Options Chain Analysis: Unveiling Insights for Experienced Traders

Introduction

In the world of options trading, gaining a competitive edge can make all the difference. One powerful tool that experienced traders utilizes is options chain analysis. By examining the options chain, traders can extract valuable insights about market sentiment, trends, and potential price movements. In this article, we will delve into the intricacies of options chain analysis, demystifying its key components and highlighting its significance in informed decision-making.

Understanding Options Chains

An options chain is a comprehensive listing of all available options contracts for a particular underlying asset, such as stocks, ETFs, or indices. It provides traders with a detailed overview of various strike prices, expiration dates, OI data, changes in OI data, IV, and volume. Analyzing an options chain can help traders gauge market expectations, identify potential support and resistance levels, and uncover profit opportunities.

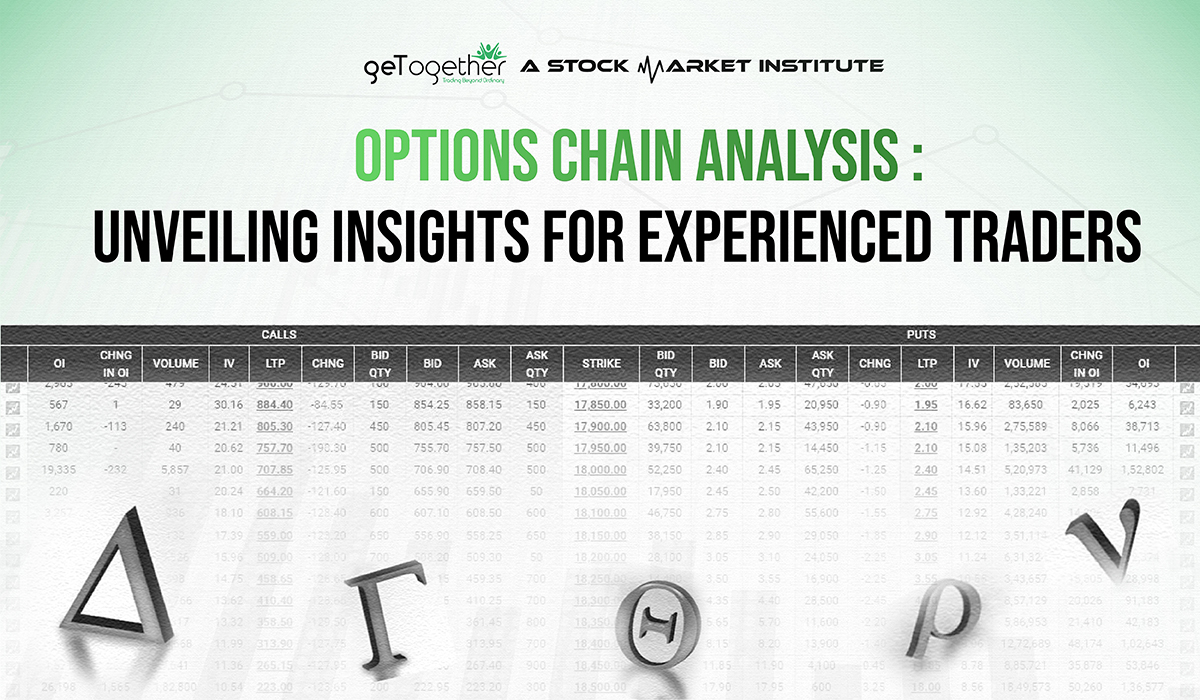

Option Chain Matrix

An option chain also known as an option chain matrix is the list of options available for a certain security. It lists all puts and calls available for the underlying asset with their volume, LTP, OI, strike price, bid price, ask price, and expiration date. There are four columns in the option chain matrix that traders can focus on for finding an excellent options trade setup:

- Latest trade price column- It displays the last traded price of the option (call and put both)

- Net Change Volume- The net volume change represents the change in buying and selling of the underlying asset.

- Bid Column- It shows the availability of the buyers for a particular price.

- Ask Column- It shows the availability of the sellers for a particular price.

