Multiple Time Frame Analysis

Overview

Multiple Time Frame Analysis (MTFA) is an excellent technical strategy that involves analyzing the stock or security on different time frames for better accuracy. For instance, a technical trader can analyze the stock on different time frame charts like monthly, weekly, daily, and hourly to get a good overview of its price movements and its stimulations. This strategy and approach help in identifying the best entry and exit point alongside managing the probable risks.

In trading and investing, Multiple time frame analysis is considered a key tool because it provides a comprehensive overview of the market, also mitigating the chances of impulsive trading decisions based on a narrow approach. With the help of multiple time frames, traders can identify the dominant market trends and align trading strategies with them for better returns with lesser risk.

This blog will look at what MTFA is, its benefits, how to perform it, key indicators, typical pitfalls, and practical tactics for using it.

Understanding Multiple Time Frame Analysis

Multiple time frame analysis requires the trader to narrow down their trading approach from a higher time frame to a lower one. For example, if you have found a good and strong demand zone on the monthly chart, and take a good on behalf of it, you need to narrow down your approach towards weekly and daily time frames. After marking the demand zone on the monthly time frame, check the marked area on the weekly demand zone and identify the price trend. If the trend is in your favor, align the strong demand zone and trend on the daily time frame to get the apt entry and exit points.

The daily time frame that is nearest or that coincides with the monthly zone will help you in getting a reliable trade setup.

This approach when you start your research from a monthly time frame and narrow it down to a daily time frame is called multiple-time frame analysis for monthly income trade; because you are using multiple time frames to analyze it (monthly, weekly, and daily). Also while analyzing this, you are taking support of higher time frames like yearly, quarterly, or half yearly to know whether they are supporting your trade setup or not. This will help you identify the trend on higher time frames as well.

Further, multiple time frame analyses can be done on different time frames you can find a good demand zone weekly and then narrow it down to a 125 or 25-minute zone or find a good demand zone daily and narrow it down to a 15 or 5-minute zone. It depends on your analysis, capital, and risk exposure.

Also Read: Sector Analysis

Finding the Right Trade Setup:

Finding the highly probable trade setup with Multiple Time Frame Analysis (MTFA) requires a step-by-step strategy to align several time frames for a more informed trade choice.

First, MTFA supports the use of higher time frames, such as monthly and weekly charts, in addition to other and lower time frames like daily and hourly. Traders need to begin by examining long-term patterns to identify broad market trends and important areas of focus. For example, on weekly charts, watch for an upward or downward trend, as well as crucial support and resistance signs.

Next, check the daily chart to confirm the weekly pattern. This helps to confirm the market’s direction and identify appropriate entry points. On the hourly chart, look for exact times to execute the trade, such as price patterns or indications that correspond to the higher time frame analysis.

