Neutral Options Strategies: How to Trade Sideways Markets Effectively

The stock market roars, roars again, then falls silent. In this unpredictable dance, traders usually chase the bulls or bears, seeking profits amidst the stampede.

But what if a particular stock does not seem to be going anywhere at all? All traders will eventually slip into market doldrums. This stagnation period lasts for weeks, or worse, for months.

If you go long or short during this time, you will not make much or lose considerable (hard-earned) money. On the flip side, if you remain market-neutral, your profitability will likely outvalue those directional schooners at a robust pace.

How is that possible? Enter neutral options strategies. Traders use these approaches when they predict minimal stock price movements or are uncertain about the overall market’s direction.

Let’s explore the best neutral options strategies that will keep you ahead of the curve no matter the market’s mood.

Table of Contents

ToggleWhat is a Neutral Trend?

A neutral trend is a situation where the stock price or the market’s overall movement is neither predominantly upward (bullish) nor downward (bearish). Simply put, the market or price movement remains stable or sideways, indicating a balance between buying and selling pressures. Moreover, the situation results in a lack of a clear and sustained direction in stock markets.

A neutral trend in the bourses happens due to multiple reasons, including:

The market wants to find equilibrium and solidify profits or losses before the next directional move

Lack of significant macroeconomic news or data releases

Neutral sentiment among options traders, where neither optimism nor pessimism prevails

Options traders often use technical analysis indicators or chart patterns to identify periods of neutral market trends. Some common indicators they use for this purpose include moving averages, Bollinger Bands, and oscillators like the Relative Strength Index (RSI).

Advantages of Neutral Options Strategies

Here are some key benefits of neutral options strategies:

Time Decay (Theta)

Many options strategies leverage time decay, also called theta decay. As time passes, the value of options decreases, particularly for out-of-the-money (OTM) options. Traders employing neutral options strategies can benefit from this decay, especially if the market remains relatively flat.

Income Generation

Neutral options strategies involve selling options to generate income. When market volatility is low, options premiums may be less expensive, and traders can capitalize on this by selling options contracts.

Profit in Sideways Markets

Neutral options strategies can be profitable when markets are moving sideways or within a defined range, unlike directional strategies that rely on the stock moving significantly in one direction. This makes them particularly attractive during choppy or consolidating market environments.

Versatility

Traders can find several neutral options strategies, including iron condors, butterflies, and calendar spreads, to suit different market conditions and risk tolerances.

Also Read: Scalping Trading

Disadvantages of Neutral Options Strategies

Despite the benefits, neutral options strategies have the following drawbacks:

Limited Profit Potential

While selling options using neutral strategies provides a consistent cash flow, it also limits the profit potential. The maximum gain is usually capped at the premium received when initiating the trade.

Prone to Market Shocks

Unexpected market events, including geopolitical developments or economic surprises, trigger rapid and unpredictable price movements. Neutral options strategies do not perform well if stock markets experience a solid and sustained directional movement. In such cases, losses on one side of the position outweigh gains on the other, resulting in an overall loss.

Complexity

Some neutral options strategies, such as calendar spreads or iron condors, can be complex to implement as they involve multiple legs. Managing and adjusting these positions requires a good understanding of options mechanics and risk management.

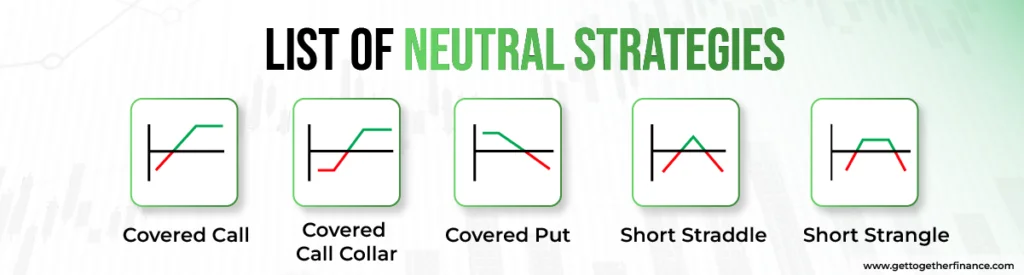

List of Neutral Strategies

Covered Call

A covered call is a neutral options strategy where you own shares of a stock and simultaneously sell a call option on it.

