Investing in New Fund Offers (NFO): Definition, Types and Advantages

Introduction

A new fund offer is the offering of a new fund by an asset management company (AMC) to the public, it allows investors to purchase the mutual fund units at the initial offer price. NFOs come with great opportunities for investors who want to go with funds having excellent growth potential, they can take early bird entry and enjoy gains over time.

This blog will cover definitions, types, and the significance NFOs hold in the Indian stock market for your detailed understanding. With a detailed understanding of NFOs, you can assess funds that align with your future investment goals. Whether you’re investing to diversify your portfolio or seeking new investment opportunities, New Fund Offer can offer both. Let’s dive into the world of NFOs and their role in financial growth!!!

What is an NFO (New Fund Offer)?

In the simplest language, a New Fund Offer is the initial launch of a mutual fund by an asset management company. Similar to IPOs, just like shares are first time offered to the public, mutual funds are offered to the public for the first time. During the offering period, the fund is open for investors to buy its unit at a fixed price (decided by AMC). The offering period of NFO typically lasts for a few weeks, and investors can place their early order before it starts trading in the market. Once the New Fund Offer’s offering period ends, it is launched in the live market, open to everyone. After this, funds units are available at NAV prevailing to the market prices.

Why is NFO Important?

NFO holds a significant importance in the investment ecosystem, here’s how:

- They give investors an opportunity to participate in new investment instruments with different sectors and holdings that were previously unavailable in the market.

- It is an appealing investment option for investors looking to diversify their portfolios.

- Investment in a good NFO can give investors the advantage of early bird entry at a lower price and as the holdings of funds grow its NAV grows; the high NAV can give them good returns.

- NFOs can have the advantage of new fund structures that align with dynamic market structures, giving investors access to the latest market opportunities.

- At last, NFO plays a huge role in expanding investment opportunities and capitalizing on emerging market trends and sectors.

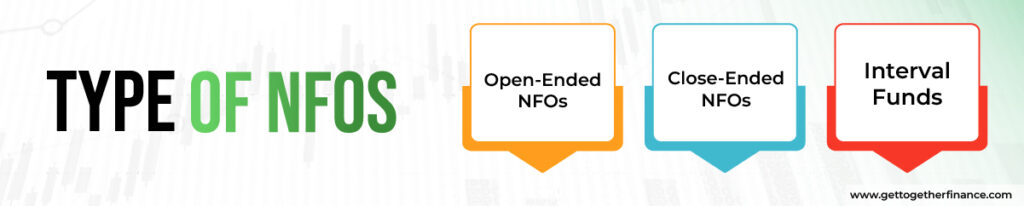

Type of NFOs

There are 3 major types of NFOs, and understanding them will help you in making informed investment decisions. Here are the three major types:

Open-Ended NFOs

Open-ended NFOs are mutual funds that remain open for investors to enter and exit at any time after the initial offering time has ended. These are normal mutual funds that we all can enter or exit at any given time; buying and selling of the fund’s unit is based on the latest NAV based on market prices. These funds offer high liquidity, allowing investors to redeem their units or invested amounts according to their convenience.

Open-ended mutual funds are best for investors who are looking to capitalize on every market opportunity they get and want flexibility with their investment money. They are dynamically managed by the fund manager and new investors can enter based on the market conditions. Similarly, existing investors can exit based on the fund’s performance and market trends.

Close-Ended NFOs

Close-ended NFOs have a fixed maturity period, implying that investors who once invested their money in it cannot redeem their units before the completion of the lock-in period or maturity period. Investors can only invest in close-ended NFOs during the initial offering; investors cannot buy or sell units of close-ended NFOs directly through the fund house after this period ends.

However, as per the SEBI, these units are listed on stock exchanges, allowing investors to trade them like stocks, having a fixed maturity date.

Closed-ended funds provide a stable asset structure to fund managers since they are not open for redemption for a certain period of time. This usually can lead to potentially higher returns. These funds are usually suitable for an investor who is looking to invest their money for a certain time horizon and wants a stable return on investment.

