Net Asset Value (NAV): Definition, Formula, Example, and Uses

Table of Contents

ToggleIntroduction

Net Asset Value is the per-share value of a fund’s assets excluding its liabilities. NAV is commonly used in assessing mutual funds and ETFs; it is calculated by dividing the total value of portfolio funds (assets-liabilities) by the number of outstanding shares. With this investors can get an overview of the fund’s value at a specific point in time.

Understanding the dynamics of NAV is crucial for investors as it helps in knowing the value of their investments in mutual funds and ETFs they have chosen. It serves as a valuable metric for making informed investment decisions, allowing investors to keep track of their holding’s value. All the more, Net Asset Value is a powerful tool in comparing different mutual funds and ETFs, it helps in assessing the growth potential; and gives assurance to the investors that their investment aligns with their financial goals.

What is NAV (Net Asset Value)?

Let’s understand what NAV is in simple terms and how it can be useful for you.

NAV Explained: A Comprehensive Definition

Net asset value is the metric that helps in knowing the actual price of the fund’s security at any given point of time It is calculated by subtracting the liabilities of the fund from its total shares and then dividing the outcome by the outstanding shares of the fund. It is calculated at the end of each trading day for mutual funds and ETFs. It is calculated based on the closing market prices of the securities (holdings of mutual funds). The precise value of NAV helps the investor in knowing the actual value of their investment at the end of each day.

How NAV is Different from Market Price

The intrinsic value of a fund or ETF’s share is represented by Net asset value; here, the market price is the price at which the share is traded on the stock exchange. For mutual funds, the NAV and market price of the share are generally the same because funds are traded on NAV at the end of the trading session. But it is not the same with ETFs, in an ETF the market price can differ from the NAV due to supply and demand dynamics because ETFs are traded live on stock exchanges.

An ETF’s trading price may be higher (above NAV) or lower (below NAV), depending on investor mood, liquidity, and market conditions. Understanding this distinction enables investors to make more informed trading decisions and determine whether they are buying or selling at a reasonable price.

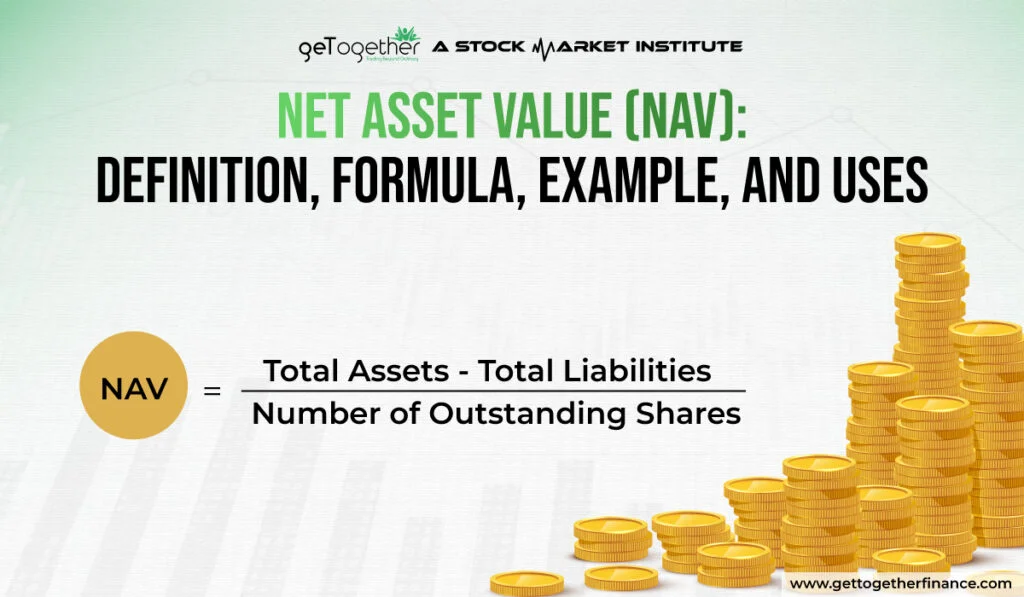

Formula for Calculating NAV (Net Asset Value)

The formula for calculating NAV is quite simple, here it is:

Now let’s understand its terms:

Total Assets: This comprises the current market value of all the holdings of funds and cash held by the fund.

