Put-Call Ratio

Overview

The stock market has various indicators that help in forecasting the price of a stock or derivative better. One such indicator is called the put-call ratio. In derivatives trading, there are various indicators that can help in predicting how the price of a stock and its derivative will move. These indicators hold great importance in every trader’s life. Having a good knowledge of indicators always helps traders in making informed decisions. This further helps in reducing their losses and increasing their profits.

What is Put-Call Ratio?

Put-call ratio specifically helps in understanding the market sentiments. It is based on people’s interest in the option over a time period. It is calculated either on option trading values or by analyzing the interest of traders in a specific time period. It shows the put value relative to the call value over a certain strike price.

When the volume of a put option is higher than the call option, then the PCR is greater than 1. Whereas, when the volume of put options is lower than the call option, then the PCR is lesser than 1.

When the Put Call Ratio is low, the market sentiment appears to be bullish. This means that people are buying the call option and hoping that the price will go up. On the contrary, when the Put Call Ratio is high, the market sentiments appear to be bearish. This means that people are buying the put option and hoping that the price will decline.

How to Analyse PCR?

The Put-Call Ratio (PCR) helps us understand how people feel about the stock market. The tool assesses the number of interested buyers and sellers of options over a certain period of time.

When the value of PCR goes above 1, it shows that more people are interested in selling (Put Options) than buying (call options). This indicates a bearish sentiment, signaling a potential downtrend in the market. But when the PCR hangs below 1, it recommends that more people are interested in buying, showing a bullish sentiment. Hence, if PCR is low, people act optimistic, hoping prices will go up. Conversely, if the ratio is high, they are expecting prices to go down. Just like checking the mood of the market!

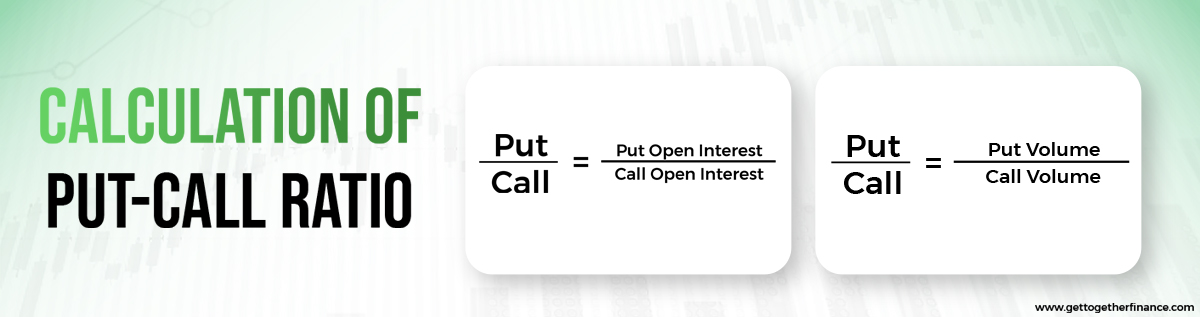

How is PCR Calculated?

The calculation simply tells the difference between call and put option buyers. It helps understand the market sentiment and potential direction of price movement. This handy tool comes with simplest formula, done on two measurement criteria;

- Number of put/call volume.

- Number of put/call open interest.

Here are the formulas based on above parameters:

- Put/Call Ratio (Based on Volume )= Put Volume/ Call Volume (for a specific Strike Price)

- Put/Call Ratio (Based on Open Interest )= Put Open Interest/ Call Open Interest (for a specific Strike Price)

Note: For every strike, traders need a separate put/call ratio for different strike prices.

Put-Call Ratio as a Contrarian Indicator

A contrarian indicator is a market indicator that helps traders in taking an opposite move in the market. This indicator helps traders in analyzing the extremist situation in any trend and indicates the reversal of a trend. Further, traders use this indicator to know when to make a move opposite from the market. In this way, Put-Call Ratio also serves as a contrarian indicator. As PCR is mostly concerned with option build-up, when traders sense the build-up has happened to an extent, they can predict the reversal of the trend.

Calculation of Put-Call Ratio

The calculation of the Put-Call ratio is quite simple. It has a simple formula:

Put/Call Ratio (Based on Volume)= Put Volume/ Call Volume (for a specific Strike Price)

Put/Call Ratio (Based on Open Interest)= Put Open Interest/ Call Open Interest (for a specific Strike Price)

Note: Remember Put-Call Ratio is different for every strike price.

Put Call Ratio = Traded Put Volume / Traded Call Volume

Traders or investors can use the traded volume of put and call to summarize the ratio. For this, the formula is:

Formula of PCR (Traded Volume) = Put Volume/ Call Volume (for a specific Strike Price)

This ratio offers insights into market sentiment based on the trading activity of put and call options. A trader can use a suitable time frame to evaluate the value.

