Exploring Everything about Preference Shares

- June 8, 2024

- 1188 Views

- by Manaswi Agarwal

Shareholders holding preference shares of a company receive dividends before common stockholders are issued. If a payout of assets is made by the company then the preferred shareholders have the right to claim the assets before common stockholders.

What are Preference Shares?

Preference shares are distributed by the company where the stocks are issued as priority recipients of dividends. Preferred stocks are considered to be more attractive than common stocks because of the additional benefits that they receive in a form of fixed income security. These kinds of shares can be readily traded on an exchange. Just like bonds, stockholders holding preferred stocks are entitled to a consistent dividend payment at a specified date as granted by the company.

What are the characteristics of preference shares?

Preference shares have the preferential rights over the common shares as they are prioritized to receive dividends and assets in the events of liquidation. Some specific features of preference-shares have made these financial instruments superior for investors during low economic phases. Let’s get to know in depth about how preferred stocks work for a company.

Dividend Payouts

Shareholders holding preferred stocks have the right to claim dividends issued by the particular company before common stockholders. They have the right to receive dividend payouts even if equity or other shareholders receive no dividends or later.

Also Read: Dividend

Voting Rights

Preference shareholders do not have the right to vote in company’s meetings. It do not give a right to the shareholders to participate in company internal processes like management and meetings.

Convertibility

Shareholders holding preference-shares can convert their share into equity under certain predefined conditions.

Participation Rights

Preferred shareholders have the right to participate in additional profits of the company apart from the dividends received. Common shareholders receive a fixed amount of dividend as declared by the company whereas preferred shareholders can share the remaining profits.

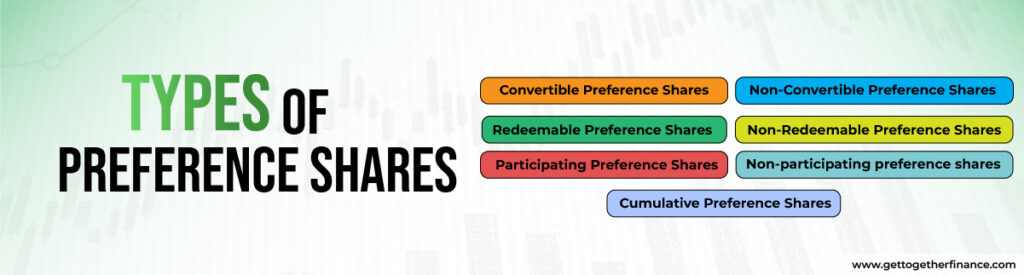

Types of Preference Shares

After knowing several characteristics of preferred stocks and their working, now let’s understand the various kinds of stocks that an investor can hold.

Convertible Preference-Shares

These shares can be easily converted into equity shares; there are no restrictions on their conversion. Stockholders can convert these shares easily into

Non-Convertible Preference Shares

These shares cannot be converted into equity shares. Investors holding non-convertible shares cannot convert their shares back into common or equity shares.

Redeemable Preference-Shares

Issuing Company has the right to redeem or repurchase the redeemable shares at a predetermined future date and specified price.

Non-Redeemable Preference Shares

These shares are not redeemable by the issuing company as they are the opposite of redeemable shares and act as a lifesaver for a company during the times of inflation.

Participating Preference-Shares

Holding these shares gives a right to the shareholders to participate in surplus profits of the company at the time of company’s liquidation after the dividend payout process is completed. Participating preference shareholders receive fixed dividends, moreover, they get surplus profits along with equity shareholders.

Non-participating preference shares

These shareholders are eligible to get their fixed dividend but do not get additional earnings from surplus profits earned by the company as a part of additional dividend.

Cumulative Preference-Shares

Cumulative preference shareholders can enjoy the rights of receiving cumulative dividend payout by a company even if the company is not making profits. The dividends are counted as outstanding when the company is not making profits and the amount of dividend accumulated that is paid the next year when business generates sufficient profits.

Non-Cumulative Preference Shares

The profits of shareholders do not get accumulated if a company has not generated enough profits in a particular year. Shareholders are not eligible to claim dividends in future profits. These shareholders get the dividend from the profits generated in the current year and if the company fails to generate profits in a year then these shareholders will not receive any dividends.

Adjustable Preference-Shares

In case of adjusted preferable shares, the rate of dividend is not fixed and hence influenced by the fluctuations in current market prices.

Pros of Preference Shares

Investors holding preferred stocks get to enjoy several benefits such as receiving dividends on priority and many others. The prices of these shares are considered to be more stable as compared to common stocks because of fixed dividend payments. Also, investors receive a higher amount of dividends as compared to dividends received by common stockholders. These stocks can also be converted into common stocks, additionally; the stocks are less volatile to changes in economic conditions.

Cons of Preference Shares

Stockholders do not have voting rights. The payment of dividend to preference stockholders is paid after the bondholders have been paid. The shares are issued with a fixed dividend rate which limits the potential for share price increase and hence it is a limitation of restricted capital appreciation.

Difference between equity and preference shares

| Basis | Preference Shares | Equity Shares |

| Voting Rights | No voting rights | Have voting rights |

| Conversion | Can be converted into equity stocks | Cannot be converted into preference stocks |

| Volatility | Less volatile | Much volatile |

| Dividends | A fixed dividend payment is guaranteed to the shareholders. | Dividends depend on the profitability of the company. |

Summing it up

Stockholders are more inclined towards preference shares instead of equity shares because of its several advantages. Investors holding preference stock have the right to claim the assets of the company at the time of liquidation before equity stockholders and also receive their dividends earlier than other shareholders.

FAQs

What are preference shares?

Preference shareholders have preferential rights over common shareholders as they receive dividend payouts before them.

What are convertible and non convertible preference-shares?

Convertible preference-shares are those which can be converted into equity shares easily. Non convertible preferred stocks cannot be converted into equity stocks.

What are redeemable and non-redeemable preference shares?

Redeemable preferred stocks can be repurchased by the company while non-redeemable stocks cannot be redeemed or repurchased by the company in future.

What is the difference between equity and preferred stocks?

Stockholders holding preferred stocks have benefits of claiming early dividends as compared to equity shareholders. Preferred stockholders can also convert their shares into equity stocks.

What are the types of preference shares?

Preference shares can be classified into nine different types of shares which include convertible, non-convertible, redeemable, non-redeemable, participating, non-participating, cumulative, non-cumulative, and adjustable preference shares.

Instagram

Instagram