Interval Funds

Interval funds are a hybrid between open-ended and closed-ended funds. These funds give allowance to investors for buying and selling units at specific time intervals; these time intervals are predetermined and stated in the fund’s offer document. During these time intervals, the fund is equivalent to an open-ended fund, allowing investors to buy and redeem their units. Apart from this time period, funds are equivalent to closed-ended funds, restricting transactions. Interval funds are a good investment option for investors seeking a balance between commitment and flexibility with their capital.

Each type of New Fund Offer caters to different investment needs and risk profiles, so investors should choose the type that best matches their financial goals and liquidity preferences.

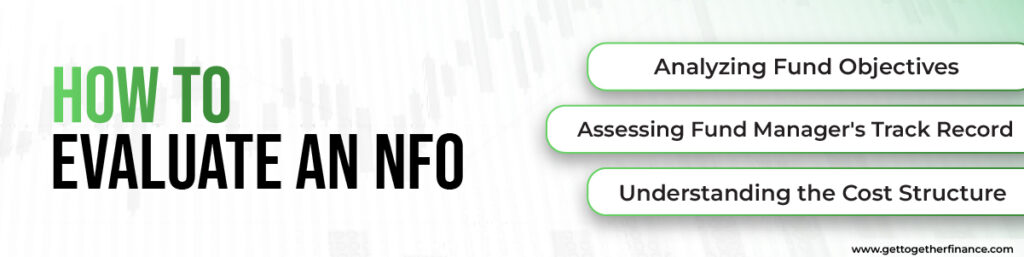

How to Evaluate an NFO

Now that you’ve understood what NFOs are, let’s learn how to evaluate them for informed investment decisions.

Analyzing Fund Objectives

Understanding the objectives associated with the new fund offering is the foremost step. Fund objectives should clearly define investment goals, and the holdings details of the fund to know where the investments are to be made. Your investment goals should be aligned with fund objectives, whether you want to enjoy compounding or capitalize on short-term opportunities, it should be aligned perfectly with the fund. For this, you need to look into the prospectus of the fund—be it growth, value, income, or a specific sector or theme.

Assessing Fund Manager’s Track Record

Fund managers decide the fate of NFO, their expertise, and experience in managing funds well in adverse market conditions is crucial for meeting your investment goals. Know the track record of the fund manager by assessing the funds previously managed by them and their results. Check the detailed record of the previously managed funds in terms of risk-to-reward ratio and their performance in every market condition. The fund manager whose track record of managing funds is good is more likely to give desired investment results in the New Fund Offer. Furthermore, knowing and understating the und manager’s investment plan and strategy can give you insights into how they will handle the upcoming fund.

Understanding the Cost Structure

Determining the net returns of the NFO depends on its cost structure. Common costs of the NFO include management fees, expense ratio, entry and exit loads, and other administrative expenses. The expense ratio covers annual operating costs, which is significant while analyzing the fund as the high expenses of the funds decline the profit percentage earned by investors. To assess whether the cost structure of a New Fund Offer is reliable, study the cost structure of similar funds to know whether you’re getting a competitive deal or not. Stay away from funds with high initial costs or ongoing fees, as these can significantly impact your overall profitability.

By thoroughly analyzing the above-mentioned metrics, you can judge whether the fund meets your investment goals or not. This detailed evaluation will help you identify funds that align with your investment goals and offer the best potential for returns.

Benefits of Investing in NFO

Investing in good NFOs comes with several benefits for investors, let’s know them:

Opportunity for Early Entry

One of the great benefits of investing in NFO is you get early and discounted access to the funds that are going to boom in the future. Early investment gives you access to be a part of the fund’s growth journey and enjoy the exorbitant returns in due course, potentially maximizing the gains as funds gain momentum in the market if their holdings are well managed. Furthermore, being an early bird in NFO can be advantageous because it gives them access to new and innovative investment strategies that are not yet widely available.