Total Liabilities: This comprises the fund’s all obligations, such as fees, expenses, and any other debts.

Number of Outstanding Shares: The total number of shares that investors have in the fund at a given point of time.

Let’s understand this with an easy example:

Let’s assume a case of fund where:

Total Assets: ₹50,00,00,000 (₹50 crore)

Total Liabilities: ₹5,00,00,000 (₹5 crore)

Number of Outstanding Shares: 10,00,000 (10 lakh)

Using the NAV formula:

Next, we need to divide the net assets by the number of outstanding shares.

Now, we can say that NAV per share is ₹450, implying that each share of the mutual fund is valued at ₹450, giving investors a clear understanding of the valuation of their investment.

Know This: You don’t need to calculate NAV everytime you go for selling or buying the funds, it is automated in in online brokers.

Mutual Funds and Net Asset Value

Mutual Funds are pooled investment by multiple investors to invest in a diversified portfolio of securities like stocks, bonds, or other assets.

NAV represents the per-unit price of a mutual fund and is used to determine the value of one share or unit of the fund.

How is the Net Value of an asset relevant for investors?

Net Asset Value (NAV) is highly relevant for investors to invest in mutual funds as it helps in decision making. It matters to analyze Pricing of Mutual Fund Units, Performance Tracking, Portfolio Valuation, Basis for Comparison, Decision-Making Tool and reflecting the funds market value.

Role of NAV in the performance of a Fund

Net Asset Value (NAV) plays a crucial role in understanding and evaluating the performance of a mutual fund. Some important role of NAV include:

Indicator of Growth

Basis for Calculating Returns

Reflects Portfolio Management Efficiency

Determines Investment Value

Not the sole measure of performance

Transparency for Investors

NAV Allotment for different investment types

Net Asset Value (NAV) allotment process varies for different types of mutual fund investments, such as lump-sum investments, Systematic Investment Plans (SIPs), and Systematic Transfer Plans (STPs).

Uses of NAV

Net asset value helps investors in various ways, here’s the detailed take on uses of NAV:

Valuation of Mutual Funds: Net Asset Value serves as an important component in mutual funds because it serves as a parameter to know per unit value of mutual funds. It is calculated at the end of each trading to provide the precise value of the fund. Investors use this to know the value of their investments, eventually making a decision to buy or sell. When purchasing or selling mutual fund shares, transactions are done at the fund’s NAV, making sure that investors trade at the genuine value of the underlying assets. This transparency is required for fair trade and accurate valuation of investment growth.

Helps in Tax Reporting: Tax reporting is eased by the NAV calculator because NAV gives a clear valuation of a mutual fund’s holdings at a specific time. This helps investors in accurately calculate their capital gains or losses when they buy or sell the fund units, ensuring correct details for tax filing. It simplifies tracking the investment performance of the fund and determining tax levels related to fund transactions.

Dividend Reinvestment Plans: NAV significantly in dividend reinvestment plans by determining the value at which dividends are reinvested to buy additional units. When a fund announces dividends, these dividends are used to buy more holdings at the current Net Asset Value. Dividend reinvestment schemes allow investors to compound their invested capital in the fund by purchasing more shares or securities without incurring transaction fees, this in turn increases their overall holdings and potential future returns.

Also Read: Return on Equity

Factors Affecting NAV

Several factor can contribute in fluctuating NAV, here are some:

Market Fluctuations

The market value of underlying assets or funds’ holdings is impacted significantly by market fluctuations, eventually impacting NAV. A rise in stocks and prices increases the NAV, conversely, when these prices fall, the NAV decreases. This makes NAV susceptible to sudden market movements and is also a key metric in understanding market sentiment for your invested fund.

