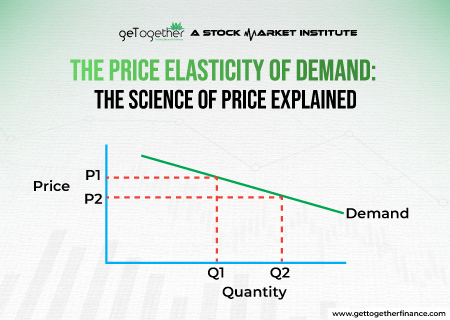

The Price Elasticity of Demand: The Science of Price Explained

As we already know the law of demand discusses the inverse relationship between the price and quantity. This means, if the price shoots up, people tend to buy less and when the prices go down, people tend to buy more. But the question emerges of how much less or more when it comes to buying. That’s where the idea of elasticity comes in the picture.

The concept of elasticity shows how sensitively the quantity of demand reacts when the price changes. With this e-guide, we will explore the idea of price elasticity of demand. To add to this, we will also go through the different types of price elasticity of demand and factors that influence it with suitable examples.

Table of Contents

ToggleWhat Is Price Elasticity of Demand?

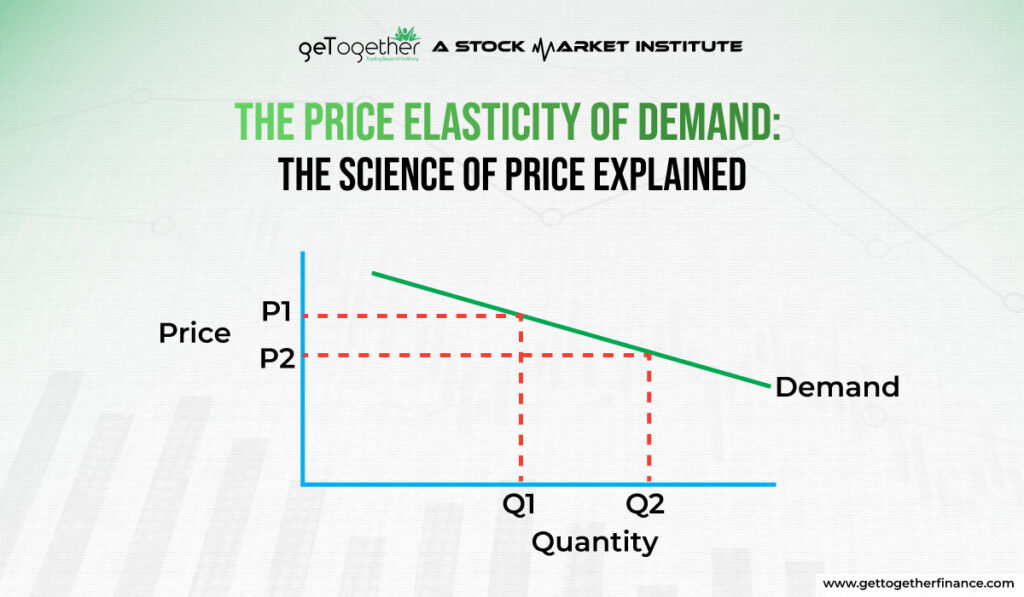

The price elasticity of demand discusses how sensitive the demand for a product or service is to changes in its price. In simpler terms, it’s about how much the quantity demanded changes when the price changes.

Let’s understand it with a simple example. Suppose you’re buying your favourite ice cream at the store. If the price of that ice cream goes up even by a small amount, how much would you be willing to spend and would you change the amount you buy regularly? That’s the simple way to understand the price elasticity of demand.

The price elasticity of demand can vary depending on the product or service. The basic needs such as food and water, tend to have inelastic demand – people will keep buying them even when prices rise. Whereas luxury items or non-essential products often have more elastic demand, where people will buy a lot less when prices go up. The concept comes from the broader phenomenon of elasticity of demand.

