Understanding the Difference: Portfolio Management vs. Financial Planning

- May 15, 2024

- 3156 Views

- by Manaswi Agarwal

Financial Security is the one most important part of an individual’s life. You will always implement the best strategies to protect and secure your money to meet the long term financial goals. But financial planning and portfolio management are the two different terms which are assumed to be the same. In portfolio-management, fund managers allocate the assets in various securities to gain maximum returns in the short term as well as long term. The blog will focus on deeply understanding the meaning of each term and identifying potential differences among them.

Table of Contents

ToggleWhat is Portfolio Management?

Portfolio Management is to manage the financial securities of an investor which includes shares, government bonds, debentures, units and other kinds of financial assets. An investment portfolio is managed regularly to reduce the risks and maximize potential gains. Portfolio-management is to invest in the securities that make changes accordingly in the portfolio as per the ongoing market conditions. A portfolio manager is ought to invest in equities or derivatives segments by allocating the funds.

Key Components of Portfolio Management

As understood, portfolio management is only focused towards managing funds of an individual by allocating the assets in the right direction. The major components of Portfolio-management include allocating the assets, risk management, and diversifying the portfolio based on assets.

Investment Allocation

Portfolio managers can allocate the funds to remove the stocks from high risks and invest them into more stable instruments such as bonds, dividends, fixed income, etc. The investments are allocated by portfolio managers by identifying the investor’s time horizon, goals of investment and risk tolerance.

Risk Management

Portfolio Managers have to essentially recognize, evaluate and manage the risks that might affect an investor’s portfolio. The risks could be related to market conditions, credit, liquidity, inflation, interest rates, liquidity and geopolitics. The risks are managed by adopting effective strategies such as hedging, diversification, using derivatives and other methods.

Portfolio Diversification

A portfolio manager always reduces the risks by adopting a risk management strategy of diversification where the investments are spread over a range of assets, asset classes, derivatives, sectors, industries and geographical areas.

What is Financial Planning?

Financial Planning is to manage your overall finances over the long term. This approach is efficiently utilized to analyze the current financial situation and understand the short term as well as long term financial goals and achieve them through planned strategies. Financial Planning involves evaluation of the available resources like income, credit score, assets, debt, budgeting preferences, etc. to control the expenditure and make decisions for a better future.

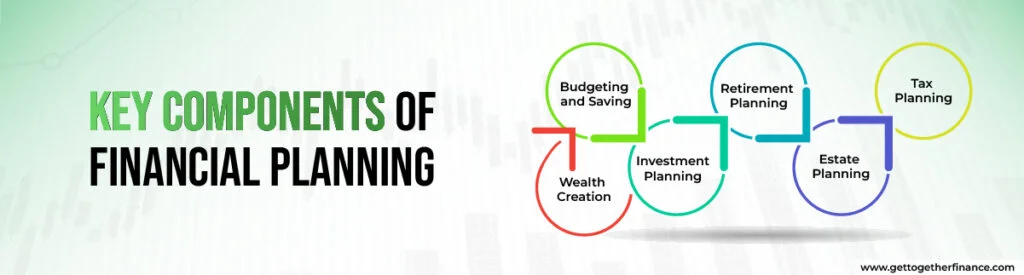

Key Components of Financial Planning

The motive of financial planning is to generate wealth by analyzing the present and future situation of funds and develop strategies accordingly to achieve the targets. The key components of financial-planning are wealth creation, budgeting and saving, investment planning, retirement planning, tax planning, insurance and estate planning.

Wealth Creation

Wealth creation is a primary activity for an individual where the person manages the finances by keeping a broader perspective. Managing a portfolio is an activity that comes under wealth creation or wealth management. Wealth management is for the financial well being of families which includes proper management of finances, investment, estate, taxes, retirement, and others.

Budgeting and Saving

Financial stability is managed by creating a budget and achieving goals through controlled expenditure. Financial goals are achieved by budget planning and allocating money for investments savings. This helps to make best use of money in crucial times.

Retirement Planning

Financial-planning involves retirement planning wherein the savings are determined for maintaining a desired lifestyle after retirement. In this planning, tools like retirement accounts, pensions, and other investment vehicles are used.

Tax Planning

Financial Planning involves reducing taxes and maximizing tax efficiency by using accounts, credits and deductions for deducting taxable income.

Estate Planning

Estate planning is to diversify the investments and transferring wealth in a way to minimize the taxes as well as to avoid legal complications.

Investment Planning

Long term investments or short term investments are planned under investment planning which is a part of financial-planning of an individual. Portfolios are managed to plan the investments and maximize the returns by minimizing several risks.

Read More : Systematic Investment Plan

Portfolio Management Vs Financial Planning

It is a normal belief that managing a portfolio and financial planning is one and the same thing but in reality that is not the case. As we have understood that portfolio management is a part of financial-planning, there are basic key differences between portfolio-management and financial-planning which must be understood briefly.

- The goal of financial planning is to assist people towards broader financial management activities like risk management, growth assets, etc. As a part of it, portfolio-management is to optimize investment returns while managing the risks. It is focused on achieving investment goals and objectives by regular amendments.

- It is done to extensively analyze the budget, savings, investment, insurance, estate planning, taxes and other finances of an individual. Portfolio management is only concerned with managing risks and maximizing returns in the portfolio.

- It is focused towards accomplishing long term financial goals and objectives with overall planning of investments, wealth transfers and retirement planning that can stretch up to decades. Portfolio management is mainly concentrated on the performance of the investments in an individual’s portfolio.

- Portfolio managers use investment analysis, asset allocation, and security selection as a tool for the management of an individual’s portfolio. However, in financial planning techniques of cash flow management, insurance analysis, retirement planning procedures, tax optimization strategies, estate planning are used for the execution of effective strategies.

- In portfolio management, regulations of risk disclosure, investment management procedures and fiduciary duties are applied. In financial planning, rules and regulations formulated by the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) must be followed by considering various licensing requirements and fiduciary standards.

Also Read: What is Finance?

Conclusion

Summing it up, financial planning has a broader scope as compared to portfolio-management because it involves wealth creation, budgeting and saving, investment planning, retirement planning, tax planning for a better future of an individual. Managing a portfolio is limited to allocating the funds in various assets to increase income.

FAQs

What is portfolio management?

Portfolio management is managing investments of an individual by allocating the assets to maximize the returns and minimize the risks associated.

What is Financial Planning?

Financial planning is associated with managing finances on a long term basis where retirement planning, tax planning, estate planning and investment are taken into account as a whole.

What is the role of financial planners?

The role of a financial planner is to help people achieve their financial goals by analyzing present and future financial situations. The financial planners are focused towards investment management activities, tax planning, and retirement planning of individuals to help them fulfill their financial objectives.

What do portfolio managers do?

Portfolio managers are solely concerned with managing the portfolios of investors for asset allocation, risk management and portfolio diversification.

What is the difference between portfolio management and financial planning?

Portfolio-management means to manage the funds in a portfolio by diversifying into different assets and asset classes. Financial-planning is however to manage the overall finances including taxes, insurances, retirement planning, etc.

Instagram

Instagram