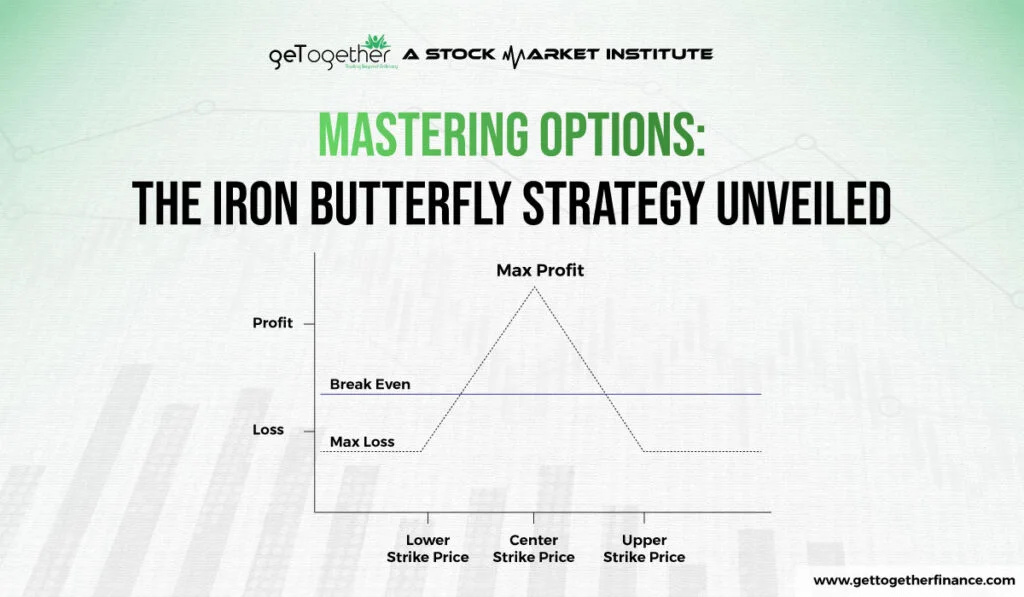

Iron Butterfly Strategy Payoff Diagram

The diagram shows peak profit at the middle strike price and sloping downwards — maximum loss at or beyond the upper and lower strike prices.

Maximum Profit: If the stock price remains at Rs. 100 after the option expiration, i.e., after 1 month, the maximum profit is limited to the premium received by selling the options.

Maximum Loss: There can be two scenarios for this:

- Scenario 1: If the stock price at expiration is ≤ Rs. 90,

- The long call lapses

- The short call lapses

- The short put becomes OTM

- The long put becomes ITM/ATM

- Scenario 2: If the stock price at expiration is ≥ Rs. 110

- The long put lapses

- The short put lapses

- The short call becomes OTM

- The long call becomes ITM/ATM

In both these scenarios, the OTM (Out of the Money) options cause losses, and the ITM (In the Money) / ATM (At the Money) options expire profitably. They cancel off to create a limited net loss.

Entering an Iron Butterfly Strategy

While entering the Iron Butterfly strategy, keep the timing and market conditions in mind. Confirm the low volatility and market sentiments. Then, choose the options and execute the trade.

Exiting an Iron Butterfly Strategy

There are many ways to exit the iron butterfly trading strategy.:

- Close all positions: You can square off all four options and close the positions before expiry.

- Roll Forward: Move all the positions to a later expiration date before expiry.

- Expiry: Let the positions expire if the stock price is near the strike price.

Time Decay Impact on an Iron Butterfly Strategy

Options premiums tend to decrease as time passes (Theta 𝚹). This gets accelerated if the stock price remains close to the strike price. Hence, it provides maximum benefits to options sellers. It is one of the determining factors for the iron butterfly strategy.

Implied Volatility Impact on an Iron Butterfly Strategy

Implied Volatility (Sigma 𝛔) shows the potential volatility in the market by calculating percentages and standard deviations. The VIX index (generally ranges between 15-25) shows the market’s implied volatility. A lower value of VIX (ideally around or below 15) is perfect to apply the iron butterfly trading strategy.

Rolling an Iron Butterfly Strategy

If you think that your strategy needs more time to fructify, you can roll up or down your iron butterfly strategy by:

- Closing all the existing positions

- Opening new positions for a later date with adjusted strike prices according to the stock price

Hedging an Iron Butterfly Strategy

If you are unsure whether the market will remain volatile, you can spread the iron butterfly strategy horizontally.

- Protective Puts: Buy additional puts with even lower strike prices to protect from the downside risk.

- Call Spreads: Buy additional calls with even higher strike prices to cap the upside risk.

Also Read: Hedge Funds in India

Conclusion

The Iron Butterfly Trading Strategy is one of the most powerful tools for traders in a low-volatility market to earn good profits. If you can manage the strategy well, it can limit your risk and increase your profits. If you want to learn about options trading and such advanced trading strategies in detail, Join our Options Trading Course Now!

FAQs

u003cstrongu003eWhat is the advantage of the iron butterfly strategy?u003c/strongu003e

By applying the u003cstrongu003eiron butterfly strategyu003c/strongu003e, you can ensure a limited risk and limited return exposure in a low-volatility market. As long as the strike price remains close to the stock price, you can have consistent returns.

u003cstrongu003eWhat is the success rate of the iron butterfly strategyu003c/strongu003e?

There is no Sureshot money-making formula in the stock markets. Every investment carries risk. For an iron butterfly trading strategy to go right, the following should be correct:u003cbru003eMarket Conditions and Sentimentsu003cbru003eLow Volatilityu003cbru003eThe ability of the traderu003cbru003eDisciplined implementation and management

u003cstrongu003eWhat is the formula for the iron butterfly strategy?u003c/strongu003e

The formula for u003cstrongu003eiron butterfly optionsu003c/strongu003e can be quoted as “➕,➖,➖,➕” where ➕ is buying and ➖ is selling.u003cbru003e➕ = Buying an OTM Put (at the lowest strike price)u003cbru003e➖ = Selling an ATM Put (at the middle strike price)u003cbru003e➖ = Selling an ATM Call (at the middle strike price)u003cbru003e➕ = Buying an OTM Call (at the highest strike price)

u003cstrongu003eIs Butterfly a good options strategy?u003c/strongu003e

The iron butterfly options strategy is the best choice for traders who want to invest with low risk in the stock markets. This strategy allows you to limit your maximum profit and losses in a low-volatility market. However, you need to have a sound understanding of how to apply and manage this strategy.

Facebook

Facebook Instagram

Instagram Youtube

Youtube