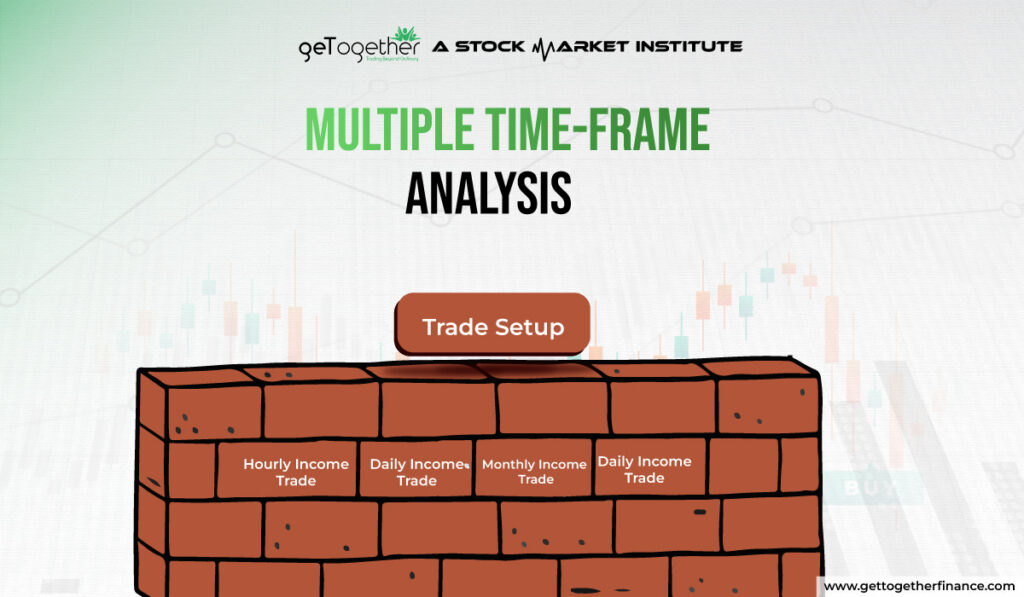

Now it is important to remember that trade not only works in a monthly to daily time frame, instead, you can find various types of trades by combining different time frame analyses. There are different types of trades like monthly income trade, weekly income trade, daily income trade etc. Here’s how they are:

- Monthly Income Trade: This trade works when the trader goes from checking the strong demand zone on the monthly time frame to aligning it with the trend on the weekly time frame and finding execution and exit points on the daily time frame.

- Weekly Income Trade: This trade works when the trader goes from checking the strong demand zone on the weekly time frame to aligning it with the trend on the daily time frame and finding execution and exit points on 75/125 mints time frame or on the hourly, 2 hours or 4 hours time frame.

- Daily Income Trade: This trade works when the trader goes from checking the strong demand zone on the daily time frame, aligning it with the trend on75/125 mints time frame or on the hourly, 2 hours or 4 hours time frame, and finding execution and exit points on the 15-minute or 5-minute time frame.

| Trading Purpose | Higher Time Frame | Intermediate Time Frame | Lower Time Frame |

| HTF | ITF | LTF | |

| Location/Curve | Trend | Execution | |

| Hourly Income Trade (HTF) | 75/60min | 15 min | 5 min |

| Daily Income Trade (DIT) | Daily | 75/60min | 15 min |

| Weekly Income Trade (WIT) | Weekly | Daily | 125/75/60/240 min |

| Monthly Income Trade (MIT) | Monthly | Weekly | Daily |

You can learn more about multiple time frame theory by watching the video.

How to Do Multiple Time Frame Analysis

Multiple Time Frame Analysis requires the trader to analyze the security in different time frames to find the high-probability trade setup. There are two core approaches of MTFA: the top-down approach and the bottom-up approach, let’s understand both:

Top-Down Approach:

In the top-down approach, you start by looking into higher time frames like yearly, health yearly, quarterly, and monthly. You identify the broader trend and strong demand and supply areas with detailed price action. This will give you a broader perspective, and help in understanding how the price of stock reacts to the term vision board. Further, as you go down to a short time frame, you’ll get reasoning for every movement. Finally, when you see a shorter time frame to fine-tune your trade timing, you’ll get better results. For example, you might start with a monthly chart to see the major demand zones, check the trend weekly, and then look at a daily chart for specific trade entry and exit points; this will be called multiple time frame analysis for monthly income trade.

Using multiple time frame analysis wisely allows you to find trade specific to the time frame with support of higher time frames, to make it more reliable. For example, while finding monthly income trade, you can check the strong demand and supply areas on yearly and quarterly time frames too. If the price in the monthly demand zone is coming from the yearly supply zone, then the chances of the monthly demand zone working are very low. You can refrain from taking the trade in this situation and prevent losses.

This way multiple time frame analysis helps in finding good demand and supply zones with support of higher time frames, to get the high probable trade setup. This way your stop losses become less and your targets are achieved easily.

Case Study Example:

Let’s say you are analyzing and researching a stock using the top-down approach. you start with the monthly chart and notice a strong upward trend starting with an excellent demand zone (to know about demand and supply theory click here). Moving to the weekly chart, you see the stock has the support of a good demand zone in weekly time at the same trend in the favor, suggesting a good buying opportunity. Finally, you check the daily and hourly hour chart to time your entry.

This way by using multiple time frame analysis, you can combine the advantages of different time frames to give support to your trade setup and reduce the risk of relying on a single time frame.