Great Potential for High Returns

If the fund is well managed, has great holdings, and invests in a growing sector, then it has enormous potential for giving high returns. Being new in the market, NFOs get the opportunity to exploit the emerging technologies and sector opportunities that existing funds may hinder. The low-cost entry that investors get in initial offerings combined with the strategic investment of fund managers can help in getting good returns over time. But, it is crucial to remember that risk and reward go hand in hand in the stock market, make sure you do your research well before putting your money in any NFO, as the fund’s performance is not yet established.

Diversification

Investing in NFOs comes with the benefit of diversifying your portfolio. NFOs can often introduce investment in unique themes, and sectors or introduce different investment strategies that are not so popular in the market yet. Capitalizing on these under-exploited investment strategies can be beneficial over time. By investing in good NFOs, you can spread your investment across various asset classes and sectors, reducing the overall risk. Diversification reduces the impact of declining prices of the single investment, resulting in a more balanced and resilient portfolio.

Also Read: CANSLIM

Risks of Investing in NFOs

Market Risk: NFOs are not always rewarding, they are susceptible to market volatility. Changes in interest rates, economic conditions, and political events can impact to NFOs’ performance leading to potential losses.

No Previous Data: Since NFOs are new, they do not have any history that can aid in understanding their probable performance. For NFO investors can only rely on an understanding of holdings AMC and fund manager reputation, this might not always lead to expected returns.

Liquidity Risks: Closed NFOs and interval NFOs often have limited liquidity. Investors might not get to sell their unit at the desired price before the fund matures or during non-trading intervals, this can be a barrier to booking the highest profits.

Fund Manager Risk: The performance of NFO highly depends on the fund manager’s resilience and strategy. Slight mismanagement or poor decisions regarding investment can negatively affect the fund’s performance.

Inflated Prices: Initial market cost and setup cost of NFOs can be a burden on AMCs, that lead to potentially higher expense ratios, which can further reduce returns.

Conclusion

New Fund Offerings (NFOs) provide unique opportunities and potential benefits for investors seeking to diversify their portfolios and capitalize on rising market trends. Investing early allows you to access funds at their creation and potentially earn substantial returns as the fund expands. However, it is critical to be aware of the hazards, which include market volatility, liquidity concerns, and a lack of performance history. These risks can be mitigated by carefully examining the fund’s objectives, the fund manager’s ability, and market conditions in general. Whether you are an experienced investor or new to the market, understanding the characteristics of NFOs can help you make informed investing decisions that match with your financial objectives. Investing in NFOs can be a profitable enterprise when addressed appropriately with diligence and strategic planning.

Frequently Asked Questions

What is a New Fund Offer (NFO)?

An asset management firm (AMC) issues a New Fund Offer (NFO) when it launches a new mutual fund. During this time, investors can purchase mutual fund units at a predetermined price before they begin trading in the market.

How do I evaluate the potential of an NFO?

To analyse an NFO, consider the fund’s objectives, the fund manager’s track record, the sectors or themes in which it invests, and its cost structure. Examine the AMC’s reputation and determine how well the fund’s strategy fits with your investment objectives.

What are the risks associated with investing in an NFO?

Risks include market volatility, a lack of historical performance data, liquidity limits (particularly with closed-ended and interval funds), fund management risks, and potentially higher expense ratios due to early establishment expenses.

Can I sell my units in a close-ended NFO before maturity?

Close-ended NFOs have a set maturity period, and units cannot be redeemed directly with the fund until then. However, these units are frequently listed on stock exchanges, allowing you to trade them as stocks, though liquidity may be limited.

How does investing in an NFO help with portfolio diversification?

NFOs can provide new themes, industries, and investing methods that are not present in current funds. Investing in NFOs allows you to diversify your portfolio across asset classes and sectors, lowering overall risk while increasing possible rewards.

Instagram

Instagram