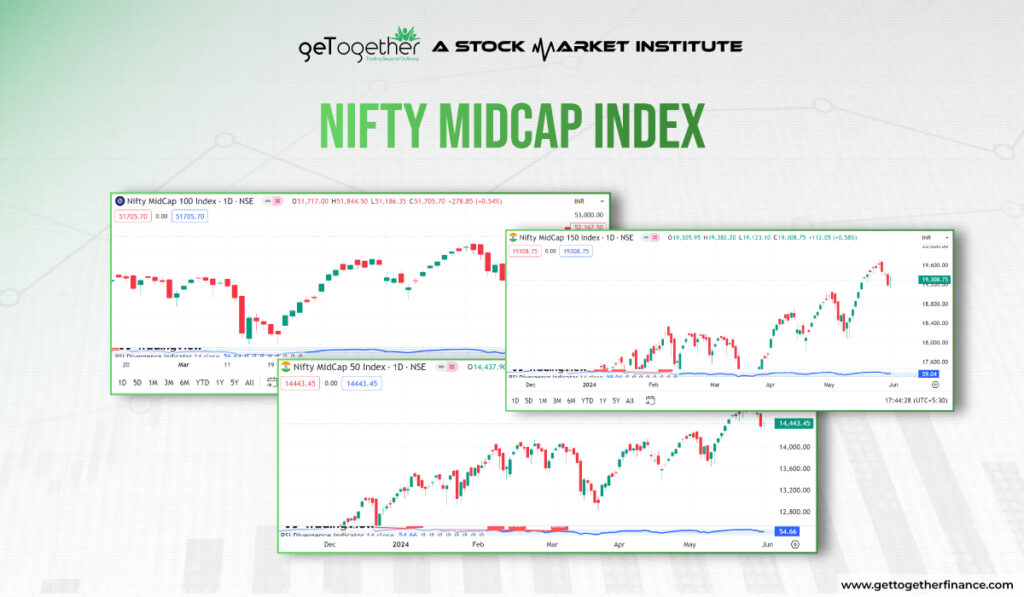

NIFTY MIDCAP INDEX

Introduction

The National Stock Exchange (NSE) has created benchmarks of NIFTY to track certain segments of the stock market. These indices comprise different categories such as large-caps, small-caps, and mid-caps stocks. They thoroughly help investors understand market trends and make informed decisions based on market outlook. NIFTY midcap indexes such as midcap 50, midcap 100, and midcap 150 track the medium-sized listed companies whose valuation falls between large and small-cap companies.

People often are finding the road between the companies that are still in their growth phase for stable yet growing investment. That’s when midcap companies come to the rescue. Mid-cap companies offer a balance of growth and stability making them attractive investments. If the company is good in both technicals and fundamentals, it can offer good returns compared to large-caps while being less riskier than small-cap stocks. This blend of risk and reward makes midcap indices important for portfolio diversification and long-term investment strategies.

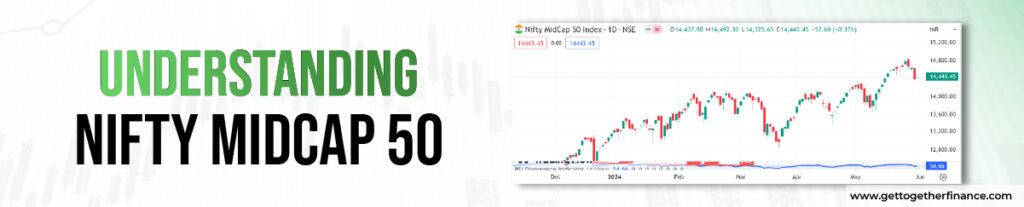

Understanding NIFTY Midcap 50

Definition and Composition

The NIFTY Midcap 50 represents the performance of the top 50 midcap companies listed on the NSE. These companies are selected based on their market capitalization and trading volume in the market, that is the total value of outstanding shares in the open market. The market movement of mid-cap companies is aimed to be captured with this index. Which eventually helps investors who are seeking investment in the midcap sector.