Impact of Dividends

Dividends lower the NAV for the time being. When the fund pays out a dividend or bonus to its investors, its overall NAV decreases. Consequently, the NAV also drops with the amount distributed per share. This reduction, however, has no effect on the overall value of an investor’s holdings because the distribution is made in cash or reinvestment choices.

Expenses and Fees

Expenses and fees, such as administrative costs, management fees, and other operating expenses, significantly decline the NAV. This is because this cost is deducted from the assets of the fund, lowering the total asset value and, consequently, the NAV. High expenses of the fund can significantly impact the NAV over time, making returns lower for investors in the long term.

Limitations of NAV

End-of-Day Calculation: NAV is only updated after the trading sessions end, it is not reflected during the live market.

Future Potential: NAV doesn’t help in assessing the future growth of the fund or ETF.

Market Price Deviations: For ETF, NAV can differ from actual market value because of the demand and supply forces involved in live trading.

Tax Implications: NAV does not provide information on the tax implications of fund distributions and does not give an overview of the fund’s overall tax efficiency.

Expense Consideration: NAV only reflects the current value of the assets or security, it doesn’t account for future expenses or fees that could impact returns on the fund or ETF.

Non-Market Factors: Non-market factors such as economic conditions, geopolitical events, and investor sentiments that may have an impact on fund performance are not included in NAV.

Common Misconceptions About NAV

High NAV always Have Expensive Funds: A higher Net Asset Value is never associated with an expensive fund or a fund with exceptional performance. It simply shows the value of per share in the fund.

Comparing NAVs helps in Assessing Funds: Only comparing NAVs of the funds based solely on it is not an ideal method. It is better for investors to compare the percentage returns of the fund over the same period to get a good overview.

Future Performance is Associated with NAV: Past NAV or current NAV does not imply anything for the future performance of the fund. Investors should look at other factors funds management, funds past performance, the sector it is associated with, and most importantly the holdings (stocks or securities) of the funds and the market conditions.

Low NAV does not Mean Poor Fund: Low NAV does not imply the fund is performing badly, it may be due to volatile or rescission market conditions. Check all other fundamentals well before investing.

Conclusion

NAV, or Net Asset Value, is a metric of mutual funds that helps assess the per-share value of its holdings. It is used to gauge the overall performance of the funds for every particular day. However, many people misinterpret NAV, believing it helps in assessing future growth potential or market price of the mutual fund, which leads to poor investment decisions. It’s important for investors to remember that NAV only represents the per-share value of the fund’s holdings, which helps investors understand the current value of their shares. It does not help in predicting future performance in any way. Investors need to understand that NAV is only for knowing their actual investment value, using it for other purposes may hinder in their informed investment goals.

FAQs

What is Net Asset Value (NAV) and why is it important?

Net Asset worth (NAV) is the per-share worth of a fund’s assets less its liabilities. It is critical for investors because it provides a correct assessment of their mutual fund and ETF investments, allowing them to make better decisions and track performance.

How is Net Asset Value different from the market price of a fund?

Net Asset Value is the intrinsic value of a fund’s shares as calculated at the end of each trading day. The market price, on the other hand, represents the current trading price of the fund’s shares on the stock exchange, which might fluctuate throughout the day, particularly for ETFs.

How do dividends and distributions affect NAV?

When a fund pays out dividends or distributions, the overall value of its assets falls, resulting in a decline in NAV. This, however, has no effect on the overall value of an investor’s holdings because the dividend is paid in cash or through reinvestment.

What factors can cause NAV to fluctuate?

NAV may vary owing to market volatility, changes in the value of the fund’s underlying assets, dividend and distribution distributions, and the deduction of expenses and fees from the fund’s assets.

Are there any limitations to using NAV as an investment metric?

Yes, NAV is limited in that it is determined only at the end of the trading day, does not reflect real-time market conditions, does not account for future growth potential, and is impacted by non-market factors such as economic conditions and investor sentiment.

Instagram

Instagram