Key Components of an Options Chain

Let’s explore the essential elements found within an options chain:

Option Symbol:

Each option contract has a unique symbol that identifies the underlying asset, expiration date, and strike price. This symbol helps traders differentiate between different options and facilitates accurate analysis.

Strike Price:

The strike price is a prearranged price at which the underlying asset can be purchased or sold when an option is exercised. It is a key factor in determining the potential profit in the selected options contract.

Expiration Date:

Options have an expiration date, indicating the last day on which the contract can be exercised. Different expiration dates offer varying timeframes for traders to capture potential price movements. This helps traders to remain informed about the expiry and many more factors which can affect their options trade.

Call and Put Options:

Options chains consist of both call and put options. Call options give the holder the right to buy the underlying asset, while put options grant the right to sell it. Understanding the distinction between these options is vital for effective analysis. As this provides many insights such as volume, OI (open interest) etc.

Interpreting Options Prices and Volumes:

Option prices and volumes are essential data points in options chain analysis. options prices help to identify the authenticity of contracts by considering factors such as Implied volatility ( IV ) and more. Volume data helps determine the level of interest or activity in specific options contracts, indicating potential areas of focus.

Implied Volatility and Its Impact on Options:

Implied volatility is a measure of the market’s expectations for future price fluctuations. Higher implied volatility indicates greater uncertainty, leading to increased options premiums. Traders analyze implied volatility to assess options’ perceived risk and potential profitability.

Analyzing Open Interest and Volume:

Open interest refers to the total number of outstanding options contracts for a particular strike price and expiration date. By monitoring changes in open interest and volume, traders can gain insights into market sentiment and identify areas where significant buying or selling pressure exists. Traders majorly use it for indices such as bank nifty and nifty.

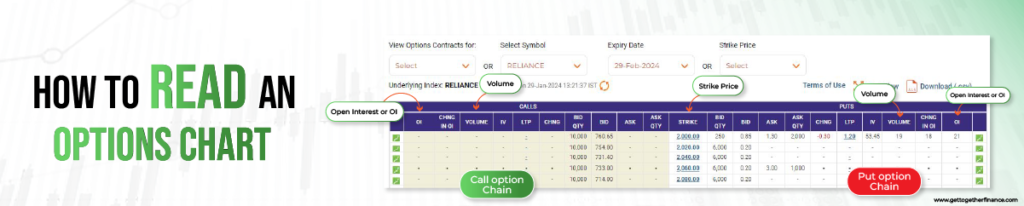

How to Read an Options Chart

The options chart comes with a list of all available options for the stock or underlying asset. Different elements in the charts need the trader’s focus for a better understanding of options. Well, the enigma of these element or option charts is not so tough, here’s how you can read it easily:

Option Type:

There are two types of options; call options and put options. Traders buy the call option and sell the put option when the market outlook is bullish. On the contrary, traders buy the put option and sell the call option when the market outlook is bearish.

Market Sentiment

Firstly, you need to analyze the market outlook with the help of technical analysis. You need to be sure whether the market is going bullish, bearish, or going to remain neutral for some time.

Strike Price

The strike price on an options contract is the price at which the underlying security can be either bought or sold once exercised.

Open Interest or OI

Open Interest refers to the interest of traders at a certain strike price. The bigger the OI, the greater the traders’ interest in an option’s actual strike price. If the strike price has increased interest then it may become tough for the underlying asset to cross that point.

Volume

The volume shows the number of contracts bought or sold for the particular strike price. The increased interest of traders leads to increased volume.

At last, reading the option chain is necessary, but you need to master the advanced technical analysis to take the help of options chain elements. The price movement depicted by the candlestick chart is a major indicator of future movements. Use all option chain analysis as an add-on to your technical study, do not rely on them wholly.

Also Read: Bid-Ask Spread

Usage of Option Chain

Option chains are financial tools for derivatives trading. The matrix of calls and puts along with trading tools like Implied volatility and options Greeks. They give a better understanding of trader sentiments for the particular underlying asset and its options at a given point in time.