Also Read: Small Cap v/s Large Cap

Selection Criteria

Not every company can be included in the NIFTY Midcap 50 index, there are certain criteria that the company needs to fulfill. Firstly, the company mandatorily needs to be part of NIFTY MIDCAP 150. From nifty midcap 150, the 50 most liquid stocks are chosen based on trading volume and impact cost, which measures the cost of trading of stock. This makes sure that the chosen companies are not only good in market cap but are actively traded by traders. These layers of selection criteria ensure the reliability of the index.

Here are some of the well-known stocks of Midcap 50:

- Ashok Leyland: Auto Sector

- SAIL: Metal Sector

- SUZLON Energy: Energy Sector

- AU Bank: Financial Services

Exploring NIFTY Midcap 100

Definition and Composition

The NIFTY Midcap 100 is an index that represents the top 100 well-performing mid-cap companies listed on NSE. It provides a holistic view of the midcap category, capturing the performance of mid-cap companies that fall between the large-cap and small-cap categories.

Selection Criteria

The NIFTY Midcap 100 index comprises 100 businesses selected from the NIFTY Midcap 150 index. These companies are chosen based on market capitalization and financial performance. To guarantee that the index accurately reflects the midcap market, likewise to NIFTY Midcap 50, only the most liquid and specific stocks are included. This selection method entails an analysis of daily trade volume and price impact, ensuring that the chosen companies are significant and actively traded. This method guarantees that the index remains a trusted model for investors.

Here are some of the well-known stocks of Midcap 100:

- Godrej Properties: Real Estate Sector

- HDFCAMC: Finance Sector

- Voltas Ltd: Home Appliances

- Bharat Heavy Electricals: PSE Sector

- Aurobindo Pharma: Pharma Sector

Insights into NIFTY Midcap 150

Definition and Composition

The Nifty Midcap 150 index tracks the performance of India’s top 150 companies listed on the National Stock Exchange (NSE). These companies are classified as midcaps because their market capitalization falls between large and small companies. Nifty Midcap 150 provides a comprehensive overview of the midcap market, including a diverse range of companies and sectors.

Selection Criteria

The companies included in the NIFTY Midcap 150 are chosen based on specified criteria to guarantee that the index accurately represents the mid-cap category. First, companies must achieve a particular amount of market capitalization that qualifies them as mid-cap rather than large-cap. In addition, liquidity is a crucial aspect; only actively traded companies with high trading volume are included. This is derived by taking into account average daily turnover and cost impact, ensuring that index shares can be purchased and sold without materially influencing their value. This selection approach helps to create a robust and representative index on which investors may rely for information about the mid-cap market.

Here are some well-known stocks of Midcap 150:

- SunTv Network: Network & Media Sector

- NHPC Ltd: PSE Sector

- ZEEL: Network & Media Sector

- Bank of India: PSU Banks

- J K Cements: Infrastructure Sector

… and the list goes on with companies of different sectors.

Comparing NIFTY Midcap 50, Midcap 100, and Midcap 150

Liquidity

The three Midcap NIFTY have different liquidity range. More liquid stocks are taken into consideration in Midcap 50 with high trading volume and lower impact cost. Follwingly, Midcap 100 focuses on stocks between large and small midcap with comparatively low liquidity. At last, the Midcap 150 contains a varied range of companies, including those with lesser liquidity than the top 50 and 100.

Market Capitalization Comparison

NIFTY midcap consists of top midcap companies that rank from 1-50 in terms of market capitalization. Followed by the Midcap 100 and the Midcap 150. Nifty Midcap has top midcap companies. Following, Midcap 100 has companies ranked 101-200 in terms of market capitalization. At last, Midcap 150 consists of companies ranked 101-250 in terms of market capitalization.

Volatility and Risk Assessment

The level of volatility and risk may change between the three sub-indices due to differences in market structure and size. NIFTY Midcap 50 is highly volatile due to companies with high market cap and low constituents. Whereas, the Midcap 50 is moderately volatile based on its increased constituent companies. At last, the NIFTY 150 is comparatively very less volatile since the number of companies is high and they balance out the losses of each other. The mid-cap 100 and 150, along with more diversified portfolios, may contain less conflict and risk data. Investors can select a mid-cap stock based on their risk tolerance and investing objectives.

