Index Derivatives: A Change in Lot Size

- October 21, 2024

- 670 Views

- by Manaswi Agarwal

A report from SEBI shows that individual traders made net losses of Rs 1.81 lakh crore in F&O in the past three years with only 7.2% making a profit. To protect investors’ interest, NSE has revised the lot sizes for index derivatives which will come into effect from November 20, 2024. Read this blog to know the impact of revised lot sizes on investors.

What is a Lot Size in Index?

A lot size defines the number of shares a trader can buy in one transaction. In the Index, the lot size refers to the number of shares purchased in one transaction of Nifty, Nifty Bank, Nifty Financial Services, and other indices. In options and future trading of index, the total number of contracts contained in one derivative security is represented by the lot size.

For Instance: The lot size of an options contract is 100, if an investor enters into one options contract that means it is an agreement of buying 100 shares of the underlying asset.

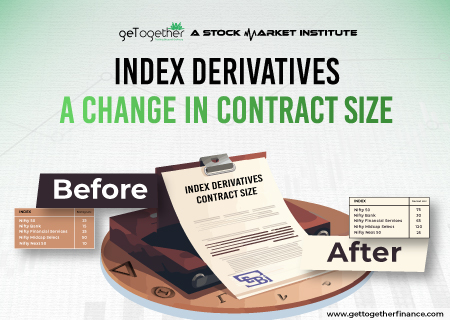

Revised Lot Sizes

NSE released a circular on Oct 18, 2024 with revised contract sizes for index derivatives. According to the guidelines of SEBI, revised versions of index derivatives have been released to strengthen the equity index derivatives framework which would result in protecting investors’ interests and maintain stability in the market.

The revised lot size for index derivative is as follows:

| Index | Existing Lots | Revised Lots |

| Nifty 50 | 25 | 75 |

| Nifty Bank | 15 | 30 |

| Nifty Financial Services | 25 | 65 |

| Nifty Midcap Select | 50 | 120 |

| Nifty Next 50 | 10 | 25 |

It will come into effect for all new index derivatives contracts (includes weekly, monthly, quarterly and half- yearly) introduced from November 20, 2024, onwards.

*Existing contracts will continue with the same lot size till the date of expiry. While quarterly and half-yearly expiry contracts shall be transitioned to the new contract size on December 24, 2024.

Change in Contract Size

From November 20, 2024, the contract size for index F&O contracts will be between Rs 15 Lakhs to Rs 20 Lakhs, currently it falls between Rs 5 Lakh to 10 Lakhs. An increase in contract value states a direct proportional increase in margin requirements as per the revised contract sizes for index derivatives.

No Calendar Spread Benefits

During calendar spreads, traders hold a variety of positions across different expiries which reduces the margin requirements on the day of expiry. To manage the risks of high volatility and unpredictable price movements, traders will not be eligible for margin benefits for calendar spreads on the day of expiry for contracts expiring on that day from February 1, 2025. This will require the traders to maintain full margin on the day of expiry.

Expiry Contracts

According to the recent regulations, there are weekly expiries for 4 indices on NSE and 2 on BSE. The new rules will come into effect from November 20, 2024 where the stock exchanges are allowed to offer weekly expiry contracts on one benchmark index. NSE will offer weekly expiry for Nifty 50 index, and offer only monthly expiry for other indices, hence eliminating weekly expiries.

Increased Margins

To maintain the volatility during expiry days, traders are required to maintain an Extreme Loss Margin (ELM) of 2% to short position. This will help to cover potential risks due to increased volatility.

ELM = Strike Price * Lot Size *2%

Impact on F&O Index Participants

Small index derivatives participants have been directly impacted by the implementation of revised lot sizes. Let us look how small participants can be impacted by these changes:

Increased Capital Requirements

Due to an increased lot size, index derivatives become less accessible for traders as the capital requirements are high. It restricts the participation of smaller traders as it might get difficult for them to allocate higher margins.

Market Volatility

An increase in the lot size simply indicates less participation of retail traders. This reduces market volatility due to a reduced number of small speculative trades.

Shift to other Financial Instruments

The increased lot size can be a cause for small traders to shift to other financial instruments due to the high risks involved in index derivatives. They can shift towards exchange traded funds, mini derivatives or options with lower lot sizes.

Less Flexibility

Traders who maintain smaller positions might find it less flexible to increment their positions due to larger lot sizes. In volatile markets, this could prove to be disadvantageous.

The Bottom Line

Index derivatives are highly risky due to its volatility. To protect retail investors from losses, NSE has revised the lot size for index derivatives. To deeply understand the workings of equity and index, enroll in an advanced technical analysis course “Trading in the Zone” offered by GTF.

FAQs

What is an Index Derivative?

An index derivative is in the form of options and futures which is a class of derivatives, the value of which is derived from the underlying index.

What is the lot size of index derivatives?

Previously, the lot size in Nifty 50 was 25 which is now revised to 75. Similarly, the lot sizes of other indices have been increased by SEBI.

Do all the indices have the same lot size?

No, the lot sizes of indices are different, according to revised norms, Nifty has 75 lots and Bank Nifty with 30 lots.

Instagram

Instagram