Put Call Ratio = Put Open Interest / Call Open Interest

The Put-Call Ratio (PCR) is typically calculated using the trading volume of put and call options rather than the open interest. However some investors/traders use the below-mentioned formula for the estimate outcome:

Formula of PCR (Open Interest) = Put Open Interest/ Call Open Interest (for a specific Strike Price)

In this case, ratio is calculated using the open interest; the total number of outstanding call and put option contracts. This can offer a different idea on market sentiment, compared to using trading volumes.

Also Read: Option Chain Analysis

Example of Calculating Put Call Ratio

Suppose you’re analyzing options for a specific stock, and you find the following information:

- Put options traded volume: 1,500 contracts

- Call options traded volume: 2,000 contracts

To calculate the PCR, you would use the formula:

Put-Call Ratio (PCR) = Traded Put Volume/Traded Call Volume

Let’s study the example of Put-Call ratio, based on traded volume:

- Traded Put Volume: 1,500 contracts

- Traded Call Volume: 2,000 contracts

Formula of Put Call Ratio (Traded Volume) = Put Volume/ Call Volume (for a specific Strike Price)

Substituting the values:

PCR = 1500/2000 = 0.75

Interpretation: A Put-Call Ratio of 0.75 suggests a relatively bullish sentiment. It signifies more trading activity in call options compared to put options.

Put Call Ratio = Open Interest of Puts / Open Interest of Calls

Here is an example to simplify the concept of put-call ratio on the grounds of open interest values:

- Open Interest of Puts: 3,000 contracts

- Open Interest of Calls: 2,500 contracts

Formula of Put-Call Ratio (Traded Open Interests) = Put Open Interest/ Call Open Interest (for a specific Strike Price)

Substituting the values:

PCR = 3000/2500 = 1.2

Interpretation: A Put-Call ratio of 1.2 using open interest values shows the slightly bearish mood of the market, as there is higher open interest in put options compared to calls.

What is a Good Put-Call Ratio?

The Put-Call Ratio changes with changes in market moods and is not fixed. The adequate PCR for bears of the stock market is said to be 0.7-1. This indicates the bearish buildup in the market, interpreting that, people are buying more put options over the call options. Whereas, when the PCR is between 0.7-0.5, it indicates the bullish buildup in the market, interpreting that people are buying more call options over the put options.

Why is PCR important?

Put-Call Ratio helps in gauging the market sentiments with the option buildup. It helps traders in making informed trading decisions regarding the directional movement of the stock. Also, it is worth noting that Put-Call Ratio acts as an excellent contrarian indicator. It helps traders to not get trapped in herd mentality, meaning not to follow the community blindly.

As the PCR is calculated both in terms of Open Interest (OI) and Volume, it helps in completely analyzing the market sentiments.

Advantages of Put Call Ratio

Among several pros, PCR helps in improving timing, confirming trends, helping with risk management, predict volatility changes, and reveals overcrowded trades. But despite this, here are few listed advantages of put-call ratio:

| Put-Call Ratio (PCR) | Advantages |

| 1. Sentiment Analysis | Helps measure market sentiment (bullish or bearish). |

| 2. Contrarian Indicator | Signals potential market reversals, especially during extreme ratios. |

| 3. Trend Reversal Signals | Gives early signals of potential trend reversals. |

| 4. Risk Management | Helps in analysing overall risk in the market. |

| 5. Confirmation Tool | Used alongside other indicators to track trends and market movements. |

| 6. Different Timeframes | Can be analyzed over various timeframes to suit different trading preferences. |

| 7. Early Warning System | Changes in PCR often precede price movements, offering an early warning. |

| 8. Options Market Insight | Provides insights into options traders’ expectations and positioning. |

Disadvantages of Put-call Ratio

Among several benefits, there are few setbacks or cons of put-call ratio. One of the major disadvantages is that put-call ratio can cause misinterpretation on trend prediction during extreme market conditions. Below are listed major setbacks/disadvantages of put-call ratio:

| Put-Call Ratio (PCR) | Disadvantages |

| 1. Misinterpretation in Extreme Conditions | May be misinterpreted during highly volatile markets. |

| 2. Variations in Option Expirations | Affected by variations, leading to potentially skewed readings. |

| 3. Limited Comprehensive Insight | Provides a limited view, necessitating additional indicators. |

| 4. Potential Lack of Specificity | May not specify the precise factors influencing sentiment changes. |

| 5. Single Metric Reliance | Overlooking crucial market dynamics by depending solely on PCR. |

| 6. Dynamic Market Nature | PCR may not capture all aspects of evolving trends in real-time. |

Limitations of PCR

Although PCR can provide valuable insights regarding market sentiments, it has some limitations. These limitations are:

- It can interpret market sentiments based only on Put and Call volumes. Whereas, other economic, geopolitical, and technical factors are overseen in this case.