If the stock price stays below the strike price by the expiration date, the call option expires worthless, and you keep both the stock and the premium. Conversely, if the stock price exceeds the strike price by the expiration date, the buyer can purchase your shares at the strike price. Either way, your maximum profit is capped at the premium received plus any price appreciation below the strike price.

The covered call strategy is suitable for traders who are neutral to moderately bullish on the stock.

Covered Call Collar

A covered call collar, or simply called a collar, builds upon the simple covered call by adding an extra protection layer against considerable downward price movements. This neutral options strategy includes three primary components – owning the stock, selling a covered call, and buying a protective put.

Here is how it works:

- Own a specific number of shares of a stock

- Sell one out-of-the-money (OTM) call option on the same stock with a predefined strike price and expiration date

- Purchase one OTM put option on the same stock with the same expiration date but a lower strike price than the call option’s strike price

- Get the call option premium for selling the call option

Here, OTM means trading options at a higher price than the stock’s current market price (CMP).

Covered Put

A covered put is a neutral options strategy where an investor has a short position in the stock and sells put options against that short position. The put option sold is usually an OTM put. Traders use this tactic when they are neutral to moderately bearish on the stock’s price and want to generate income from the premium received by writing put options.

Short Straddle

To use a short straddle, you must simultaneously sell both call and put options with the same strike price and expiration date. Both the options you trade must be at-the-money (ATM), meaning the strike price is the same as the stock’s CMP.

This neutral options strategy is ideal when you believe price volatility will likely remain low, so you can collect option premiums without owning the stock. Your potential loss is unlimited if the stock price moves significantly in either direction.

Short Strangle

A short strangle involves simultaneously selling a call option and a put option (both OTM). This neutral options strategy is ideal when traders expect the stock to remain within a specific price range and want to profit from a decrease in the overall volatility of the stock.

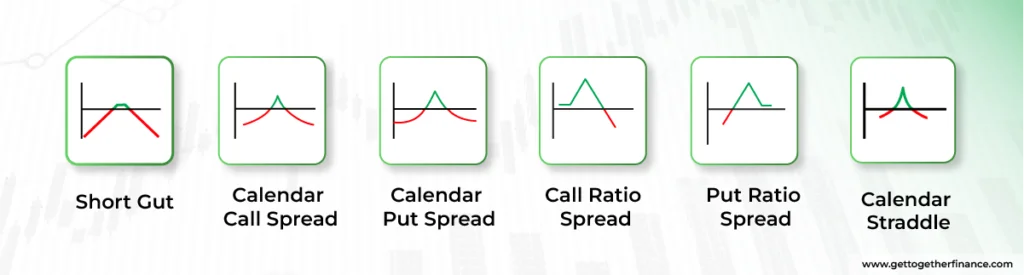

Short Gut

The short gut incorporates selling equal quantities of in-the-money (ITM) calls and puts of the same stock at the same expiration date. In other words, you trade options at strike prices below the stock’s CMP. In this neutral options strategy, the strikes should be equidistant from the CMP of the underlying stock.

Calendar Call Spread

A calendar call spread helps traders to profit from time decay and a neutral to slightly bullish outlook on the stock’s price. First, you write a call option with a near-term expiration date at a specified strike price, generally a few weeks or months away. Simultaneously, you purchase another call option with the same strike price but a longer-term expiration date, usually several months.

Calendar Put Spread

A calendar put spread is a neutral to bearish options strategy. Under this tactic, traders purchase a put option with a longer-term expiration date and simultaneously sell another put option with a near-term expiration date. Both the trades happen at the same strike price, typically OTM.

Call Ratio Spread

A call ratio spread is a neutral to bullish options strategy where you purchase call options at lower strikes (ITM) and sell more call options at higher strikes (OTM). Both options trades occur on the same underlying stock with the same expiration date.

Put Ratio Spread

A put ratio spread is a three-legged neutral options strategy where you buy ITM and ATM put options and sell more OTM put options. Both transactions happen on the same stock with the same expiration date.

