Point and Figure Charting: A Basic Introduction

- December 30, 2024

- 352 Views

- by Manaswi Agarwal

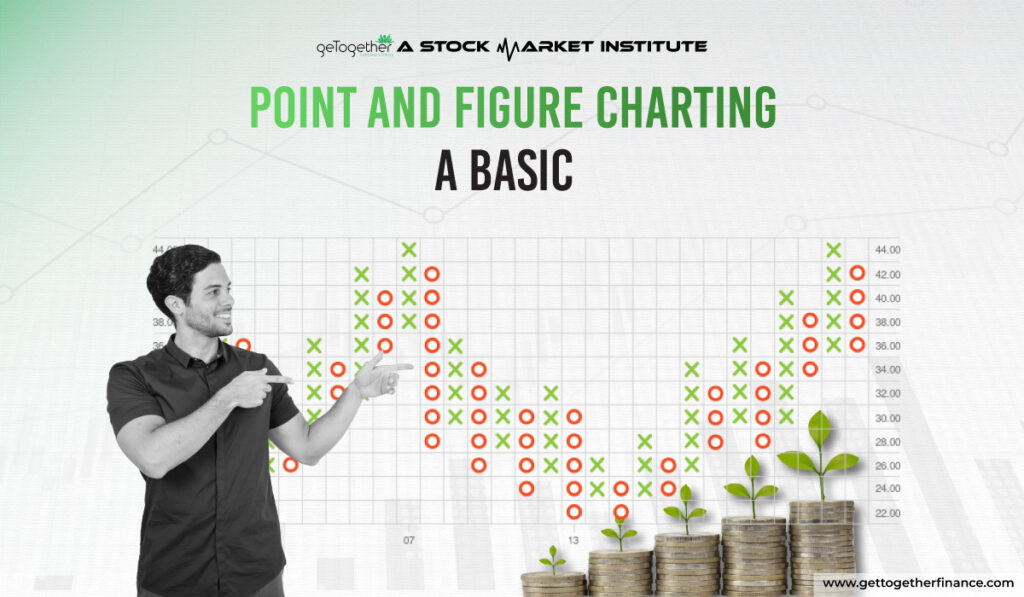

Points and Figure charts are used for a long term investment strategy which gives a visual representation of price movements and trends in the assets. You might find it complicated at the beginning but let’s dive deep into it to gain a better understanding.

What is Point and Figure Charting?

Point and Figures Chart are widely used for technical analysis which helps in identifying trends and patterns in the market of securities. Point and figure chart pattern is a technical tool that prefers to analyze the stock price movements based on price action.

P&F charts follow a different approach as compared to traditional chart patterns and provide a clear picture about market sentiments and trend direction. This method of charting is solely focused on change in price instead of displaying price movements over time. P&F charts are a valuable tool for traders to filter out minor price fluctuations and provide a clear view of market trends and reversal.

Elements of Point and Figure Chart Patterns

X Column: “X” Columns represent rising which indicates an upward movement in a specific amount.

O Column: “O” Column represents falling prices which indicates a falling movement in a specific amount.

Box Size: The box size indicates the price range that is represented by a single “X” or “O” which signifies the movements in stock’s price. Let us take an example, if the box size represents an amount of $1 then the columns tend to represent the movement of $1 in the stock’s prices.

Reversal Pattern: The reversal criterion contains one, two and three box sizes. The purpose of these criteria is to determine the start of a new column of “X” or “O”. It helps to determine the number of box increments that are required to reverse the current trend and form a new column.

Trend Lines: The trend lines are formed after the formation of the two columns that indicates potential support and resistance levels.

To Construct Point and Figures Charts

Determine the size of the box which will define the price movements based on the volatility of the asset. You can keep the box sizes a $1, $0.5, or $5 for stocks.

Decide the reversal amount to determine the beginning of a new column; three box reversals is the standard box reversal to filter minor price fluctuations.

- Start with the first data point to construct the chart.

- Draw an X in the first column if the price rises by one box size.

- If the price continues to rise, draw additional X to increase the box size.

- If the price takes a reversal by dropping, go to the new column and fill it with Os.

- Keep going with the process as the price rises and falls between the X and O columns.

How to read a Point and Figure Chart Pattern?

As a beginner, it might seem complex to read the point and figure chart but as you get familiar with the chart and gain experience it becomes easier with practice. To capture the movements according to point and figure charts, you must consider the following points.

Analyze Box Size and Reversal Amount

Identify the box size which lets you know the amount of price movement required that is helpful to create a new “X” or “O” in the chart. On the other hand, the reversal amount will be helpful to identify the number of boxes that change the direction of the trend.

Observe the Patterns

After the identification of box size and reversal amount, observe and analyze the price movements through Xs and Os that represent rising and falling price movements respectively. When new X or O is created, they are placed as per the previous price movement.

Support and Resistance Level

Traders draw horizontal lines to identify the support and resistance levels across the tops of X columns or the bottoms of O columns. The support level increases the buying pressure as the buyers gain control while the resistance level resists the prices to move upwards.

Double Top /Bottom Pattern

This is a breakout pattern which is formed when the rising level in which the column of X exceeds the previous column or the column “O” drops below the previous column.

Advantages of Point and Figure Charting Pattern

Point and Figure Charting Pattern is differently perceived by traders, and considers a unique approach of analysis apart from traditional technical methods which offers certain advantages to the traders, let us know them in brief:

Simplified Price Movements

Point and figure chart pattern gives a simplified view about price movements. It gives a clear picture of price patterns that makes it easier for traders to enter the positions based on trend lines, support and resistance levels.

Noise Elimination

Point and figure chart patterns effectively avoid minor price movements that can affect the formation of other chart patterns. The movement in this pattern only focuses on significant price changes without impacting minor price movements.

Breakout Patterns

Point and Figure chart pattern straightforwardly helps traders to identify key support and resistance levels as they indicate potential breakout points.

Limitations of Point and Figure Charting Pattern

Apart from the advantages offered by the P&F charts, there are many drawbacks that needs to be considered:

Ignores Time Element

This particular chart pattern ignores time elements and does not provide actual insights about how long a trend is going to last. Traders cannot decide to make a move as for how long they have to keep their holdings.

Lack of Technical Approach

In point and figure charting patterns, traders do not follow a demand and supply approach which is a major drawback in trading. Trading solely based on charting patterns results in lots of losses for traders. Top down approach, demand and supply analysis matters the most to initiate a successful trade.

Subjectivity

The nature of the P&F chart pattern is very subjective as it involves selection of box and reversal criteria that could lead to different interpretations and results. Each trader might have a different perspective of looking at the trade through this chart pattern.

Conclusion

Point and Figure Chart pattern can be understood after gaining experience as it is quite complicated and a unique approach. Apart from this, when you consider the demand and supply approach, there is no need to enter into complexity. GTF offers Trading in the Zone course which simply helps you understand buying and selling pressure in the security.

FAQs

What is the Point and Figure Chart?

Point and Figure is a charting technique used for traders to technically analyze the price movements and change in direction of price by plotting a column of “X” when the price rises and column “O” when prices fall.

How do I plot a Point and Figure Chart?

Point and figure chart is made up of multiple columns where X column represents an increase in the asset’s price while O column represents a fall in the prices and each box in these columns equals a certain price level.

How to trade Point and Figure?

To trade point and figure, set the box size and determine reversal criteria while identifying multiple time frames. Entry and exit points are based on key support and resistance level as it represents buying or selling pressure respectively.

Instagram

Instagram