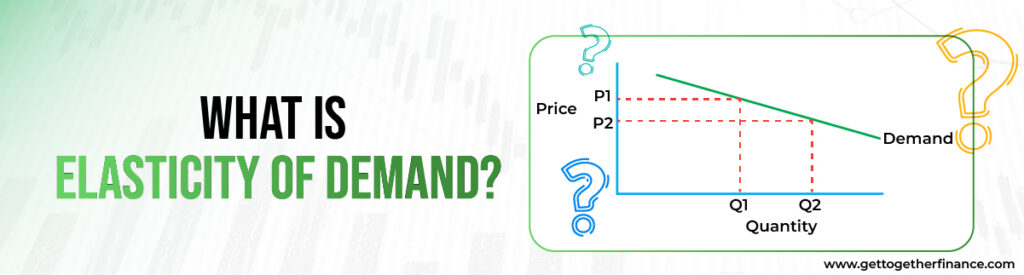

What is Elasticity of Demand?

Elasticity of demand is a broader concept that tells the story of demand sensitivity relative to changes in any factors affecting it. It encounters and studies the behaviour of consumer buying, depending on the needs and ease of price. Simply, if the price of a product increases, how much will the consumers reduce their purchases of that product. But despite just including changes in price, it also changes in income, prices of related goods, consumer preferences, etc.

Types of Price Elasticity of Demand

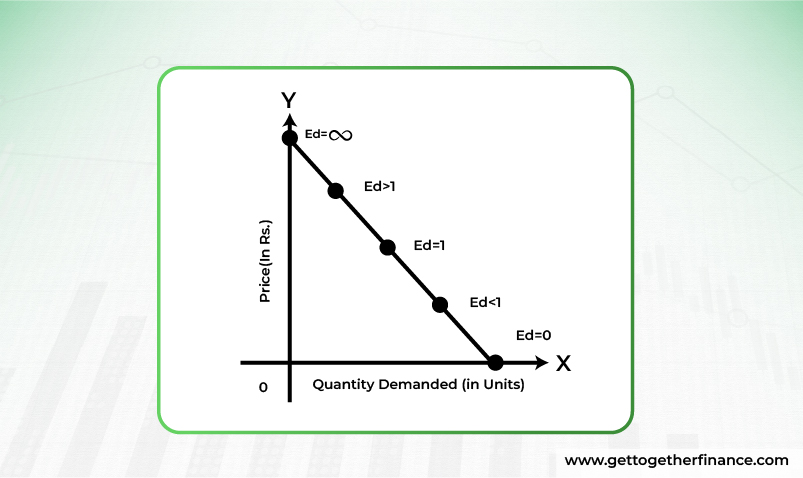

Depending on the categories of graphically measuring the elasticity, the price elasticity of demand is segregated into five primary types:

Perfectly Inelastic Demand

This basically means the quantity demanded does not change at all when the price changes. For example, if the price of water goes up, people will still buy the same amount because they need it to survive.

Inelastic Demand

The concept of inelastic demand is similar to perfectly inelastic demand but with a little flexibility. This means the quantity demanded changes only a little when the price changes. For example, if the price of gas or fossil oil goes up, people may only slightly reduce the amount they buy because they still need it to travel or perform daily chores.

Unit Elastic Demand

It primarily dictates that both the quantity demand and price change with the same percentage. For example, if the price of a smartphone goes up by 10%, the quantity demanded goes down by 10%.

Elastic Demand

Akin to the flexibility of elasticity, this accepts the changes in the price with the fluid response of demand. Simply put, the quantity of product demand changes a lot with the price fluctuations. For example, if the price of a luxury item like jewellery goes up, people may drastically reduce how much they buy.

Perfectly Elastic Demand

This type stands less than the unitary elastic demand. In this, if the price rises too much, the quantity of demand can even go up to zero. For example, if the price of a product increases even a little, no one will buy it because there are perfect substitutes available.

Also Read: Swap Market

How to Calculate Price Elasticity of Demand?

Although often there is a generic formula used to calculate price elasticity of demand, here we have listed two mathematical ways to measure it:

Proportionate or Percentage Method

The Proportionate or Percentage Method calculates price elasticity as the percentage change in quantity demanded divided by the percentage change in price.

The formula is:

Ed = (% change in quantity demanded) / (% change in price)

This method is useful for calculating the elasticity between two points on the demand curve. It provides an estimated point of elasticity.