When you sell more OTM puts, it is called the put ratio front spread. Conversely, the put ratio back spread arises when you buy more OTM puts.

Calendar Straddle

A calendar straddle involves the simultaneous purchase of call and put options with the same strike price but different expiration dates. This neutral options strategy includes the following trades:

- Sell ATM calls with a near-term expiration date

- Sell ATM puts with the same expiration date

- Purchase ATM calls with a later expiration date

- Purchase ATM puts with the same expiration date

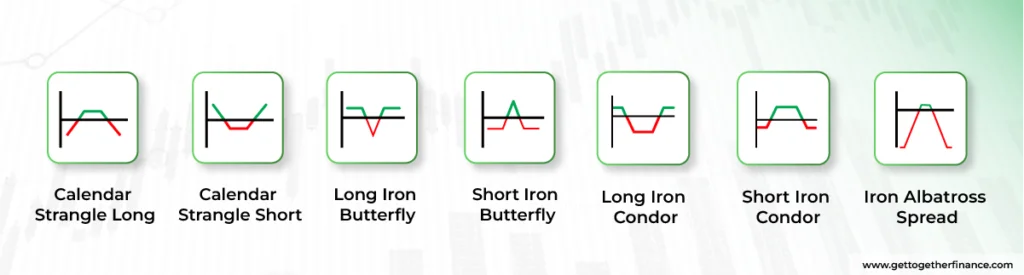

Calendar Strangle

A calendar strangle involves using two calendar spreads – short strangle and long strangle – with different strike prices but the same expiration date. This neutral options strategy is designed to leverage the time decay of options (theta decay) and profit from low volatility.

Here is how a calendar strangle is structured:

- Sell OTM call options with a near-term expiration date

- Simultaneously, purchase OTM call options with a later expiration date and the same strike price

- Sell OTM put options with the same near-term expiration date

- Simultaneously, purchase OTM put options with a later expiration date and the same strike price

Iron Butterfly Spread

An iron butterfly spread involves trading four options with the same expiration date but three different strike prices.

This neutral options strategy is further divided into:

Long Iron Butterfly

It includes the following transactions:

- Purchasing one OTM call/put option

- Selling two ATM call/put options

- Purchasing one OTM call/put option

Short Iron Butterfly

It includes the following transactions:

- Selling one OTM call/put option

- Buying two ATM call/put options

- Selling an OTM call/put option

You achieve the maximum profit if the stock price matches exactly the middle strike price at expiration. The maximum risk you bear is limited to the net premium paid or received when trading the options.

Iron Condor Spread

An iron condor spread contains two put options (long and short), two call options (long and short), and four strike prices, all with the same expiration date. This neutral options strategy also further breaks down into:

Long Iron Condor

It includes the following four legs:

- Purchase one far OTM put option

- Write one OTM put option

- Write one OTM call option

- Purchase one far OTM call option

Short Iron Condor

It includes the following four legs:

- Purchase one OTM put option

- Write one far OTM put option

- Purchase one OTM call option

- Write one far OTM call option

The pre-determined strike prices for buying and selling options should be equidistant from each other at the same expiration date.

Your profit hits its maximum if the stock’s price closes between the strike prices of the call and put options at expiration. Your maximum risk is limited to the difference in strike prices of either the put or call spreads minus the net options premium received.

Iron Albatross Spread

The iron albatross spread, also known as the wide iron condor spread, is an advanced yet powerful neutral options strategy that includes four separate trades:

- Buying far OTM call options

- Selling an OTM call option

- Purchasing far OTM put options

- Writing an OTM put option

Your maximum profit is the amount of options premium received, while your maximum loss is restricted to the difference between the strike prices of the options you traded.

Harvesting Profits, Sideways

In the ever-changing global market, where volatility can erupt unexpectedly, neutral options strategies offer a haven of calculated opportunity. They arm options traders with the tools to capitalize on uncertainty, hedge existing positions, and build a consistent income, even when the stock takes a breather.

While mastering these strategies requires dedication and thorough risk management, the potential rewards are undeniable. Plus, remember that neutrality can be your silent partner, whispering profit amidst the noise.