Mainly, the option chains are used for analyzing the option strength with the help of its OI and volume. High OI of particular strike prices indicates that institutions have shorted their positions. It indicates that it may be tough for the underlying asset to cross that price point.

For instance, currently, NIFTY is at 20000, now there is a call option for 20200 with high OI, which means institutions are expecting that the market will not go above the 20200 mark. The same happens in the scenario where there is a put option of 19800 with a high OI, which means institutions are anticipating that the market will not go below the 19800 mark.

The options chain is crucial for investors and traders to make informed trading decisions. But, to get a sure shot at trades in the market, align your technical analysis with option chain analysis. It helps in assessing market sentiments, risk tolerance, and capital positioning all with a practical and reliable approach.

NOTE: When you are analyzing the stock chart with the help of demand and supply theory, there is no use in reading options chains based on the depth of OI and volume. You can enter into trades solely based on your analysis of demand and supply.

Option Chains Example

As mentioned above, the options chain can be described as a list of all option contracts. It comes in two sections: call and put with buy and sell options for both. A call option is a contract that grants you the right but does not oblige you to buy an underlying asset at a specific price and before the expiration date. Here’s what the option chain looks like.

Option Chain vs Price Action: Key Differences

Option chain and price action are two different approaches used in the stock market for trading and investing. Both have different methodologies for different purposes. Here are the key differences between them:

1. Option Chain

All its data is derived from the movement of its underlying asset, it can be stock or commodity. Here are its functions:

- Derivatives centered: The option chain focuses on derivatives that involve call and put options. It has a certain expiry date and is highly impacted by the slight movement in the market.

- Risk Management: Traders use option chains to manage their equity holdings and hedge against unfavorable market conditions. Options are assessed based on market conditions and risk tolerance of the trader.

- Market Sentiments: The option chain clearly reflects the market sentiments with its indicators like OI, Volume, Option Greeks, etc. They depict how traders are anticipating the market.

- Strategy Development: Investors use option chains to develop risk-reward strategies, such as covered calls or protected puts, in a variety of market circumstances.

2. Price Action

Price action is based on technical analysis of candlestick charts, it can be done for both derivatives and cash securities. Here’s how it functions:

- Underlying Asset Management: Price action analysis analyzes the history and current movements of the underlying asset’s or the stock’s price, frequently utilizing charts and technical analysis and demand and supply.

- Trend Identification: Traders look at price patterns, demand, and supply zones, and chart formations to spot trends and potential reversals.

- Psychological Factors: Price action considers market psychology, emphasizing the importance of key price levels with good zones and patterns of candles as indicators of institutional behavior.

- Entry and Exit Points: The entry and exit points are very well assessed by the trader with the help of candlestick patterns.

In summary, while option chains provide information on options and market sentiment, price action analysis focuses on the movement of the underlying asset as well as the psychological aspects of market behavior. A good trader needs to use both tactics to get a thorough grasp of market dynamics and make informed investments.

Using Options Chain Analysis in Trading Decisions

Options chain analysis serves as a valuable tool in making informed trading decisions. it gives you add-on confirmation that you are choosing the right path for yourself while trading By integrating the insights derived from options chain analysis with technical analysis, traders can enhance their understanding of the market and make more accurate predictions.

Dangers and Limits of Options Chain Examination

While option chain examination gives significant bits of knowledge, recognizing its intrinsic dangers and limitations is important. Options prices can be influenced by a variety of factors, and market conditions can shift rapidly. Traders shouldn’t just rely on options chain analysis to make decisions about trading. To ensure a comprehensive analysis, it is essential to take into account additional technical indicators.

Conclusion

Options chain analysis is a potent instrument that provides traders with useful insights into market sentiment, trends, and potential price movements. Traders can increase their chances of success in the volatile world of options trading by thoroughly examining the options chain. options chain acts as an add-on confirmation for your options trades.

FAQs

Q1. What is Option Chain Analysis?

Option chain analysis involves studying and analyzing the matrix of call and put options for an underlying asset or the stock. Traders look onto various strike prices and expiration dates of options to make informed decisions on different options strategies. Key options indicators such as implied volatility, option greeks and open interest help in understanding market sentiment and further predicting next market movements. This analysis aids in risk management, strategy development, and understanding potential price movements in the options market.