Example of Proportionate or Percentage Method

For example, the original price of a product was ₹10 and the quantity demanded was 100 units. The new price is ₹12 and the new quantity demanded is 80 units.

Let’s first measure the percentage change in quantity demanded:

% change in quantity = (New quantity – Original quantity) / Original quantity * 100

= (80 – 100) / 100 * 100

= -20%

Calculate the percentage change in price:

% change in price = (New price – Original price) / Original price * 100

=(12 – 10) / 10 * 100

=20%

Hence, if we apply the figures in the formula:

Ed = (% change in quantity) / (% change in price)

Ed = -20% / 20%

Ed = -1

The negative value shows that demand volume and price move in opposite directions. A value of -1 means demand is unit elastic – a 1% change in price leads to a 1% change in quantity in the opposite direction.

Geometry Method

This method uses the slope of the demand curve to calculate elasticity. This method is also well-known as the “Point Method of measuring Elasticity of Demand’.

The formula to calculate is:

ED = (Lower segment of the demand curve) / (Upper segment of the demand curve)

Where:

- The lower segment is the distance between the original quantity (Q1) and the new quantity (Q2).

- The upper segment is the distance between the original price (P1) and the new price (P2).

Example of Geometry Method

For example, the original price is ₹10 and the demanded quantity is 100 units. The new price is ₹12 and the new quantity demanded is 80 units. Now the lower segment would be the change in quantity:

100 – 80 = 20 units

The upper segment would be the change in price:

₹12 – ₹10 = ₹2

Hence the ED would be:

Ed = 20 / 2 = 10

This means the price elasticity of demand is 10, which shows that the demand is elastic. A 1% change in price leads to a 10% change in quantity demanded in the opposite direction.

Factors That Affect Price Elasticity of Demand

The price elasticity of demand is not as simple or linear as it seems. There are various factors that decide if the product is elastic or not. Here are the key factors that affect the price elasticity of demand in simple terms:

- Substitutes: The more substitutes a product has, the more elastic the demand. Consumers can easily switch to alternatives if the price goes up.

- Need: Demand for essential goods tends to be inelastic. People will keep buying them even if the price increases.

- Income Proportion: If a product takes up a large part of someone’s budget, the demand is likely more elastic. Consumers are more sensitive to price changes for those products.

- Time Period: Demand is usually more elastic in the long run. Consumers have more time to adjust their buying habits.

- Uniqueness: Demand for unique or prestigious products is often less elastic. Consumers are willing to pay higher prices for these items.

The combination of these factors determines whether the demand for a product is elastic (very responsive to price changes) or inelastic (not very responsive to price changes). Understanding this concept is important for businesses to set effective pricing strategies.

Bottomline

Understanding what affects price elasticity of demand is important for businesses when setting prices. If demand is elastic, it means customers are very sensitive to price changes. For these products, companies need to adjust prices often to maximise profits and sales. On the other hand, if demand is inelastic, customers don’t change their buying much when prices change. Knowing the factors that influence elasticity helps businesses make better pricing decisions. By understanding elasticity, companies can develop effective pricing strategies, both in the short-term and long-term. They can identify their most valuable products, set optimal prices, and even shift tax burdens onto customers in some cases.

FAQs

What Makes a Product Elastic?

A product is elastic if a price increase leads to a big drop in how much people buy such as lots of substitutes, like fancy clothes. If they get expensive, people might just buy regular clothes instead.

What Makes a Product Inelastic?

A product is inelastic if a price increase doesn’t affect how much people buy such as medicine. Even if it costs more, people will still likely buy it because they have to.

What Is the Importance of Price Elasticity of Demand?

Understanding price elasticity helps businesses set good prices. They can raise prices on things people still need (inelastic) to make more money. They might need to keep prices lower on things people are more price-conscious about (elastic) to keep customers buying.

How does price elasticity of demand affect the stock market?

Price elasticity can affect how a company’s stock price reacts to price changes for their products. If a company with elastic products can raise prices without hurting sales, investors might see it as a good investment. On the other hand, if a company with inelastic products struggles to raise prices, it could spoil its profits and stock price.

Facebook

Facebook Instagram

Instagram Youtube

Youtube