So, embrace stock market neutrality, include these powerful neutral options strategies in your trading arsenal, and let the market’s indecision become your greatest advantage.

FAQ

1. What are neutral options strategies in trading?

Neutral options strategies are trading tactics that investors use when they believe a stock’s price will experience minimal movement in the specified time frame. In these options strategies, traders profit from the lack of considerable price movement instead of anticipating a clear uptrend or downtrend.

2. Give brief examples of neutral options strategies.

Popular examples of neutral options strategies include ratio spreads, calendar spreads, covered call/put, and short straddle. For instance, in a cover call strategy, traders own a stock and sell call options against it. Additionally, a covered put involves selling put options while shorting the stock simultaneously.

3. Why choose neutral options over bullish or bearish?

Choosing neutral options strategies is the right move when you expect minimal stock price movement. These trading approaches offer profit potential in low-volatility scenarios, offering a buffer against market fluctuations. Unlike bullish or bearish trading strategies, neutral approaches are less prone to market movement, making them ideal in uncertain or sideways markets.

4. What are the factors guiding neutral options strategy implementation?

Factors, including implied volatility, stock’s fundamental analysis, economic events, traders’ risk appetite, and interest rates, influence the execution of neutral options strategies.

5. What are the ideal market conditions for neutral options strategies?

Here are some scenarios that offer neutral options strategies more favorable ground:

Low-to-moderate volatility with expected range-bound movement.

Sideways or range-bound markets with limited directional movement.

Stable economic ecosystem, where considerable market-shifting events are minimal.

Markets with reasonable liquidity to ensure smooth options trading.

Steady interest rates.

6. What are the risks in neutral options strategies, and how to minimize them?

The following are the major risks in neutral options strategies, and how to prevent them:

Even neutral options strategies can suffer losses if the stock’s price moves significantly beyond the expected range. So, use wider strike prices in your spreads to account for potential larger movements.

Options value decreases over time, significantly impacting profits, especially for longer-term strategies. Hence, choose shorter expiration dates for options, especially in low-volatility environments.

If the stock’s price approaches the strike price of your short options, the option holder might exercise early, forcing you to sell or buy the stock even if you don’t want to. Here, you can use strike prices further away from the current market price.

7. What is the impact of implied volatility on neutral options strategies?

Here is how implied volatility (IV) affects neutral options strategies:

High IV translates to inflated option premiums, resulting in potentially larger profits if the strategy plays out successfully.

High IV leads to higher option prices, requiring a larger initial investment and eating into potential gains.

High IV can expand the range of potential price movements, impacting the risk/reward profile of neutral options strategies.

8. How do traders adjust neutral options strategies to changes?

Traders can adjust neutral options strategies in several ways to keep pace with evolving market conditions, some of which include:

Extend the duration of a strategy to later expiration dates, allowing more time for the market to move within the desired range.

Adjust strike prices to better align with the current market conditions or create a wider range for potential profits.

Modify the number of options in each leg of your spread to adjust risk and potential reward.

Close existing positions and open new ones with modified parameters to better align with market shifts.

9. What are some common mistakes to avoid in neutral options strategies?

Avoid these common mistakes while implementing neutral options strategies:

Misjudging the impact of implied volatility on options pricing and potential returns.

Poor risk management, such as not setting stop-loss orders or failing to adjust positions when needed.

Not continuously monitoring the positions and adjusting them.

Relying only on a single neutral options strategy.

Trading options of illiquid stocks.

Entering or exiting options trades at the wrong time.

Panic-sell or hold onto losing positions based on gut feelings.

Picking the wrong strike price and expiration date.

10. What is the impact of economic indicators on neutral options strategies?

While neutral options strategies are direction-agnostic, economic indicators can still influence them:

Volatility: High stock price volatility due to inflation, GDP, and interest rates benefits neutral strategies as they profit from price swings in either direction.

Trading sentiment: Unexpected economic news might trigger early selling/buying, affecting your planned profit timeline, or even leading to losses.

Hedging effectiveness: If you use neutral options for hedging, their efficacy depends on how the economic indicator affects the stock. For instance, a positive indicator might counterbalance the hedge’s protection.

Facebook

Facebook Instagram

Instagram Youtube

Youtube