Outside Days: Technical Method to Spot Price Action

- April 19, 2025

- 504 Views

- by Manaswi Agarwal

As a regular market participant or a full time stock trader, it is essential for you to understand outside day patterns in security. The pattern can either be bullish or bearish depending on the market conditions and direction of the price trends. To trade based on this pattern, dive deep into this blog and appropriate strategies for trading.

What is an Outside Day Trading?

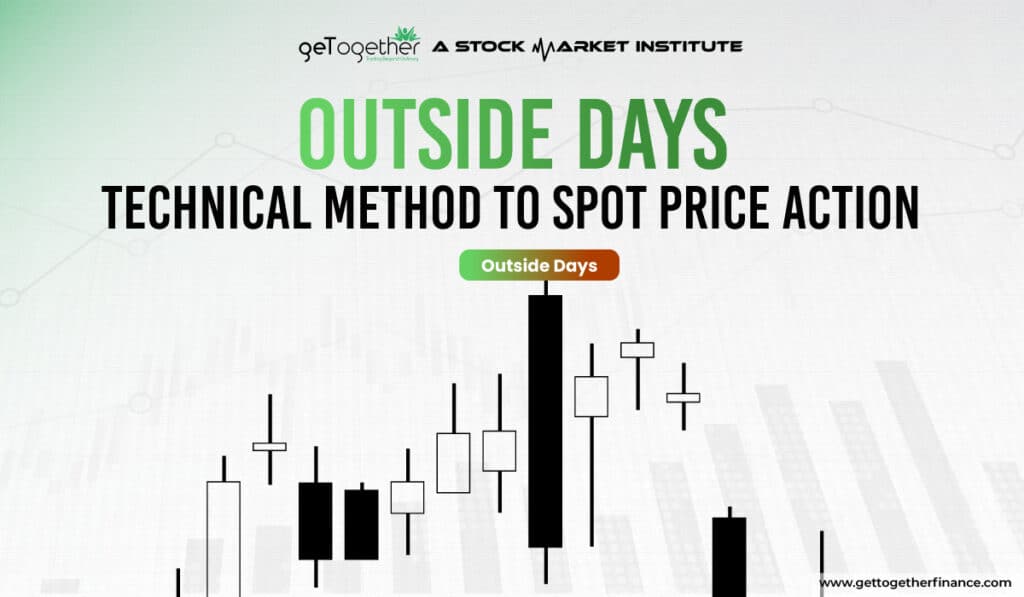

Outside days is a technical chart pattern which is used by stock traders to make certain profits by recognizing increased volatility in the market. Outside day is a trading form according to which the price action of an outside day determines the outside range of the previous day.

How to Identify an Outside Days Pattern?

To determine the formation of outside day, traders are required to look at certain features which are:

Higher High and Lower Low: when the candlestick bars continuously form higher highs and lower lows and from the outside they pattern the price of the current day should exceed the high or low of the previous trading session.

Opening and Closing Price: The opening and closing prices of the current trading session must lie outside the range found by the previous day prices.

Two Day Pattern: the price pattern of an outside day pattern consists of a two bar pattern where the bars consider the price behavior of two consecutive days.

Types of outside days

To determine the trend, traders can look for four types of outside days pattern

- First bar up, second bar up determines upward continuation of the trend.

- First bar down, second bar up is the determination of a reversal pattern where the buyers become active.

- First bar up, second bar down is considered as a warning signal where the sellers are regaining the strength.

- First bar down, second bar down is an indication of a continuation pattern where downtrend is followed in the security.

When does Outside Day occur?

Generally an outside day occurs when the price trades below the previous session’s low or above the high of the previous session. A trend reversal is signified when the entire price action occurs outside the previous range especially when the prices have reached the edge of an existing range.

It is observed that after the occurrence of an outside day when the price moves higher on the following day a trader can go long for the positions and vice versa if the price drops considerably.

Example: Let say if the price of ‘A’ on a date closed at Rs300 and on the following day if the price opens at 295 and gives a rally by pushing the prices to 310 which make a higher high compared to the previous day trading session but then it closes at 295 giving a lower low compare to the previous day trading session.

This forms an outside day as the price gives us a higher high of 310 and lower low of 295 as compared to the previous state reading session. However this also depends upon certain factors like volume, market behavior and external conditions.

Limitation of an Outside Day

To seek the validation of an outside day pattern, you are required to wait for additional confirmation before taking any action. For example the traders must look for a follow through candle in the same direction after the occurrence of outside day.

Volume

Another important factor that validates the price movement in the security is volume. Volume plays an important role to ascertain the number of buyers as sellers as per the expected price action.

A high volume suggests a stronger participation in the move while a lower volume does not give a confirmation to execute the trade as it might not give a proper move and hence traders wait for a more compelling signal.

Market Behavior

Outside day trading patterns lack the power of certainty which can result in false signals leading traders to get trapped. Change in market behavior and market impulse can simply fail due to external market factors like sudden news events and other indecisive states which can lead traders towards confusion.

Late Entry/Exit

By the time the outside day provides signals of entry or exit into the market, the price movement may already have occurred and hence might not give an extra. This results in missed opportunities due to entrance in trades too late. Additionally, it does not let you manage your risks appropriately, it requires the use of a demand and supply approach to better protect your losses.

Outside Days Advantages

Outside Day pattern is one technical analysis pattern which has several advantages when trades are executed correctly. Below are discussed some potential advantages of outside days:

Signals Potential Reversal

The price action formed through an outside day pattern represents a significant shift in the trading activity which indicates a reversal in the market condition. It helps the traders to identify potential opportunities where they can enter or exit the trades timely by analyzing the market reversal.

Flexibility

The pattern is not rigid for traders and allows flexibility as they can use the pattern on different times from intraday to weekly and monthly charts. It gives traders an edge to change their trading strategies as per market conditions and adopt different trading styles with their objectives.

Final Words

Outside day is an exceptional way of trading, however, due to its limitations, it’s too complicated for traders to stay away from false information and get the correct prediction each and every time. Demand and Supply theory is a savior in this case as it provides much higher accuracy certainty in trades.

FAQs

What is an Outside Day Trading?

In technical analysis, outside day trading helps to determine trend reversal in the security. Outsider day occurs when the price trades making higher high or lower lows as compared to the previous day’s trading session.

Is an Outside Day Bullish?

A Bullish Outside Day occurs when the price heads higher on the following day by meeting other criteria of forming higher lows and longer bodies.

How to trade an Outside Day?

To trade an outside day, look for higher high and lower low formation on the second day. The two bars fit outside the prior day’s range.

How reliable is the Outside Day Pattern?

The reliability of the outside day pattern increases with trend analysis, volume confirmation, and other technical indicators and chart patterns.

How to make an entry in the outside day pattern?

Traders often enter positions when the price breaks above or below the high or low of the Outside Day.

How to confirm an outside day pattern?

To confirm the pattern, use additional technical indicators like moving averages, RSI and the price action and make informed decisions.

Instagram

Instagram