Common Mistakes to Avoid in Multiple Time Frame Analysis

While doing multiple time frame analyses, traders can make several mistakes that intervene with their analysis, here’s what mistakes can look like:

Overcomplicating Analysis:

One of the most common mistakes is burdening the analysis with too many time frames or technical indicators. It is important to have a comprehensive overview of the stock but using too many time frame charts and indicators might take your analysis off track. This happens when you become overwhelmed with exaggerated information and are unable to make the right decisions, hence unable to find good entry and exit points. To avoid this, stick to a few important time frame charts and be consistent with your trading strategy in these time frames. Also, use a small number of indicators that serve as an add-on to your study. Simplicity frequently results in improved decision-making.

Ignoring Long-Term Trends:

Another huge mistake made by traders is focusing on short-term time frames and relying on short-term price swings while completely ignoring the long-term traders and broader perspective. Short-term price movements can be quick, chaotic, and mostly impacted by market noise which is not reliable. On the contrary, long-term patterns give a more accurate market trend picture. If you completely oversee the longer perspective, you end up going against the market trend that you’re unaware of, which increases your risk.

It is advisable to begin your study with a longer time frame to grasp the general trend before moving on to shorter time frames for specific trade possibilities.

Relying Solely on Technical Indicators:

While technical indicators are valuable tools in technical analysis, completely relying on them is never good. make your technical study like demand and supply combined with price action strong and use technical indicators only as an add-on. If they align with your study, your trade setup gets stronger. Do not start finding trade setups solely based on RSI, MACD, etc indicators. Furthermore, market fundamentals, new events, and geopolitical events also play huge roles in price movements, make sure you have a slight idea of what is going on to make informed investments.

Avoiding these frequent mistakes—overcomplicating your research, neglecting long-term trends, and depending entirely on technical indicators—will help you improve the effectiveness of your Multiple Time Frame Analysis research and make better trading decisions.

Conclusion

Multiple Time Frame Analysis (MTFA) is an effective method for traders and investors, offering a comprehensive perspective of market patterns and potential trading opportunities. Traders can make better decisions, find ideal entry and exit opportunities, and manage risk by studying assets over many time periods. Avoiding typical mistakes including overcomplicating analysis, neglecting long-term trends, and depending primarily on technical indications will help improve MTFA accuracy and reliability. By incorporating MTFA into your trading strategy, you align your trades with broader market movements, increasing your chances of obtaining consistent, successful outcomes. Practice and improvement of these approaches are critical for learning MTFA and improving your overall trading performance.

FAQs

What is Multiple Time Frame Analysis?

MTFA is a trading method that examines an asset over a variety of time frames, including monthly, weekly, daily, and hourly charts. This strategy provides traders with a comprehensive perspective of the asset’s price fluctuations and patterns, allowing them to make better decisions about entry and exit points.

Why is multiple time frame analysis important in trading and investing?

MTFA is important because it offers a comprehensive view of the market, lowering the risk of making rash judgements based on short-term changes. By looking at several time periods, traders can detect dominating trends, align their methods with these trends, and increase their chances of making good trades with less risk.

How do I choose the right time frames for analysis?

Choosing the appropriate time frames is determined by your trading style, goals, and availability. Short-term time frames are appropriate for day traders who can constantly monitor the market, medium-term time frames are great for swing traders seeking larger price fluctuations, and long-term time frames are optimal for investors seeking long-term gains with less monitoring.

What is the difference between the top-down and bottom-up approaches in MTFA?

The top-down technique begins by analyzing wider time frames to detect the overall market trend, before narrowing down to shorter time frames for precise trade entries. The bottom-up strategy begins with lower time frames to identify instant trade ideas, which are subsequently confirmed by analyzing longer timeframes. The top-down strategy is widely seen as more effective for aligning trades with the main market trend.

What are common mistakes to avoid in Multiple Time Frame Analysis?

Common mistakes include cluttering the research with too many time frames or indicators, neglecting long-term patterns in favor of short-term price swings, and relying entirely on technical indicators without taking into account fundamental reasons or market news. Keeping your analysis concise and comprehensive improves decision-making and trading performance.

Instagram

Instagram