- PCR is calculated for a specific time period. This narrows its scope a lot, as long-term market trends cannot be captured in the narrow picture.

- Though PCR is considered a contrarian indicator, it is not 100% reliable. One should do a technical analysis before making a decision solely based on PCR regarding the reversal trend.

- Sometimes, PCR is taken away by speculating about the trading of the market. This trading is done based on any external news or tips and often is wrong. Thus, PCR can be disrupted or misinterpreted in this scenario.

Bottom Line

The put-call ratio is a helpful tool for traders and investors to evaluate market sentiment and price patterns in the options market. Despite its limitations, it offers crucial information regarding the ratio of favorable and unfavorable opinions. Put-Call Ratio might predict future changes as a contrarian indicator, but they shouldn’t be the only tool traders utilize. The best results using PCR can be obtained when combined with other specialized instruments and fundamental research. Understanding the significance of the Put-Call connection and using it in a comprehensive trading strategy can help traders make better trading decisions and have more success. It is critical to use the Put-Call indicator in conjunction with other technical research tools when making trading decisions.

FAQs

What is a good put-call ratio?

There is no specific criteria of setting a good put-call ratio as it changes with the market and is fixed. According to experts, the 0.7-1 ratio is considered a good sign that the bear market is gonna take a lead. It shows that the call market is lower than the put market. On the contrary, 0.7-0.5 PCR indicates the upcoming signs of bullish apart. It decides that the bull is ready to give a bounce to the market.

What if pcr is more than 1?

If a PCR value heads above 1, it means that put option buyers have overshadowed the call options buyers. That means the market is acting bearish and the mood is to show the hit of the market bear. If the value remains below 1, it shows that call option buyers are still more than put buyers, giving a bullish market view.

Is the PCR ratio bullish or bearish?

PCR ratio is just an estimate of put/call ratio or open interest. This helps option buyers understand the market sentiment and potential market direction. PCR alone as a concept doesn’t act bullish or bearish. However, if the PCR value stays between or above 0.7 – 1, traders/investors predict a downtrend. On the contrary, if the PCR value hangs or goes below 0.7-0.5, it shows the upcoming good times for call option buyers.

What is the PCR trading strategy?

PCR or Put-Call Ratio is one of the vernacular indicators, often used to set the mood of the options market. Known as a contrarian indicator, commonly opt to conduct technical stock market analysis. Change in the shift of numbers gives valuable insight on future price movements and shifts in investor sentiment.

How Can Traders Interpret Sudden Changes in Put-Call Ratio?

Interpreting sudden changes in the Put-Call Ratio (PCR) includes undertaking potential shifts and market sentiments. Here are the ways traders use to interpret sudden movements:

A rapid increase in buying volume, showing overbuying and overselling in data.

As a contrarian indicator, PCR indicates market reversal and potential turning points.

Via reading concurrent price movements, confirm PCR changes.

Remember to not rely on PCR as a comprehensive approach to detect market moods. Combine this with more foolproof approaches such as demand-supply zone and price-action analysis to make your research infallible.

What does a low Put-Call Ratio indicate?

A low put-call ratio indicates that the market is acting bullish. It’s a good sign for call buyers as it shows that the number of call option buyers are higher than the put volume. However, if an extremely low ratio shows caution, signaling that call options might be overbought. Validate your research with other indicators and tools to make informed decisions.

Can Put-Call Ratio Predict Market Trends?

Yes, it can offer you insights of the potential market direction and sentiments of traders. If the ratio is read below 1, it shows the signs of a positive market. But if the numbers go beyond 1, it’s time to enjoy the downward rallies.

No, put-call ratio doesn’t provide certainty about the market trends and can give false signals often.

Are There Different Timeframes for Put-Call Ratios?

Yes, a trader can analyse put-call ratio over different timeframes. Where short-term ratios may show immediate sentiment, long-term ratios offer in-depth details of sustained market moods. Both of these hold good value to investors or traders, depending on the perspective to look at.

Are There Limitations to Using Put-Call Ratio?

Yes, there are several setbacks of put-call ratio. These limitations include the misinterpretation during extreme market conditions, variation in option expirations, and the fact that just ratio might not provide a clear picture. Always blend the theory with more reliable tools or concepts to ensure your outcome.

How is Put-Call Ratio Calculated?

Here is the formula of Put-Call ratio:

Put/Call Ratio (Based on Volume )= Put Volume/ Call Volume (for a specific Strike Price)

Put/Call Ratio (Based on Open Interest )= Put Open Interest/ Call Open Interest (for a specific Strike Price)

CATEGORIES

Facebook

Facebook  Instagram

Instagram  Youtube

Youtube