Why should you invest in Midcap stocks?

Growth Potential

Midcap indices offer significant growth potential in the investment ecosystem. Midcap companies are usually in the growth phase, which provides a lot of growth and expansion opportunities, eventually rewarding its investors.

Diversification Benefits

Another significant benefit of midcap companies is their diversification potential. Diversification entails spreading investments across multiple sectors to lessen overall risk. Midcap stocks represent corporations from a variety of industries and areas. This classification helps to mitigate the risks connected with investing in a particular sector or company. Even if some companies in the index underperform, others may outperform, balancing earnings with sectoral rotation. As a result, investing in midcap indices can give investors with greater investment balance and diversity, mitigating the impact of a company’s bad performance.

Risk and Reward Balance

Mid-cap stocks provide an appropriate blend of risk and reward Mid-cap stocks come as less risky than small-cap businesses due to their increased size and possibly stable volatility, and they also have the potential for bigger profits. Mid-cap stocks provide industries with a balance between risk and reward ratio. While the midcap index exhibits short-term fluctuations, by seeing the historical data, the midcap index has provided good returns over the time experienced. As a result, a mix of mid-cap equities and mutual funds can help investors attain both stability and return.

Conclusion

The NIFTY Midcap indexes, which include the Midcap 50, Midcap 100, and Midcap 150, are important instruments for investors looking to diversify their portfolios and capitalize on the growth potential of mid-sized companies. These indices offer a balanced approach to investing, with a combination of stability and growth that appeals to both risk-averse and growth-oriented investors. The NIFTY Midcap 50 provides exposure to the best-performing midcap equities, and the Midcap 100 and Midcap 150 provide more diverse possibilities. Understanding the content, selection criteria, and performance measures of these indexes allows investors to make more educated decisions and optimize their investing strategies. Mid Cap indexes, with their potential for significant returns and relatively reduced risk compared to small-cap stocks, are an important component of a well-rounded investment portfolio, supporting long-term financial growth and stability.

FAQs

Q1. What are midcap indices and why are they important?

Midcap indices, including the NIFTY Midcap 50, Midcap 100, and Midcap 150, reflect the performance of medium-sized companies listed on India’s National Stock Exchange (NSE). These companies strike a balance between growth potential and stability, making them appealing to investors looking to diversify their portfolios and achieve long-term financial success.

Q2. How are companies selected for the NIFTY Midcap 50, 100, and 150 indices?

Companies are chosen according to their market capitalization and liquidity. The NIFTY Midcap 50 comprises the top 50 businesses from the NIFTY Midcap 150, chosen based on trading volume and impact cost. The NIFTY Midcap 100 contains the top 100 companies, while the NIFTY Midcap 150 includes the top 150, providing a full picture of the midcap market.

Q3. What is the difference between NIFTY Midcap 50, Midcap 100, and Midcap 150?

The main distinction is in their composition: the NIFTY Midcap 50 contains the top 50 midcap businesses, the Midcap 100 includes the top 100, and the Midcap 150 includes the top 150. This diversity in composition influences their market capitalization, volatility, and risk levels, providing investors with a variety of options according to their investing objectives and risk tolerance.

Q4. What are the benefits of investing in midcap indices?

Investing in midcap indexes has various advantages, including large growth potential, diversity, and a balanced risk-reward ratio. Midcap firms are frequently in growth mode, providing better returns than large-cap stocks, and their diversification across sectors helps offset risks associated with specific companies or industries.

Q5. How can I include midcap indices in my investment portfolio?

You can incorporate midcap indexes into your investment portfolio by investing in mutual funds or exchange-traded funds (ETFs) that track them. You can also invest directly in the constituent equities of the midcap indices, depending on your investment plan and risk tolerance. It is recommended that you talk with a financial professional to identify the optimal strategy for your unique financial objectives.

Instagram

Instagram