Q2. How does option chain analysis help in predicting market trends?

Option chain analysis helps in forecasting market trends by providing insights into market and traders sentiment and expectations. Traders can analyze the current open interest, implied volatility, and strike prices to get a clear view of their trade. This information helps in predicting potential price movements, allowing traders to make informed decisions on market direction and trends.

Q3. Can you explain the key components of an option chain?

The key components of an option chain are implied volatility, option greek, strike price, volume, call and put prices, and open interest.

Q4. What role does implied volatility and open interest play in the option chain?

Implied volatility reflects market expectations for future price movement, crucial for assessing potential profitability in the options trade. Open interest measures the number of pending orders and the interest of traders in a particular trade, indicating market activity and liquidity. Both factors in the option chain inform traders about market sentiment and potential price movements.

Q5. How do traders use option chain data to make informed decisions?

Traders use option chain data to make informed trading or investment decisions by analyzing expiration dates, strike prices, implied volatility, option greeks, and open interest. This information helps in selecting apt option trading strategy, risk management, and understanding market sentiment, enabling traders to anticipate price movements and optimize their positions in the options market.

Q6. What are some common strategies derived from option chain analysis?

Common strategies derived from option chain analysis include covered calls, protective puts, straddles, and strangles. Traders can use specific options with different strike prices and expiration dates to manage risk, generate income, or speculate on price movements on the underlying asset.

Q7. How does option chain analysis differ from technical analysis in trading?

Option chain analysis is about evaluating the matrix of call and put options for an underlying asset, by seeing strike prices and expiration dates. It provides insights into market sentiment and potential price movements for an underlying asset. In contrast, technical analysis involves studying historical price data and candlestick chart patterns to identify trends and key levels, by focusing on the psychological aspects of market behavior. Both approaches offer distinct perspectives for traders. Combining technical analysis and option chain analysis can benefit a trader immensely.

Q8. What impact can option chain analysis have on risk management in trading?

Option chain analysis significantly impacts risk management in trading by allowing traders to select and trade options contracts aligned with their risk tolerance and understanding. By analyzing and considering various strike prices and expiration dates, traders can amend strategies to optimize risk and reward, enhancing their ability to bear the dynamic nature of the stock market.

Q9. Are there any specific indicators or signals within the option chain that traders commonly look for?

Traders frequently search for certain signs in the option chain, such as high implied volatility, low theta decay, or big fluctuations in open interest. Unusual patterns in these measurements can indicate possible market movements or shifts in sentiment, assisting traders in their decision-making.

Q10. How frequently should one review the option chain for effective market analysis?

To keep up with shifting market conditions, traders frequently check the option chain on a daily basis. Regular monitoring helps to catch changes in implied volatility, open interest, and prospective possibilities for informed decision-making.

Q11. How frequently should I examine the options chain?

Analyzing the options chain regularly is a good idea, especially before entering or exiting a trade. Keeping up with the most recent options data can give you a competitive advantage because market conditions can change quickly.

Q12. Can options chain analysis predict price movements with certainty?

Options chain analysis provides insights into market sentiment and trends but cannot predict price movements with absolute certainty. It should be used as part of a comprehensive trading strategy that incorporates other indicators and risk management techniques.

Q13. Are there any free resources for accessing option chains?

Yes, several financial websites like NSE option chain and trading platforms like Sharekhan provide free access to option chains. It is advisable to explore reliable sources that offer comprehensive and up-to-date options data.

Q14. How can options chain analysis be used in conjunction with technical analysis?

Options chain analysis can complement technical analysis by providing insights into market expectations and sentiment. By combining both approaches, traders can gain a more comprehensive understanding of the underlying asset and make better-informed trading decisions.

Q15. Can options chain analysis be used for other financial instruments besides stocks?

Yes, options chain analysis can be applied to various financial instruments, including ETFs, indices, commodities, and futures. The principles and techniques remain largely the same across different asset classes.

CATEGORIES

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube