Outside Reversal: How does it work in Technical Analysis?

- December 23, 2024

- 889 Views

- by Manaswi Agarwal

In technical analysis, outside reversal indicates a potential change in the direction of the trend. The reversal can be either bullish or bearish based on the stock chart patterns.

The outside reversal in the technical chart pattern describes or signals a potential reversal in the trend direction of the price of a security. Several traders and investors rely on trend reversal chart patterns to make informed decisions about their investment in the stock market.

Table of Contents

ToggleWhat is an Outside Reversal Pattern?

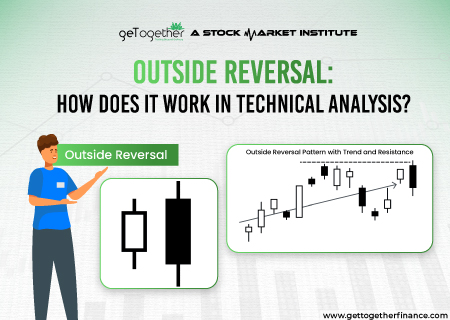

Outside reversal represents the reversal of the trend where the high and low prices of an asset for the day exceeds those achieved in the prior trading session. This pattern can help traders to seize profitable opportunities from the market while managing risks.

Major components of Outside Reversal Pattern

Now, to analyze the outside reversal pattern, traders look for some major components like highs and lows of the previous day, Opening price, closing prices and the factors that can influence the formation of this pattern. These major components are essential to recognize the pattern and a trader needs to get them familiarized with such components.

Highs and Lows of Previous Day

The upper wick of the candle is the high of the day where the lower Wick of the candle indicates the lowest price of the day. This is the maximum or minimum price that the security has traded in a session. To identify the outside reversal in the chart pattern, traders find the signal of increased volatility in the security which is indicated when the high of the current day exceeds the previous high and the low of the current day is lower than the previous trading session’s lower wick.

Opening Price

The second component of this pattern is the opening price which is the price of the security at which it is traded when the market opens. When the opening price is lower than the previous day’s low then it indicates a bullish outside reversal. In the case of bearish outside reversal, the price opens higher than the high of the previous day. The opening price of a security is a useful indicator to identify the potential changes in market sentiments.

Closing Price

The third component of the outside reversible pattern is the closing price which determines the final price at which the security has been traded in the market session. While identifying this pattern in bullish terms, traders tend to look for the pattern when the closing price is higher than the high of the previous day which signifies buying pressure in the security. To identify the bearish outside reversible pattern, the closing price should be lower than the law of the previous day which indicates a selling pressure in the security.

Factors Influencing Outside Reversal

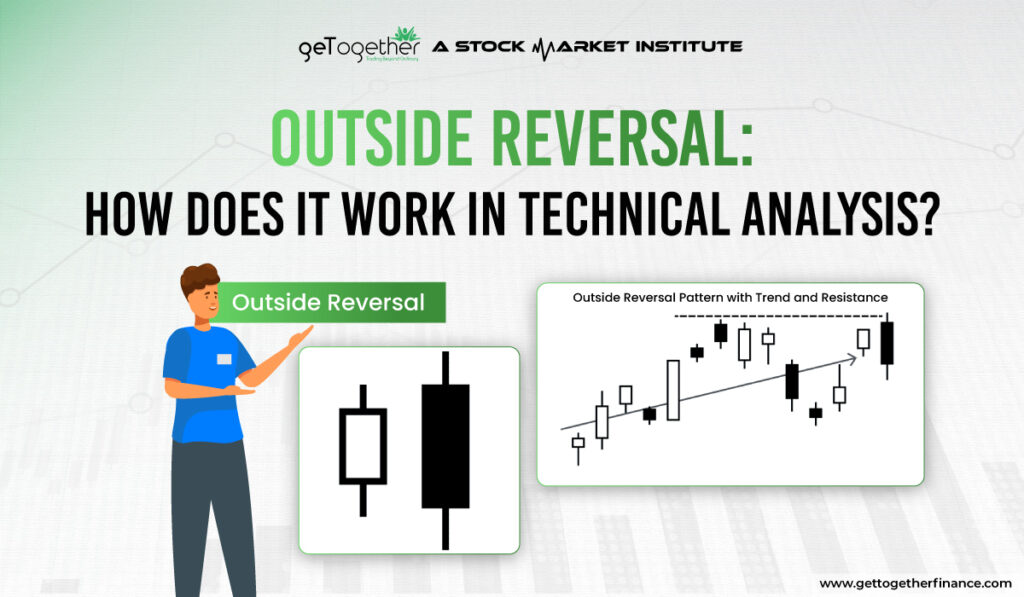

The formation of a trend over a period of time influences this pattern. Prevailing trends in security, increased volume, extreme price changes are various factors through which the formation of reversal is affected. If such factors disrespect the formation of these patterns then the formation of outside reversal cannot be assured.

Prevailing Trend in the Security

This pattern is considered to be valid when there is already a preceding trend in the security. The security can follow either a downwards or upwards trend which signifies a potential reversal in this trend.

Increased Volume

Increased volume in the security is one essential factor that is considered to predict the outside reversal. An increase in the volume suggests a change towards market sentiments because investors gain interest and adds credibility to the reversal signal in the security.

Extreme Price Changes

The pattern is confirmed when there are extreme changes in the prices. These extreme changes impact the volume of trading, followed by the closing price, which indicates a buying or selling pressure in the security signals the future price direction.

Benefits of Outside Reversal

Let us look at the benefits that traders get after identifying the outside reversal pattern:

Predicting Market Sentiments

The pattern of outsider reversal when formed in a security gives a confirmation of reversal in the prevailing trend of security. Outside reversal pattern is quite beneficial to understand future market sentiments and take actions based on the predictions. Bullish reversal in this pattern helps to identify the buying pressure while bearish outside reversal indicates a fall in prices.

Improved Decisions Making

The confirmation of the outside reversal pattern helps traders to identify exact entry and exit points. They can make informed decisions after analyzing the pattern for a consistent period of time and gaining several insights about outsider reversal price movements.

Also Read: Stock Chart Patterns

Considerations for Outside Reversal Pattern

In a trader’s arsenal, this pattern is considered to be a really powerful tool to provide clear signals about an asset’s direction of its prices. When used correctly with appropriate risk measures can prove to be profitable, otherwise, this can also impose various complexities in a trader’s decisions. To avoid maximum complexities, practical considerations are required to be undertaken for impactful decisions.

Market Behavior

The price movement of the outsider reversal pattern depends on the overall market sentiments. If the market does not support the direction of outside reversal, it might prove to be wrong for the traders. Sometimes, the outside reversal pattern can signify a pause instead of complete trend reversal. This is why it is important for traders to assess broader market conditions rather than solely depending on the reversal pattern.

False Signal

Outside reversal can also sometimes produce false signals especially when the market is not decisive. Like all technical indicators, as there are chances that they can produce false signals and to mitigate such risks, traders acquire additional information that can give confirmation about the trend reversal.

Entry Exit Points

This pattern does not provide accurate entry or exit points as it only predicts whether the market is bullish or bearish. Traders cannot make their entry based on this pattern, provided the market sentiment, it becomes difficult for traders to manage their risk. They cannot place appropriate stop loss orders which makes it quite risky affecting their overall portfolio.

Wrap It Up…

As we have read in the blog, outside reversal patterns allow traders to pick profitable opportunities but there are some considerations that need to be taken care of. Trading through this pattern can be very risky and hence making efficient use of the demand and supply approach ensures reliability and profitability.

FAQs

What is an Outside Reversal in Technical Analysis?

In technical Analysis, traders analyze the reversal in the direction of the trend. The outside reversal in the trend or price indicates a change in the price direction of the security.

What is Bullish Outside Reversal?

Bullish outside reversal indicates that bears had the command over the prices of the security for a long term but bulls become more active indicating a buying pressure and a change in the prevailing trend of an asset’s prices.

What is Bearish outside Reversal?

Bearish outside Reversal indicates that bears are now active to change the prevailing trend in the security and are ready to push the prices downwards.

How to identify outside reversal in technical analysis?

To identify outside reversal in technical analysis, a trader should look for the behavior of major components like highs and lows of the previous day, opening price and closing price.

Instagram

Instagram